A Conversion May Lead To More Taxes

When you convert a traditional IRA or traditional 401 that has used pre-tax contributions or IRA), youll end up with a tax bill. Youre recognizing that contribution as income, and you must pay taxes on it the taxes you didnt pay when it went into the account.

If you convert a Roth 401 into a Roth IRA, you skip the tax hit, because theyre both after-tax accounts. However, any employer match in a Roth 401 is technically held in a traditional 401, meaning that a portion of the account cannot be converted without incurring some taxes.

A Possible Backdoor Solution

There is a possible solution in what’s called a “backdoor Roth.” Currently, it’s possible to convert a traditional IRA to a Roth IRA even if you’re above the income limits . Basically, you first open a traditional IRA and make a contribution. There are no income limits for making a contribution to a traditional IRA, but you may not be able to deduct the amount.

You then convert that IRA to a Roth. You’d have to pay income taxes on any deductible contributions and earnings converted to the Roth, but from then on, you’d enjoy the tax-free benefits. This works well if you’ve never had a traditional IRA before. However, if you have an existing IRA, the distribution rules get more complicated.

If this is something you think might work for you, I recommend talking to a financial or tax advisor before taking action.

When Converting A 401 To A Roth Ira Makes Sense

First things first by far, the most common scenario in which rolling over a 401 into a Roth IRA is considered involves an employment transition. While there are numerous choices available when leaving your job , this particular method offers unique benefits so letâs cover the situations when such a move makes sense.

For starters, for investors who expect to be in a higher tax bracket after retiring whether due to RMDs or other sources of income, footing the tax bill now and enjoying tax-free growth and withdrawals later has some obvious benefits which are quite difficult to find elsewhere. One should also keep in mind the possibility that taxes as a whole will increase in the future something that seems quite likely when looking at future budget proposals.

Speaking of RMDs or required minimum distributions the mandatory payments that start at age 72 associated with traditional IRAs well, Roth IRAs donât have them. This helps keep down taxable income in retirement and allows for a much greater degree of control.

A lot of 401 programs are notorious for high fees and limited investment opportunities. In contrast with that, today, with the rising popularity of easy-to-use stock trading apps, the accessibility of Roth IRAs and the diversity of investment offerings has never been greater.

Recommended Reading: How To Generate Income From 401k

How To Roll A 401 Into An Ira

Here’s how to start and finish a 401 to IRA rollover in three steps.

1. Choose which type of IRA account to open

An IRA may offer you more investment options and lower fees than your old 401 had.

2. Open your new IRA account

You generally have two options for where to get an IRA: a robo-advisor or an online broker.

-

If you’re not interested in picking individual investments, a robo-advisor might be a good option. Robo-advisors build personalized portfolios using low-cost funds based on your preferences, then rebalance those funds over time to help you stay on track, usually for a much lower fee than a conventional investment manager.

-

If you want to build and manage your own investment portfolio, an online broker lets you buy and sell investments yourself. Look for a provider that charges no account fees, offers a wide selection of low-cost investments, and has a reputation for good customer service.

» Ready to get started? Explore our picks for best IRA accounts

3. Ask your 401 plan for a direct rollover

Here are the basic instructions for a direct rollover:

Contact your former employers plan administrator, ask for a direct rollover, complete a few forms, and ask for a check or wire of your account balance to be sent to your new account provider.

The new account provider gives you instructions for how the check or wire should be made out, what information to include, and where it should be sent.

If I Want To Keep A Specific Stock Or Asset In My Ira In My Portfolio For The Long Term Can I Keep That Asset And Convert It To A Roth Ira

Yes. If you are holding investments in a traditional IRAones you want to keep for a number of years and you think you may be in a lower tax bracket this year than you might be in the future, then a “focused conversion” may be a strategy to consider. With this strategy you move specific assets from a traditional IRA to a Roth IRA, rather than selling the assets first and then moving the resulting cash. In terms of the taxes, there is no difference between the 2 techniques.

Tip: To learn more, read Viewpoints on Fidelity.com: Focused conversion: A strategy for IRAs

Also Check: How To Buy Real Estate With Your 401k

Establish Your 2022 Retirement Plan

First, a question: As you read this, do you have your retirement plan in place?

If not, and if you have some cash you can put it into a retirement plan, get busy and put that retirement plan in place so you can obtain a tax deduction for 2022.

For most dened contribution plans, such as 401 plans, you are both an employee and the employer, whether you operate as a corporation or as a sole proprietorship. And thats good because you can make both the employer and the employee contributions, allowing you to put a good chunk of money away.

In general, your plan document will dene when you can make employee or employer contributions that will produce 2022 tax deductions. Make sure you know exactly when you can make both

- Your employer contributions, and

- Your employee contributions.

