Use Assessed Value Of Property For In

No. The taxes owed on the in-kind distribution of the land will be based on the fair market value of the land. As such, it would not necessarily be appropriate to use the assessed value . The most conservative approach would be to obtain a third party valuation such as an appraisal or at least an assessment from a professional such as an experienced realtor based on comps, etc. Ultimately, the governments concern is the underpayment of taxes especially from the distribution of property owned inside a solo 401k plan or a self-directed IRA.

Contribution Effects On Your Paycheck

An employer-sponsored retirement savings account could be one of your best tools for creating a secure retirement. It provides two important advantages:

-

All contributions and earnings are tax-deferred. You only pay taxes on contributions and earnings when the money is withdrawn.

-

Many employers provide matching contributions to your account, which can range from 0% to 100% of your contributions.

Use this calculator to see how increasing your contributions to a 401 can affect your paycheck as well as your retirement savings.

This calculator uses the latest withholding schedules, rules and rates .

Rules Change Regarding Offering Solo 401k Plan To Part

QUESTION 5: Have the rules changed for 2020 regarding whether I can still fund my solo 401k if I have two part-time employees that work less than 1000 hrs/year, but more than 500 hrs/year? Would I have to open up retirement accounts for them?

ANSWER: In short yes resulting from the SECURE Act, but it would be for those part-time employees who satisfy the new rule by 2024. Effective for tax year 2021 , solo 401k plans will need to be offered to part-time employees who have three consecutive 12-month periods of 500 hours of service and who satisfy the plans minimum age requirement. Hours of service during 12-month periods beginning before January 1, 2021, are not taken into account for this rule. See Section 112 of the ACT for more information.

Last Weeks Most Popular Solo 401k FAQs

You May Like: Can I Take From My 401k To Buy A House

What Is The Difference Between An Individual 401k And A Solo 401k

While Individual 401k and Solo 401k are often lumped under same definition, there are many differences. While both Individual 401k and Solo 401k are for the owner-only business owner/self-employed, brokerage firms and large financial institutions generally refer to their owner-only 401k as Individual 401k.

