S For Rolling Over A 401 Into A Roth Ira

Once youve done the research, consulted a professional, and decided that a 401 conversion to a Roth IRA is right for you, theres a few things youll have to do.

First, youll need to open a Roth IRA account. NextAdvisor recommends these 5 online brokerages, which generally have low fees and good customer service.

Next, call that brokerage and tell them youd like to roll over a 401. This will likely be more effective than calling the institution that holds your 401 money after all, that company is not incentivized to help you move it out. As a general rule, its usually a lot easier to get money into a financial institution than it is to get money out of one, says Hernandez.

Depending on the institutions involved, the next steps may involve a paper check being mailed to your home, so youll need to make sure that both institutions have your most updated personal information on file. Make sure youre keeping track of the transactions for tax purposes. The 401 institution should provide you with a 1099-R form, which you can provide to your tax preparer.

Try not to get overwhelmed by the paperwork, says Stanley. Break the task into steps and give yourself time to get it done. You dont even need to do it all at once, she says. Whether you get it done in days or weeks, youll have taken a great step toward your financial goals.

You Want Lower Fees And More Investment Options

Because a 401 account is tied to an employer, it likely has a limited number of investment options, especially if the plan is administered by a small company.

For example, you might have access to only a small group of mutual funds with relatively high expense ratios, or fees. Many discount brokerages, on the other hand, offer index funds with expense ratios close to zero within self-directed IRA accounts.

In a 401, a lot of people feel like theyre handcuffed in terms of what they can own, says Hernandez. In most cases, in an IRA you have a lot more flexibility in what you can own.

Roth Ira Conversion Doesn’t Have To Be Forever

Yes that’s right! If you have second thoughts, you can convert at any time. The good news is you can convert your traditional IRA to a Roth IRA, or your traditional 401k to a Roth 401k. The price to make that conversion is including the amount you convert to Roth as taxable income for the year in which you make the conversion.For example, if you convert $100,000 from your traditional IRA to a Roth IRA in 2017, you will list $100,00 as income on your 2017 tax return. You will then pay any federal and state taxes on that income depending on your 2017 tax bracket.

You probably dont like the idea of paying additional taxes to convert. Honestly, who would? Nobody likes paying their friends at the IRS more taxes now. However, you can easily end up saving more money as your account grows and the entire growth comes out tax free.

Don’t Miss: How Do I Find Old 401k Plans

How To Do An Ira To 401k Reverse Rollover

On to the nitty-gritty. So you’ve decided that it makes sense for you to do an IRA to 401k reverse rollover. So, where do you actually begin? Here is our simple step-by-step guide on how to do the reverse rollover.

Step 1 – Confirm Eligibility

Before you begin anything, you need to confirm that your employer-sponsored 401k accepts IRA rollover funds. While doing this step, you should also get the deposit information from your 401k provider on where to send the check, what account numbers or information is needed, and what forms you might need to fill out .

Step 2 – Request A Distribution

Once you’re 100% positive that your employer 401k accepts a rollover contribution from your IRA, you can request a distribution from your IRA. Each IRA provider has it’s own policies and procedures for doing a distribution, but you should be prepared to fill out a form and select the reason why you’re requesting the distribution.

At this step, make sure you select “Rollover”, otherwise your brokerage may attempt to withhold funds from your distribution for taxes. If your brokerage withholds funds from your distribution, you’ll need to come up with that money when you re-deposit it in your 401k.

Step 3 – Deposit The Funds In Your 401k

Step 4 – Report The Rollover Accurately On Your Tax Return

If the amount of your distribution from your IRA and the amount you deposited into your 401k don’t match, that difference is the “taxable amount” and you’ll owe taxes and a 10% penalty on that.

You Want To Relax Early

Proponents of the FIRE movement invest aggressively so they can become work-optional in their 50s or even earlier.

If thats your plan, youll want at least a portion of your investments to be in an account thats more accessible than a 401, which you cannot tap without penalty before the age of 59 ½. A strategy known as a Roth conversion ladder involves converting 401 funds into a Roth IRA over a period of years.

Its a bit complex, says Hernandez. Theres a small number of people that it could make sense for. Its important to understand the tax impact.

You May Like: How Does A 401k Work When You Change Jobs

Basic Information: Conduit Iras

The portion of your 401 distribution that you roll over can be deposited into a conduit IRA, which is an IRA that receives only rollover money. According to Investopedia, the main advantage of using a conduit IRA is that it automatically qualifies for a subsequent rollover into another employer plan. Some employer retirement plans dont accept IRA rollovers unless they come from a conduit IRA. If you make non-rollover contributions to a conduit IRA, it loses its special status and becomes a regular IRA.

