How Much Does A 401 Cost Small Business Employers

LAST REVIEWED Jul 18 202220 MIN READ

Key Takeaways

-

401 plan costs can be broken into three general categories: startup costs, employer contributions , and plan administration fees

-

Well review how plan costs can differand provide industry benchmarks for 401 service fees and other expenses

-

Comparing plan costs vs. industry averages can help you understand if you are overpaying

Think that 401 plans are an expensive benefit reserved exclusively for large businesses with deep pockets? Think again. While this may have been a reality in the past, many companies including small businessesarent aware that 401 plans can be affordable and attainable.

These days, 401 providers can use technology to cut costs. Additionally, there are tax credits that help cover startup costs for new plans. Finally, offering a 401 can provide businesses with tax deductions, which helps reduce the overall costs of the plan.

Given the options available, its a good idea to examine if a 401 plan might now be an option for your business.

Advice For Employees And Also Employers

A Roth 401 is a relatively recent alternative to a traditional 401 retirement plan, with different tax advantages to a 401 or traditional IRA account. Not all employers offer them, but it is worth investigating as a retirement vehicle option.

Keep It Running Smoothly

Ongoing nondiscrimination testingOffering a retirement plan takes regular upkeep and a close eye on 401 plan compliance deadlines to ensure you dont run afoul of ERISA and IRS rules. Most 401 plans are required to pass nondiscrimination testing each year. These look at the value of each employee’s account, employee contribution rates, and other details. Employer matching and profit sharing also come under scrutiny. Your company may also want to regularly review or revise your plan features as the company’s situation changes.

Government filingsIn addition to keeping up with compliance testing, youll need to file an IRS Form 5500 each year. This federally-mandated form includes information about your business, your retirement plans, number of participants, and more.

How much will a small business 401 cost?Guideline 401 starts at a $49 base fee plus $8 per employee per month. Learn more about our fees and services here.

When evaluating a small business 401, consider if there are hidden fees for key functions such as compliance, recordkeeping, and investment management. Also ask about setup fees, monthly fees, annual fees, Form 5500 fees, and whether a provider expects you to pay fees to anyone else. All these standard services are included in Guideline’s pricing.

*This content is for informational purposes only and is not intended to be construed as tax advice. You should consult a tax professional to determine the best tax advantaged retirement plan for you.

Also Check: How To Open A 401k With Fidelity

Research Retirement Options For Your Business

It’s important to do your due diligence in researching firms that provide recordkeeping and third-party administration services for 401 plans. As you assemble your list, include a range of established, reputable mutual fund companies, brokerage firms, and insurance companies. Focus on providers that can serve you and your employees long-term with extensive resources and excellent customer service.

You may also want to hear from owners of businesses that are similar to yours, as they may be able to offer insights from their own experiences selecting 401 plan service providers.

How To Set Up A Safe Harbor 401 Plan

A popular retirement solution for small business owners

- Maximize your retirement plan contributions

- Incentivize your team to save for their future

- Sail through required IRS compliance testing

- Receive up to $16,500 in tax credits over three years when you open a 401 with auto-enrollment

Establish your Safe Harbor Plan with Ubiquity.Call or schedule a time to meet with a retirement expert.

Looking to reward your employees with higher retirement contributions and allow higher contributions for owners, while legally bypassing potentially expensive annual nondiscrimination testing?

The Safe Harbor 401 Plan is easier and less expensive to administer than a traditional 401, but you will need to talk with your retirement plan provider to set it up.

Take a lesson in Safe Harbor 101:

Read Also: What Age Can I Withdraw From 401k

How Many Employees Do You Need To Have A 401 Plan Can Small Businesses Even Offer A 401

Lets get this out of the way. Yes, any size business can offer a 401 plan. Traditionally, 401 providers charged small and mid-sized businesses exorbitant fees or ignored them altogetherleading millions of smaller businesses out in the cold without an easy way to offer meaningful retirement benefits. Guideline is changing that by offering small businesses an easy, affordable 401.

Strategies For Saving When Youre Self

The joys of self-employment are many, but so are the stressors. High among those is the need to plan for retirement entirely on your own. You are in charge of creating a satisfying quality of life post-retirement. When it comes to building that life, the earlier you start, the better. Luckily, there are several retirement plans for those who are self-employed.

