Option : Roll Over The Money Into Your New Employers Plan

Rolling your money over to your new 401 plan has some benefits. It simplifies your investments by putting them in one place. And you also have higher contribution limits with a 401 than you would with an IRAwhich means you can save more!

But there are lots of rules and restrictions for rolling money over into your new employers plan, so its usually not your best bet. Plus, your new 401 plan probably only has a handful of investing options to choose from too. And if youre feeling iffyabout those options, why put all your retirement savings there? Which brings us to . . .

Move To Your Next Jobs Plan

If you left your job for a different job, you might be able to transfer your 401 assets into the new jobs 401, 403, TSP, or another retirement plan.

This strategy allows you to keep your retirement savings in one place and simplifies life. Before deciding on this, compare fees and expenses on both plans, and ask your new employer if youre allowed to roll money into the plan. Then, find out if you can withdraw that money if you ever need it.

Advantages:

- Simplify and minimize the number of accounts

- Avoid leaving a trail of old accounts with former employers

- Potential for larger 401 loans

Potential pitfalls:

- New plan might have higher costs or be more restrictive

- Might not be able to access the money while employed

Move Money To New Employer’s 401

Although there’s no penalty for keeping your plan with your old employer, you do lose some perks. Money left in the former companys plan cannot be used as the basis for loans. More importantly, investors may easily lose track of investments left in previous plans.

For accounts between $1,000 and $5,000, your company is required to roll the money into an IRA on your behalf if it forces you out of the plan.

If you have at least $5,000 in your account, most companies allow you to roll it over. But accounts of less than $5,000 can be rolled out of the plan by the company if a former employee does not respond to a notification letter within 30 days.

For amounts under $1,000, federal regulations now allow companies to send you a check, triggering federal taxes and state taxes if applicable, and a 10% early withdrawal penalty if you are under age 59½. In either scenario, taxes and a potential penalty can be avoided if you roll over the funds into another retirement plan within 60 days.

Don’t Miss: Where To Find Fidelity 401k Account Number

Leave It In Your Current 401 Plan

The pros: If your former employer allows it, you can leave your money where it is. Your savings have the potential for growth that is tax-deferred, youll pay no taxes until you start making withdrawals, and youll retain the right to roll over or withdraw the funds at any point in the future.

The cons: Youll no longer be able to contribute to the plan, and the plan provider may charge additional fees because youre no longer an employee. Managing multiple tax-deferred accounts can also prove complicated. The IRS mandates required minimum distributions annually from all such accounts beginning at age 72 . Fail to calculate the correct amount across multiple accounts, and the IRS will slap you with a 50% penalty on the shortfall.

Contact Your Current Plan Administrator And New Plan Administrator

The easiest 401 rollover option is to get your old plan administrator to transfer your balance directly to your new account. This is called a direct 401 rollover, and it frees you from having to worry about tax consequences or early withdrawal penalties.

Speak with your new plan provider about getting an account number, then provide the information to your current 401 administrator. Theyll take care of the rest.

Be aware that not every plan administrator will perform a direct 401 rollover. In this case, the plan administrator cuts you a check for the balance, and its up to you to send the funds to your new 401 plan provider. You have just 60 days to redeposit the balance in your new plan. Otherwise its treated as an early withdrawal that incurs a penalty and income tax liabilities.

Don’t Miss: Does Company Match Count Towards 401k Limit

Where Should You Transfer Your 401

You have several options on what to do with your 401 savings after retirement or when you change jobs. For example, you can:

The right choice depends on your needs, and thats a choice everybody needs to make after evaluating all of the options.

Want help finding the right place for your retirement savings? Thats exactly what I do. As a fee-only fiduciary advisor, I can provide advice whether you prefer to pay a flat fee or youd like me to handle investment management for you, and I dont earn any commissions. To help with that decision, learn more about me or take a look at the Pricing page to see if it makes sense to talk. Theres no obligation to chat.

Important:The different rules that apply to 401 and IRA accounts are confusing. Discuss any transfers with a professional advisor before you make any decisions. This article is not tax advice, and you need to verify details with a CPA and your employers plan administrator. Likewise, only an attorney authorized to work in your state can provide guidance on legal matters. Approach Financial, Inc. does not provide tax or legal services. This information might not be applicable to your situation, it may be out of date, and it may contain errors and omissions.

Next Up: Curious About Meeting?

