See If You Qualify For A Hardship Withdrawal

A hardship withdrawal is a withdrawal of funds from a retirement plan due to an immediate and heavy financial need. A hardship withdrawal usually isn’t subject to penalty.

Generally, these things qualify for a hardship withdrawal:

-

Medical bills for you, your spouse or dependents.

-

Money to buy a house .

-

College tuition, fees, and room and board for you, your spouse or your dependents.

-

Money to avoid foreclosure or eviction.

-

Funeral expenses.

-

Certain costs to repair damage to your home.

How to make a hardship withdrawal

Your employers plan administrator usually decides if you qualify for a hardship withdrawal. You may need to explain why you cant get the money elsewhere. You usually can withdraw your 401 contributions and maybe any matching contributions your employer has made, but not normally the gains on the contributions . You may have to pay income taxes on a hardship distribution, and you may be subject to the 10% penalty mentioned earlier.

What Is The Compensation Plan For Employees With Higher Compensation

There are also additional contribution restrictions for employees that are highly compensated defined by the IRS for a 401k plan.

For an employee that is highly compensated, they meet one of these qualifications:

1. They have 5% ownership of the business sponsoring the plan at any point in the previous year. This 5% includes both individual holdings and that of relatives working for the company.

2. They earn more than the slated annual compensation limit by the IRS. For 2021, we have a limit of $130,000. There can also be a specification that states that the individual must be in the top 20% when it comes to compensation.

To maintain the ERISA directives, employees with higher compensation can make contributions from their salary that is 2% more than normal employees. Since the average employee contributes 5%, employees with higher compensation contribute 7%.

That might be a bit difficult since the limit is based on employees contributions and compensation. Also, when you fail to make contributions in the calendar year, you lose the chance to do so. And you will not know your actual contribution limit until the early part of another year.

It is best to contribute an amount that matches the standard contribution limit and let the administrator decide if it is more than you should contribute. When you do this, the excess will be returned to you, and you will owe income taxes on the entire amount. The principal and the earnings are inclusive.

How To Make Contribution And Investment Changes

Fidelity is the Master Administrator for the Plan this means that you have the streamlined ability to enroll in the Plan and make contribution changes, whether you contribute to Fidelity, TIAA, or both. In order to contribute to TIAA, you need to have an RIT TIAA account. By offering one consolidated plan, RIT is able to avoid unnecessary fees and keep costs to employees as low as possible.

- View and/or change your contribution percentage

- View and/or change the split between your pre-tax and Roth contribution percentage

- Join the annual increase program to automatically increase your contribution each September 1

- Change your record keeper election between Fidelity and TIAA

Log in at . You can set up a login if you do not have one by clicking on “Register Now” at the top of the page and follow the prompts.

Step 1:Once logged in, click on the drop down arrow to the right of Quick Links and choose “Contribution Amount“. If you are already logged in, click on the “Contributions” tab.

Step 2:There are three choices

- Contribution Amount – to view and change your contribution percentage and/or the split between pre-tax and after-tax Roth contributions

- Annual Increase Program – to enroll or change participation in the program to automatically increase your contribution effective each September 1

- Retirement Providers – to view and change the allocation for your future contributions between the two record keepers, Fidelity and TIAA

Read Also: Can I Use 401k To Pay Off Debt

Why Solo 401k Loan Not On Fidelity Statement Question:

Looking at my solo 401k brokerage account and Im confused on how the account is showing up. I wrote a check for the solo 401k participant loan proceeds , and it looks like the account is showing the actual balance has decreased. Is this just how Fidelity is accounting it or did this actually come from the balance as a withdrawal? Where can I see the actual loan balance/ information?

What’s The Maximum I Can Request To Withdraw From My Account

The maximum you can request to withdraw from your account online or by telephone is $100,000 per account. To request a withdrawal greater than $100,000, you must complete a paper form. You can obtain a copy of that form by going to Customer Service > Find a Form, or by contacting a Fidelity representative at 800-544-6666. If you’ve changed your mailing address within the past 15 days, the most you can request to withdraw by check online or by telephone is $10,000.

Read Also: Is It Best To Rollover A 401k To An Ira

Rolling 401k Into Ira

When you leave an employer, you have several options for what to do with your 401k, including rolling it over into an IRA account.

Its possible to do the same thing while still working for an employer, but only if the rules governing your workplace 401k allow for it.

The negative for rolling the money into an IRA is that you cant borrow from a traditional IRA account.

Another option when you leave an employer is to simply leave the 401k account where it is until you are ready to retire. You also could transfer your old 401k into your new employers retirement account.

