Option : Roll Over Your 401 Into An Ira

Instead of keeping your funds in a 401, you may also choose to roll over your plan into an IRA. Youll do this with a bank or brokerage firm separate from your employer. This is a common choice for people who are leaving the workforce or for those who dont have an employer that offers a 401 plan.

The main benefit of an IRA versus a 401 is more flexibility in withdrawing money penalty-free before reaching the age of 59 ½. You also have direct access and more control over your investment options. You may have other investments and can now move this money to the same brokerage so that everything is in one plan, which consolidates logins.

If you choose to withdraw money from a rollover IRA, it may be used for a qualifying first-time home purchase or higher education expenses in addition to the exceptions for 401s.

The drawbacks of an IRA is that youll lose some hardship distribution options as well as qualified status, which means less protection of your assets. For example, if you were to be sued, some states would allow money in IRAs to be collected but not if it was in a 401.

What Happens To Your 401k If You Quit

Youre a diligent saver. Youve been planting those retirement seeds in your 401k account with every paycheck because you know how powerful a 401k can be for growing your wealth. But what happens to your 401k if you quit?

If you leave your old job, you dont want your 401k money to disappear! It took a lot of discipline to save that money. Does it go away? Does your old employer keep it? What about the government? Does your 401k money get paid out to you? Will it follow you to your new job?

There are a couple of possible paths that your 401k money can take if you decide to quit your old job. If youre in a position where youre about to leave your job or youve just left, then this will be an important article for you to read. Making the wrong decision with your 401k money could possibly incur a very large tax bill thats not what anyone wants!

I just left my old job, so Im in a position where I need to consider the possibilities for my old 401k money again. We might be in the same boat!

Here, you can read the official rules from the IRS about 401k distributions. Its a really good resource, but its a little confusing. Ill help put it in more simple terms. If you want to know what happens to your 401k money when quit your job, read on.

Leave Your 401 In Your Old Plan

Leaving your 401 in your old employers plan saves you from having to make an immediate choice about what you want to do with your 401 when leaving a job. A temporary decision to leave your 401 in your old plan can turn into a permanent one, so you need to make this choice proactively. Otherwise, you might find yourself with a lot of old 401 accounts youre not as invested in as you should be.

Before making this decision, there are some things to consider. For instance, if your balance is under $1,000, your employer can discontinue your plan without your permission. Additionally, if your balance is between $1,000 and $5,000, your employer is permitted to move your balance to a separate individual retirement account.

No matter what, you should contact your old employer and discuss your options. Keep in mind that if you choose to leave your 401 intact, you will not be able to add additional money to the plan and your ability to take a loan from your plan will no longer exist in most cases. Also, withdrawal options might be limited, and you might have to take the entire account balance versus a partial withdrawal.

Dont Miss: How Do I Find Out Where My Old 401k Is

Don’t Miss: Can I Open A Solo 401k

Repay Your 401k Loans

Prior to 2018, the tax law dictated you had 60 days to repay a 401 loan when you left a job. However in the Tax Cuts and Jobs Act, you now have the option to offset your account balance with the outstanding balance of the loan during a rollover. This could be to another eligible IRA or retirement account.

This offset distribution uses your current 401 funds to pay the amount of the outstanding loan balance without giving you any money. Its like taking money out of your 401 and putting it back as outside cash to pay off your loan all while making a rollover happen.

If a 401 plan loan is offset, you have until the due date of your tax return for the year you leave your job to pay the taxes and penalties . An offset distribution is reported with code M in box 7 of the Form 1099-R for the year in which the distribution occurs .

Before you change jobs, double-check your 401 loan situation to see if you can afford to repay the loan in order to avoid the penalties. If you cant repay the 401 loan, check to see if your 401 account has the funds to go through an offset distribution.

Use Your Insurance Benefits One Last Time

Another drawback of going freelance is that you’ll be losing that sweet employer-subsidized health insurance. If you’re going to be joining a spouse’s plan, this tip may not be as crucial for you, but if you’re going to be self-funding your health insurance, make sure you get in for last-minute appointments under the plan you’re leaving.