Rolling 401 Assets Into An Ira

When you retire or leave your job for any reason, you have the right to roll over your 401 assets to an IRA. You have a number of direct rollover options:

Rolling your traditional 401 to a traditional IRA. You can roll your traditional 401 assets into a new or existing traditional IRA. To initiate the rollover, you complete the forms required by both the IRA provider you choose and your 401 plan administrator. The money is moved directly, either electronically or by check. No taxes are due on the assets you move, and any new earnings accumulate tax deferred.

Rolling your Roth 401 to a Roth IRA. You can roll your Roth 401 assets into a new or existing Roth IRA with a custodian of your choice. You complete the forms required by the IRA provider and your 401 plan administrator, and the money is moved directly either electronically or by check. No taxes are due when the money is moved and any new earnings accumulate tax deferred. Earnings are eligible for tax-free withdrawal once the IRA has been open at least five years and you are at least 59½.

Rolling your traditional 401 to a Roth IRA. If your traditional 401 plan permits direct rollovers to a Roth IRA, you can roll over assets in your traditional 401 to a new or existing Roth IRA. Keep in mind youll have to pay taxes on the rollover amount you convert.

You May Like: How To Set Up My 401k

You Get More Investment Options

In a 401 plan, your mutual fund investment options can be limited, points out Dominique Henderson, certified financial planner , founder of DJH Capital Management.

Often you have between six and 24 fund choices in a 401, Henderson says. With an IRA, you can choose individual stocks as well as fundsand even use alternative investments. Alternative investments can include everything from real estate to Bitcoin, but youll also have access to a wider range of index funds as well as exchange-traded funds , which are often missing from 401 offerings.

Reasons You May Want To Wait To Roll Over Your 401

- Temporary ban on contributions. Some plan sponsors impose a temporary ban on further 401 contributions for employees who withdraw funds before leaving the company. Youll want to determine if the gap in contributions will significantly impact your retirement savings.

- Early retirement. Most 401s allow penalty-free withdrawals after age 55 for early retirees. With an IRA, you must wait until 59 ½ to avoid paying a 10% penalty.

- Increased fees. IRA investors may pay more fees than they would in employer-sponsored plans. One reason: The range of more sophisticated investment options you may choose can be more expensive than 401 investments. Your advisor can help identify what extra cost a rollover may incur and if the benefits of the rollover justify those additional costs.

- Can take loans out. Your 401 may permit you to take out a loan from the account, but this is typically only for active employees. And you may have to pay in full any outstanding loan balances when you leave the company. You cannot take loans from IRAs.

You May Like: How Much To 401k Per Year

Best Places For Your 401 Rollover

Banks are increasingly the destination of choice for Americans rolling over their 401 into an IRA. That qualifies as “uh-oh” worthy in my book.

According to a new survey of affluent investors by BAI and the Financial Research Corporation banks are grabbing serious market share from brokerages and fund companies. Check out this telling chart that shows banks’ share of rollovers has nearly doubled since 2007.

- There’s no FDIC insurance if the money is actually invested, not saved. Hopefully this is clear, but just in case: If you rollover the money into a bona fide bank account, such as CD, or money market deposit account , you are in fact protected by FDIC insurance, up to certain limits. But if you roll over the 401 to a bank account and then invest the money in a mutual fund, ETF or the direct purchase of stocks and bonds, that money is not covered by FDIC insurance. Classic bank savings accounts are covered by FDIC insurance. Investments are not.

