Ways To Become Eligible For A Solo 401k Plan

The Solo 401k is for Solopreneurs. A Solopreneur is a solo entrepreneur or solo business owner.

Your Solo 401k business can be your main full-time job, part-time, in addition to a full-time job, etc. The business can be any entity structure, including a sole proprietorship, LLC, S-Corp or C-Corp, or a partnership. Sole proprietor is the most common form of business.

You can start with one business entity and change your business entity later on. For example, you may start your business as a sole proprietor and change to an S-Corp later on.

You also have full flexibility in changing your business. You can start with one type of business and later change to a completely different business

You can earn income from your business as 1099-MISC, Schedule C, K-1, 1120, 1120S, or 1065. The money you get from your business to qualify for the Solo 401k must be earned income .

Your Solo 401k business cannot have any full-time W2 employees, other than you or your spouse. You may have part-time W2 employees , or independent contractors who work with your business.

If you have no W2 employees in your business, you qualify!

Your Solo 401k business can be a side-business and its OK to have a regular full-time job in addition to your Solo 401k.

Some common examples of Solopreneurs are:

- Software developers

Solo 401 Plan Design Options

Because solo 401 plans cover few employees and dont require much administration, 401 providers typically charge low fees to administer them. Thats the good news. The bad news is that solo 401 providers often fail to make popular 401 plan design options like participant loans or in-service distributions available to business owners to maximize their profit from these plans.

They rarely make voluntary after-tax contributions available either. These contributions are uncommon today because they make annual nondiscrimination testing difficult to impossible to pass. However, this shortcoming is moot with solo 401 plans because they dont require annual testing.

So why should you want voluntary after-tax contributions in your solo 401 plan? They make mega back door Roth IRA contributions possible. Under this tax strategy, you make voluntary after-tax contributions to your 401 account up to the 415 limit â and then immediately roll them to a Roth IRA where their investment earnings can grow tax-free. For the strategy to work, your solo 401 plan must also allow the in-service distribution of voluntary contributions at any time.

Recommended Reading: How Does A Residential Solar System Work

Deducting Retirement Plan Contributions

Total limits on plan contributions depend in part on your plan type. See the contribution limits for your plan.

A limit applies to the amount of annual compensation you can take into account for determining retirement plan contributions. This limit is $305,000 in 2022, $290,000 in 2021, $285,000 in 2020 and $280,000 in 2019 and is adjusted annually.

Plan contributions for a self-employed individual are deducted on Form 1040, Schedule 1 and not on the Schedule C. If you made the deduction on Schedule C, or made and deducted more than your allowed plan contribution for yourself, you must amend your Form 1040 tax return and Schedule C.

You should amend your Form 1040 tax return and Schedule C if you:

- deducted your own plan contribution on Schedule C instead of on Form 1040, Schedule 1, or

- made and deducted more than the allowable plan contribution for yourself.

If you contributed more for yourself than your plan terms allowed, you should also correct this plan qualification failure by using the IRS correction programs.

Recommended Reading: Who Do I Call About My 401k

My Wife As Trustee Of The Solo 401k Question:

For my business entity/LLC, I am the only member/owner of this LLC. My wife currently is not an owner of this LLC. Can she still be a TRUSTEE in my SOLO-K that we are setting up?

ANSWER

Per our initial conversation, you need to be self-employed with no full-time employees. Moreover, the key in demonstrating that you are self-employed is that you are reporting self-employment activity .

Your wife can be co-trustee in the Solo 401k even if she is not an owner of the LLC and not reporting self-employment activity. Having her as co-trustee will have the benefit of providing you both with signing authority.

You need to report at least some self-employment activity for the year that you open/establish the solo 401k plan on your taxes and going forward. This could be in the form of w-2 wages, activity on Schedule C, etc. Please note that you dont necessarily need to be profitable to receive self-employment income .

What To Know About Erisa Qualified Retirement Plans

- Blog, Compliance, Entrepreneurship, Participant Loan, SDIRA, Solo 401k, Solo 401k Investing, Solo 401k Qualification, Solo 401k Setup, Uncategorized

The Employee Retirement Income Security Act of 1974 is a federal law. ERISA was created to protect employees who invest in their company retirement plan. Since a Solo 401k doesnt have non-owner employees, many titles of ERISA dont apply. However, its still important to know about the protections in an ERISA Qualified Retirement Plan.

