Next Steps To Consider

This information is intended to be educational and is not tailored to the investment needs of any specific investor.

Recently enacted legislation made a number of changes to the rules regarding defined contribution, defined benefit, and/or individual retirement plans and 529 plans. Information herein may refer to or be based on certain rules in effect prior to this legislation and current rules may differ. As always, before making any decisions about your retirement planning or withdrawals, you should consult with your personal tax advisor.

Fidelity does not provide legal or tax advice. The information herein is general and educational in nature and should not be considered legal or tax advice. Tax laws and regulations are complex and subject to change, which can materially impact investment results. Fidelity cannot guarantee that the information herein is accurate, complete, or timely. Fidelity makes no warranties with regard to such information or results obtained by its use, and disclaims any liability arising out of your use of, or any tax position taken in reliance on, such information. Consult an attorney or tax professional regarding your specific situation.

Be sure to consider all your available options and the applicable fees and features of each before moving your retirement assets.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

How Can I Find My Old 401k Account

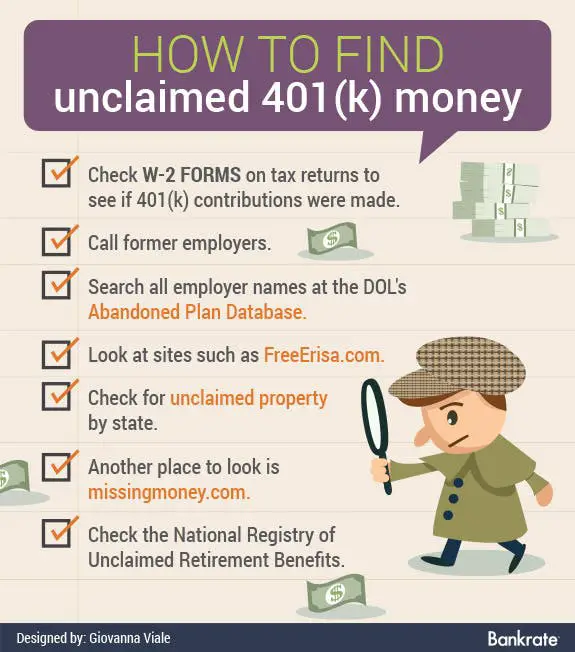

The good news is that its relatively painless to locate lost funds in unclaimed 401k accounts. Online resources such as missingmoney.com and unclaimed.org allow you to search for assets in any states in which youve lived or worked. And if you do find money from an old 401k thats owed to you, its often as easy as filling out a simple online form to get it back.

Darin Bostic, a Schwab financial planner, points out that the best way to keep track of your funds is not to lose them in the first place. Consolidating similar accounts, such as old and new 401s, can help you keep track of your savings, says Darin.

Whats more, consolidation helps ensure your assets are working in harmony toward your long-term goals. Its difficult to follow a comprehensive investment strategy when your money is spread out all over the place.

Roll Your 401 Into An Ira

The IRS has relatively strict rules on rollovers and how they need to be accomplished, and running afoul of them is costly. Typically, the financial institution that is in line to receive the money will be more than happy to help with the process and avoid any missteps.

Funds withdrawn from your 401 must be rolled over to another retirement account within 60 days to avoid taxes and penalties.

Read Also: What Is The Best 401k Match

Don’t Miss: How Much Can I Contribute To 401k And Roth Ira

Ways To Dig Up An Old 401 Account

Before we play lost and found with your old 401 plan, know that even though you cant find your 401 account , your plan money is federally protected.

Thats right. By law, nobody can access, steal or otherwise make off with your 401 funds while theyve gone missing.

With Uncle Sam at your back, use these tips and strategies to find a lost 401 account.

Government And Military Pension Resource

Depending on your role in the military, some pensions are available to both veterans and their survivors. Be sure to refer to the U.S. Department of Veterans Affairs website for more information.

- Department of Veteran Affairs: If you or your deceased spouse is a veteran, you can find information on your pension at the VAs pension website.

- State government websites: If you were an employee of your state or local government, be sure to check your states government website to search for information regarding your pension.

- Federal and military resources: Other government employees and military members can find information regarding federal and military pensions through the Thrift Savings Plan, Department of Defense and Office of Personnel Management websites.

Don’t Miss: Where To Move 401k Money

Other Ways To Find Lost Money

If you are hoping to find lost money, you might want to start by creating a comprehensive and detailed retirement plan. This enables you to:

- Document what you have right now.

- Take stock and think about what might be missing.

- Learning about what you need for a secure retirement is a great way organize your financial life.

- Discover opportunities to make more out of what you have. People who use the NewRetirement retirement planner typically improve their plans by thousands of dollars in their first session with the tool.

How To Find A Lost 401 Account

Think you may be one of the millions with forgotten 401 money floating around somewhere? Start by scouring your personal email or laptop for any old 401 plan statements that you may have saved in the past.