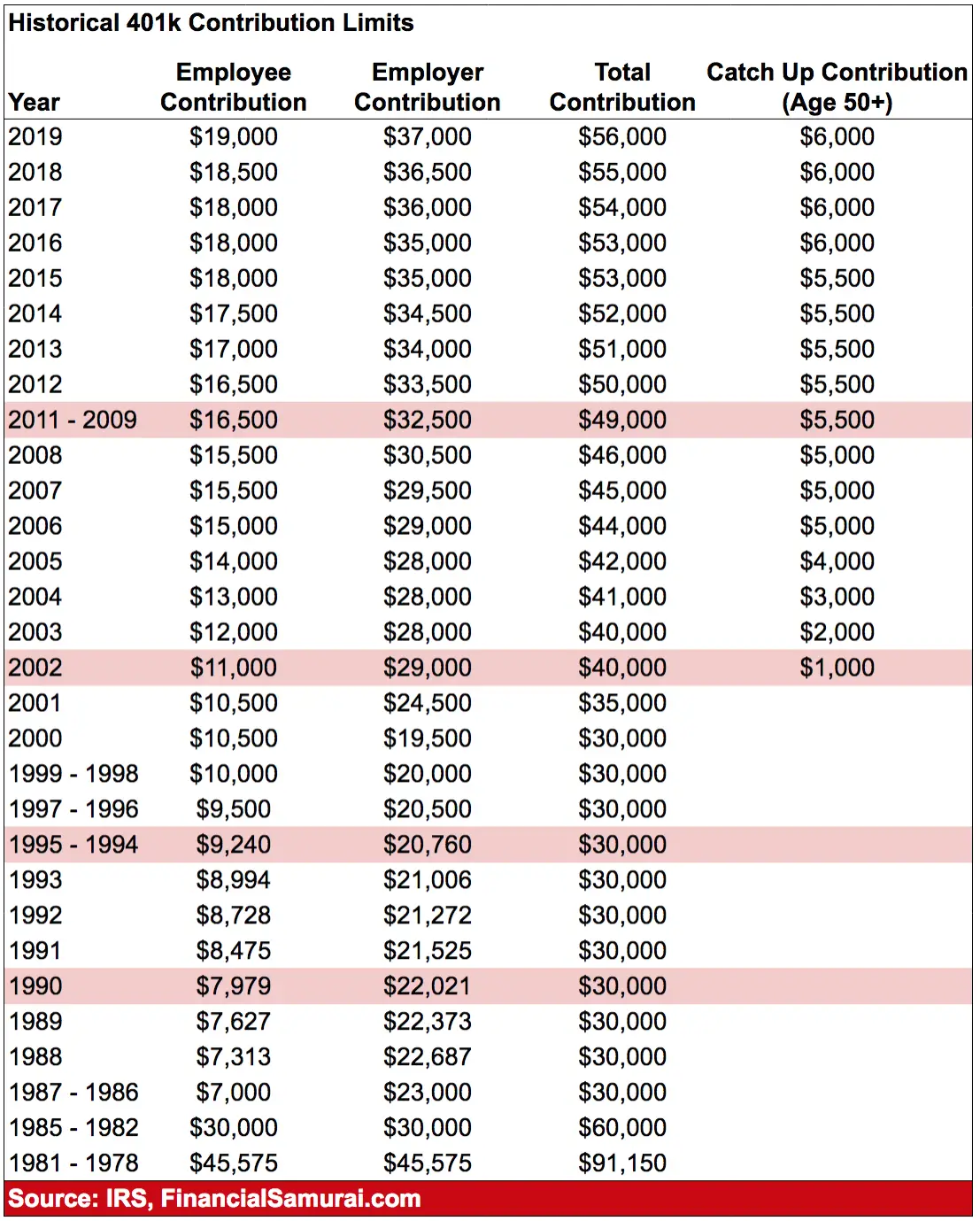

How Much Can A 65 Year Old Contribute To A 401k

The maximum amount workers can contribute to a 401 for 2020 is $500 higher than it was in 2019its now up to $19,500 if youre younger than age 50. If youre age 50 and older, you can add an extra $6,500 per year in catch-up contributions, bringing your total 401 contributions for 2020 to $26,000.

Don’t Miss: Does The Maximum Contribution To 401k Include Employer Match

Cant I Just Write A Check

For most workers, the answer is no. Your regular contributions to your 401 account typically only happen through salary deferral. In other words, the Payroll department needs to send money, and you cant just write a personal check if youre hoping to invest a large chunk or reach the maximum contribution limit by the end of the year.

Why not? For starters, the law does not allow you to defer funds that you already received. If the money is in your checking account, you received it. Also, your 401 plan might have specific rules saying you cant make your own payments into the plan.

Catch-up contributions: Those over age 50 can make additional catch-up contributions to retirement accounts. But 401 catch-up contributions, like other employee contributions, generally must go in through payroll deduction.

Can I Contribute To A 401k On My Own

401 Plans

Each year that youre employed, youre allowed to contribute to the 401 plan and your employer can make contributions on your behalf, regardless of your age. However, if you are age 50 or older, the limits are higher. For 2018, if youre younger than 50, you cant contribute more than $18,500.

You May Like: Can You Convert A Roth 401k To A Roth Ira

What About A Roth 401

If your employer offers a Roth 401, the elective deferrals you use to fund it are also a type of after-tax contributions. However, withdrawing assets from a Roth 401 is different from taking your after-tax contributions from a traditional 401.

When you make qualified withdrawals from a Roth 401, you wont face any taxes as long as youre at least 59.5. However, the IRS will tax the earnings on your contributions to your traditional 401. In addition, you dont have tax-free access to the contributions you make to a Roth 401 before you turn 59.5. This is not the case with after-tax contributions to a 401.

What Is A Simple Ira

A SIMPLE IRA is a retirement savings plan designed for small businesses, particularly those with less than 10 employees. As such, its typically low cost and easy to set up and administer. Employees who participate in a SIMPLE IRA can defer a percentage of their salary to their savings account and their employer is required to either match it or make non-elective contributions.

Also Check: How To Get Money From Your 401k

Where Should You Begin With Your 401

Thinking about starting a 401 plan for your employees? Youre taking an important first step in helping secure a better financial future for your employees. If youve never offered a 401or are considering a switch from your current providerits wise to understand the basics before you move forward. Now that youre equipped with some information about 401s, you can consult your financial, tax, and/or legal advisors to decide whats best for your business.

