The Boring Glory Of Index Funds

Your best bet is to buy something called an index fund and keep it forever. Index funds buy every stock or bond in a particular category or market. The advantage is that you know youll be capturing all of the returns available in, say, big American stocks or bonds in emerging markets.

And yes, buying index funds is boring: You usually wont see enormous day-to-day swings in prices the same way you may if you owned Apple stock. But those big swings come with powerful feelings of greed, fear and regret, and those feelings may cause you to buy or sell your investments at the worst possible time. So best to avoid the emotional tumult by touching your investments

Are Your 401 Contributions Keeping Up With Your Salary

You may still be a few decades away from retirement, but its never too soon to ramp up your savings for your life as a retiree. And one of the best ways to do so is to increase your contributions to your 401or whatever retirement account you have access towhenever your salary goes up.

This year, you may even see a bigger boost to your salary. U.S. employers expect to give an average 3.4% raise to their workers in 2022, according to a survey from Willis Towers Watson, a risk management and insurance brokerage company. Of course, your salary increase may be less or more than this amount. Either way, a good strategy is to put at least some of that salary boost to work in your 401.

Why is it so important to put in as much as you can to your 401? Lets review the key benefits of this plan:

Tax advantages By contributing pretax dollars to your 401, you can lower your taxable income, and your money can grow on a tax-deferred basis. If you contribute to a Roth 401, you put in after-tax dollars, so you dont get an immediate reduction in your taxes, but your earnings growth and distributions in retirement are generally tax free.

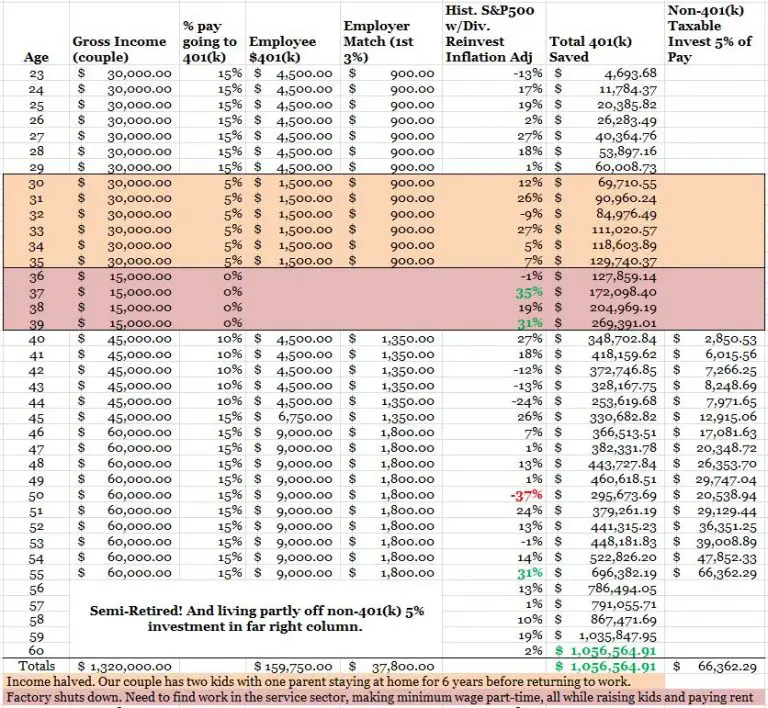

Employer match If your employer offers a match, you can think of it as almost a bonus in pay. Matching amounts vary among employers. They are commonly structured as 50 cents on the dollar or a dollar-for-dollar match, usually for 3% to 6% of an employees salary.

But How Much Is Enough

Our guideline: Aim to save at least 15% of your pre-tax income1 each year, which includes any employer match. That’s assuming you save for retirement from age 25 to age 67. Together with other steps, that should help ensure you have enough income to maintain your current lifestyle in retirement.