For example, if you have vision insurance through your W-2 employer, get in for an eye exam and consider picking up a new pair of glasses while you can still get a good deal on them.

Recommended Reading: How To Open A 401k Plan

Option : Roll Over Your Old 401 Into An Individual Retirement Account

Still another option is to roll over your old 401 into an IRA. The primary benefit of an IRA rollover is having access to a wider range of investment options, since youll be in control of your retirement savings rather than a participant in an employers plan. Depending on what you invest in, a rollover can also save you money from management and administrative fees, costs that can eat into investment returns over time. If you decide to roll over an old 401 into an IRA, you will have several options, each of which has different tax implications.

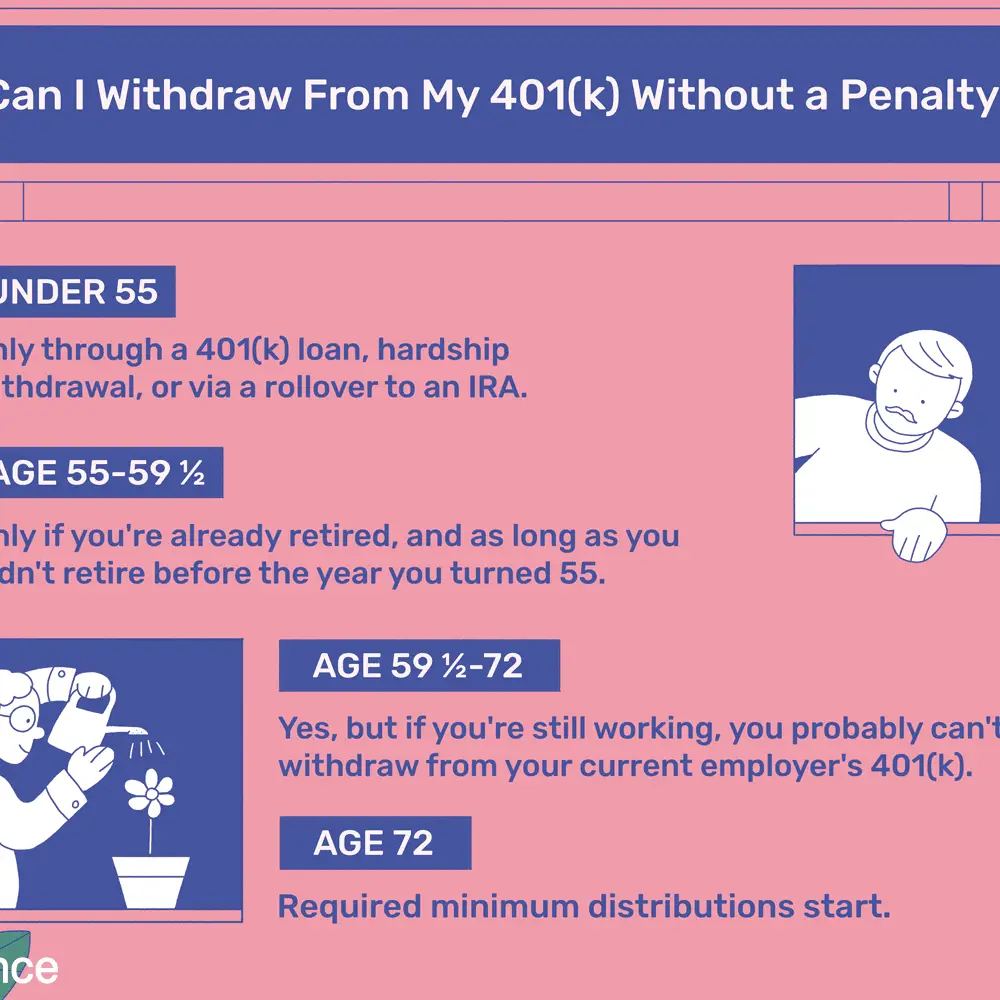

Can I Cash Out My 401 While Still Working

One of the most common questions I get asked is whether or not you can cash out your 401 while still working. The answer is yes, but there are some important things to keep in mind before you do.