Interestingly, it sets minimum standards for most voluntarily established pension and health plans in private business. The purpose is to provide protection for people vested in the plans. However, to qualify, a plan must be employer sponsored. That means the IRS requires plan contributions to be tax deductible.

A corporate 401k is an ERISA qualified retirement plan because it is employer defined and therefore employer sponsored.

Important: You can be the employer who sets up a Solo 401k for yourself. This is something many people dont understand. People see the words employer sponsored and think they have to work for someone else. However, many owners operate their own small business. Any business owner can set up a qualified retirement plan.

Read Also: How Do 401k Withdrawals Work

How Do Small Business Owners Choose The Best 401 For Their Needs

To find the right 401 for their small business, employers generally look for plan providers that:

- Charge reasonable plan and investment fees and have no hidden costs

- Provide real-time integration between the 401 recordkeeping and payroll systems to eliminate manual data entry and reduce errors

- Offer a simplified compliance process

- Make administrative fiduciary oversight available

- Offer ERISA bond and corporate trustee services

- Help with investment fiduciary services and plan investment responsibilities

- Make investment advisory services available for employees

Do You Qualify For A Self

LAST REVIEWED Oct 29 20208 MIN READ

Are you a self-employed professional planning for your retirement? A self-employed 401 is an excellent plan to build out your retirement nest egg. Whether you are a freelancer, shop owner, or small business owner without employees, a solo 401 retirement plan can help you live your dream life when you retire. Here well discuss an overview of a self-employed 401, setting one up, how to withdraw from the account and other vital information.

Recommended Reading: Can 401k Be Used For Home Purchase

Solo 401k Rules For Sole Proprietor

Being a sole proprietor is the simplest and easiest way to start out in business. You typically do business under your personal name or you could have a DBA name. Most of the rules for a sole proprietorship are similar to any other business structure, except for a few main areas