If you are at least 59 ½ years old, you could take a lump-sum distribution without penalty, but there would be income tax consequences.

How Long Does It Take To Cash Out A 401 After Leaving A Job

Depending on who administers your 401 account , it can take between three and 10 business days to receive a check after cashing out your 401. If you need money in a pinch, it may be time to make some quick cash or look into other financial crisis options before taking money out of a retirement account.

Read Also: Where To Put 401k Money Now

What Are The Pros And Cons Of Withdrawal Vs A 401 Loan

A withdrawal is a permanent hit to your retirement savings. By pulling out money early, youll miss out on the long-term growth that a larger sum of money in your 401 would have yielded.

Though you wont have to pay the money back, you will have to pay the income taxes due, along with a 10% penalty if the money does not meet the IRS rules for a hardship or an exception.

A loan against your 401 has to be paid back. If it is paid back in a timely manner, you at least wont lose much of that long-term growth in your retirement account.

You May Like: How To Find Missing 401k Accounts

Fidelity Solo 401k Brokerage Account From My Solo 401k Financial

A Fidelity Investments Solo 401k brokerage account with checkbook control from My Solo 401k Financial is ideal for those looking to still have the option to invest in equities while also gaining checkbook control over their retirement funds for investing in alternative investments such as real estate, notes, tax liens, and private shares in addition to processing a solo 401k participant loan.

You May Like: How Much Can I Put In A Solo 401k

Is Vanguard Good For 403b

Why choose Vanguard? Our track record of reliable 403 plan management high-quality, low-cost mutual funds and convenient account services makes Vanguard the smart choice for employers who want to help employees save for retirement and for employees seeking a trustworthy partner to help them reach their goals.

What Do I Do With My 401 If I Leave My Job

If you’re older than 55 and are no longer employed, you can start withdrawals from your 401 without penalties. If you’re under age 55, you may be able to keep the 401 with your previous employer or move it to a new employer’s plan when you start working again. Talk to the plan administrator about your options. No matter what, don’t abandon your 401 when you change employers.

Don’t Miss: Does Allied Universal Have 401k

Timing Of The Brokerage Account Setup

After submitting the Fidelity brokerage forms to Fidelity Investments, between 5-7 business days , you should receive an email from Fidelity Investments that their system has updated your email address. This indicates the application is in processing.

When you start receiving emails from Fidelity, you can check if the account has been fully setup without having to wait on the Fidelity Welcome Letter in the mail which includes your new account number. Please try to log in using one of the following methods:

- If you have an existing Fidelity login , you should see the new Non-Prototype account appear under your portfolio with an account number that starts with the letter Z.

- If you do not have an existing Fidelity login, you can try to register to Fidelity.com at the following link: You will need to create a username and password.

Contributing To Your Mit 401 Account

You contribute to your 401 account through deductions from your MIT paycheck. You can contribute pre-tax dollars, Roth post-tax dollars, or a combination of both. You may change your contribution preferences any time through Fidelity NetBenefits.

Your contributions are sent to Fidelity Investments at the end of each pay period. You may contribute as little as 1% and as much as 95% of your salary after amounts for Social Security and Medicare taxes and health and dental insurance have been subtracted. You may start, stop, or change your deferral or investment elections at any time.

Federal law limits the amount of your pay each year that may be recognized for determining your allowable contribution. In 2021, MIT can consider only the first $290,000 of pay for calculating your allowable contributions. This means that if your annual compensation exceeds $290,000, MIT Payroll will take 401 deductions from your pay until your pay for the year reaches $290,000, or one of the other 401 program limits has been reached .

