Rules You Must Follow In Self

The rules of a self-directed 401K basically limit the types of items you can purchase and the types of transactions you are allowed to complete. For example, you are not allowed to complete any transactions with yourself or family members. You are not allowed to purchase collectibles like works of art with the 401k, and you cannot live in or use the properties that you own as investments. This is where self-directed 401k rollovers come into play.

Why It Works To Move Your Retirement Plan To A Self

There are numerous reasons people choose to transfer and/or rollover their retirement account to a self-directed IRA. The main reason is to protect their savings from a volatile stock market or unpredictable changes in the economy. By diversifying their investments, they have a greater opportunity to stay on track with their retirement goals.

Self-directed IRAs are also known to perform much better than stocks and bonds. A recent examination of self-directed investments held at IRAR suggests that investments held for 3 years had an ROI of over 23%. This is why most investors are self-directing their retirement.

How To Transfer From Your 401 To An Ira

When youre ready to make the transfer, you need to do three things:

I often help clients prepare these requests and do a three-way call with them , making it quick and easy to get things done. But if you prefer, you can probably figure this out on your own.

Unfortunately, you typically have to go through your former employer or a vendor they use. With many 401 plans, you cannot request a transfer using paperwork from the receiving IRA custodian.

Who to Contact

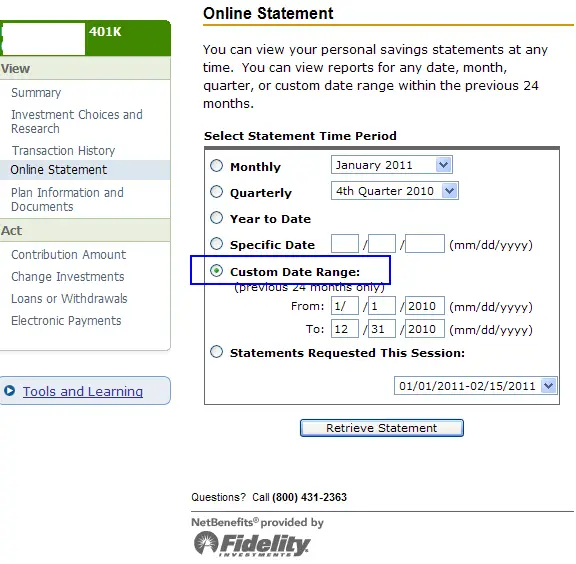

If you work for a large company, you can most likely contact your 401 provider directly. For example, contact Fidelity, Vanguard, or whatever website you use to manage your account. Alternatively, call whoever prints your 401 statements. If you work for a small company, you may need to contact the human resources department, which might just be the person who hired you. Either way, you eventually need one of the following:

What to Say

Read Also: How To Withdraw My 401k

Tax Consequences Of The One

Beginning in 2015, if you receive a distribution from an IRA of previously untaxed amounts:

- you must include the amounts in gross income if you made an IRA-to-IRA rollover in the preceding 12 months , and

- you may be subject to the 10% early withdrawal tax on the amounts you include in gross income.

Additionally, if you pay the distributed amounts into another IRA, the amounts may be:

- taxed at 6% per year as long as they remain in the IRA.

Why Choose Irar For Your Self

The answer is clear and simple!

Your account will be serviced by an experienced team of Certified IRA Services Professionals with expertise in self-directed IRAs. Our knowledge and experience in self-directed IRA rules, regulations, and recent trends, will assist you in making smart educated decisions.

Youll also be able to save over 50% compared to fees charged by other industry providers. We believe in maintaining lower fees because were committed to helping you build long-lasting retirement wealth.

At IRAR we see many cases in which IRA owners transfer their existing self-directed IRA to IRAR because theyve grown unhappy with their current provider account fees were too high, poor service, or the provider has gone out of business or changed in management.

Regardless of the reason, we want to help.

Also Check: How Do I Find Old 401k Plans

Option : Move The Money To Your New Employer’s 401 Plan

Moving money to your new employers 401 may be an option, depending on whether your current employer has a 401 plan and the terms of the plan. Like your former employer’s plan, many factors ultimately depend on the terms of your plan, but you should keep the following mind:

- Ability to add money: You’ll generally be able to add money to your new employer’s plan as long as you meet the plan’s requirements. This option also allows you to consolidate your retirement accounts, which may make it easier to monitor your investments and simplify your account information at tax time.

- Investment choices: 401 plans typically have a more limited number of investment options compared to an IRA, but they may include investments you can’t get through an IRA.

- Available services: Some plans may offer educational materials, planning tools, telephone help lines and workshops. Your plan may or may not provide access to a financial advisor.

- Fees and expenses: 401 fees and expenses often include administrative fees, investment-related expenses and distribution fees. These fees and expenses may be lower than the fees and expenses of an IRA.

- Penalty-free distributions: Generally, you can take money from your plan without tax penalties at age 55, if you leave your employer in the calendar year you turn 55 or older.

- Required minimum distributions: Generally, you must take minimum distributions from your plan beginning at age 72, unless you are still working at the company.