Example: You are the only employee in your business, you operate as a one-owner S Corporation, and you want an individual 401 plan deduction for the 2022 calendar year. To obtain the maximum 401 deduction for this calendar year, you must have an individual 401 plan in place on or before December 31.

If you have your S corporation 401 plan in place on or before December 31, 2022, then you can make your personal employee contribution on or before December 31, 2022. You also can make the employer contribution on or before December 31 or anytime before the 2022 S corporation tax return is due, such as on March 15, 2023 .

Can I Open A Roth Ira For My Kids

Where would you be financially if someone had started a tax-free Roth IRA for you before you could count to 10? Few parents or grandparents think about starting a Roth retirement account for young children. But think for a moment about what an enormous advantage it would be for a young child to have six or seven decades with one of these accounts compounding from birth until retirement.

Opening a Roth IRA for a young child can be the easiest way to create generational wealth!

Read Also: Can I Withdraw 401k After Leaving Job

When Can I Start Making Designated Roth Contributions To A Designated Roth Account

You may begin making designated Roth contributions to your 401, 403 or governmental 457 plan after you become a participant in a plan that allows contributions to Roth accounts. If your plan doesnt have a designated Roth feature, the plan sponsor must amend the plan to add this feature before you can make designated Roth contributions.

S For Rolling Over A 401 Into A Roth Ira

Once youve done the research, consulted a professional, and decided that a 401 conversion to a Roth IRA is right for you, theres a few things youll have to do.

First, youll need to open a Roth IRA account. NextAdvisor recommends these 5 online brokerages, which generally have low fees and good customer service.

Next, call that brokerage and tell them youd like to roll over a 401. This will likely be more effective than calling the institution that holds your 401 money after all, that company is not incentivized to help you move it out. As a general rule, its usually a lot easier to get money into a financial institution than it is to get money out of one, says Hernandez.

Depending on the institutions involved, the next steps may involve a paper check being mailed to your home, so youll need to make sure that both institutions have your most updated personal information on file. Make sure youre keeping track of the transactions for tax purposes. The 401 institution should provide you with a 1099-R form, which you can provide to your tax preparer.

Try not to get overwhelmed by the paperwork, says Stanley. Break the task into steps and give yourself time to get it done. You dont even need to do it all at once, she says. Whether you get it done in days or weeks, youll have taken a great step toward your financial goals.

Dont Miss: How Do I Get My 401k Money From Walmart

Read Also: How To Check If You Have Money In 401k

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Heres how to use a Roth IRA conversion to set up tax-free income for your retirement.

Where Should I Put My Retirement Money After I Retire

Roll over to an IRA. This option can also retain the tax-deferred advantage of a lump-sum distribution while offering a range of investment options. Alternatively, you can invest part or all of the lump-sum rollover in an annuity. It can provide you with a guaranteed income stream throughout your retirement.

What is the safest retirement fund?

No investment is completely safe, but there are five that are considered the safest investments you can have. Bank savings accounts and CDs are usually FDIC insured. Treasury securities are government-backed notes.

Where should a retiree put their money?

You can mix and match these investments to suit your income needs and risk tolerance.

- Immediate Fixed Annuity.

- Real Estate Investment Trusts

Read Also: How Do I Put My 401k Into An Ira

Can I Contribute The Maximum Including Catch

Yes, for 2022, if you are age 50 or older, you can make a contribution of up to $27,000 to your 401, 403 or governmental 457 plan and $7,000 to a Roth IRA for a total of $34,000. Income limits apply to Roth IRA contributions, however. For 2023, if you are age 50 or older, you can make a contribution of up to $30,000 to your 401, 403 or governmental 457 plan and $7,500 to a Roth IRA for a total of $37,500. Income limits apply to Roth IRA contributions, however.

Do I Have To Convert The Entire Amount In My Traditional Ira Or Qrp

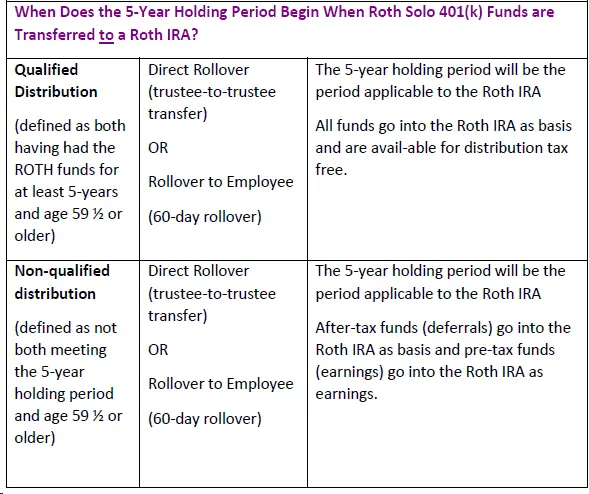

No. You may convert just a portion of your assets, and there is no limit to the number of conversions. To help manage the taxes due on each conversion, you may convert smaller amounts over several years. Keep in mind, if you want to take a distribution, each conversion has its own five-year waiting period to avoid the 10% additional tax if you are under age 59 1/2.

