Eligibility & Contribution Limits

Your eligibility for a 401 plan simply depends on whether your employer offers them. Generally, you have to inquire a little bit more about taking advantage of an employer match program.

On the other hand, without an employers help, a Roth IRA may not prove available to everyone. For one, you have to find an institution with which to open your account. Some institutions may only accept applicants with high deposit amounts, limiting their products to more wealthy clients.

Its important to note, however, that Roth IRAs offer a solid savings option for those with lower income. This is because you fund a Roth IRA with after-tax money, making your withdrawals tax-free. This structure comes in handy for people who see themselves in a higher tax bracket in retirement.

Plus, Roth IRA rules and limitations tend to phase out higher earners. For tax year 2023, total contributions to Roth IRAs cannot exceed $6,500, or $7,500 for those over 50. Those numbers were $6,000 and $7,000 respectively in 2022. To the opposite, 401 plans have much higher contribution limits.

For tax year 2023, you can contribute up to $22,500 to your 401. For tax year 2022, the limit was $20,500. Dont forget that if your employer matches your 401 contribution, their match does not count towards that limit. Instead, you have to ensure your total annual 401 contributions do not exceed the lesser of 100% of your salary or $66,000 in 2023.

Should You Max Out Your Roth 401 Contributions

Saving for retirement is vital for your financial plan and contributing to your Roth 401 is an excellent idea to help you get there. However, maxing out your contributions might strain your finances and achieving financial health means balancing priorities. For example, its essential to knock out debt and save for other goals, such as a down payment for a house. Therefore, contributing the full $22,500 might not be optimal.

Instead, its recommended to contribute enough to take advantage of matching funds, if possible. You dont want to leave free money on the table, so allocating enough money each month to receive the full match from your employer can provide exponential growth to your retirement account. In addition, other retirement vehicles can offer more flexibility and profitability.

Employer-sponsored retirement plans can restrict your investment choices, while individual retirement accounts allow you to invest in funds that fit your preferences. If you have enough income, it might be best to contribute enough to your 401 to receive matching funds and deposit another chunk of cash into an IRA.

Who Is Eligible For A Roth 401

If your employer offers it, youre eligible. Unlike a Roth IRA, a Roth 401 has no income limits. Thats a fantastic feature of the Roth option! No matter how much money you earn, you can contribute to a Roth 401.

If you dont have access to a Roth option at work, you can still take advantage of the Roth benefits by working with your investment professional to open a Roth IRA.

Don’t Miss: How Are 401k Withdrawals Taxed

Should I Choose A Roth Or A Traditional Ira

It depends. The key issue is whether your income tax rate will be greater or lesser than the time when you begin withdrawing funds from the account. That is probably impossible to know for sure, so you are forced to make an educated guess. Factors to consider are your current tax rate and whether you think your tax rate will be far higher in the future.

What Do I Need To Know About Roth 401 Withdrawal Rules

When it comes to retirement savings, there are different routes you could go. You may have your traditional 401. You could also have an individual retirement account or a Roth IRA. But what if you have a Roth 401? How does one work and what are the Roth 401 withdrawal rules? Lets answer these questions and more here. You can also work with a financial advisor to not only get your questions answered but to help you manage your retirement plan and investments.

What Is a Roth 401 and How Does It Work?

A Roth 401 is an employer-sponsored retirement savings program that uses post-tax money. That means that the government has already taxed the money you put in the account. Because its already been taxed, you dont pay taxes on withdrawals when you retire, like with a Roth IRA. However, you cant deduct contributions from your taxes like you can with a traditional 401.

What Are the Basic Roth 401 Withdrawal Rules?

There are four basic Roth 401 withdrawal rules that you m just follow to avoid penalties or unnecessary taxes. These withdrawal rules are:

1. Qualified Withdrawals Are Tax-Free

If you wait until youre 59 ½, you can take withdrawals on your Roth 401 without paying taxes. That includes contributions as well as earnings. Compare this to a traditional 401, where you avoid the taxes upfront but pay on both contributions and earnings when you withdraw. You can see why, if your employer offers it, a Roth 401 might be a good option.

3. The Five-Year Rule

The Bottom Line

Recommended Reading: How Much Loan I Can Take From 401k

When A Roth May Be Right For You

Here are three situations where a Roth probably makes the most sense:

1. You are currently in a lower tax bracket, but you expect that to change. Lets say you are a young professional who is anticipating salary increases, which will put you in a higher tax bracket down the road. Contributing to a Roth IRA or Roth 401 means you pay the relatively low rate on taxable income now. Once youve retired, you will not pay any taxes on qualified distributions from the plan.