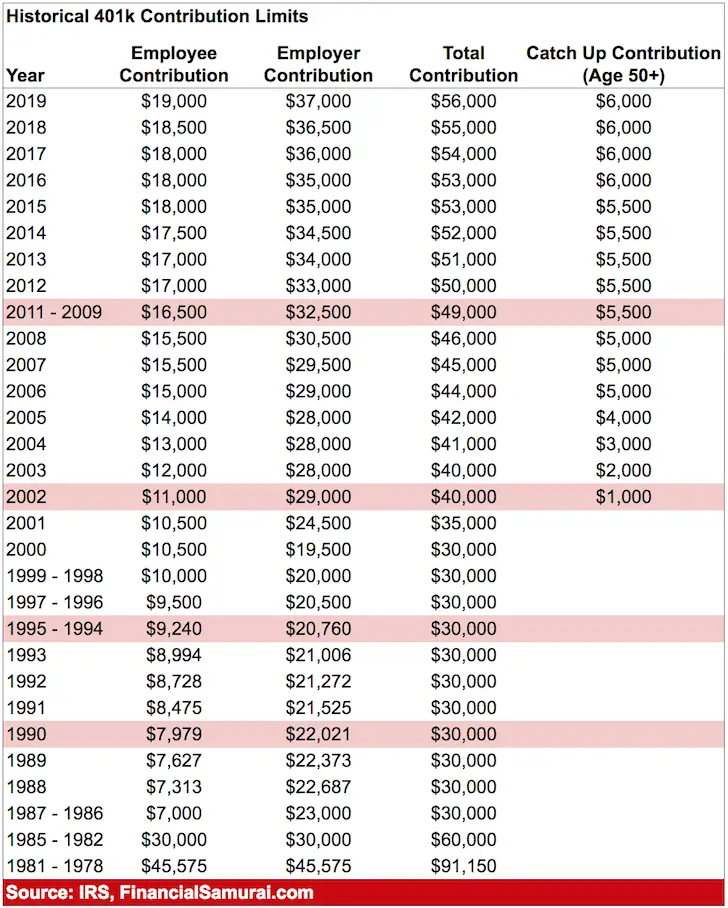

Contribution limits

What MIT contributes to your 401 Plan

- MIT matches your 401 contributions dollar-for-dollar up to the first 5% of your MIT pay .

- MIT only contributes a match during months in which you have made a contribution

- The MIT match is provided pre-tax, and therefore is fully taxable when you withdraw your matching contributions from the plan, along with associated investment earnings.

When contributions are invested in your 401 account

Also Check: How Do I Make A Withdrawal From My 401k

Can I Lose Money In A 403 B

If you make a withdrawal from your 403 before youre 59 1/2, youll have to pay a 10% early withdrawal penalty. Plus, youd be losing the growth potential of those dollars and stealing from your future self. Dont do this! Now, a distribution is when you take money out of your 403 plan penalty free.05-Nov-2021

If You Are 59 1/2 Or Older

Once you are six months away from your 60th birthday, you can begin making withdrawals from your Fidelity 401k without having to worry about any additional tax penalties. Your 401k is now money thats there for you to start preparing for the next stage of your life as you put the finishing touches on your career and prepare to start drawing Social Security benefits.

However, that doesnt mean you dont have to worry at all about taxes. Money withdrawn from your 401k is taxable income, so you should be careful to consider just how much you need to withdraw in any given tax year to ensure youre not hitting a higher tax bracket and seeing more of your hard-earned money lost to taxes. If you have a Roth IRA or Roth 401k, though, you can make tax-free withdrawals from those, so you can balance withdrawals to minimize the tax impact.

Your Fidelity 401k comes with the option to schedule regular withdrawals so that you can do the paperwork for your withdrawal once and then set up a recurring payment. With structured, regular withdrawals, you can set up a budget that will limit your withdrawals to what you need, and youll be able to have checks showing up on a set schedule.

Learn: The Best 401k Companies

Also Check: How To Get Money From 401k After Retirement

Three Consequences Of A 401 Early Withdrawal Or Cashing Out A 401

Taxes will be withheld. The IRS generally requires automatic withholding of 20% of a 401 early withdrawal for taxes. So if you withdraw $10,000 from your 401 at age 40, you may get only about $8,000. Keep in mind that you might get some of this back in the form of a tax refund at tax time if your withholding exceeds your actual tax liability.

The IRS will penalize you. If you withdraw money from your 401 before youre 59½, the IRS usually assesses a 10% penalty when you file your tax return. That could mean giving the government $1,000 or 10% of that $10,000 withdrawal in addition to paying ordinary income tax on that money. Between the taxes and penalty, your immediate take-home total could be as low as $7,000 from your original $10,000.

It may mean less money for your future. That may be especially true if the market is down when you make the early withdrawal. If you’re pulling funds out, it can severely impact your ability to participate in a rebound, and then your entire retirement plan is offset, says Adam Harding, a certified financial planner in Scottsdale, Arizona.

Wait To Withdraw Until Youre At Least 595 Years Old

If all goes according to plan, you wont need your retirement savings until you leave the workforce. By age 59.5 , you will be eligible to begin withdrawing money from your 401 without having to pay a penalty tax.

Youll simply need to contact your plan administrator or log into your account online and request a withdrawal. However, you will owe income taxes on the money , so a portion of each distribution should be designated to cover your tax liability. 401 withdrawals arent mandatory until April 1 of the year after you turn 72 , at which point you must take a required minimum distribution every year.