What To Consider When Choosing A Broker

If youre planning to roll over your 401 into an IRA, youll likely be most concerned with a broker that can do the following things best. Most brokers do offer an IRA, but some popular ones do not, but the brokers above all offer IRAs. We also considered the following factors when selecting the top places for your 401 rollover.

- Price: Trading commissions for stocks and ETFs have fallen to $0 at most online brokers, and thats great for investors. But there are other costs, too, perhaps most notably account fees, such as fees for transferring out of your account.

- No-transaction-fee mutual funds: The brokers in the list above offer thousands of mutual funds without a transaction fee. If youre rolling over your 401 and you like the mutual funds you have already, these brokers may allow you to buy and sell the same one without a fee.

- Investing strategy: While a 401 may limit your investing options to a pre-selected group of mutual funds, an IRA gives you the ability to invest in almost anything trading in the market. So we considered how each broker might fit an investors needs.

You May Like: What’s The Best 401k Investments

Risky For Inexperienced Investors

Of course, having that level of freedom is not always good. Because 401 plans are nondiscriminatory by nature, most plan charters require that these accounts must be offered to all employees in a companyincluding those with little or no knowledge or experience with investments. In many cases, the plan feature was added because a few top-level employees lobbied for it, and then they paid forand followed the advice or strategy ofa professional money manager.

It was a standard plan design, especially for law firms, historically, says David Wray, president of the Plan Sponsor Council of America , which represents companies that offer 401 and profit-sharing plans. Even today, the people who use are typically highly paidnot your typical 401 participant going into a target-date fund, Wray adds.

Indeed, 2021 data from Charles Schwab, a leading provider of SDBAs, shows that the average advised balance for self-directed brokerage accounts as of June 30, 2019, was $550,127.

Ira Rollover Vs Transfer

Although both rollovers and transfers allow you to move your retirement savings from one financial institution to another, the process for each is different, and each have different rules.

A 401 rollover occurs when you move retirement funds from an employer-sponsored plan to an IRA this is why it’s also called a Rollover IRA. This option is typically chosen when an employee leaves a job and is no longer contributing to the employer-sponsored retirement plan.

A Transfer is when you move your IRA to another IRA at a different institution. In the case of a transfer, funds or assets are sent between institutions, from the previous custodian or trust company to the new one. This is not only the quickest, but also the best method of moving your IRA to a self-directed IRA.

Read Also: How To Open A 401k Self Employed

Roll Over Your 401 To A Traditional Ira

If you’re switching jobs or retiring, rolling over your 401 to a Traditional IRA may give you more flexibility in managing your savings. Traditional IRAs are tax-deferred1 retirement accounts.

- Pros

-

- Your money can continue to grow tax-deferred.1

- You may have access to investment choices that are not available in your former employer’s 401 or a new employer’s plan.

- You may be able to consolidate several retirement accounts into a single IRA to simplify management.

- Your IRA provider may offer additional services, such as investing tools and guidance.

- Cons

-

- You can’t borrow against an IRA as you can with a 401.

- Depending on the IRA provider you choose, you may pay annual fees or other fees for maintaining your IRA, or you may face higher investing fees, pricing, and expenses than you would with a 401.

- Some investments that are offered in a 401 plan may not be offered in an IRA.

- Your IRA assets are generally protected from creditors only in the case of bankruptcy.

- Rolling over company stock may have negative tax implications.

- Whether or not you’re still working at age 72 RMDs are required from Traditional IRAs.

Solo 401k Faq: Can I Transfer Assets Like Stocks Into My Solo 401 What Is The Cost Of This Process

First, there is no cost to rollover cash and/or assets to the Solo 401k.

The key issue is whether the assets that a solo 401k owner wishes to transfer into the solo 401k are held in a retirement account that are eligible to be rolled into the plan.

If stocks or other assets are not in a retirement account , the solo 401k owner cannot transfer non-cash assets to the solo 401. When a solo 401k owner deposits non-retirement assets into a solo 401 owner, this must be made as a contribution and all Solo 401k contributions must be made as cash contributions and subject to the contribution rules .

If the stocks or other assets are in a retirement account, the stock may be rolled over to the solo 401k if the stock is a retirement account that is eligible to be rolled over . If the stock is in a Roth IRA, it cant be rolled over to a solo 401k it cant be transferred to a Solo 401k because cash and assets in a Roth IRA cant be transferred to any type of 401k including a Solo 401k.

Also Check: Where Is My 401k Account Number

Roll Over Your 401 To A Roth Ira

If youâre transitioning to a new job or heading into retirement, rolling over your 401 to a Roth IRA can help you continue to save for retirement while letting any earnings grow tax-free.2

- Pros

-

- You can roll Roth 401 contributions and earnings directly into a Roth IRA tax-free.2

- Any additional contributions and earnings can grow tax-free.2

- You are not required to take RMDs.

- You may have more investment choices than what was available in your former employerâs 401.

- Your Roth IRA provider may offer additional services, such as investing tools and guidance.