To read this article in Spanish, please download the translated version now.

You May Like: How To Roll 401k Into New Job

Establish A Trust Fund To Hold The Assets Of The Plan

Its essential that all plan assets are held in trust, so theyre used exclusively to benefit members and their beneficiaries. 401 trusts require at least one trustee to manage contributions, investments, and distributions. Therefore, choosing the right trustee is one of the most crucial decisions youll make when setting up a 401 because it impacts the plans financial security. If the plan has insurance, you dont need to worry about this step.

Deadline To Set Up And Fund

- For taxable years 2020 and beyond, individual 401 plans may be set up by tax filing deadlines plus extensions. Note: It can take 30 or more days to establish a plan.

- Salary deferral portion of the contribution must be deducted from a paycheck prior to year end, with some exceptions for certain business structures.

- Business owner contributions may be made up through the business tax filing due date plus extensions.

Don’t Miss: Can I Pull Out My 401k

How To Set Up A Solo 401 In 5 Steps

A Solo 401 is a retirement account that allows an individual to save for retirement on their own. In order to set up a solo 401, you must first calculate your contribution amount, then decide how much of the total contribution will go towards your employers match and how much will go towards yourself.

If youre looking for a Solo 401 provider, ShareBuilder 401k can help you optimize your retirement savings while keeping the setup and administration costs down. Clients benefit from a low-cost, broad, high-quality fund lineup as well as a user-friendly website.

Here are the steps to creating your own Solo 401:

Roll Your 401 Into An Ira

The IRS has relatively strict rules on rollovers and how they need to be accomplished, and running afoul of them is costly. Typically, the financial institution that is in line to receive the money will be more than happy to help with the process and avoid any missteps.

Funds withdrawn from your 401 must be rolled over to another retirement account within 60 days to avoid taxes and penalties.

Read Also: How Old To Start A 401k

Basics Of 401 Allocation

When you allocate your 401, you can decide where the money you contribute to the account will go by directing it into investments of your choice.

At a minimum, consider investments for your 401 that contain the mix of assets you want to hold in your portfolio in the percentages that meet your retirement goals and suit your tolerance for risk.

Why Are 401 Plans Beneficial To Small Businesses

Referencing the guide 401 Plans for Small Businesses from the U.S. Department of Labors Employee Benefits Security Administration and the Internal Revenue Service , these plans promote your employees financial security and bring you several advantages as a small business owner:

- 401s help you recruit and retain qualified employees, as mentioned above.

- If you contribute to an employees account, you can claim a tax deduction.

- Diversifying investment vehicles will allow the money contributed to grow.

- Employer contributions are deductible, and earnings and contributions are tax-deferred until distribution.

- When employees leave the company, their benefits follow them, reducing the amount of administrative work.

In light of these benefits, you may want to know how to set up a 401 for employees. Read on to learn.

Recommended Reading: What Is Better Than A 401k

How Do You Choose The Best Funds To Offer To Your Employees

The contributions you make to your 401 are invested in a portfolio made up of mutual funds, stocks, bonds, money market funds, savings accounts, and other investment options, as permitted by the plan.

Beneficial funds allow your employees to choose the types of investments they make. The fund choices are transparent, have a low fee, and follow well-researched investment approaches. Again, speak with a finance professional while you are researching options.

Benefits Of Starting A 401

A 401 plan is an employer-sponsored retirement option that lets employees contribute pre-tax dollars to their accounts. As a result, the contribution reduces an employees tax liability and lets them save for retirement. But what about the business benefits of setting up a 401?

Setting up a 401 for small business can help you:

- Attract and retain employees: 68% of private industry workers have access to employer-provided retirement plans. Providing a 401 plan can help you stay competitive as an employer.

- Expand your employer benefits, tax-free: Employer matching and nonelective contributions to retirement plans are not subject to Social Security and Medicare taxes.

- Claim tax deductions: Eligible small businesses who start a new 401 plan and/or add an automatic enrollment feature to any 401 plan can lower their tax liability through 401 tax credits.

