Could You Increase Your 401 Contribution

A 1% increase only makes a small difference in your paycheckbut may make a big difference down the road.

Cutting or reducing non-essentials could allow you to bump up the money youre putting into your 401 or 403. Like the gym membership you havent used in 6 months, for example. Or buying a certified used car instead of a new one. How about those merit increases or a bonus?

A little could go a long way in the future. Consider this example1 for a $35,000 annual income:

| Additional contribution |

|---|

| $18,068 |

Imagine if you could increase it to 10% of your pay?

If youre wondering how to save more toward retirement, read 5 smart money tips from super savers.

Tip: Dont forget inflations impact on retirement savings. You may feel like youre saving enough to maintain your current lifestyle. Even though your income may increase over the years, so will your cost of living . If you spend $50,000 a year to live in todays dollars, for example, how much more will it take 30 years from now?

How We Use Your Personal Data

How we use your information depends on the product and service that you use and your relationship with us. We may use it to:

- Verify your identity, personalize the content you receive, or create and administer your account.

- Provide specific products and services to you, such as portfolio management or data aggregation.

- Develop and improve features of our offerings.

To learn more about how we handle and protect your data, visit our privacy center.

Key Limit Remains Unchanged

The limit on annual contributions to an IRA remains unchanged at $6,000. The additional catch-up contribution limit for individuals aged 50 and over is not subject to an annual cost-of-living adjustment and remains $1,000.

Details on these and other retirement-related cost-of-living adjustments for 2020 are in Notice 2019-59 PDF, available on IRS.gov.

Read Also: How Much Money Should I Put In My 401k

Don’t Miss: How To Roll Over 401k To Ira Vanguard

An Ira Might Be A Better Option

If you are already contributing up to your employer match, another way to invest additional cash is through a traditional or Roth individual retirement account. The IRA contribution limit is much lower $6,000 in 2021 and 2022 so if you max that out but want to continue saving, go back to your 401.

Some 401 plans, typically at large companies, have access to investments with very low expense ratios. That means youll pay less through your 401 than you might through an IRA for the very same investment. In other cases, the opposite is true small companies generally cant negotiate for low-fee funds the way large companies may be able to. And because 401 plans offer a small selection of investments, youre limited to whats available.

Lets be clear: While fees are a bummer, matching dollars from your employer outweigh any fee you might be charged. But once youve contributed enough to earn the full match or if youre in a plan with no match at all the decision of whether to continue contributions to your 401 is all about those fees. fee analyzer.) If the fees are high, direct additional dollars over the match to a traditional or Roth IRA.

Dont Miss: What Is A 401k Vs Roth Ira

Best Places For Employee Benefits

SmartAssets interactive map highlights the counties across the country that are best for employee benefits. Zoom between states and the national map to see data points for each region, or look specifically at one of four factors driving our analysis: unemployment rate, percentage of residents contributing to retirement accounts, cost of living and percentage of the population with health insurance.

Also Check: How To Transfer 401k When Changing Jobs

If You Start At Age :

With a 4% rate of return: $843.24 per month

- Annual salary needed if you save 10% of your income: $101,189

- Annual salary needed if you save 15% of your income: $67,459

With a 6% rate of return: $499.64 per month

- Annual salary needed if you save 10% of your income: $59,957

- Annual salary needed if you save 15% of your income: $39,971

With an 8% rate of return: $284.55 per month

- Annual salary needed if you save 10% of your income: $34,146

- Annual salary needed if you save 15% of your income: $22,764

Matching Roth 401k Contributions

Some employers offer what is referred to as a Roth 401k in addition to a traditional 401k. Contributions to a Roth 401k are made with after-tax money, or in other words, money that youve already paid taxes on. Traditional 401k contributions are made with pre-tax money, or money that you havent paid taxes on yet.

What this means from a practical standpoint is that you can withdraw money from a Roth 401k tax-free after you retire. With a traditional 401k, youll have to pay income tax on withdrawals in retirement. However, traditional 401k contributions reduce your current taxable income, which reduces your current taxes Roth 401k contributions dont do this.

The contribution limits for Roth 401ks are the same as for traditional 401ks: up to $20,500 in 2022, or $27,000 if youre 50 years of age or over. Unlike Roth IRAs, there is not an income limit for participating in a Roth 401k. Note that employer matches to Roth 401k accounts are made into a traditional 401k.