- You can consolidate multiple retirement accounts into a single Roth IRA to simplify management.

- Cons

-

- You canât borrow against a Roth IRA as you can with a 401.

- Any Traditional 401 assets that are rolled into a Roth IRA are subject to taxes at the time of conversion.

- You may pay annual fees or other fees for maintaining your Roth IRA at some companies, or you may face higher investing fees, pricing, and expenses than you did with your 401.

- Some investments offered in a 401 plan may not be offered in a Roth IRA.

- Your IRA assets are generally protected from creditors only in the case of bankruptcy.

- Rolling over company stock may have negative tax implications.

Rolling Into An Ira Stay On Top Of The Move

If you decide to roll over your 401 into an IRA, your IRA sponsor or advisor will help guide you through the process to ensure the money gets to the proper destination in a timely manner.

Be sure your new broker or advisor has experience with rollovers, especially if you have company stock in your 401. Why? Because company stock is liquidated when its rolled into an IRA, and later, when distributed, may be taxed as ordinary income resulting in a higher tax liability.

As recommended above, stay vigilant until your money is safely in its new home and that you have proof typically verified online through the IRA providers website.

You May Like: How To Set Up 401k Contributions

Completing The 401k Rollover Process

In order to rollover your 401k, you will need to contact the human resources representative at your old company to find out who the plans administrator is. Then you will need to complete the paper work to pull the money out. You have sixty days from the time the money is issued to you to deposit it into an eligible IRA account.

When you open an IRA, you can choose to open your IRA at three different types of places. The type of IRA you want will determine where you open your IRA.

You can open your IRA at a bank or credit union. These funds will be in a Certificate of Deposit. The FDIC guarantees these funds up to $250,000. However, they have the lowest rates of growth.

Investment firms will allow you to open an IRA and roll your 401k into it. The investment firms will allow you to choose among several different mutual funds. This type of account is the closest to a traditional 401k account.

You can also choose a self-directed IRA, which works similarly to a self-directed 401k. You can choose the same types of investments and will need to follow the same rules when it comes to the eligible transactions you can complete.

You can also choose between a traditional and Roth IRA. The easiest 401k rollover process is go straight from a traditional 401k to a traditional IRA, or from a Roth 401k to a Roth IRA. If you switch from a traditional 401k to a Roth IRA, you will need to be prepared to pay taxes on the amount that you rollover.

Value For Every Asset Level

“I would like to thank for his genuine interest in my financial well-being. I feel educated and informed when I speak to him. I truly believe he would be helpful if I had $25 or $300,000. It is important to be able to trust my retirement plan and the people who work with it. Please know I am very grateful for the relationship I am developing with .”

– Client of 1 year

Don’t Miss: How To Set Up A Company 401k Plan

Rollover To A Life Insurance Policy

Technically, you cant roll over your 401 account into an insurance policy however, if you have a life insurance needs, you can withdraw funds from the account and redirect them to pay for a life insurance policy. You can avoid early withdrawal penalties under IRS Rule 72t,2 which allows you to take equal payments from your accounts. However, you must agree to take consistent withdrawals from your account each year for life.

Fiduciary Issues With 401 Brokerage Accounts

Plan sponsors that offer brokerage accounts should carefully analyze the potential liability of substantial losses sustained by novice investors. Many sponsors believe that they cannot be held responsible for what happens in these accounts, but many benefits experts and attorneys say otherwise.

All other investment options inside qualified plans are required by the Employee Retirement Income Security Act of 1974 to meet certain fiduciary characteristics, even if they are aggressive in nature. Nevertheless, a large percentage of the investment options that participants can purchase in a brokerage account will fail to meet this standard.

To manage a self-directed brokerage account successfully takes a great deal of knowledge and expertise.

You May Like: How Do I Find Out What’s In My 401k

If You Have An Outstanding 401 Loan

Did you borrow any money from your 401? If you did and youre leaving the company, voluntarily or otherwise, you have the option to repay the loan to an IRA and you have until your personal tax return deadline of the following year to contribute that repayment amount to an IRA thanks to the 2017 Tax Cuts and Jobs Act, explains Mat Sorensen, CEO of Directed IRA and Directed Trust Company.

If you cant pay the loan back in the allotted time, the plan will reduce your vested account balance in order to recoup the unpaid amount, says Ian Berger, IRA Analyst with IRAHelp.com. This is called a loan offset.

I think that many people forget that if they have a loan outstanding, it has to be paid, says Wayne Bogosian, co-author of The Complete Idiots Guide to 401 Plans.

Fail to repay it and the loan amount will count as income, potentially subject to tax, plus youll pay an additional penalty equal to 10 percent of the sum you borrowed if youre younger than age 59 ½, says Bogosian.

Taking a loan from your 401 is really borrowing from yourself and may be an appropriate decision for some people who are unemployed with no income source, need money for medical expenses, or are purchasing their first home. However, there are many things to consider before doing so.

If you cant pay the loan back to your 401, other than the potential tax implications listed above, the options below still apply.