The Fee Factor FidelityVanguardSchwab

First published on February 16, 2010 / 11:29 AM

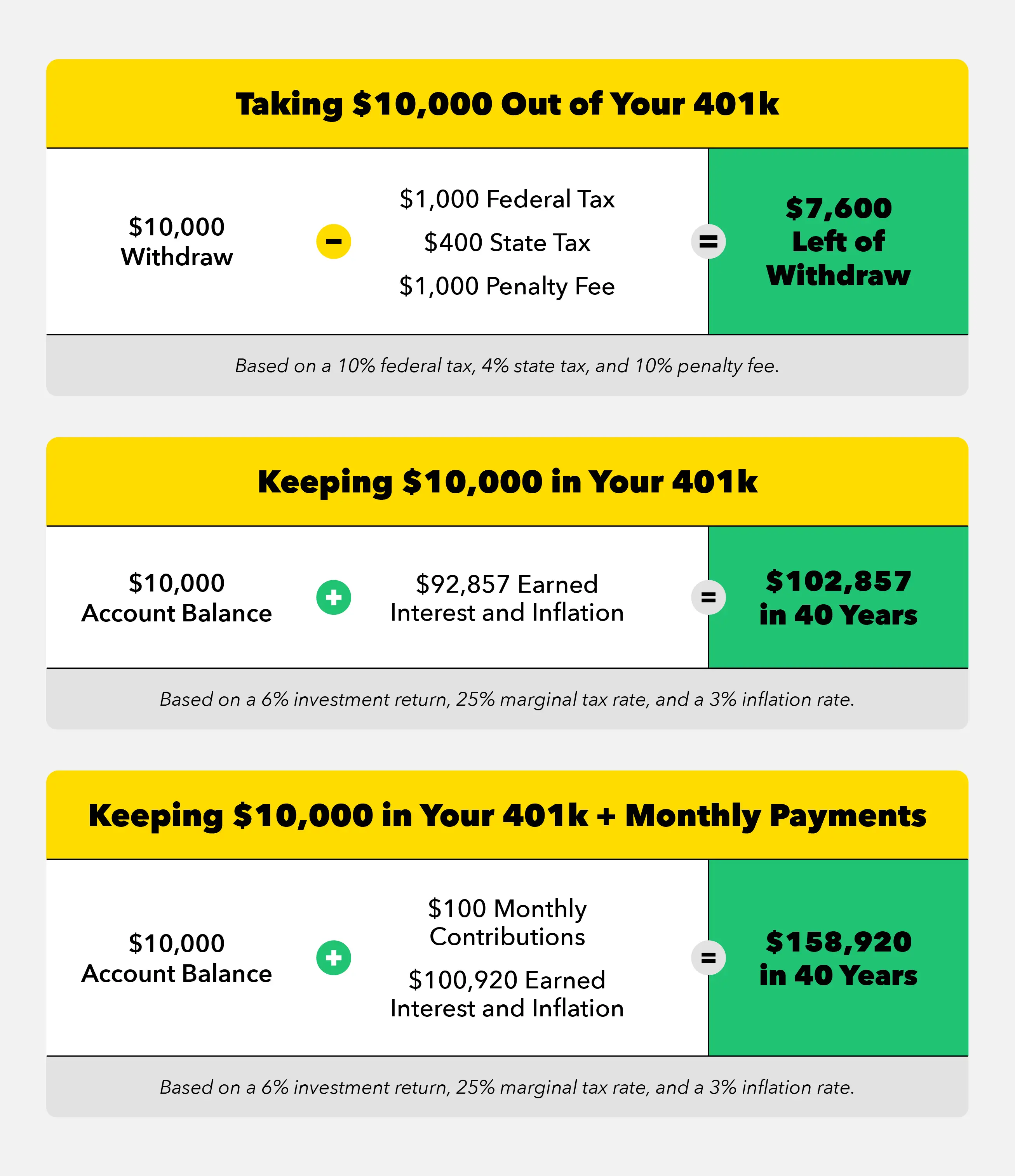

Option : Cashing Out Your 401

While withdrawing your money is an option, in most circumstances, it means those funds will not be there when you need them in retirement. In addition, cashing out your 401 generally means you’ll have to pay taxes on the withdrawal, and there’s typically an additional 10% tax penalty if you’re younger than 59½, unless you left your employer in the calendar year you turned 55 or older.

Net unrealized appreciation: special considerations for employer stockIf you own stock in your former employer and that stock has increased in value from your original investment, you may be able to receive special tax treatment on these securities. This is referred to as net unrealized appreciation . If you roll the employer stock into a traditional or Roth IRA or move it to your new employers plan, the ability to use the NUA strategy is lost. NUA rules are complex. If you’re considering NUA, we suggest consulting with a tax professional prior to making any decisions on distributions from your existing plan.

Should I roll over my 401?The decision about whether to roll over your 401 is dependent on your individual situation. A financial advisor will work with you to help identify your goals and determine what’s important to you. By understanding your investment personality, he or she will be able to advise if rolling over your 401 is the best option for you.

Also Check: Can I Have A Personal 401k

Rolling Over Your Old 401 To A New Employer

Many companies offer 401 plans, so people often end up having multiple 401s over their years in the workforce. If youd rather keep your funds in a single 401 or dont want to open an IRA, you might have the option of transferring assets from your old 401 to your new one at your current job. If not, youll need to keep an eye on how each is performing individually.

The process for this is as simple as talking to both your current and past plan providers to make sure they will both accept a transfer of assets. While the providers can offer more specific instructions, youll likely use one of the methods above to complete the rollover.