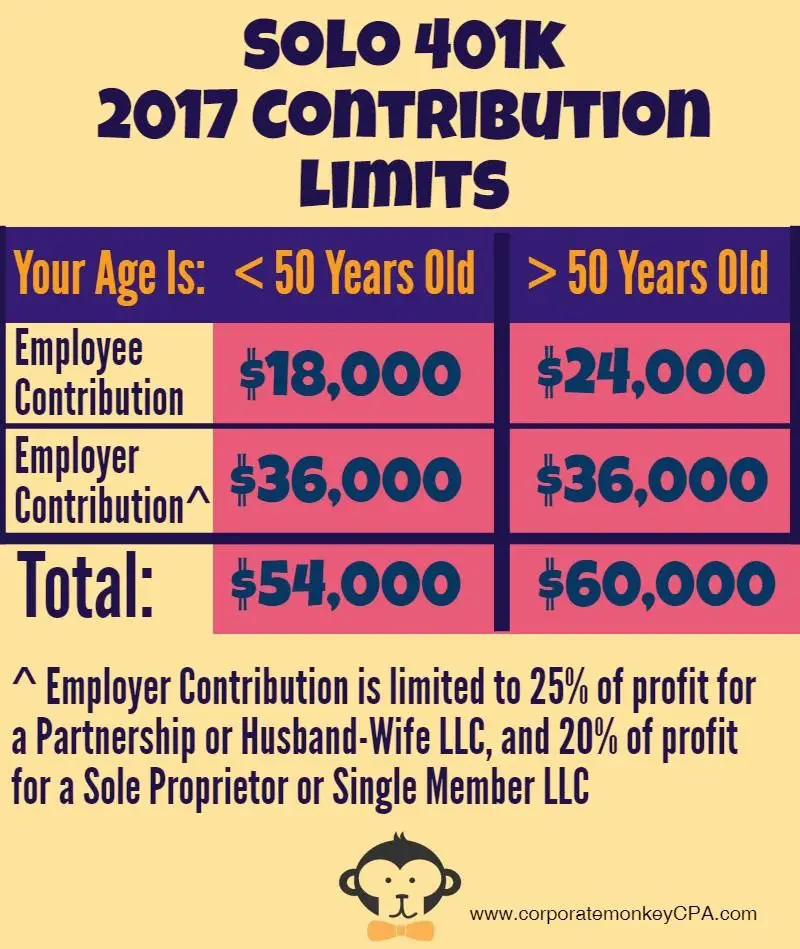

When calculating contributions from your sole proprietorship you get to use net business income. Your salary deferral can be up to $19,500 or $26,000 if you are 50 years of age or older. This can be up to 100% of your net business income. Your employer profit sharing contribution is a little bit more complex to calculate. You can look at IRS publication 560 which has a deduction worksheet for self employed in chapter 6. This worksheet helps you calculate your employer profit sharing contribution. Its generally about 20% of your net business income minus half of your self employment income tax. You should work with a qualified tax professional to finalize your numbers. To get an estimate you can also use this Solo 401k calculator.

Your sole proprietorship contributions need to be made before your tax filing deadline. April 15 is the deadline for normal filing. If you file an extension you can make contributions all the way until October 15th. Put your tax deductible contributions on IRS Form 1040, Schedule 1, Line 15. You can write the check to make your contributions from your business checking account and deposit it into your Solo 401k Trust bank or brokerage account.

What Is The Maximum Contribution To A Solo 401k

Contribution limits to a Solo 401k are very high. For 2021, the max is $58,000 and $64,500 if you are 50 years old or older. This is up from $57,000 and $63,500 in 2020. This limit is per participant. So if your spouse is earning money from your small business that means they can also contribute up to the same amount into the Solo 401k. If you are both 50 years old or older, this means that combined contributions could be up to $129,000 per year!

Solo 401k contributions are much higher than all other retirement plans. Traditional and Roth IRA limits are just $6,000. The catch up contribution is $1,000 more if you are 50 years old or older. The IRS typically increases contribution limits every couple years as a cost of living increase to keep up with inflation. Therefore, its a fair bet to expect contribution limits to continue going up over time.

Read Also: What Is A Sole Proprietorship Vs Llc

Recommended Reading: Can I Combine 401k Accounts

Contribute To Your Account

You can use the Contribution Worksheet to calculate your annual contributions.

To mail contributions to Fidelity

To set up salary deferral elections

To roll over other plan assets

If you already have a retirement savings plan for your business, you may be able to roll over or transfer existing plan assets to a Self-Employed 401. Consult with your tax advisor or benefits consultant prior to making a change to your retirement plan.

Assets from the following plans may be eligible to be rolled over into a Self-Employed 401:

- Profit Sharing, Money Purchase, and 401 plans

- SIMPLE IRA accounts after two years of SIMPLE participation

- 403 and governmental 457 plans

- Traditional IRAs

Call a retirement specialist at 800-544-5373 to get help with a rollover into a Fidelity Self-Employed 401.

Contribution deadlines

The deadline for depositing your employer profit-sharing contributions for the current calendar year is the business’ tax-filing deadline, plus extensions .

Solo 401 Contribution Limits If You Participate In Another Plan

If you are self-employed and work at a second job, you can have a Solo 401 and a regular 401 at the same time. The contribution limits are calculated cumulatively across both retirement accounts. For elective deferrals, you can set aside up to $19,500 in 2021 across both accounts. If you max out the elective deferrals in the 401, you cannot make employee contributions in the Solo 401.

However, employer contributions are calculated per plan, and two unrelated employers can each contribute up to the IRS annual limit. You can contribute up to 25% of the compensation earned per unrelated employer. You can contribute up to $58,000 to your Solo 401 in 2021, and another $58,000 to your 401 account. If you are over 50, you can make catch-up contributions of $6,500 to only one retirement account.

Read Also: How Do I Find A Old 401k

Contribution Limit As An Employer

Wearing the employer hat, you can contribute up to 25% of your compensation.

The total contribution limit for a solo 401 as both employer and employee is $58,000 for 2021, and $61,000 in 2022, or 25% of your adjusted gross income, whichever is lower.

People ages 50 and above can add an extra $6,500 a year as a catch-up contribution. In other words, in 2022 you can contribute a total of $61,000 along with a $6,500 catch-up contribution if applicable for a maximum of $67,500 for the year.