Three Reasons To Do A Reverse Rollover

While there are likely more than three reasons to do a reverse rollover, these are the three most common reasons that a IRA to 401k reverse rollover might make sense.

The three reasons are:

Before we dive into the main reasons to do the reverse rollover, we want to remind you that every situation is different, and this might not make sense for your personal situation. Always consult a CPA about the taxability of these types of scenarios, because they can get complex.

Also Check: How To Cash Out 401k While Still Employed

You Think Your Tax Rate Is Going To Go Up

If you believe your current tax rate is lower than it might be in the future, you may want to convert your investments into a Roth IRA, pay your fair share of taxes now, and then let that money grow tax-free until you need it.

Converting a pre-tax 401 into a post-tax Roth IRA will trigger a tax bill, but a financial professional might recommend it anyway. Its a way to hedge against the risk of taxes going up in the future, says Hernandez. In a general sense, if youre still in the early stages of your earning career, it makes sense to go ahead and pay the taxes upfront and do the Roth contributions.

Of course, no one knows for sure what their tax rate will look like in the future. Thats why many experts recommend diversifying your long-term investments into different buckets: some in a tax-deferred account like a 401, and others in a post-tax account like a Roth IRA. If all your money is one bucket, a conversion could make sense.

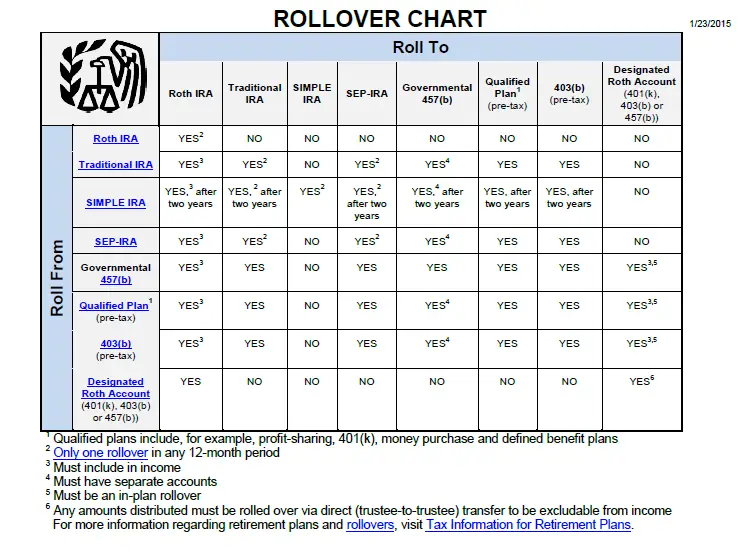

Rules For Simple Ira Rollovers To 401 Plans

Transferring your SIMPLE IRA assets to a 401 is straightforward. But you must complete the rollover within the terms of your SIMPLE IRA plan and the IRS rules to ensure that the rollover qualifies as tax- and penalty-free.

You can only make a tax-free rollover from a SIMPLE IRA to a 401 following a two-year period. The clock starts running from the date you first participated in the plan, not the date you left your employer.

You’ll have to pay taxes if you don’t comply with this two-year rule. The amount will be treated as a withdrawal if it occurs within the two-year period and you roll over your SIMPLE assets into a 401 plan. You’ll have to include the withdrawal in your taxable income for that year.

You may be on the hook for an increased age-related penalty as well.The 10% penalty you’d pay if you’re younger than 59½ increases to 25% if you roll over your SIMPLE IRA within the two-year period unless you qualify for an exception. Changing jobs in itself is not considered an exception. You may qualify for an exception if the amount you withdraw is less than the amount you pay for health insurance while you’re unemployed, however.

Your SIMPLE IRA must be in place for at least two years from the date of plan participation to qualify for a tax-free rollover to a 401.

Don’t Miss: Can You Take Money Out Of 401k

How Much Money Do I Need To Open A Vanguard Ira

At Vanguard, you can open an account with a $0 balance. But there are a few minimums to keep in mind as you begin to invest.

- Vanguard ETFs: You only need enough money to cover the price of 1 share, which can generally range from $50 to a few hundred dollars.

- Vanguard mutual funds: Some Vanguard mutual funds have a $1,000 minimum . Most of our other Vanguard mutual funds have a $3,000 minimum.