“Your statement will provide your account number and plan administrator’s contact information,” Corina Cavazos, managing director, advice and planning at Wells Fargo Wealth & Investment Management, tells Select. Your former coworkers may have old statements that you can reference, too.

If you don’t have any luck, Cavazos says that your best bet is to contact your former employer’s HR or accounting department. By providing your full name, Social Security number and dates of employment with that company, you can have them check their 401 plan records to see if you were once a participant.

If you’ve tried contacting your 401 plan administrator or former employer to no success, you may be able to find old retirement account funds on the National Registry of Unclaimed Retirement Benefits. Upon entering your Social Security number, the secure website allows you to conduct a free database search to see if there’s any unpaid retirement money in your name.

Another search database is the FreeERISA website, which indicates if your former employer rolled your 401 funds into a default participant IRA account on your behalf. FreeERISA requires you to register before performing a search, but it is free to do so.

Read Also: Can You Take From 401k To Buy A House

Too Complicated Get Some Help

If this process seems like a lot of work, youâre not alone. Locating your old 401 accounts and finding the proper place to transfer them to can get confusing.

Fortunately, Beagle can do all of the difficult work for you. The tasks of finding your accounts and facilitating their transfers are all done for you. Getting started is easy.

What If You Have An Existing 401 At Your Previous Employer

If you have a 401 at a previous employer, youll want to consider whether a rollover makes sense for you. You may want to consult with a tax professional to make sure that you are making a decision that is best for your unique circumstances.

As youre thinking about what to do with your old 401, here are some options to consider:

You May Like: How To Rollover Ira To 401k

Other Forgotten Funds And Where To Find Them

Retirement funds arent the only assets that may be lost or forgotten. Others include insurance accounts or annuities unpaid wages pensions from former employers FHA-insurance refunds tax refunds savings bonds accounts from bank or credit union failures. In addition, heirs may easily overlook one or more accounts, if the estate plan failed to list all of them.

The National Association of Unclaimed Property Administrators reports that about 1 in 10 Americans have unclaimed property, and more than $3 billion is returned to owners each year.

Brokerage firms and other financial institutions must report unclaimed or abandoned accounts once they have made a diligent effort to locate the owner. Should they be unsuccessful, they must report it to the state agency that handles such matters. The agency then claims it through a process known as escheatment so that the owners can find it.

Websites you can use to find lost funds include your states unclaimed property site NAUPAs missingmoney.com the U.S. Department of Labor database for back wages or the Pension Benefit Guaranty Corp to claim your pension funds. To find accounts at failed banks, try the Federal Deposit Insurance Corp. For credit unions, go to the National Credit Union Administration.

A final note: Claiming your assets is free. Beware of anyone who wants to charge you for doing so.

Also of Interest

How To Find Your Old 401 Accounts

1. Contact your former employer

You can start your search for your missing retirement savings by contacting your former employers human resources department. Simply tell them youre a former employee who wants to access a 401 plan you left behind. Then, theyll likely ask you for identifying information and dates of employment to help search their record.

If the HR department can locate your 401 account, theyll let you know what your options are for accessing the account. They can also give you steps to take to roll those assets over into your new employers 401 or to a rollover IRA account.

However, you might run into a hiccup if youre previous employer has been acquired by another company. In this case, you can search online for news about the acquisitions details, including the name and location of the purchasing company. If youre still in touch with former colleagues from that job, they may be able to provide you with the information as well.

2. National Registry of Unclaimed Retirement Benefits

If your online sleuthing doesnt turn up the information you need to find your old 401, dont despair. You can search the National Registry of Unclaimed Retirement Benefits, which helps employers connect with former employees who have left assets behind in a retirement plan.

3. U.S. Department of Labors Abandoned Plan Search

4. Use Beagle, the 401k super sleuths

Also Check: How To Access My Walmart 401k

Is There A Company Match And If So What Are The Rules

Many employers offer incentives for employees to contribute to their 401 plans by matching contributions up to a certain point. For instance, some companies may match every dollar you contribute with 50 cents of their own, up to a certain percentage of your salary. Thats a nice benefit you dont want to miss out on. But individual plans vary widely, and there may be restrictions on qualifying for the company match or vesting schedules for the match. Ask your plan administrator for the rules that apply to your companys plan.

Sports Fans Are Ready To Open Their Wallets: Study

Your best bet is to visit FreeERISA.com, which can help you track down your old 401 using the following website tools:

- Code search: Find employee benefit and retirement plan filings by location.

- Dynamic name search: Find 5500s even if the plan sponsor’s name changed.

- Instant View: See benefit filings right in your browser instantly.

Also Check: How Much Can An Employer Match In A 401k

How To Find An Old 401 And What To Do With It

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

There are billions of dollars sitting unclaimed in ghosted workplace retirement plans. And some of it might be yours if youve ever left a job and forgotten to take your vested retirement savings with you.

But no matter how long the cobwebs have been forming on your old 401, that money is still yours. All you have to do is find it.

