Looking For A Financial Advisor

Get In Touch With A Pre-screened Financial Advisor In 3 Minutes

Depending on your tax situation, both Luber and Whitney say it also might make sense to take a portion of your 401 and do a Roth IRA conversion. However, its important to review the tax consequences of a move like this with a tax professional.

Keep in mind that any money converted to an IRA would make the funds ineligible for the rule of 55 and prevent penalty-free access for five years under Roth conversion rules. That said, moving funds into a Roth IRA allows you to benefit from years of valuable tax-free investment growth.

Before you leave your job, make sure you look at all your accounts and assets and review the potential tax consequences, Whitney says. Then decide what is likely to work best for you.

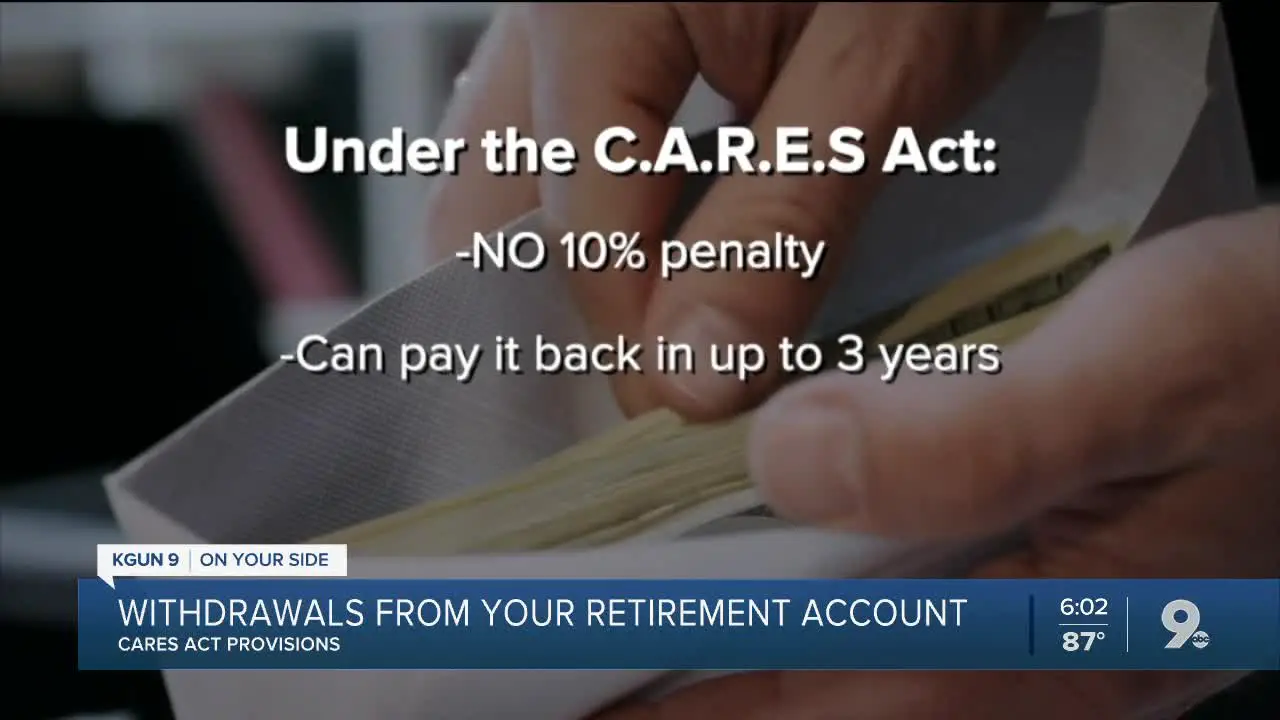

And Ira Withdrawals For Covid Reasons

The CARES Act had many provisions that received attention, especially the Paycheck Protection Plan loans and the individual relief checks that went to a majority of Americans. One less-noticed part of the bill, though, changes the way that pre-retirement withdrawals from retirement plans work.