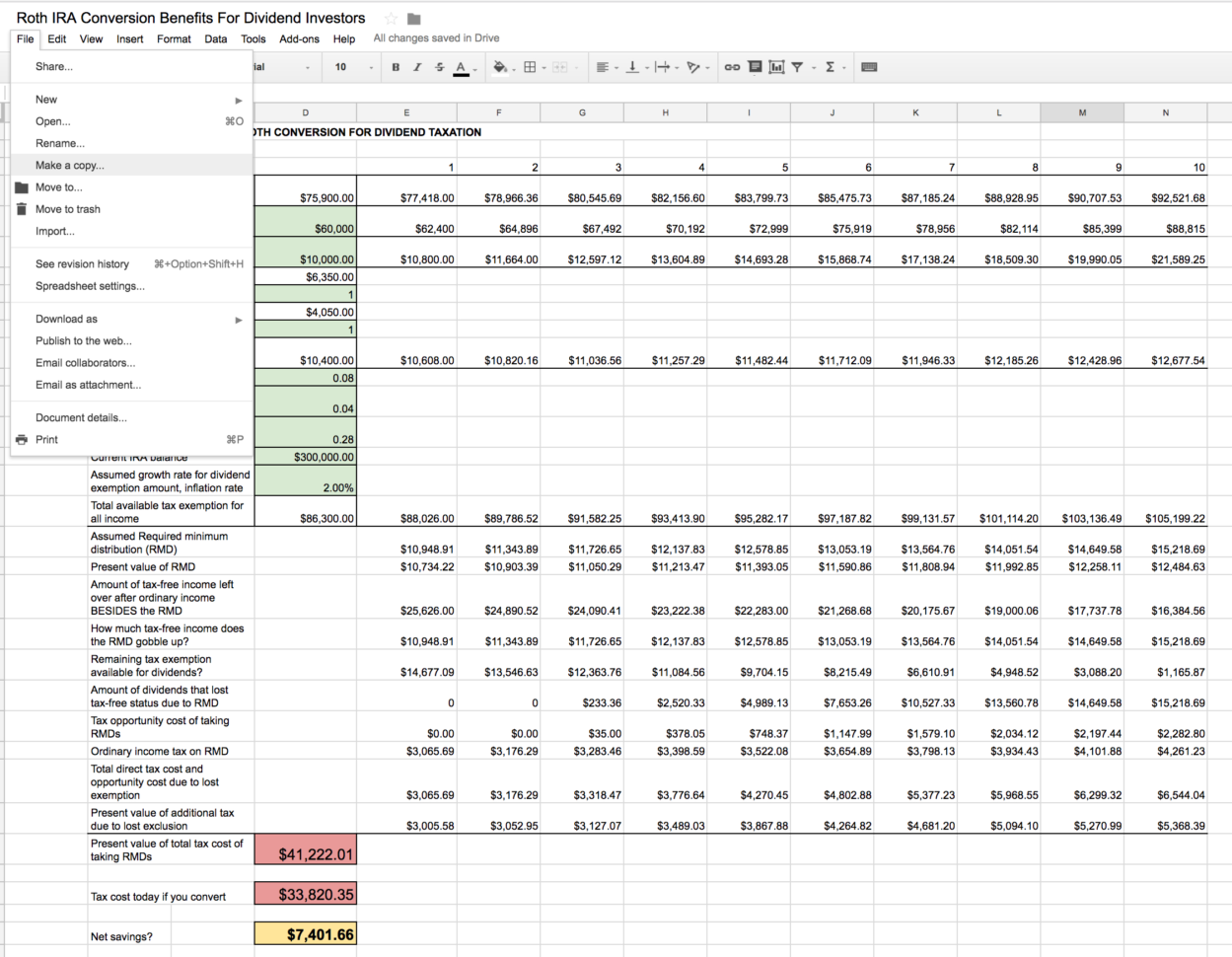

You Want To Avoid Required Minimum Distributions

Heres another rule that applies to a 401 but not a Roth IRA: required minimum distributions, or RMDs.

The IRS requires all 401 owners to withdraw a minimum amount from their accounts each year beginning in the year they turn 72. The exact amount depends on your balance, your age, and a life-expectancy variable determined by the IRS.

With a Roth IRA, that money has already been taxed, so RMDs are not required.

Also Check: How To Buy A House With 401k

How Do I Complete A Rollover

Reasons To Convert Your Traditional Ira/401 To A Roth

A Roth is the opposite of a traditional IRA or 401k. Roth IRAs and 401ks grow and the money invested in them is distributed tax free when you decide to retire. So if you had a Roth, you’d pay taxes now and pay no taxes on distributions when you decide to retire.

The benefit of paying now is it’s less money in the long run. If you can afford to pay taxes today, they’ll be cheaper than their equivalent in 20 or even 5 years. $20 today can inflate dramatically in the time until you retire.