During your search, there are several factors you can consider when taking stock of different 401 providers, including the following:

-

Transparent, low fees

-

Easy setup options that decrease HR workload

-

Robust technology including payroll integration capabilities

-

Compliance support, including preparing nondiscrimination testing, annual notices, and more

-

Superior customer service for employer administrators and employees

-

Flexibility for plan design options

Who Should Make After

Your employer may allow you to make after-tax 401 contributions. These are not tax-deductible like your regular 401 contributions, but you can make after-tax deferrals beyond the annual 401 contribution limit. Plus, the earnings from these extra contributions grow tax-free. This retirement strategy also opens the door for rollover opportunities that will provide you with even more tax breaks. However, making after-tax 401 contributions may not be the best decision for everyone. Consider talking to a financial advisor if you have specific questions about your situation.

Read Also: What Happens To 401k When Changing Jobs

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Basics That You And Your Payroll Company Must Know

The Solo 401k is a perfect tool for small business owners looking to maximize their retirement contributions. Any business type qualifies. This includes corporations, LLCs, partnerships, and sole proprietors. The only requirement is that you are the only employee . Any other employees must work less than 1,000 hours per year.

You can contribute up to $62,000 for retirement into a Solo 401k for 2019. All of it is tax deferred or a tax write off. If your spouse is on payroll, this can mean up to $124,000 in savings. The $62,000 per person includes an extra $6,000 per year in catch-up contributions for people over age 50. If youre not over age 50, the allowable contributions are only slightly lower at $56,000 per person. Either way, the Solo 401k allows small-business owners to salt away much more for retirement than if you have a traditional IRA or even a SEP IRA.

Contributions come from two sources. The first is from the employee, which in a Solo 401k is you as the business owner . That amount is $19,000 for 2019 as an employee . And get this it can be 100% of your self-employed earnings for the year. The other contribution source is the employer contribution. If your business is a sole proprietor or partnership, the maximum profit sharing contribution is 20% of your net income. If your business is structured as a corporation, the maximum profit sharing contribution is 25% of gross income. The combination of the two contributions cannot exceed $56,000 per person .

You May Like: How To Find Your 401k

How Do I Roll Over A 401 From A Previous Employer

Rolling over a 401 plan from an old employer is easy. Contact the plan sponsor of both the new and old company and they can often manage the rollover directly. If you want to roll it over to an IRA, you can also contact the IRA sponsor . In some cases, the old plan sponsor will send you a check in the amount of the 401, which you must submit to your new plan within 60 days in order to maintain the tax benefits.

How Much Can You Put Into A 401k

There is a limit to how much you can contribute annually to your 401. In 2021, the standard annual contribution limit is $19,500 for 401 plans. And those over age 50 can use catch-up contributions to add an extra $6,500 in their 401 account. Employer contributions dont count towards those specific limits.

You May Like: How Early Can I Retire 401k

Know Your Retirement Provider Options

It can take some time to find a new provider and review the ins and outs of their administrative offerings. But because you have a fiduciary responsibility to your plan participants, its essential to take the process seriously. Youre responsible for due diligencealthough the right providers can help ease administrative burdens and lower your overall costs in the process.

Human Interest offers an affordable, full-service 401 thats meant to streamline much of the manual work of plan administration. By integrating with more than 200 leading payroll providers, were able to automate things to cut costs and save you time. And by selecting an service level that makes Human Interest a 3 fiduciary for select plan administrative functions, you can both reduce your fiduciary liability and the amount of time you spend on plan administration.

What Are The Benefits Of Offering A 401k To Employees

Helping employees plan for the future is a big responsibility, but it can also be very rewarding. Employers who offer a 401k may be able to:

- Attract and retain talent In addition to competitive salaries and health benefits, retirement savings plans can be a major influencer with candidates who are weighing different job offers.

- Improve retirement readiness Employees who are financially prepared for retirement can leave the workforce when the time is right, thereby creating growth opportunities for other employees and new talent.

- Take advantage of tax savings Businesses that sponsor a 401k are potentially eligible for a $500 tax credit to cover startup administration costs during the first three years of the plan. Additional tax deductions may be available if the employer matches employee contributions.