Where Is My 401

When you leave your employer you have three options for the money youâve accumulated in your old 401 account. You can either:

- Leave it alone and keep it in the same account

- Roll over the funds to your new employerâs 401 plan or

- Roll over the funds to an IRA.

Most people leave their 401âs alone, either from neglect or they donât bother with facilitating the transfer.

You can rollover your old 401 funds to an IRA as soon as youâd like. If your IRA is already set up then it can accept the funds immediately.

However, if your new employer implements a waiting period before you can participate in their 401 program, then you have no choice but to leave it alone until youâre eligible.

This is where things fall through the cracks. Unattended 401âs can end up in a few different places: the old account you have with your former employers, an automatic safe harbor rollover account set up by your plan, the unclaimed property department in the state, or your old 401s could have been cashed out already if the balance was less than $5,000 when you left the job.

Recommended Reading: Can I Roll My 401k Into An Ira

Find Lost 401k: How To Find Out If You Have Lost Or Forgotten Retirement Accounts

Here is a guide for how to find lost money a lost 401k or other unclaimed retirement benefits.

Finding a lost 401k or other retirement account is more tedious than metal detector treasure hunting,but perhaps more rewarding.

A few years ago, I received a strange notice in the mail: a former employer was discontinuing their retirement plan and I had 30 days to either roll my balance into a different account or receive a distribution from the plan. This sort of thing happens quite often when people change jobs and leave their retirement account in the old employers plan. The strange thing about this notice was, I had no idea Id been participating in the plan while I worked there!

Could the same thing have happened to you? If youre looking for ways to increase your retirement savings, you just may want to look for lost or forgotten retirement accounts.

What To Do If Youve Lost A Pension

If your search for unclaimed retirement benefits is specific to a pension rather than a 401, the U.S. Department of Labors Employee Benefits Security Administration can help. The site has an Abandoned Plans section that details plans that have been neglected by the employers who sponsored them. This often happens when an employer filed bankruptcy or the plan sponsor is no longer around to administer it.

Another resource for tracking down a lost pension is the U.S. Department of Labors Form 5500 Search. Employers are required to report their retirement details using this form, so a search can help you track down the information you need to get in touch with your plan administrator.

If your pension was governmental, you should go through the government website specific to your city, county, or state. State and local government pensions can be tracked down through the personnel office. Military pensions are administered through the U.S. Department of Veterans Affairs, and information on federal government pensions is available through the Federal Employees Retirement System .

Whatever search you use to ask, Do I have retirement money somewhere? these databases are solely designed to identify those funds. Youll still have to contact the plan administrator or former employer to get your money. It will at least give you the information youll need to get started, though.

Also Check: Who Can Open A 401k

Tracking Down Your Plan

If you think youve lost track of a savings plan, search your files for old retirement account statements. These should provide some key data to help your search, such as your account number and contact information for the plan administrator. If you dont have any statements, contact your former employers human resources department.

If your employer filed for bankruptcy, your 401 balance is protected from creditors and is likely still held at the investment company that administered your plan. In the case of a pension, it was either taken over by an insurance company or the federal Pension Benefit Guaranty Corp., which protects traditional pensions. You can track down your pension at pbgc.gov/search-all.

Its also possible that your employer turned over your 401 balance to your states unclaimed property fund. Your states treasury department should offer an online service that lets you search for your money. You can also check the National Registry of Unclaimed Retirement Benefits.

Leverage The National Registry

The National Registry, run by Pen Check, a retirement plan distribution firm, is a nationwide, secure database listing of retirement plan account balances that have been left unclaimed by former participants of retirement plans.

The site offers an easy, free-of-charge way to locate lost or forgotten employee retirement accounts. You can conduct as many searches as you want, using just your Social Security number. The site is safe, encrypting any information you input on a secure server.

Recommended Reading: How To Get A 401k Loan From Vanguard

Use Additional Government Document Recovery Tools

Lots of folks say the federal government is beholden to excessive paperwork and, in many ways, those people are right. But your hunt for an old 401 isn’t a good example of that mindset.

Exhibit “A” is the U.S. Department of Labor’s Abandoned Plan Database. The database can tell you if your company’s old 401 plan is still up and running, has been deep-sixed, or is being held by an outside administrator who can steer you to your old 401 account.

When using the website, the more information you can provide, the better. Your best bets include using the plan’s name, the name of your old employer, the city and state where the company resided, and the appropriate zip code.

Roll Over The Old 401 Account Into An Ira

This will likely be the best option for most people because the IRA is attached to you instead of your employer, making it less likely that youll lose track of the account again. An IRA also comes with a much wider selection of investments than most 401 plans. Youll be able to choose from individual stocks as well as mutual funds, ETFs and more.

If you dont already have an IRA, youll need to set up an account before you roll over your 401. The process is fairly straightforward and you can open an IRA through most online brokers.

Recommended Reading: How To Collect My 401k