K And Roth Ira Plans How To Invest Money

Investing for the long term and retirement has become particularly difficult in recent years, as pension plans rollback and self funded retirement plans take over. The issue with self funded retirement plans is that your retirement income varies with the market instead of having a fixed income. Over the last 20 years, 9/11, the Great Recession and now the Coronavirus have caused major financial setbacks for individuals. Two types of major retirement accounts that everyone should be investing in are 401k and Roth IRA plans. Having a non-retirement brokerage account in addition is great for short term goals. So is a 401k, Roth IRA, or non-retirement account better for you and why?

Read Also: How To Cash Out 401k After Leaving Job

Disadvantages Of Roth Conversion

You expect your tax rate in retirement to be lower. If youre in a high federal tax bracket today and expect your retirement income to be low enough that your tax rate will be lower, too, Roth conversions dont make any sense. That said, you still face the wildcard issue of what Congress might do with tax rates in coming years.

Paying taxes upfront. Do you have the free cash flow to handle the extra tax hit from a Roth conversion? If you have high-rate credit card debt, or your emergency fund is a bit thin, you might want to tackle those issues before giving yourself a bigger tax bill.

Social Security issues. If youre already collecting Social Security, whether the payout is taxableand the extent to which it will be taxedis based in part on your income. The year you do a Roth conversion, your taxable income will rise, which could cause a portion of your Social Security benefit to be taxed or push you into a situation where more of your benefit is taxed.

Less bankruptcy protection. Creditors cant touch money inside a 401 account, but there is a limit on protection of IRA assets. The current combined IRA amount protected from creditors is $1,362,800. This cap is reset every three years to adjust for inflationthe next adjustment will be in April 2022.

Read Also: How To Keep 401k After Leaving A Job

When Can I Start Making Designated Roth Contributions To A Designated Roth Account

You may begin making designated Roth contributions to your 401, 403 or governmental 457 plan after you become a participant in a plan that allows contributions to Roth accounts. If your plan doesnt have a designated Roth feature, the plan sponsor must amend the plan to add this feature before you can make designated Roth contributions.

Recommended Reading: How Does 401k Match Work

Is A Backdoor Roth Ira Worth It

Yes. Roth IRAs dont have required minimum distributions, which means you can leave your money in the account and let it grow. And the money you do withdraw isnt taxable, which means you pay on the contributionsnot the distributions themselves. If you leave the money in a traditional IRA, any earnings are subject to taxes. Just make sure you know the rules so you dont end up paying more than you save.

Ira Rollover Vs Transfer

Although both rollovers and transfers allow you to move your retirement savings from one financial institution to another, the process for each is different, and each have different rules.

A 401 rollover occurs when you move retirement funds from an employer-sponsored plan to an IRA this is why its also called a Rollover IRA. This option is typically chosen when an employee leaves a job and is no longer contributing to the employer-sponsored retirement plan.

A Transfer is when you move your IRA to another IRA at a different institution. In the case of a transfer, funds or assets are sent between institutions, from the previous custodian or trust company to the new one. This is not only the quickest, but also the best method of moving your IRA to a self-directed IRA.

Dont Miss: How Do You Transfer 401k

Don’t Miss: How To Pay Off 401k Loan

Generally A Roth Ira Conversion Makes Sense If You:

- Wont need the converted Roth funds for at least five years.

- Expect to be in the same or a higher tax bracket during retirement.

- Can pay the conversion taxes without using the retirement funds themselves.

- May not need the funds for retirement and may want to transfer them to your beneficiaries.

A Roth IRA conversion may not be appropriate if you:

- Are not sure what your tax situation will be like this year because once you convert you cannot recharacterize or “undo” the conversion.

- Have to deplete other assets to pay the taxes due on the conversion.

- Are pushed into a higher tax bracket due to the amount you convert.

- Will be in a lower tax bracket in retirement.

- Will be relocating to a state with no or lower state income tax.

- Are wanting to convert your RMD because RMDs cannot be converted. You must first satisfy your RMD and then complete a Roth conversion.

May Be Worth A Second Look

There are many aspects of a Roth 401 benefit that make the option worth a second look for many participants.

As your employees come to you and ask questions about their retirement planning needs, understanding the differences could help you to financially empower your workforce.

If you have questions, feel free to reach out to your Morgan Stanley Financial Advisor to discuss your options. You should also consult with your legal and tax advisor.

You May Like: Can I Invest My 401k In A Business

Investing The Money In Your Ira

Once the money is rolled over into your new IRA account, select your investments.

-

Index funds: You can put index funds in your IRA, which is a fund that aims to mirror the performance of a market index such as the S& P 500.

-

ETFs: These investments often make sense for many people because theyre a basket of assets, such as stocks or bonds, that can be bought and sold during market trading hours. ETFs are a good way to diversify a portfolio.

-

Stocks: Individual stocks are also an investment option for IRA accounts.

-

Mutual funds: These are investments that combine money from investors to buy stocks, bonds, and other assets. Mutual funds are another way to create diversification in your portfolio.