- Enhance productivity through financial wellness A retirement savings plan is one of the cornerstones of financial wellness. And when employees feel secure about their future, they tend to be less stressed and more productive at work.

Also Check: How Much Does A 401k Grow Per Year

K Retirement Plan Contributions Explained

Although 401ks are not the only means of saving for retirement, they offer many perks that make them appealing. In addition to your contributions, your employer can contribute to your plan on your behalf as well. Employers can match your contributions dollar for dollar, a percentage of your contributions, or a combination of the two, and might also put a dollar limit on the total match. For example, your company might match the first 3 percent of your salary of your salary dollar for dollar, and the next 3 percent at 50 cents per dollar, up to a maximum of $10,000.

The 401k cap for contributions is substantially higher than the limits for an IRA. For 2018, youre allowed to contribute up to $18,500 of your salary to your 401k. Plus, people age 50 or older can make an additional catch-up contribution of as much as $6,000, for a total of up to $24,000. Note that 401k limits can change from year to year with inflation.

Although you cant write a check or deposit cash straight into your 401k account, there might be options for you to increase your contributions before the end of the year. Check with your 401k plan administrator to learn how often you can make a free change to your contribution limits.

Related: 13 Ways to Increase Your 401k

Bankruptcy & Creditor Protection For Solo 401k Plan

QUESTION 4: I am trying to better understand the protections of the solo 401k. I believe it qualifies for unlimited bankruptcy protection, but does it also have unlimited lawsuit protection under ERISA ?

ANSWER:

- Bankruptcy: Solo 401K plans have creditor protection under the federal bankruptcy rules.

- As far as protection from non bankruptcy creditors, the protection falls at the state level. While solo 401K plans are not covered by the federal creditor protection rules of ERISA, they are generally protected under most state laws subject to certain carve outs .

Read Also: What Can You Do With 401k When You Leave Company

How Do Employers Choose The Best Mutual Funds To Offer Employees

Managing investments is sometimes beyond the expertise of employers. Thats why many of them outsource the process of selecting, diversifying and monitoring plan investments to an investment advisor. Professional assistance helps ensure that the investment options are in the best interest of the plan and its participants.

This article is intended to be used as a starting point in analyzing 401k and is not a comprehensive resource of requirements. It offers practical information concerning the subject matter and is provided with the understanding that ADP is not rendering legal or tax advice or other professional services. ADP, Inc. and its affiliates do not offer investment, tax or legal advice to individuals. Nothing contained in this communication is intended to be, nor should be construed as, particularized advice or a recommendation or suggestion that you take or not take a particular action.

Unless otherwise agreed in writing with a client, ADP, Inc. and its affiliates do not endorse or recommend specific investment companies or products, financial advisors or service providers engage or compensate any financial advisor or firm for the provision of advice offer financial, investment, tax or legal advice or management services or serve in a fiduciary capacity with respect to retirement plans. All ADP companies identified are affiliated companies.

ADPRS-20220422-3172

How Much You And Your Employer Can Contribute For You In 2022

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

If your employer offers a 401 plan, it can be one of the easiest and most effective ways to save for your retirement. But while a major advantage of 401 plans is that they let you put a portion of your pay automatically into your account, there are some limits on how much you can contribute.

Each year, usually in October or November, the Internal Revenue Service reviews and sometimes adjusts the maximum contribution limits for 401 plans, individual retirement accounts , and other retirement savings vehicles. In November 2021, the IRS made updates for 2022.

Also Check: How Much Should You Be Putting In Your 401k

What Are The Benefits Of A 401k Compared To Other Retirement Options

Compared to simplified employee pension individual retirement accounts and savings incentive match plans for employees , 401k plans have higher annual contribution limits. Thus, employees may be able to save more money in a shorter amount of time with a 401k, making it ideal for those who are older and short of their savings goals. It also allows employees to borrow money from their retirement savings accounts. SEP IRA and SIMPLE IRA plans do not.

Can I Make A Lump

Asked by: Mathias Homenick

“Lump-sum contributions are usually allowed by employer plans and usually must come from another qualified account or qualified employer plan,” Fort says. “For example, a rollover from an existing IRA, Roth, 401, 403, 457, Simple, SEP and more may be accepted into the current employer plan.”

You May Like: How To Take A Loan Against Your 401k