How did we come up with 15%? First, we had to understand how much people generally spend in retirement. After analyzing enormous amounts of national spending data, we concluded that most people will need somewhere between 55% and 80% of their preretirement income to maintain their lifestyle in retirement.1

Not all of that money will need to come from your savings, however. Some will likely come from Social Security. So, we did the math and found that most people will need to generate about 45% of their retirement income from savings. Based on our estimates, saving 15% each year from age 25 to 67 should get you there. If you are lucky enough to have a pension, your target savings rate may be lower.

Here’s a hypothetical example. Consider Joanna, age 25, who earns $54,000 a year. We assume her income grows 1.5% a year to about $100,000 by the time she is 67 and ready to retire. To maintain her preretirement lifestyle throughout retirement, we estimate that about $45,000 each year , or 45% of her $100,000 preretirement income, needs to come from her savings.

Recommended Reading: How Do I Withdraw Money From My Fidelity 401k

How Much Will You Need In Retirement

The sum youll need to retire is a highly personal question but needs careful consideration.

I believe retirement is a financial number versus a retirement age. Assess how much you need in your retirement account to live at least 20 years in retirement without having to go back to work to pay your bills, says Shaquana Watson-Harkness, personal finance coach and founder of Dollars Makes Cents, an online debt management and investing training course.

Rita-Soledad Fernández Paulino, a NextAdvisor contributor and creator of Wealth Para Todos, told us how she calculates her financial independence number using Trinity Studys 4% rule. According to the 4% rule, you can estimate how much money youll need to live on during retirement using this quick calculation:

Annual Expenses x 25 = Nest Egg .

For example, if your annual expenses are $40,000, multiply that by 25 for a total of $1M the amount youd need to retire, based on the 4% rule above.

If youre already freezing up thinking about million-dollar sums, remember youre not solely responsible for saving up this much on your own. The market, through compound interest, will do most of the heavy lifting for you, especially if you invest early and let your portfolio grow for decades.

Thats why starting early is so important.

Its Easier To Make Exciting Progress Towards A Goal With Your Bonus

This one is purely behavioral. If we were all robots, it wouldnt matter. Alas, we are these squishy, irrational humans who dont always do the optimal thing.

Lets say your bonus is $20,000 .

You have a goal that will cost you $20,000.

You could save for that goal with $1000 out of each semi-monthly paycheck. Youll be waiting 10 months to get there.

Or you could direct your entire bonus to the goal and be done now.

You get to buy that car now, or pay off your credit card debt now, or book that vacation now.

Doesnt that sound way more gratifying?

Or hell, if youre saving for a sabbatical or a down payment, getting $20k closer to that goal in one fell swoop can be veeeery motivating.

No matter the goal or its time frame, youre more likely to save for it if you feel motivated and optimistic about achieving it.

Don’t Miss: What Is The Most You Can Contribute To A 401k

What Is The Optimal Amount To Contribute To Your 401 Plan

There are many types of retirement accounts out there, but the 401 may just be the most convenient.

An employer-sponsored 401 plan allows you to automatically contribute to your account from each paycheck, invest in professionally-vetted funds, and, in most cases, put off income tax on that income until later in life.

Many employers have a matching contribution to 401s as an employee benefit – as long as you put in some cash yourself. But how much should you put in, and what can you do to get the most from your 401 in the long haul? Here’s what you need to know.

What To Do If You’ve Maxed Out Your 401 Plan

So you’ve put the maximum amount of money in your 401 account for the year. Good for you! If you want to save even more for retirement, you have a few other options.

- Open an IRA. You can open an Individual Retirement Account on your own with a brokerage. An IRA is another type of tax-advantaged retirement account, and it’s not connected to an employer. They come in two main types: a Roth IRA, in which you contribute post-tax income and withdraw it tax-free later, or a traditional IRA, in which you contribute pre-tax income and pay taxes when you take it out at retirement. However, keep in mind that there are income limits for opening a Roth IRA, so not everyone is eligible. Talk to an accountant to find out which tax strategy makes the most sense for you.