-

Real estate: You can hold real estate in your IRA, but youll need to do so by means of a self-directed IRA.

-

Cryptocurrency: Bitcoin, Litecoin and Ethereum are all examples of alternative investments you can choose.

-

Target-date funds: 401s often allocate money into target-date funds, which buy shares of other mutual funds with the goal of shifting investments automatically over time as you approach a specific date, such as retirement. If you like that approach, you probably can find a similar target-date fund for your IRA at an online broker.

Those who would rather automate the investing process can use a robo-advisor for this. When you open a new account at a robo-advisor, that robo-advisors algorithms usually will select your investments based on questions you answer.

Make Sure You Understand These Rules Before Converting Your 401 Funds To A Roth Ira

A 401 is a smart place to keep your retirement savings, especially if your company offers a matching contribution. But as some people look toward retirement, they find the Roth IRAs tax-free distributions more appealing. Contributing funds to a Roth IRA is always an option, but you could also do a 401 to Roth IRA conversion with your existing savings.

This lets you reclassify your 401 funds as Roth savings by paying taxes on the amount youd like to convert. Heres a closer look at how 401 to Roth IRA conversions work and how to decide if theyre right for you.

Recommended Reading: What Is Minimum Withdrawal From 401k

Also Check: Can I Have A 401k Without A Job

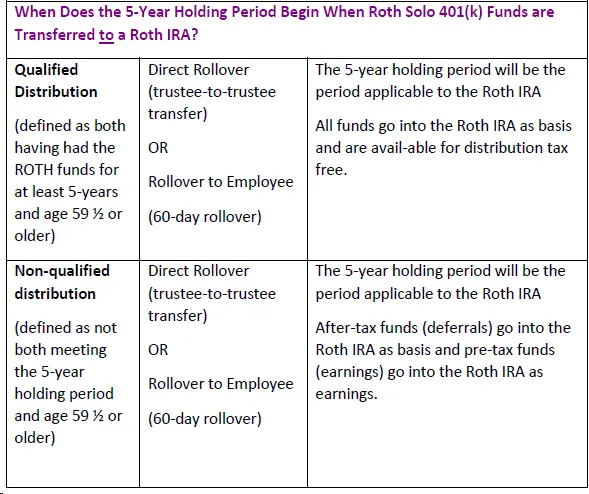

What Is A Qualified Distribution From A Designated Roth Account

A qualified distribution is generally a distribution that is made after a 5-taxable-year period of participation and is either:

If a distribution is made to your alternate payee or beneficiary, then your age, death or disability is used to determine whether the distribution is qualified. The only exception is when the alternate payee or surviving spouse rolls over the distribution to his or her own employers designated Roth account, in which case their own age, death or disability is used to determine whether the distribution is qualified.

A qualified distribution from a designated Roth account is not included in your gross income.

Open Your Account And Find Out How To Conduct A Rollover

After youve found a brokerage or robo-advisor that meets your needs, open your IRA account. Once its open, you can begin the process for rolling over your 401 money into the account.

Each brokerage and robo-advisor has its own process for conducting a rollover, so youll need to contact the institution for your new account to see exactly whats needed. Youll want to follow their procedures exactly. If youre rolling over money into your current 401, contact your new plan administrator for instructions on what to do.

For example, if the 401 company is sending a check, your IRA institution may request that the check be written in a certain way and they might require that the check contains your IRA account number on it.

Again, follow your institutions instructions carefully to avoid complications.

You May Like: How To Calculate Employer 401k Match

You May Like: What Can I Rollover My 401k Into

What About The Roth 401k

If your employer offers a Roth 401k and you were savvy enough to take part, the path to a rollover will be much easier. When youre converting one Roth product to another, there is simply no need for conversion. You would simply roll the Roth 401 directly into the Roth IRA with the help of your plan provider.

Roll Your 401 by Following These Steps

How To Convert To A Roth 401

Here’s a general overview of the process of converting your traditional 401 to a Roth 401:

Not every company allows employees to convert an existing 401 balance to a Roth 401. If you can’t convert, consider making your future 401 contributions to a Roth account rather than a traditional one. You are allowed to have both types.

As mentioned, you’ll owe income tax on the amount you convert. So after you calculate the tax cost of converting, figure out how you can set aside enough cash from outside your retirement accountto cover it. Remember that you have until the date you file your taxes to pay the bill. For example, if you convert in January, you’ll have until April of the following year to save up the money.

Don’t rob your retirement account to pay the tax bill for converting. Try to save up for it or find the cash elsewhere.

Recommended Reading: How To Take Out A 401k Loan Fidelity

If I Am Required To Take A Corrective Distribution From My 401 Plan Because The Plan Failed The Adp Nondiscrimination Test Can I Take Some Or All Of The Corrective Distribution From My Designated Roth Account

Yes, a plan can provide that a highly compensated employee , as defined in Code Section 414, with both traditional, pre-tax elective contributions and designated Roth contributions during a year may elect to attribute excess contributions to pre-tax elective or designated Roth contributions. The plan does not have to provide this option and may provide for correction without permitting an HCE to make this election.