Also Check: How Do I Know If I Have A 401k Somewhere

What Is The Principal Difference Between Roth And Traditional Accounts

The most obvious difference between Roth and traditional accounts is that Roth accounts are funded with after-tax dollars. Traditional IRA and 401 accounts are funded with pre-tax dollars. The latter reduces adjusted gross income and the tax bill associated with it during the contribution year.

While their benefits arent immediately felt, Roth IRAs and Roth 401s have several distinct advantages over their traditional counterparts. For those who can wait for their tax benefits to be realized later, the advantage of having tax-free withdrawals during retirement can be substantial.

What Is A 401 Rollover

A 401 rollover involves transferring the funds out of your current 401 account and into a new 401 plan or other retirement account. The rollover could involve transferring the money to your new employers 401 if they offer one. But thats not the only choice. The options vary depending on how much money you have in the account, the rules associated with your current 401 plan, your future financial needs, and more.

Before starting a rollover, its important for workers to explore their options. The considerations may vary depending on age, employment status and financial goals, and preferences, says Nathan Voris, director, investments, insights, and consultant services at Schwab Retirement Plan Services.

Its also important to understand as you review options, that some choices trigger tax consequences including penalties if you opt to withdraw or cash out funds prior to retirement age.

Don’t Miss: Can You Take A Loan Against Your 401k

Traditional 401s Vs Roth 401s

Employer-sponsored 401 plans are an easy, automatic tool for building toward a secure retirement. Many employers now offer two types of 401s: the traditional, tax-deferred version and the newer Roth 401.

Of all the retirement accounts available to most investors, such as 401 and 403 plans, traditional IRAs, and Roth IRAs, the traditional 401 allows you to contribute the most money and get the biggest tax break right away. For 2022, the contribution limit is $20,500 if you’re under age 50. If you’re 50 or older, you can add an extra $6,500 catch-up contribution for a total of $26,000. In 2023, the contribution limit increases to $22,500 and the catch-up contribution raises to $7,500, for a total of $30,000.

Plus, many employers will match some or all of the money you contribute. A Roth 401 offers the same convenience as a traditional 401, along with many of the benefits of a Roth IRA. And unlike a Roth IRA, there are no income limits for participating in a Roth 401. So if your income is too high for a Roth IRA, you may still be able to have the 401 version. The contribution limits on a Roth 401 are the same as those for a traditional 401: $20,500 in 2022, with the $6,500 catch-up amount, and $22,500 in 2023, with the $7,500 catch-up contribution depending on your age.

If I Am Required To Take A Corrective Distribution From My 401 Plan Because The Plan Failed The Adp Nondiscrimination Test Can I Take Some Or All Of The Corrective Distribution From My Designated Roth Account

Yes, a plan can provide that a highly compensated employee , as defined in Code Section 414, with both traditional, pre-tax elective contributions and designated Roth contributions during a year may elect to attribute excess contributions to pre-tax elective or designated Roth contributions. The plan does not have to provide this option and may provide for correction without permitting an HCE to make this election.

A distribution of excess contributions is not includible in gross income if it is a distribution of designated Roth contributions. However, the income allocable to a corrective distribution of excess contributions that are designated Roth contributions is includible in gross income in the same manner as income allocable to a corrective distribution of excess contributions that are pre-tax elective contributions. The final Roth 401 regulations also provide a similar rule under the correction methods that a plan may use if it fails to satisfy the actual contribution percentage test.

Also Check: How To Locate Lost 401k

Is There A Limit On How Much I May Contribute To My Designated Roth Account

Yes, the combined amount contributed to all designated Roth accounts and traditional, pre-tax accounts in any one year for any individual is limited ). The limit is $22,500 in 2023 , plus an additional $7,500 in 2023 if you are age 50 or older at the end of the year. These limits may be increased in later years to reflect cost-of-living adjustments.

Heres What To Expect:

Step 1 Contact a Wells Fargo retirement professional at 1-877-493-4727 to initiate your conversion request and get an overview of the process.

Step 2 Our team will help you open a new Roth IRA account if you don’t already have one, fill out the appropriate paperwork, and answer any questions you may have.

Step 3 An account form will be sent to you to initiate your conversion.

- Whether youre converting a Wells Fargo Traditional IRA, an IRA from another financial institution, or a qualified employer sponsored retirement plan such as 401, 403, or governmental 457, well walk you through the process to make sure all of your questions are answered.

Step 4 Return the paperwork to complete your request.

Don’t Miss: How To Fill Out 401k Enrollment Form