- First, you will likely have to pay taxes on the money you withdraw.

- Second, you may be hit with a 10% early withdrawal penalty if you are younger than 59 ½.

- And finally, remember that once you cash out your 401, the money is gone for good you cant put it back in.

With that said, there are some situations where cashing out your 401 while still working makes sense. For example, if you are facing financial hardship and need the money to cover essential expenses, or if you leave your job and dont want to roll your 401 into a new employers plan. Just be sure to weigh all of your options carefully before making a decision.

Also Check: What To Ask 401k Advisor

Cashing Out Your 401 After Leaving A Job

LAST REVIEWED Feb 18 20219 MIN READ

Based on the amount of money in your 401 account, your employer may allow you to leave the account with them. However, you will not be able to contribute any more to your old account.

Leaving your account with the old employer may not be prudentespecially when you have access to more flexible Individual Retirement Account plans from most brokers. You may roll over your 401 account to your new employer or transfer the funds into an IRA. If you meet the age criteria, you may start taking distributions without having to pay any penalty for early withdrawal.

How To Take Money Out Of Your 401

There are many different ways to take money out of a 401, including:

- Withdrawing money when you retire: These are withdrawals made after age 59 1/2.

- Making an early withdrawal: These are withdrawals made prior to age 59 1/2. You may be subject to a 10% penalty unless your situation qualifies as an exception.

- Making a hardship withdrawal: These are early withdrawals made because of immediate financial need. You may be still be penalized for them.

- Taking out a 401 loan: You can borrow against your 401 and will not incur penalties as long as you repay the loan on schedule.

- Rolling over a 401: If you leave your job, you can move your 401 into another 401 or IRA without penalty as long as the funds are moved over within 60 days of your distribution.

Recommended Reading: How Much Do I Need To Withdraw From My 401k

Recommended Reading: How To Split 401k In Divorce

Option : Keep Your 401 With Your Old Employer

Many are surprised to learn that in certain circumstances, you can leave your 401 with your old companys retirement plan. However, if you have less than $5,000 in retirement savings, your company may force you out by issuing you a check. If they issue you a check, its crucial that you transfer the funds into a new 401 within 60 days, or else youll have to pay income tax on the distributed balance.

Leaving your retirement savings with your old employer has its drawbacks. For example, you wont be able to make any more contributions to the account, and you may also not be able to take out a loan on your 401. Your old employer may also charge administration fees on the account now that youre no longer an active participant. Additionally, youre still locked in to the funds that plan offers, which may be limited and expensive. For these reasons, many people particularly those new to the workforce choose to roll over their 401 to their new employer.

Rollover Your Old 401k Money Into A New Ira

Known as a rollover IRA, this type of IRA is designed to accept the transfer of assets from a former employers 401k. If your new employer doesnt offer a 401k or youre not pleased with the plans costs or investment options, this is probably your best option because it will give you the most flexibility and control to stay on track with your retirement savings goals. In fact, this is what we generally recommend to our clients who have old 401ks. IRAs generally have more investment options, no plan fees, and greater withdrawal flexibility.

In order to execute a rollover IRA, your first step is to open a new IRA with an investment advisor or financial institution. The rollover process is similar to the one described above except that you will instruct the administrator of your former employers 401k to transfer plan assets directly into your new rollover IRA.

Conversely, you can have a check sent directly to you, but make sure that the check is made payable to your IRA custodian for benefit of your name. The former plan administrator will withhold 20% of the amount for the payment of taxes and you will have 60 days to deposit the full balance, including the 20% withheld, into your rollover IRA. Failure to deposit the entire amount into your new IRA could result in current tax liabilities plus a 10 percent penalty if youre under age 59½.

Recommended Reading: How To Transfer From 401k To Roth Ira

Indirect Rollovers Can Be Complicated To Manage

With an indirect rollover, you receive a check for the balance of your account that is made payable to you. That might sound good, but as a result, you are now responsible for getting it to the right place. You have 60 days to complete the rollover process of moving these assets to your new employers plan or an IRA.