- Stay compliant in your state: For some employers, offering a retirement plan isnt a choice. Your state may require that you offer employees a retirement plan, like a 401.

One of the reasons small businesses hesitate on starting a 401 is the time and cost commitment. Recognizing this, Congress passed the SECURE Act in 2019. The act incentivizes small employers to begin offering 401s with expanded tax credits.

Also Check: Does A 401k Rollover Count As A Contribution

Start Your Own Retirement Plan

When youre an employee, you can only use a 401 plan if your employer establishes a plan and youre eligible to contribute. All too often, thats not the case. But you still have options.

5 Ways to Save on Your Own

Ask for a 401: Your employer might be willing to set up a 401 they just havent done it yet. Start the conversation by asking why there isnt one, why you want one, and that there are potential tax benefits for employers. Explain that valuable employees like yourself would be even more valuable with excellent benefits. Offer to do some of the legwork required to get the plan up and running. In some cases, especially with small organizations, your employer simply doesnt have time to set up a plan. Cost is another factor companies and small nonprofits might be hesitant to pay plan costs . If cost is the primary concern, discuss less-expensive options like SIMPLE plans. Only time will tell if itll actually happen, but it never hurts to ask.

IRAs: If you dont have a 401, you may still be able to save in an individual retirement account , and you might even receive tax benefits similar to a 401. Unfortunately, the IRS sets maximum annual limits much lower for IRAs. Still, something is better than nothing. Evaluate traditional IRAs for potential pre-tax saving, and Roth IRAs for possible tax-free withdrawals . Another drawback of IRAs ) is that you may need to qualify to make contributions or receive a deduction. Speak with a tax expert before you do anything.

Finalizing Your 401 Selection

Next, with the help of a financial advisor, choose the plan that makes the most sense for your company and your employees. If you have a relatively small company with only a few employees, your plan selection will likely be quite different if you have 90 employees.

The final step will be to inform your employees and to update your benefits package to reflect the change, so you can clearly tell potential employees about the 401 plan, as well. You will likely want to mention the benefit on all of your job listings in the future, too.

CO aims to bring you inspiration from leading respected experts. However, before making any business decision, you should consult a professional who can advise you based on your individual situation.

Want to read more?

To stay on top of all the news impacting your small business, go here for all of our latest small business news and updates.

COis committed to helping you start, run and grow your small business. Learn more about the benefits of small business membership in the U.S. Chamber of Commerce, here.

Don’t Miss: Can I Rollover My Current 401k To An Ira

Skip Testing Hassle With Safe Harbor

Small business owners often ask, Is there really no Safe Harbor test? Most 401 plans require compliance testing to determine whether the program meets IRS fairness standards in compensating rank-and-file employees the same as highly-compensated executives, directors, and owners. A plan must pass the annual fairness test in order to maintain its tax-qualified status.

With a Safe Harbor plan, however, you generally dont have to worry about the most common compliance tests given by the IRS. In exchange for getting a pass on the Actual Deferral Percentage test and Actual Contribution Percentage test, your company agrees to make a minimum contribution to all your employees 401 accounts each year which must be immediately 100% vested.

To Set Up A Retirement Plan Company Contribution Item Using Custom Setup:

You May Like: Can I Rollover My 401k To A Mutual Fund

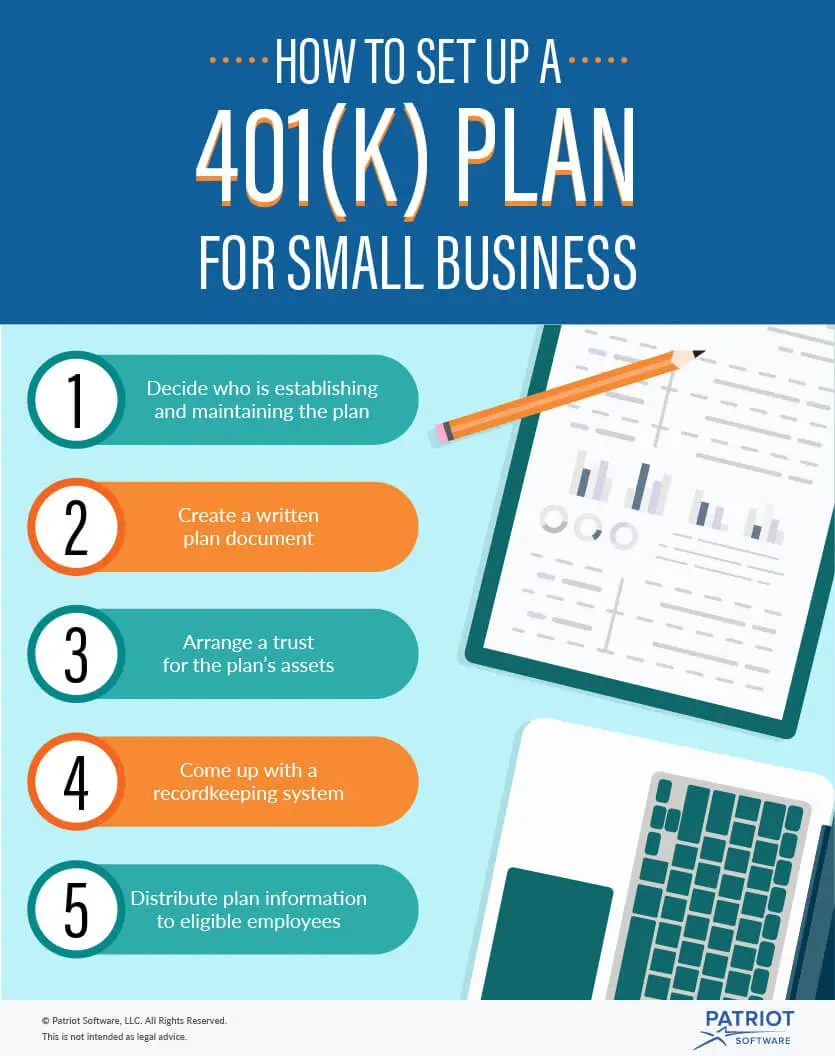

Irc 401 Plans Establishing A 401 Plan

When you establish a 401 plan you must take certain basic actions. For instance, one of your decisions will be whether to set up the plan yourself or consult a professional or financial institution – such as a bank, mutual fund provider, or insurance company – to help you establish and maintain the plan.

How A Keogh Works

Keogh plans usually can take the form of a defined-contribution plan, in which a fixed sum or percentage is contributed every pay period. In 2021, these plans cap total contributions in a year at $58,000. Another option, though, allows them to be structured as defined-benefit plans. In 2021, the maximum annual benefit was set at $230,000 or 100% of the employees compensation, whichever is lower it rises to $245,000 in 2022.

A business must be unincorporated and set up as a sole proprietorship, limited liability company , or partnership to use a Keogh plan. Although all contributions are made on a pretax basis, there may be a vesting requirement. These plans benefit high earners, especially the defined-benefit version, which allows greater contributions than any other plan.

Also Check: How To Check My 401k Plan

Designing Your Plan Based On Safe Harbor 401 Matching

Employers can choose one of three types of Safe Harbor 401 matching:

- Basic Matching: Employees must defer funds to receive contributions. The company matches 100% of all employee contributions, dollar for dollar, on the first 3%, plus 50% matching on the next 2%.

- Enhanced Matching: Again, employees must defer funds to receive contributions. The company matches 100%, dollar for dollar, on at least 4% of employee contributions, up to a maximum of 6%.

- Non-Elective Contributions: Even if an employee chooses not to make contributions, the company contributes 3% of the employees W2 income.

Your choice of 401 matching is a personal decision, and we are happy to discuss it with you. Companies sometimes switch from a safe harbor non-elective contribution to a match, thinking low deferral rates will be less expensive, only to find that employees increase their deferrals to receive the larger company contribution.

So, if your goal is to encourage saving for retirement, matching is a good bet. If your goal is cost-savings, a different 401 plan might be better suited to your needs.

Additionally, Safe Harbor matching deposits are often required at least quarterly, while non-elective contributions can be made as late as the last day of the following year, so that is another point to consider when choosing among these plans.