- Make other investments. There’s no limit to how much you can invest if you open a general brokerage account and purchase individual stocks, bonds and mutual funds. If you’re not sure how to invest strategically, consider hiring an investment advisor who can help you choose investments or manage them for you. If you’re a conservative investor, you could invest in CDs, which have a low but guaranteed return. While these types of investments aren’t tax-advantaged in regard to retirement, they may provide more cash for retirementand you won’t have to pay penalties if you need to access the money before then.

Don’t Miss: Can You Take All Your 401k Money Out

How Much You Can Afford To Contribute

Despite contribution limits, often times employees will contribute what they can afford to set aside for retirement. Financial experts generally recommend that everyone contribute 10% of their paycheck to a 401, but this may not be doable for all. Plus, often times we think about other ways well need to use that money now.

Your life expenses can play a role in how much of your paycheck you feel comfortable contributing to your 401. If you tend to have high monthly costs or someone who relies on your financial support, you may feel like contributing a higher percentage to your 401 may mean having less in your paycheck to meet your monthly expenses.

If attempting to max out your 401 means putting yourself in a financially stressful situation, its okay to just contribute what you feel comfortable with.

In this case, a good rule of thumb that still has a profound positive impact on your retirement savings is to contribute just enough to receive the full employer match. So if your employer will match up to 7% of your contributions, only contribute 7% so you can take full advantage of that extra money. Your employer match is essentially free money so you dont want to leave any sitting on the table.

You May Like: How Do I Get My Money From My 401k

Make Sure You Contribute At Least This Much

Deciding how much to save in your 401 shouldn’t take an advanced degree in mathematics.