Also Check: Can I Rollover My Current 401k To An Ira

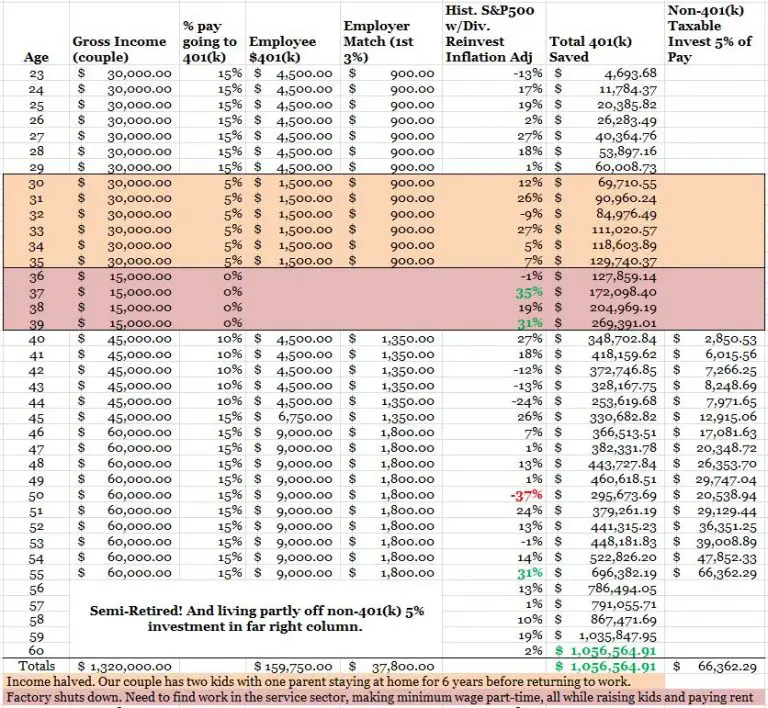

Don’t Forget The Match

Of course, every person’s answer to this question depends on individual retirement goals, existing resources, lifestyle, and family decisions, but a common rule of thumb is to set aside at least 10% of your gross earnings as a start.

In any case, if your company offers a 401 matching contribution, you should put in at least enough to get the maximum amount. A typical match might be 3% of salary or 50% of the first 6% of the employee contribution.

It’s free money, so be sure to check if your plan has a match and contribute at least enough to get all of it. You can always ramp up or scale back your contribution later.

“There is no ideal contribution to a 401 plan unless there is a company match. You should always take full advantage of a company match because it is essentially free money that the company gives you,” notes Arie Korving, a financial advisor with Koving & Company in Suffolk, Va.

Many plans require a 6% deferral to get the full match, and many savers stop there. That may be enough for those who expect to have other resources, but for most, it probably won’t be.

If you start early enough, given the time your money has to grow, 10% may add up to a very nice nest egg, especially as your salary increases over time.

It Never Hurts To Save More

Twenty percent is a great goal, but some retirement experts actually suggest saving more like 25% or even 30. Why?

You know that saying, Past returns are no guarantee of future performance? Thats why. Its true that the annual average return of the S& P 500 between 1928 and 2014 was 10%. But that doesnt mean well get that average return over the next 86 years.

Jack Bogle, the father of index funds and founder of Vanguard, says that investors should plan on lower returns in the coming decade and other commenters suggest lower yields even beyond that.

We have no way of knowing what future returns will bethey could be 8%, they could be 4%. But the only way to hedge against an uncertain future is to save more money. The more you have, the less you need jaw-dropping returns to meet your goals.

Read Also: Can I Move My 401k To Bitcoin

Withdrawing From Your 401

You cant withdraw money from your 401 before a certain age without incurring a financial penalty .

The age when you can begin withdrawing is 59-1/2 for most people, 55 in some exceptional cases .

Even though you arent paying taxes on your contributions now, you will pay them eventually, as you withdraw money during retirement.

Can You Open A Joint 401 As A Married Couple

While it is possible for married couples to open a joint bank account, you cannot open a joint 401 even if you are a couple. IRS rules require that retirement accounts such as 401s and IRAs be individually-owned, and you cannot co-own your spouseâs 401 account or move funds between the retirement accounts.