Don’t Miss: How Do You Pull Money Out Of Your 401k

How To Withdraw Money From Fidelity Fidelity Withdrawal Options

Withdrawal via bank transfer is by far the most common option. It is available at basically all brokers, and Fidelity is no exception.

You can also withdraw money to electronic wallets. This is a nice feature that isn’t available at all brokers. At Fidelity, you can withdraw money to the following electronic wallets: PayPal.

Speed also matters. Unlike some deposit options, withdrawal is rarely instant. It usually takes at least 1 business day, but often several business days for your money to arrive.

We tested withdrawal at Fidelity and it took us 2 business days, which is considered fairly average.

To withdraw money from Fidelity, you need to go through the following steps:

- Log in to your account

- Select ‘Withdrawal’ or ‘Withdraw funds’ from the appropriate menu

- Select the withdrawal method and/or the account to withdraw to

- Enter the amount to be withdrawn, and, if prompted, a short reason or description

- Submit your request

Please note that you may only withdraw money to accounts that are in your name.

Roth Ira Statement From Fidelity Representative: Question:

Can you confirm whether this statement is true or not . The IRS does not allow for Roth IRA money to be rolled into any 401k plan. That is only allowed on pre-tax IRA and retirement accounts. I was hoping to roll over a Roth IRA into my solo 401k roth account. Is this allowed?

The Fidelity representative is correct that a Roth IRA cannot be transferred to a Roth solo 401k. This is a Roth IRA rule. Visit here for more on this rule. I suspect this rule was put in place because the distribution rules are different for a Roth IRA vs a Roth solo 401k.

Also Check: How To Cash In My 401k

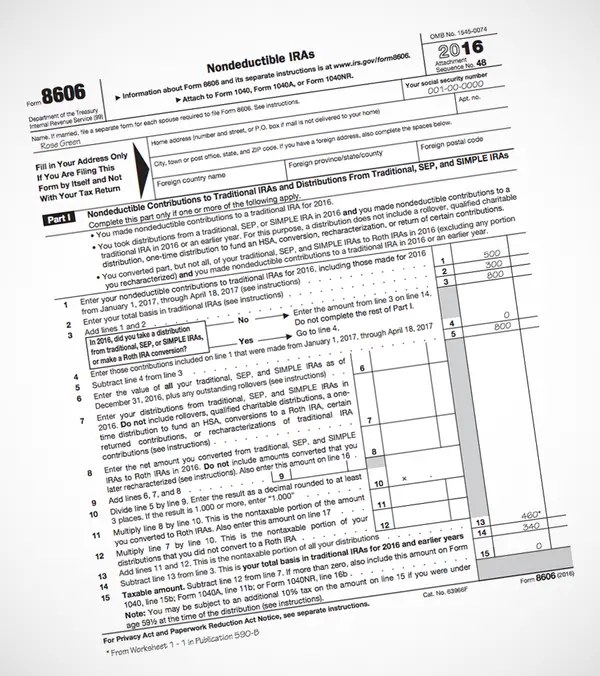

What Is An Early Distribution

A distribution from a traditional IRA prior to the age 59 1/2 is generally considered to be an early withdrawal. An early withdrawal from an IRA is potentially subject to a 10% excise tax penalty unless the distribution is rolled over or converted to another IRA within 60 days. When the early withdrawal is due to disability, or if you are the beneficiary on a deceased individual’s IRA, distribution by death, the penalty may be waived. For more information, access Fidelity’s online Retirement Investing Center and consult a tax advisor about your particular situation.

Other exceptions exist for early distributions due to:

- A series ofsubstantially equal periodic payments based on the owner’s life expectancy

- Deductible medical expenses in excess of 7.5% of adjustedgross income

- Qualified first-time home buyer expenses

- Qualified higher education expenses

- An IRS levy against the account

Please call a Retirement Specialist at 800-544-6666 for more information.

How And Why To Transfer Your 401 To An Ira

posted on

By Justin Pritchard, CFP® in Montrose, CO

When you change jobs or retire, you have several options for the money in your 401. You can typically transfer that money to an IRA, leave it in the plan, move it to your new jobs retirement plan, or cash out. In many cases, its smart to move your savings into an IRA. Well cover the pros and cons here so you can decide whats best.

The process can be confusing and intimidating, so its easy to do nothing. But that might result in leaving your savings with an employer that you no longer have any connection to, and one you might even dislike or distrust.

Key takeaway:Read more below, or listen to the explanation .

You May Like: How Can I Roll Over My 401k