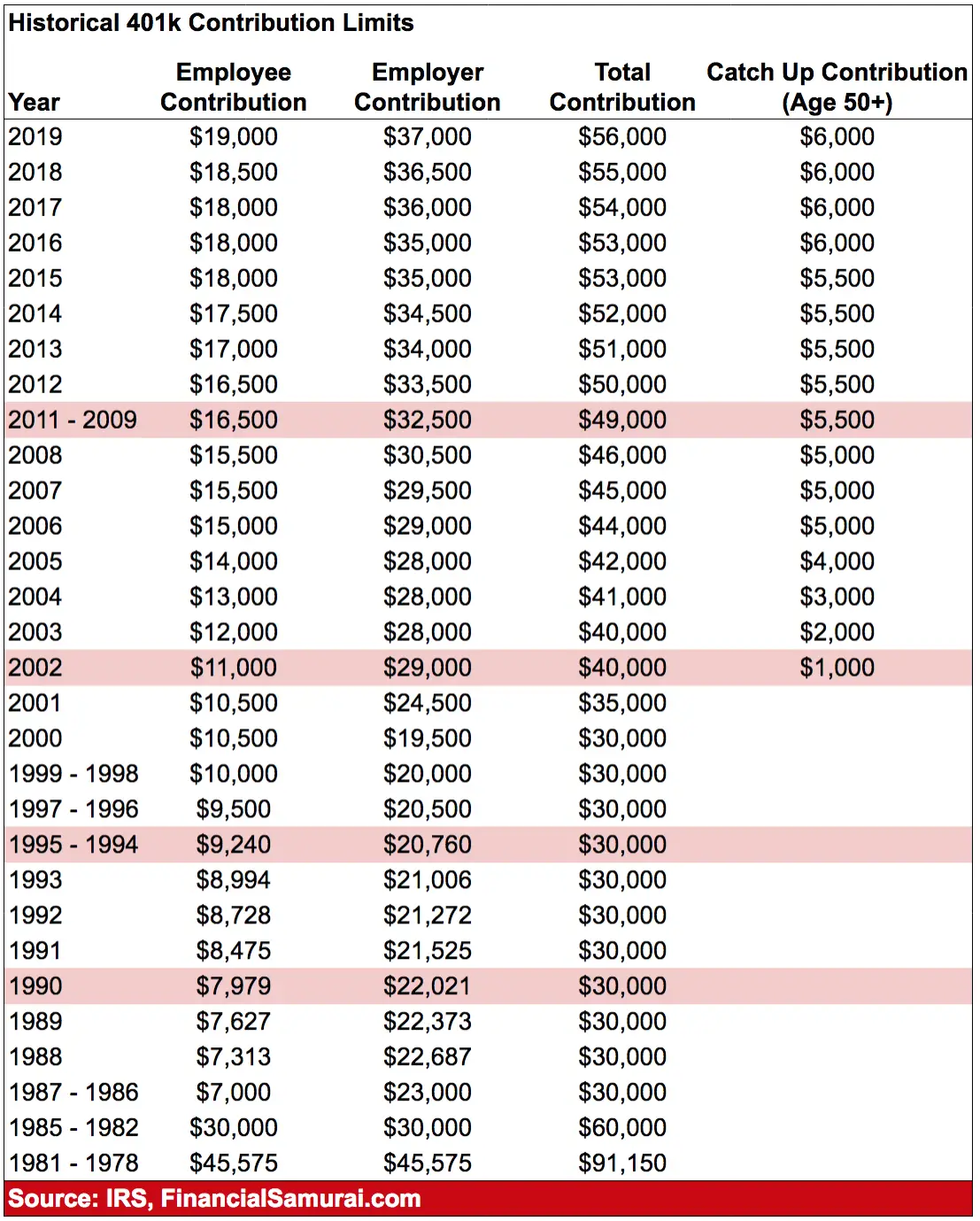

At a minimum, you should contribute as much as your employer will match to your 401. If you’re able to put away even more for retirement, you can contribute up to $19,500, or $26,000 if you’re older than 50, in 2021 .

There are a few other considerations to take into account before plowing all that money into your 401, but here’s all you need to know.

Also Check: How To Use Your 401k

What Is A 401k

A 401k is a powerful type of retirement account that many companies offer to their employees as a perk. With each pay period, you put a portion of your paycheck into the account. It happens automatically so you dont have to do anything special and there are a ton of benefits.

A 401k is called a retirement account because it gives you huge tax advantages if you dont touch your money until you reach the minimum retirement age of 59 1/2 years. While you will have to pay a penalty if you touch your 401k savings before you reach retirement age, the benefits far outweigh the risk.

Here is a snapshot of the benefits of having a 401k:

How Much Should I Contribute To My 401 If No Match

Is a 401 worth it? Yes, it is. But how much to put into a 401 account depends on whats on offer. It helps to understand what these accounts are, and the limits that restrict your investments with or without a match.

According to Investor.gov, 401s are qualified retirement accounts that offer you the ability to save some of your earnings in tax-advantaged accounts. They are usually offered by employers as part of their employee benefits.

The traditional version of the 401 enables you to save pretax dollars with the understanding that you will pay income taxes upon withdrawal after retirement. On the other hand, the Roth version enables you to save extra after-tax dollars into the retirement to avoid taxation later on when your earnings may be higher. SIMPLE and Safe Harbor 401 plans also exist, but their rules are a little bit different from the traditional and Roth 401 plans.

How much you put into each of these 401 accounts depends on the IRS contribution limits, your annual earnings and whether you will receive an employer match or not.

Don’t Miss: Where Do I Get My 401k Money

Next Steps To Consider

This information is intended to be educational and is not tailored to the investment needs of any specific investor.

Diversification and asset allocation do not ensure a profit or guarantee against loss.

Investing involves risk, including risk of loss.

Target Date Funds are an asset mix of stocks, bonds and other investments that automatically becomes more conservative as the fund approaches its target retirement date and beyond. Principal invested is not guaranteed.