A distribution of excess contributions is not includible in gross income if it is a distribution of designated Roth contributions. However, the income allocable to a corrective distribution of excess contributions that are designated Roth contributions is includible in gross income in the same manner as income allocable to a corrective distribution of excess contributions that are pre-tax elective contributions. The final Roth 401 regulations also provide a similar rule under the correction methods that a plan may use if it fails to satisfy the actual contribution percentage test.

Confusion Of The Roths

Unlike the similarly named Roth IRA, the Roth 401 is different. A Roth IRA is an individual retirement account whereas a Roth 401 is part of and offered through an employer sponsored retirement plan.

This minor confusion might be an invisible obstacle for some employees, especially high-income earners who have been told they cannot contribute to a Roth.

High-income earners may be pleasantly surprised to hear they can contribute because a Roth 401 does not have income limits like a Roth IRA does. This means they now have access to a savings vehicle that can grow tax-free.

Additionally, since Roth 401 accounts follow traditional 401 contribution guidelines, the amount that can be saved per year is subject to 401 maximums. For example, in 2020, employees can contribute up to $19,500 in a Roth 401 and if the employee is 50 years old or older, they may make a catch-up contribution of up to $6,500, for a potential total annual contribution of $26,000.5

Also Check: How To Open A Personal 401k

Don’t Miss: How To Find My Old 401k

How To Reduce Tax

If you have a large 401 balance, you may get hit with a large tax bill after transferring it to a 401. But instead of rolling over the entire balance at once, you can make partial 401-to-Roth IRA conversions over a few years. Because youd be transferring smaller amounts at a time, youd owe less in taxes throughout.

Speak with an accountant or tax advisor about ways to minimize taxes on 401 to Roth IRA transfers.

What Are The Disadvantages Of A Roth 401k

3 Disadvantages of Saving for Retirement at a Roth 401

- Tax bracket risk. When you put money into a Roth account or IRA), you are betting that is, that your tax bracket will be higher than it is now.

- RMD is still playing.

- Fewer investment options.

Can you lose money in a Roth 401k?

You can mix and match options to reach a level of risk that you are comfortable with taking. You could also lose money on a Roth 401 if you break the rules and take the early distribution. If you are considering withdrawing some money early, check with the fund manager to see if you may owe a tax penalty.

Is Roth 401k a good idea?

comes retirement, depending on your tax bracket. That means you have to save more to fund your retirement cash flow. If you are young and believe that you will earn more and be in a higher tax bracket in the future, a Roth 401 may be a good choice.

Recommended Reading: When Can You Take Out 401k

If My Only Participation In A Retirement Plan Is Through Non

You can contribute to a traditional IRA regardless of whether or not you are an active participant in a plan. However, when determining whether you can deduct a contribution to a traditional IRA, the active participant rules under IRC Section 219 apply. You are an active participant if you make designated Roth contributions to a designated Roth account. As such, your ability to deduct contributions made to a traditional IRA depends on your modified adjusted gross income.

Converting A Nondeductible Ira Contribution To A Roth Ira

You may know that if you or your spouse have a retirement plan available at work, it limits the deductible contributions you can make to a traditional IRA.3 If you’re in that boat and want to make the most of your tax-advantaged saving options, you can still make nondeductible IRA contributions. Earnings on these contributions will be tax-deferred but you do have the option of converting to a Roth IRA. In that case, your nondeductible contributions wont be taxed again, although any earnings would be treated as pre-tax balances, which means they would be taxable when converted. This type of conversion is sometimes called a backdoor Roth IRA.

If you do decide to convert either pre-tax or non-deductible contributions, the timing can be a little bit tricky. Some time should pass between the date of the contribution and the date of the conversion, but it’s not completely clear how much is enough. If you do decide to convert, consult your tax advisor first to ensure that you understand the full scope of potential tax consequences.

Also Check: Can I Get A 401k Through My Bank

Why Would You Want To Convert A 401 Into A Roth Ira

When youre employed by a company that offers a 401 plan, its an indispensable investing tool. Many companies match some of your contributions, which is essentially free money.

However, when you leave that job, this is a great time to look at the 401 youve been given and evaluate what is working for you, says Nicole Stanley, a financial coach and founder of Arise Financial Coaching.

Here are some of the most common reasons you might want to convert your 401 into a Roth IRA:

Tax Implications Of 401 To Roth Ira Conversion

To understand the tax implications, the most important thing to know is whether your 401 is a traditional or a Roth . About 75% of 401 plan participants choose to make pre-tax contributions, according to a 2018 survey by the Plan Sponsor Council of America, a non-profit trade association.

That means the majority of conversions from 401 to Roth IRA will trigger a tax bill during the year in which the conversion takes place. Depending on how much money youre converting, this could mean a significant and immediate increase in your tax bill. For that reason, a conversion is not to be taken lightly.

You have to be prepared for that tax bill, says Stanley. Its a good idea to do it in stages and talk to your tax professional.

Also Check: How Can I Pull Out My 401k