Section 2022 of the CARES Act allows people to take up to $100,000 out of a retirement plan without incurring the 10% penalty. This includes both workplace plans, like a 401 or 403, and individual plans, like an IRA. This provision is contingent on the withdrawal being for COVID-related issues. The following reasons are permitted for making these special withdrawals:

- You have been diagnosed with COVID-19

- Your spouse or a dependent has been diagnosed with COVID-19

- You have financial issues because of being quarantined, furloughed or laid off due to COVID-19

- You have financial issues because you cant work due to a lack of childcare caused by COVID-19

- Youre experiencing financial hardship because the business you own or operate had to close or reduce hours

This is obviously a fairly broad set of circumstances. Essentially, if youre having a hard time financially because of circumstances caused by the pandemic, youre likely to qualify for these early withdrawals.

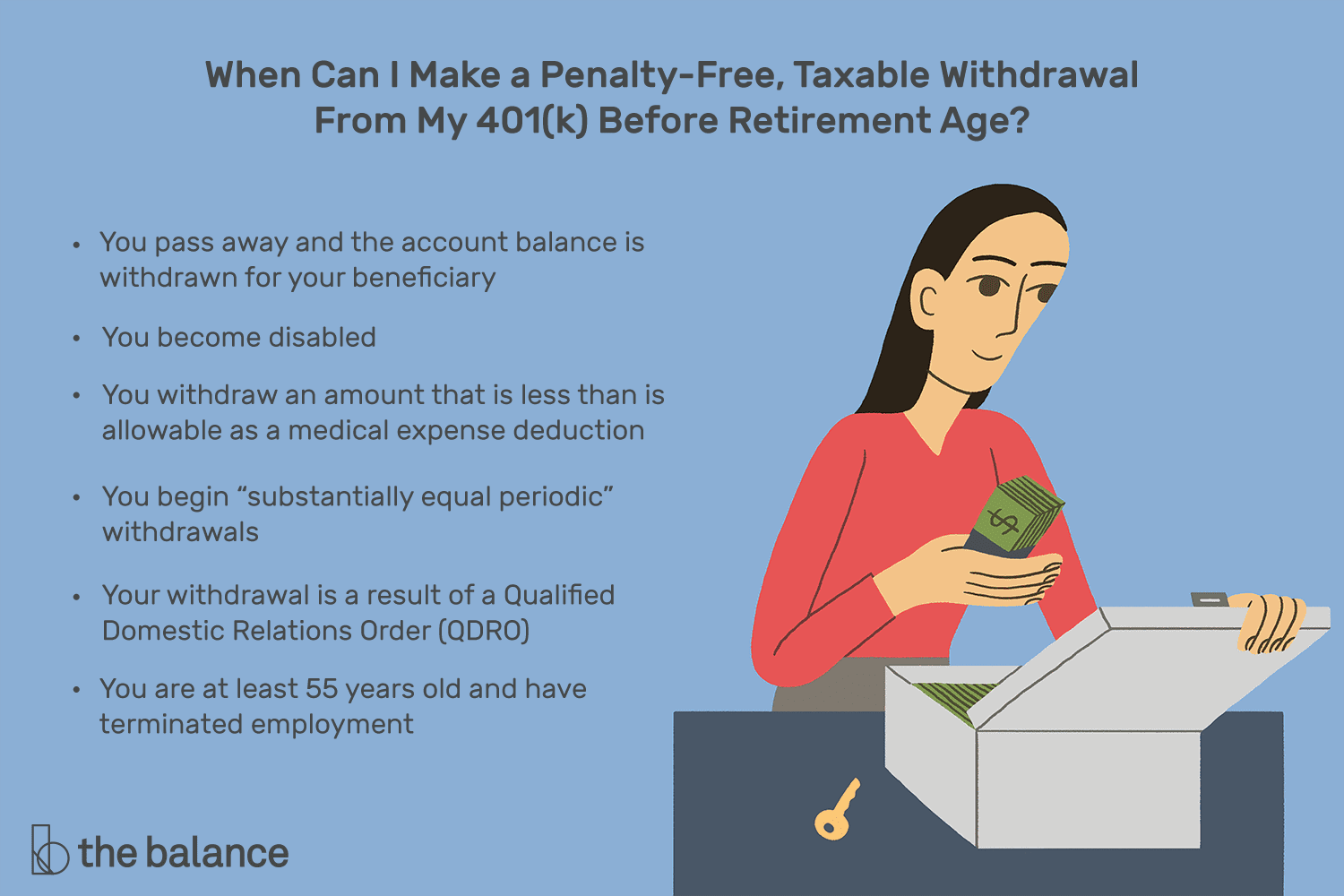

How To Avoid An Early Withdrawal Penalty

You can avoid the 401 early withdrawal penalty by waiting until you are 59 ½ to take distributions from your plan. The IRS also lists various situations which could exempt you from the 10% tax, such as taking an early distribution due to a qualifying disability or reducing excess contributions. Make sure to review the exemptions list to see if your situation qualifies.