There are several differences between traditional and Roth accounts. To put it simply, a Roth is best for you if you plan on being in a higher tax bracket then the one you’re in now when you retire. If you plan on being in a lower tax bracket, a traditional account is better for you.

Note: You may also want to check out our related articles:

Also Check: When Can You Get Your 401k

The Option To Convert To A Roth

An IRA rollover opens up the possibility of switching to a Roth account. s, a Roth IRA is the preferred rollover option.) With Roth IRAs, you pay taxes on the money you contribute when you contribute it, but there is no tax due when you withdraw money, which is the opposite of a traditional IRA. Nor do you have to take required minimum distributions at age 72 or ever from a Roth IRA.

If you believe that you will be in a higher tax bracket or that tax rates will be generally higher when you start needing your IRA money, switching to a Rothand taking the tax hit nowmight be in your best interest.

The Build Back Better infrastructure billpassed by the House of Representatives and currently under consideration by the Senateincludes provisions that would eliminate or reduce the use of Roth conversions for wealthy taxpayers in two ways, starting January 2022:

Further limitations would go into effect in 2029 and 2032, including preventing contributions to IRAs for high-income taxpayers with aggregate retirement account balances over $10 million and banning Roth conversions for high-income taxpayers.

But this can be tricky, so if a serious amount of money is involved, it’s probably best to consult with a financial advisor to weigh your options.

How To Do A Roth Ira Conversion

The actual process for converting a 401 or traditional IRA to a Roth IRA is simple. In fact, its so straightforward that you can create problems before youre aware that youve done so.

Here are the three basic steps to convert your retirement account to a Roth IRA:

If you manage your own funds, you should be able to find steps to do a Roth conversion on your investment platforms site, says Kerry Keihn, financial advisor at Earth Equity Advisors in the Asheville area, noting that each institution has a slightly different process or forms.

Within a couple weeks and often sooner the conversion to the Roth IRA will be made.

When it comes time to file taxes for the year you made the conversion, youll need to submit Form 8606 to notify the IRS that youve converted an account to a Roth IRA.

Don’t Miss: What’s The Best 401k Investments

You Expect To Earn More Money In The Future

If you plan to earn lots of money in the future or earn a high income now you should consider rolling your funds into a Roth IRA instead of a traditional IRA. For single filers in 2016, the maximum income allowable for contributions to a Roth IRA starts at $117,000 and ends at $133,000. Learn more about Roth IRA rules and contribution limits here. For married filers, on the other hand, the ability to contribute to a Roth IRA begins phasing out at $184,000 and halts completely at $194,000 for 2016. The more you earn in the future, the harder it will become to contribute to a Roth IRA and secure the benefits that come with it.

Dont Miss: Should I Keep My 401k Or Rollover To Ira

What Happens If I Dont Make Any Election Regarding My Retirement Plan Distribution

The plan administrator must give you a written explanation of your rollover options for the distribution, including your right to have the distribution transferred directly to another retirement plan or to an IRA.

If youre no longer employed by the employer maintaining your retirement plan and your plan account is between $1,000 and $5,000, the plan administrator may deposit the money into an IRA in your name if you dont elect to receive the money or roll it over. If your plan account is $1,000 or less, the plan administrator may pay it to you, less, in most cases, 20% income tax withholding, without your consent. You can still roll over the distribution within 60 days.

Read Also: Who Can Manage My 401k

Can A Qualified Charitable Distribution Satisfy My Required Minimum Distribution From An Ira

Yes, your qualified charitable distributions can satisfy all or part the amount of your required minimum distribution from your IRA. For example, if your 2018 required minimum distribution was $10,000, and you made a $5,000 qualified charitable distribution for 2018, you would have had to withdraw another $5,000 to satisfy your 2018 required minimum distribution.

Considerations For Owners Of Roth Iras

Distributions from a Roth IRA are qualified, and thus tax-free and penalty-free, provided that the 5-year aging requirement has been satisfied and at least one of the following conditions has been met:

- You reach age 59½

- You pass away

- You are disabled

- You make a qualified first-time home purchase

All other distributions are non-qualified. Non-qualified distributions of converted balances are not taxed again , but they may be subjected to a 10% penalty unless its been at least five years since the beginning of the year of your conversion, youve reached age 59½, or one of the other exceptions applies.

RMDs are not required during the lifetime of the original owner of a Roth IRA. RMD amounts are not eligible to be converted to a Roth IRA.

You May Like: Can I Buy 401k Myself

Recommended Reading: Does Employer Match Count Towards 401k Limit