Spouses suffer no harm in maintaining their own retirement account. The two 401s can grow in tandem by choosing investments that meet their financial goals. The goal of the spouses should be to create a diversified portfolio comprising a mix of short-term and long-term assets.

However, it is possible to have joint taxable investment accounts as a couple. For example, you can open a joint brokerage account as a married couple to buy and sell securities such as stocks, bonds, and ETFs. A brokerage account has various pros such as no income limits, tax benefits, and no funding restrictions, which make it more flexible than a 401 account. On the downside, brokerage accounts may have higher fees and higher risks than a traditional retirement account.

You May Like: How Much Do You Have To Take Out Of 401k

Real Estate Investing Suggestions

In addition to aggressively investing in your 401k, I highly recommend investing in real estate. Real estate is my favorite asset class to build wealth. Real estate provides shelter, produces income, and is a tangible asset. You cant live in your stocks, but you can in your properties.

If youre interested in a hands off approach to real estate investing, consider investing in a publicly traded REIT or in real estate crowdfunding.

My favorite two real estate crowdfunding platforms are:

Fundrise: A way for accredited and non-accredited investors to diversify into real estate through private eFunds. Fundrise has been around since 2012 and has consistently generated steady returns, no matter what the stock market is doing.

CrowdStreet: A way for accredited investors to invest in individual real estate opportunities mostly in 18-hour cities. 18-hour cities are secondary cities with lower valuations, higher rental yields, and potentially higher growth due to job growth and demographic trends.

Both platforms are free to sign up and explore.

Also Check: What Percentage Should I Be Putting In My 401k

Ok So Should I Maximize My 401 Contributions As Soon As Possible

With a never-ending list of financial goals , it sounds sensible to cross off maximizing your 401 right away. The reality is, however, that doing so isnt necessarily right for everyone.

The main reason you may not want to maximize your 401 too quickly is that youre most likely getting a matching contribution from your employer that is calculated and funded each pay period. The Vanguard study found that 96% of plans provide employer contributions.

Lets assume that youre making $80,000 per year and that your 401 employer match is $0.50 for every dollar up to 6% of your salary. That means that your maximum employer match is $2,400. Lets run two scenarios:

-

Scenario #1: To max out your contributions in equal amounts throughout the year, you would need to contribute 28.2% every month to complete the total of $22,500. Each pay period, your employer would contribute $0.50 for every dollar up to 6% of your salary , for an annual total of $2,400.

-

Scenario #2: But what if you were to contribute more than 23.75% per month? Lets assume that your financial situation allows you to contribute a 50% deferral every month. If you were to do that, then you would contribute $3,333.33 every month and max out your contributions in about 6.75 months. Since your employer only contributes up to 6% of your gross pay or about $200 per month, youll only receive a total of $1,350 in matching contributions for the year.

Recommended Reading: Is Rolling Over A 401k Taxable

Knowing These Rules Can Save You A Lot Of Trouble With The Irs

A 401 is a tax-advantaged retirement account, so the government sets limits on how much you can contribute every year. But it also understands that inflation makes retirement more expensive over time, so it reevaluates its limits every year and sometimes raises them. Heres an overview of all of the contribution limits the government imposes on 401s in 2020 and 2021.

Treatment Of Excess Deferrals

You have an excess deferral if the total of your elective deferrals to all plans is more than the deferral limit for the year. Notify your plan administrator before April 15 of the following year that you would like the excess deferral amount, adjusted for earnings, to be distributed to you from the plan. The April 15 date is not tied to the due date for your return.

Excess withdrawn by April 15. If you exceed the deferral limit for 2020, you must distribute the excess deferrals by April 15, 2021.

- Excess deferrals for 2020 that are withdrawn by April 15, 2021, are includable in your gross income for 2020.

- Earnings on the excess deferrals are taxed in the year distributed.

The distribution is not subject to the additional 10% tax on early distributions.

Excess not withdrawn by April 15. If you don’t take out the excess deferral by April 15, 2021, the excess, though taxable in 2020, is not included in your cost basis in figuring the taxable amount of any eventual distributions from the plan. In effect, an excess deferral left in the plan is taxed twice, once when contributed and again when distributed. Also, if the entire deferral is allowed to stay in the plan, the plan may not be a qualified plan.

Reporting corrective distributions on Form 1099-R. Corrective distributions of excess deferrals are reported to you by the plan on Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc.