Another way to avoid the 10% early withdrawal tax is to opt for a loan against your 401 account. Your loan amount won’t be taxed as a distribution as long as:

- You borrow 50% or less of your vested balance up to $50,000.

- The loan is repaid within five years .

- Your payments are substantially level.

- Payments are made at least quarterly over the life of the loan.

While 401 loans can be a good alternative, not all plan providers offer them so you’ll have to check to see if it’s an option for you.

Read Also: Can I Move My 401k To A Different Company

Cares Act 401k Withdrawal

The CARES act affects retirement accounts, such as 401 accounts, by lifting penalties for early withdrawal. Employees affected by the coronavirus who have 401 accounts are able to access their retirement accounts for up to $100,000. Those who have already borrowed against their retirement accounts will receive an extension of time to repay back their loans.

How Long Does It Take To Cash Out A 401 After Leaving A Job

Depending on who administers your 401 account , it can take between three and 10 business days to receive a check after cashing out your 401. If you need money in a pinch, it may be time to make some quick cash or look into other financial crisis options before taking money out of a retirement account.

Don’t Miss: How Much Invest In 401k

Withdrawal Rules Frequently Asked Questions

If you participate in a 401 plan, you should understand the rules around separation of service, and the rules for withdrawing money from your account otherwise known as taking a withdrawal. 401 plans have restrictive withdrawal rules that are tied to your age and employment status. If you dont understand your plans rules, or misinterpret them, you can pay unnecessary taxes or miss withdrawal opportunities.

We get a lot of questions about withdrawals from 401 participants. Below is a FAQ with answers to the most common questions we receive. If you are a 401 participant, you can use our FAQ to understand when you can take a withdrawal from your account and how to avoid penalties.

What Is Hardship Withdrawal

Hardship withdrawals refer to money taken out of your 401 to take care of a personal situation. The amount withdrawn has to be within the limits of the actual financial hardship.

The IRS determines what qualifies as financial hardship. Based on their guidelines, hardship withdrawal is only allowed for:

- Certain medical expenses

- Tuition and other educational expenses

- Payment towards certain home repairs, purchasing a home, or preventing eviction

The withdrawals arent tax-free. You may have to pay 10% tax on each one, but there are no other penalties. In some cases, you may qualify for a tax waiver as well. Side note: Hardship withdrawals are allowed by the IRS, but they arent automatically allowed on all 401 plans. Providers can have different rules, so check your documents carefully.

Also Check: What Age Do You Have To Draw From 401k

Taking 401 Distributions In Retirement

The 401 withdrawal rules require you to begin depleting your 401 savings when you reach age 72.

At this point, you must take a required minimum distribution each year until your account is depleted. If you are still working for the employer beyond age 72, you may be able to delay required minimum distribution until you stop working if your plan allows this delay. The delay option is not available to you if you own 5% or more of the business.

You have until April 1 of the year after you turn 72 to take your first required minimum distribution. After that, you must take a minimum amount by December 31 each year. Your 401 plan administrator will tell you how much you are required to take each year.

The amount is based on your life expectancy and your account balance. If you dont take your required minimum distribution each year, you will have to pay a tax of 50% of the amount that should have been taken but was not. If you participate in more than one employer plan, you must take a required minimum distribution from each plan.

Only Withdraw The Minimum Amount

While this approach wont technically help you avoid penalties and taxes, it can help you minimize the impact overall. You should only withdraw the exact amount you need for your emergency.

Dont add an extra 30-50% to cover taxes and penalties if you can afford to replace any amount lost to penalties from your pocket.

Remember, youll stunt your retirement income with every withdrawal. Similarly, you should only ever withdraw from your 401 in a real emergency. Its counter-productive to withdraw from your 401 for a luxury purchase or even to pay off debt.