If you dont complete the rollover within this 60-day window, you will owe income taxes on the amount you failed to roll over. If youre under 59 1/2, you will also face a 10% penalty tax. Indirect rollovers can be made once a year.

Your old employer is required to withhold 20% from your distribution for federal income tax purposes. To avoid being taxed and penalized on this 20%, you must be able to get enough money from other sources to cover this amount and include it with your rollover contribution.

Then, youll have to wait until the following year, when you can file your income tax return to actually get the withheld amount back.

Suppose the 401 or 403 from your prior employer has a balance of $100,000. If you decide to take a full distribution from that account, your prior employer must withhold 20%. That means they keep $20,000 and send you a check for the remaining $80,000.

Even if you have an extra $20,000 on hand, you still must wait until you file your income tax return to get the withheld $20,000 returnedor a portion of it, depending on what other taxes you owe and any other amounts withheld.

You Have $5000 Or More In Your 401

If your 401 account balance is at least $5000, your former employer may allow you to stay vested in their plan indefinitely. Usually, the employer is required to continue holding your 401 money in their retirement plan until you provide further instructions on what to do with your retirement savings.

However, employers only consider the amount you have contributed to the 401 plan. This excludes retirement savings rolled over from previous employersâ 401 plans. For example, if you have a $10,000 401 balance, and $7,000 was rolled over into the plan, it means you only contributed $3,000. This amount falls below $5000, and the savings may be moved to a forced-transfer IRA, even if your total account balance is above $10,000.

You May Like: Can I Rollover My 401k Into An Existing Ira

What Happens To Your 401 When You Quit Your Job Find Out Now

Youre currently thinking about changing things up in your career and are wondering what happens to your 401 when you quit your job.

Typically, companies will offer their employees a few options in regards to their 401 after departing from the company. For this article, well be discussing options for a traditional 401. There are four main options available to employees.

You May Be Able To Leave Your Account With Your Former Employer At Least Temporarily

Changing jobs is stressful, even in the best of circumstances. If youve lost a job and are scrambling for re-employment, youre likely focused on that. But eventually you will need to figure out what to do with your 401.

If your balance is $5,000 or more, you can leave the money right where it is which will give you time to decide the best course of action for you.

What you should do right away, regardless of the 401 balance in your old plan, and as early as your first day at the new job, is to sign up for your new companys 401 plan. Even if your new employer has an automatic opt-in feature that does not kick in for one to three months and if you rely on that, rather than taking the initiative you can miss 30 to 90 days of contributions and matching funds, Bogosian advises.

After six months, youve got a handle on the job, know youre going to stay and have some experience with your new plan. Youre now in a better position to compare your last 401 plan with this new one, including the diversity of the investments and the costs.

But what happens if the balance in your old 401 is less than $5,000? Your former employer may force you out of the plan by placing your funds in an IRA in your name or cashing you out and sending you a check.

Some companies have recently adopted auto portability meaning your small balance may automatically transfer to your new employers plan. Check with your HR Department or plan sponsor to see if this applies.

You May Like: How To Borrow Money From 401k To Buy A House

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our reporters and editors focus on the points consumers care about most how to save for retirement, understanding the types of accounts, how to choose investments and more so you can feel confident when planning for your future.

What May Be The Cons Of Rolling The Money Over To An Ira

- Money in an IRA isnt as well-protected against lawsuits as money in a 401

- Money in an IRA is never eligible for Rule-of-55 withdrawals

Again, if you choose this option, a direct rollover is almost always your best option.

If your old plan was a Roth, you can do the rollover into a Roth IRA to preserve its tax-free status. If you do this, its best to roll it over into an existing Roth IRA if you have one since the 5-year clock until you can withdraw your contributions tax and penalty-free has already been ticking for a while, potentially past the 5-year mark.

If your old plan wasnt a Roth, you may still want to consider converting it by rolling over into a Roth IRA, especially if you expect your income to be lower than usual this year, especially if this places you in a lower tax bracket.

Don’t Miss: How Can I Use 401k To Buy A House