Fidelity does not provide legal or tax advice. The information herein is general in nature and should not be considered legal or tax advice. Consult an attorney or tax professional regarding your specific situation.

With respect to federal taxation only. Contributions, investment earnings, and distributions may or may not be subject to state taxation.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

What If You Can’t Meet Your Employer Match

If you aren’t yet in a position to contribute enough to meet your employer’s match, and thus not enough to reach the desired 15% savings rate, aim to boost your retirement contributions by 1% to 2% each year. If you opt in to do so, some companies will automatically raise your contribution rate annually, so it’s worth making sure you are signed up for what is called an “auto-escalation” feature.

Ivory Johnson, a CFP and founder of Delancey Wealth Management, recommends increasing your contribution rate as you get pay raises until you max out the limit. There is a limit to how much you can contribute annually to your 401. In 2021, the standard annual contribution limit is $19,500 for 401 plans. And those over age 50 can use catch-up contributions to add an extra $6,500 in their 401 account. Employer contributions don’t count towards those specific limits.

Lynch reminds retirement savers to be strategic with the magic number they would like to contribute to their 401 before automatically trying to max it out, however.

“Situations can arise where you may need to prioritize your cash savings in your emergency fund or save for a different reason, such as for a down payment on property or a vehicle,” she adds. “$19,500 isn’t a small chunk of change.”

Keep in mind that although you don’t pay income taxes on the money you set aside in a 401, you’ll have to pay taxes later on when you eventually withdraw the funds in your nonworking years.

Don’t Miss: How Can I Look At My 401k

Consider The Ira And Roth Ira Option

If your company does not offer an employerâs match, or if you have additional cash to save, you should rollover to an IRA, either a traditional IRA or Roth IRA. An IRA offers greater control to retirement savers, and you have access to a wide pool of investment options. However, an IRA has a lower contribution limit of $6,000 a year, and a catch-up contribution of $1000 for those age 50 or older.

A traditional IRA is a tax-advantaged retirement account, and you will not pay taxes on the contributions you make. The money grows tax-free, but you will owe taxes when you withdraw funds. With a Roth IRA, you pay tax on the contributions you make to the retirement plan. You donât pay taxes on the investment returns and distributions. Therefore, Roth IRA money is more valuable in retirement since you wonât be required to pay taxes in retirement.

Tags

Choosing Health Insurance Bills Or Your 401

If you cant afford to pay your monthly bills, you cant afford to make 401 contributions. If there are unexpected expenses or loss of income, you may even need to withdraw retirement money early. If possible, focus on putting in the minimum to get your employers match, then use the additional money to pay off any high-interest debt, like credit cards.

One option, if youre struggling to afford your 401 contributions, is to choose a cheaper health insurance plan. People who overpay for health insurance are 23% more likely to forgo their employers retirement match, a TIAA Institute study found.

A health savings account can help you reduce health costs and save for retirement at the same time. You can only fund one if you have a high-deductible health plan, which often leads to higher out-of-pocket costs. You fund an HSA with pre-tax money. When you spend it on Internal Revenue Service -approved qualified medical expenses, your distributions for those are also tax-free and penalty-free.

An HSA is a good supplement to your 401 contributions because if you have unused money in the account when you turn 65, you can withdraw it without penalty for any purpose, though youll owe income taxes for distributions made for non-qualified medical expenses.

Also Check: How To Open Up A 401k

How Much Money Should You Have In Your 401k

At IWT, we talk about 401ks a lot.

And, thats with good reason. If you want to be rich, the 401k is one of the most powerful investment tools at your disposal, especially for retirement planning. It is also one of the most misunderstood money-maximizing vehicles, starting with how much you should have in your 401k.

That is a solid question, but it doesnt have a simple answer. To answer that burning question How much should I have in my 401k? we need more details. How much to invest in 401k investments will depend on your age and a few other considerations.

Lets start at the beginning.