Also Check: How To Take Money Out Of 401k Without Penalty

Withdrawals After Age 72

Many people continue to work well past age 59 1/2. They delay their 401 withdrawals, allowing the assets to continue to grow tax-deferred, but the IRS requires that you begin to take withdrawals known as “required minimum distributions” by age 72.

Those who are owners of 5% or more of a business can defer taking their RMDs while they’re still working, but the plan must have made this election. This only applies to the 401 of your current employer. RMDs for all other retirement accounts still must be taken.

What Do I Do With My 401 If I Leave My Job

If you’re older than 55 and are no longer employed, you can start withdrawals from your 401 without penalties. If you’re under age 55, you may be able to keep the 401 with your previous employer or move it to a new employer’s plan when you start working again. Talk to the plan administrator about your options. No matter what, don’t abandon your 401 when you change employers.

You May Like: How Much 401k Should I Have At 35

Take Out A Personal Loan

Theres also the option of taking out a personal loan to help deal with a temporary setback. Personal loans arent backed by any assets, which means lenders wont easily be able to take your house or car in the event you dont pay back the loan. But because personal loans are unsecured, they can be more difficult to get and the amount you can borrow will depend on variables such as your credit score and your income level.

If you think a personal loan is your best option, it may be a good idea to apply for one with a bank or credit union where you have an existing account. Youre more likely to get the loan from an institution that knows you and they might even give you some flexibility in the event you miss a payment.

Early Withdrawal: How To Withdraw Money From A 401 Early

Although it is possible to withdraw money from your 401 you should only use it as a last resort

- LW

A401 plan is a company-sponsored retirement savings plan that offers tax benefits to both the employee and the company. Over time, the money accumulated in the account is allowed to grow tax-free. The goal is to put off withdrawing money until retirement.

If you need to, you can take money out of the account before you reach the age of 59 With a few exceptions, the account holder will face a significant income tax bill as well as a 10% penalty.

And, as a result of the early withdrawal, their retirement savings will be permanently depleted.

You may want to consider other options before taking an early 401 distribution. And if you do have to make the withdrawal, there are ways to make it less painful financially.

Read Also: How To Start A 401k For My Company

Withdrawing Money From A : Taking Cash Out Early Can Be Costly

An unexpected job loss, illness or other emergencies can wreak havoc on family finances, so its understandable that people may immediately think about taking a withdrawal from their 401. Tread carefully as the decision may have long-range ramifications impacting your dreams of a comfortable retirement.

Taking a withdrawal from your traditional 401 should be your very last resort as any distributions prior to age 59 ½ will be taxed as income by the IRS, plus a 10 percent early withdrawal penalty to the IRS. This penalty was put into place to discourage people from dipping into their retirement accounts early.

Roth contribution withdrawals are generally tax- and penalty-free contribution and youre 59 ½ or older). This is because the dollars you contribute are after tax. Be careful here because the five-year rule supersedes the age 59 ½ rule that applies to traditional 401 distributions. If you didnt start contributing to a Roth until age 60, you would not be able to withdraw funds tax-free for five years, even though you are older than 59 ½.

Withdrawing Money Early From Your 401

The method and process of withdrawing money from your 401 will depend on your employer, and which type of withdrawal you choose. As noted above, the decision to remove funds early from a retirement plan should not be made lightly, as it can come with financial penalties attached. However, should you wish to proceed, the process is as follows.

Step 1: Check with your human resources department to see if the option to withdraw funds early is available. Not every employer allows you to cash in a 401 before retirement. If they do, be sure to check the fine print contained in plan documents to determine what type of withdrawals are available, and which you are eligible for.

Step 2: Contact your 401 plan provider and request that they send you the information and paperwork needed to cash out your plan, which should be promptly completed. Select providers may be able to facilitate these requests online or via phone as well.

Step 3: Obtain any necessary signatures from plan administrators or HR representatives at your former employer affirming that you have filed the necessary paperwork, executed the option to cash in your 401 early, and are authorized to proceed with doing so. Note that depending on the size of the company, this may take some time, and you may need to follow up directly with corporate representatives or plan administrators at regular intervals.