Note that not all plan providers will accept employees past 401 funds as a rollover. This is because they may not be willing to add more assets to the plan, which could overwhelm it.

Option : Transfer The Money From Your Old 401 Plan Into Your New Employers Plan

Moving your old 401 into your new employers qualified retirement plan is also an option when you change jobs. The new plan may have lower fees or investment options that better support your financial goals. Rolling over your old 401 into your new companys plan can also make it easier to track your retirement savings, since youll have everything in one place. Its worthwhile to talk with an Ameriprise advisor who will compare the investments and features of both plans.

Some things to think about if youre considering rolling over a 401 into a new employers plan:

Read Also: How Can I Take Money Out Of My 401k

Short Of Cash Be Cautious

It may be tempting to pull money out of your 401 to cover a financial gap. Or, when you are considering rolling money over from a 401 to an IRA, you may wish to roll over only a portion of your retirement savings and take the rest in cash. But do you know the true cost? Use our 401 Early Withdrawal Costs Calculator first.

Investment and Insurance Products are:

- Not Insured by the FDIC or Any Federal Government Agency

- Not a Deposit or Other Obligation of, or Guaranteed by, the Bank or Any Bank Affiliate

- Subject to Investment Risks, Including Possible Loss of the Principal Amount Invested

Investment products and services are offered through Wells Fargo Advisors. Wells Fargo Advisors is a trade name used by Wells Fargo Clearing Services, LLC and Wells Fargo Advisors Financial Network, LLC, Members SIPC, separate registered broker-dealers and non-bank affiliates of Wells Fargo & Company.

WellsTrade® and Intuitive Investor® accounts are offered through WFCS.

Retirement Professionals are registered representatives of and offer brokerage products through Wells Fargo Clearing Services, LLC . Discussions with Retirement Professionals may lead to a referral to affiliates including Wells Fargo Bank, N.A. WFCS and its associates may receive a financial or other benefit for this referral. Wells Fargo Bank, N.A. is a banking affiliate of Wells Fargo & Company.

Disadvantages Of An Ira Rollover

A rollover is not for everyone. A few cons to rolling over your accounts include:

- . You may have credit and bankruptcy protections by leaving funds in a 401k as protection from creditors vary by state under IRA rules.

- Loan options are not available. The funds may be less accessible. You may be able to get a loan from an employer-sponsored 401k account, but never from an IRA.

- Minimum distribution requirements. You can generally withdraw funds without a 10% early withdrawal penalty from a 401k if you leave your employer at age 55 or older. With an IRA you generally have to wait until you are age 59 1/2 to withdraw funds in order to avoid a 10% early withdrawal penalty. The Internal Revenue Service offers more information on tax scenarios as well as a rollover chart.

- More fees. You may be responsible for higher account fees as compared to a 401k which has access to lower-cost institutional investment funds because of group buying power.

- Tax rules on withdrawals. You may be eligible for favorable tax treatment on withdrawals if your 401K is invested in company stock.

Neither State Farm nor its agents provide tax or legal advice.

Start a Quote

Also Check: How To Find Missing 401k Money

Ira Rollover Vs Transfer

Although both rollovers and transfers allow you to move your retirement savings from one financial institution to another, the process for each is different, and each have different rules.

A 401 rollover occurs when you move retirement funds from an employer-sponsored plan to an IRA this is why its also called a Rollover IRA. This option is typically chosen when an employee leaves a job and is no longer contributing to the employer-sponsored retirement plan.

A Transfer is when you move your IRA to another IRA at a different institution. In the case of a transfer, funds or assets are sent between institutions, from the previous custodian or trust company to the new one. This is not only the quickest, but also the best method of moving your IRA to a self-directed IRA.

Contact Your Current 401 Provider And New Ira Provider

Ideally, you want a direct rollover, in which your old 401 plan administrator transfers your savings directly to your new IRA account. This helps you avoid accidentally incurring taxes or penalties. However, not every custodian will do a direct rollover.

In many cases, youll end up with a check that you need to pass on to your new account provider, Henderson says. Open your new IRA before starting the rollover so you can tell the old provider how to make out the check.

The goal, Henderson says, is to avoid having to ever put the money into your personal bank account.

You only have 60 days to complete the transaction to avoid it being a taxable event, and its best to have everything set up before getting that check, Henderson says.

Dont Miss: What Will My 401k Be Worth At Retirement

Also Check: How Can You Borrow From Your 401k