You can have a solo 401 even if youre moonlighting. If you have a 401 plan at both jobs, the total employee contribution limits must be within the maximum for the year, but the employer contribution is not limited. If youre one of these lucky folks with two retirement savings plans, talk to a tax adviser to make sure you follow the IRS rules.

Preparing And Responding To Irs Investigations

- When asked to provide information, make sure to provide it in connection with your solo 401k plan and self-employed business not your personal accounts or assets. You should also consult with your solo 401k plan provider to make sure all disclosures are up to date.

- If the IRS asks for supporting documents, make sure to provide all the documents listed on the IRS examination notice.

- If IRS requires an interview, prepared for as if it were a trial or a deposition.

About Mark Nolan

Each day I speak with energetic entrepreneurs looking to take the plunge into a new venture and small business owners eager to take control of their retirement savings. I am passionate about helping others find their financial independence. Having worked for over 20 years with some of the top retirement account custodian and insurance companies I have a deep and extensive knowledge of the complexities of self-directed 401ks and IRAs as well as retirement plan regulations.Learn more about Mark Nolan and My Solo 401k Financial > >

Read Also: How To Set Up 401k In Quickbooks

The Presence Of Self Employment Activity

This basically means you should be the owner/operator of one of the following: sole proprietorship, LLC, C Corporation, S Corporation, or Limited Partnership where the business intends to generate revenue for profit and make contributions to the solo 401k plan.

There’s no set amount of revenue for profit you should be generating. In most cases the IRS will consider you eligible if your business is legitimate and run with the intention of generating profits. You can be self employed either part time or full time, and even have another job somewhere else.

You can also participate in an employers 401k plan alongside your solo 401k. But if you choose to do this, your contribution limits will not be raised.

How Do You Contribute To A Solo 401k

The high contribution limits help you supercharge aggressive wealth growth. Just like your investments, you control your contributions. There are two ways to fund your Solo 401k:

Rollovers are the most common way to open a Solo 401k. Our unique Solo 401k software designs custom rollover and transfer packets for you to send to your previous custodian or administrator. Completing the rollover request and getting a customized rollover packet will take you 60 seconds or less, and you can initiate your rollover 24/7/365. Our customized rollover requests will contain information specifically for your rollover or transfer, including written instructions on how to complete the direct rollover into your new Solo 401k plan.

You can do a rollover from almost any other kind of retirement account including:

- Traditional IRAs

- Defined Benefit Plans

The employee and employer contributions have been covered above. While learning what is a solo 401k, you will want to know who writes the check. The contribution is not made directly from the business bank account. After you get paid as the employer/employee of your business, you write the check for the contribution to the plan. Write a check payable to your Solo 401k trust. Write Solo 401k contribution in the memo section of the check. Then, deposit the contribution check into your Solo 401k bank or brokerage account.

Have more questions about how contributions relate to your business? Weve got answers:

Recommended Reading: Do I Need A Financial Advisor For My 401k

What Is A Solo 401k And Who Needs One

Almost everyone dreams about the freedom and self-determination of being self-employed. People want to reap the full financial benefits of their work instead of giving it away as a profit for others. What holds many people back from achieving their dream is the insecurity of not having a retirement fund for their old age. But there is a reliable answer that can make your dream come true. The question that you need to ask is what is a Solo 401k? The answer is that it is an employer-sponsored Solo 401k retirement account designed for the self-employed. Typically, it comes with more benefits and fewer restrictions than what major employers offer in a 401k. The Solo 401k makes it all available without the hassles of working for others and giving away the profits earned from your work.

Solo 401k Minimum Income Requirements

There is no minimum income required in order to qualify for a Solo401k. As long as you have a self-employed business activity with intention to generate income, you are qualified to have a Solo401k plan. The business activity can be full-time or part-time. Also, the contribution is at your discretion. If you find yourself with limited cash flow one year, you can decide to contribute as little as you want, or even suspend contribution for that year. There will be no tax or penalty for not contributing to the plan. However, in order for your plan to retain its Qualified-Status substantial contributions must be made occasionally.

Donât Miss: Is It Worth Getting A Solar Battery

Recommended Reading: How To Get Your 401k Without Penalty