Don’t Miss: How Much Will I Have When I Retire 401k

What Is A Good 401 Contribution

Your ideal 401 contribution depends on several factors. If your employer offers a match, your first priority should be to contribute enough to get the full match. From there, you may want to max out a tax-free retirement account such as a Roth IRA before you finish maxing out your 401. If you’re able to do all three of these, it can help you get the most out of your investments.

Does Employer 401k Match Count Towards The Annual Limit

Do you want to take advantage of a max contribution to a 401k? Do you know if your employers 401k match counts towards the maximum limit? The answer is yes, but does it count as a contribution from the individual, or does it count as an employer contribution? These two factors can make a huge difference.

Also Check: Can You Leave Money In 401k At Your Old Job

How Much Should You Have In Your 401k By Age

How much does the average person have in their 401k by retirement?

Many workers in the US retire by age 65. Vanguard data shows that the average 401 balance at retirement is $255,151, while the median balance is $82,297.

How much 401k should I have at 35?

So, to answer the question, we believe that one to one and a half times the income saved for retirement by age 35 is a reasonable goal. Thats an achievable goal for someone who starts saving at age 25. For example, a 35-year-old woman earning $60,000 would be on track if she saved about $60,000 to $90,000.

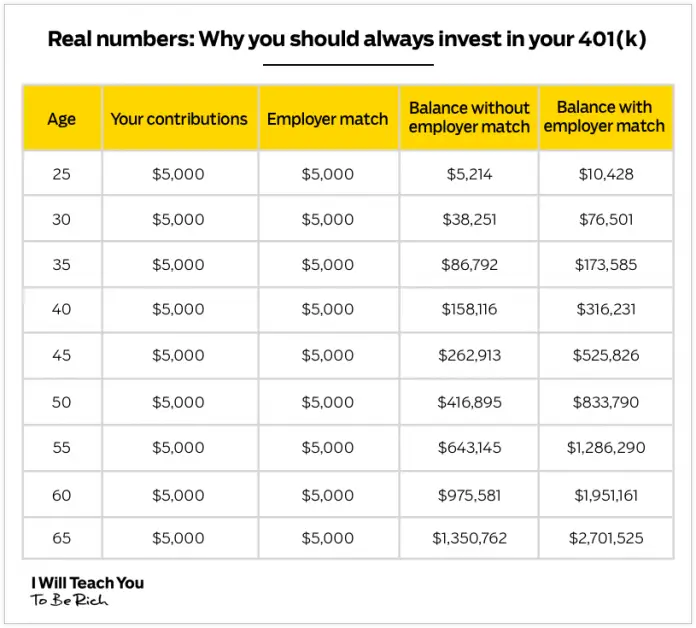

Why Should I Use One

Matching dollars, for one thing. Over 90% of employers that offer a 401 plan also kick in a company match, which means as you contribute, your employer will, too. Commonly, that match will be worth 50% to 100% of your contributions, up to a limit that typically falls between 3% and 6% of your annual salary. If your employer offers up this free money, a good rule of thumb is to do everything you can to contribute enough to take advantage of it.

The other huge benefit of the 401 is that it allows you to put a lot of money away for retirement in a tax-advantaged way. The annual 401k contribution limit is $20,500 for tax year 2022, with an extra $6,500 allowed as a catch-up contribution every year for participants age 50 or older.

Also Check: Can You Use 401k For Investment Property

Roth 401 Vs Traditional 401

Although the contribution limits are the same for traditional 401 plans and their Roth counterparts, a designated Roth 401 account is technically a separate account within your traditional 401 that allows for the contribution of after-tax dollars. The elected amount is deducted from your paycheck after income, Social Security, and other applicable taxes are assessed. The contribution doesnt garner you a tax break in the year you make it.

The big advantage of a Roth 401 is that no income tax is due on these funds or their earnings when theyre withdrawn after you retire. A traditional 401 works in the opposite way. That is, savers make their contributions on a pretax basis and pay income tax on the amounts withdrawn when they retire. Neither of these 401 accounts imposes income limitations for participation.

When available, savers may use a combination of the Roth 401 and the traditional 401 to plan for retirement. Splitting your retirement contributions between both kinds of 401s, if you have the option, can help you ease your tax burden in retirement.

Dont Miss: How To Find A Deceased Persons 401k