Also Check: How Soon Can I Borrow From My 401k

The 401 Withdrawal Rules For People Between 55 And 59

Most of the time, anyone who withdraws from their 401 before they reach 59 ½ will have to pay a 10% penalty as well as their regular income tax. However, you can withdraw your savings without a penalty at age 55 in some circumstances. You cannot be a current employee of the company that runs the 401, and you must have left that employer during or after the calendar year in which you turned 55. Many people call this the Rule of 55.

If youre between 55 and 59 ½ years old and you are considering a 401k withdrawal from an old employer, you should keep a few things in mind. For starters, doesnt matter why your employment stopped. Whether you quit, you were fired, or you were laid off, you can qualify for a penalty-free withdrawal. However, you need to meet the age requirement and your employment must end in the calendar year you turn 55 or later.

These rules for early 401 withdrawal only apply to assets in 401 plans maintained by former employers. The rules dont apply if youre still working for your employer. For example, an employee of Washington and Sons usually wont be able to make a penalty-free withdrawal before they turn 59 ½. However, the same employee can make a withdrawal from a former employers 401 account and avoid the penalty when he or she turns 55.

Request A Hardship Withdrawal

In certain circumstances you may qualify for whats known as a hardship withdrawal and avoid paying the 10% early distribution tax. While the IRS defines a hardship as an immediate and heavy financial need, your 401 plan will ultimately decide whether you are eligible for a hardship withdrawal and not all plans will offer one. According to the IRS, you may qualify for a hardship withdrawal to pay for the following:

- Medical care for yourself, your spouse, dependents or a beneficiary

- Costs directly related to the purchase of your principal residence

- Tuition, related educational fees and room and board expenses for the next 12 months of postsecondary education for you, your spouse, children, dependents or beneficiary

- Payments necessary to prevent eviction from your principal residence or foreclosure on the mortgage on that home

- Funeral expenses for you, your spouse, children or dependents

- Some expenses to repair damage to your primary residence

Although a hardship withdrawal is exempt from the 10% penalty, income tax is owed on these distributions. The amount withdrawn from a 401 is also limited to what is necessary to satisfy the need. In other words, if you have $5,000 in medical bills to pay, you may not withdraw $30,000 from your 401 and use the difference to buy a boat. You might also be required to prove that you cannot reasonably obtain the funds from another source.

Recommended Reading: Can You Convert A 401k Into A Roth Ira

India Us Tax Treaty 401k

The double taxation and its struggles are evident for NRIs and commendable efforts have been taken towards improving them in the Union Budget 2021-22 by the Finance Ministry of India. Earlier, there were various issues around taxation that caused trouble and frustrated the NRIs in India. Some of them were:

- Mismatch in period of taxability in India and USA. To tackle this, the Union Budget 2021-22 proposed to insert a new Section 89A to the Act to provide that the income of a specified person from a specified account shall be taxed in the manner and the year as prescribed by the Central Government

- Struggle in getting the credit for taxes paid in India in foreign jurisdiction

- Funds are taxed on receipt basis in the USA while on an accrual basis in India. Availing the benefits of DTAA becomes difficult in such a scenario

- Taxes can be deferred in the USA but during withdrawal the taxes burst out and if that adds in with the struggles related to getting credit for taxes paid in India, it frustrates the NRIs

Three Consequences Of A 401 Early Withdrawal Or Cashing Out A 401

Taxes will be withheld. The IRS generally requires automatic withholding of 20% of a 401 early withdrawal for taxes. So if you withdraw $10,000 from your 401 at age 40, you may get only about $8,000. Keep in mind that you might get some of this back in the form of a tax refund at tax time if your withholding exceeds your actual tax liability.

The IRS will penalize you.If you withdraw money from your 401 before youre 59½, the IRS usually assesses a 10% penalty when you file your tax return. That could mean giving the government $1,000 or 10% of that $10,000 withdrawal in addition to paying ordinary income tax on that money. Between the taxes and penalty, your immediate take-home total could be as low as $7,000 from your original $10,000.

It may mean less money for your future. That may be especially true if the market is down when you make the early withdrawal. If you’re pulling funds out, it can severely impact your ability to participate in a rebound, and then your entire retirement plan is offset, says Adam Harding, a certified financial planner in Scottsdale, Arizona.

Don’t Miss: When I Leave My Job What Happens To 401k