2. You are close to retirement and are concerned about RMDs. If youve been a disciplined saver and have contributed a healthy percentage of your income to Traditional accounts for many years, eventually youve got to pay the piper, says Young. Beginning in the year you reach age 72, you must begin taking required minimum distributions from Traditional IRAs and from 401sincluding Roth 401sthe later of age 72 or once youre retired. As the name suggests, these withdrawals are required, even if you dont need the income at the time.

RMDs could bump you to a higher tax bracket. Qualified distributions from a Roth 401 or Roth IRA, on the other hand, would not create taxable income or increase your tax rate. Therefore, a Roth contribution may be preferable in order to limit the RMD income taxed at a higher rate.

– Roger Young, CFP®, Thought Leadership Director

– Roger Young, CFP®, Thought Leadership Director

What Is An Ira

An IRA, known formally as an individual retirement arrangement, can be opened at any financial services company that qualifies as an IRA custodian or trustee.

The individual is the owner of the IRA and determines how it is invested from among the choices offered by the custodian. When a broker or mutual fund company is the custodian, the IRA usually can be invested in any publicly traded asset. Some custodians allow the account to be invested in any asset that legally can be owned by an IRA, such as real estate, small businesses, mortgages, and others.

Total contributions to all IRAs owned by an individual will be limited to $6,500 in 2023 and an additional $1,000 can be contributed by those ages 50 and over.

Contributions to a traditional IRA are deductible when the IRA owner isnt covered by an employer retirement plan and has adjusted gross income below certain levels. Contributions to a Roth IRA arent deductible. When the individuals adjusted gross income exceeds certain levels, no contributions to a Roth IRA are allowed that year.

As with a 401 plan, investment income and gains are tax-deferred as long as they remain in the IRA. Distributions from a traditional IRA are taxed as ordinary income when they are of contributions that were deducted and of accumulated income and gains. Contributions that werent deducted are tax-free when distributed.

Recommended Reading: How Much Can I Put In A Solo 401k

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

What Can Your Budget Accommodate

If you were to contribute the same amount to your 401 via Traditional or Roth, your take-home pay would be higher if you opted for Traditional. Depending on your expenses and financial plans, that might be more important for you.

If you are not as reliant on that money today, and prefer that your retirement savings be out of sight, out of mind, Roth contributions are a way to save a bit more for tomorrow . Your contributions and earnings on interest will grow tax-free and you wont be tempted to spend that money youve earmarked for retirement in your checking account. Moreover, when you make a qualified withdrawal from a Roth account, you wont owe any taxes. Think of it like a gift to future you.

In contrast, when you withdraw from a Traditional account when you retire, you will owe taxes on everything you withdraw – theres no delineation between your contributions and your earnings.

Read Also: How To Check 401k Balance Fidelity

How The Contribution Limits Work

In the 2022 tax year, you can save up to $20,500 in a 401. If you’re age 50 or older, you can add up to $6,500 as a so-called catch-up contribution.

If you have a Roth IRA, the maximum in 2022 is $6,000. If you’re 50 or older, you can add another $1,000.

For the 2023 tax year, you can save a maximum of $22,500 in a Roth 401. The catch-up amount increases to $7,500.

For a Roth IRA account, the 2023 maximum is $6,500. The catch-up contribution remains $1,000.

Talk With An Investment Pro About Your Roth 401

If you want to learn more about Roth 401s versus traditional 401s and other investment options, its a good idea to sit down with an investment professional who can help. Remember, its never a good idea to invest in something you dont fully understand.

If you need help looking for a qualified investment pro, be sure to try our SmartVestor program. SmartVestor is a free way to get connected with local financial advisors near you.

You can start building a relationship with a pro who understands and can help guide your financial journey today!

Read Also: How To Locate 401k From Previous Employer

Roth Ira Income Limits

The Roth IRA limits your contributions based on earned income. In other words, how much you can contribute to a Roth IRA depends, in part, on how much you earned in a year. What’s more, the contribution amount allowed can be reduced, or phased out, until it’s eliminated, depending on your income and filing status for your taxes . Income limits are different for 2021 and 2022.

Differences Between 401s And Iras

Aside from employer sponsorship, there are a number of differences between 401s and IRAs. Here are some of the most important differences to consider:

Investment Options

When investing in a 401, an employee is limited to the options chosen by their employerâusually bond funds and stock funds, as well as balanced funds, which offer a combination of bonds and stocks.

With an IRA, on the other hand, you typically have a wider range of available options, including certificates of deposit and individual stocks and bonds.

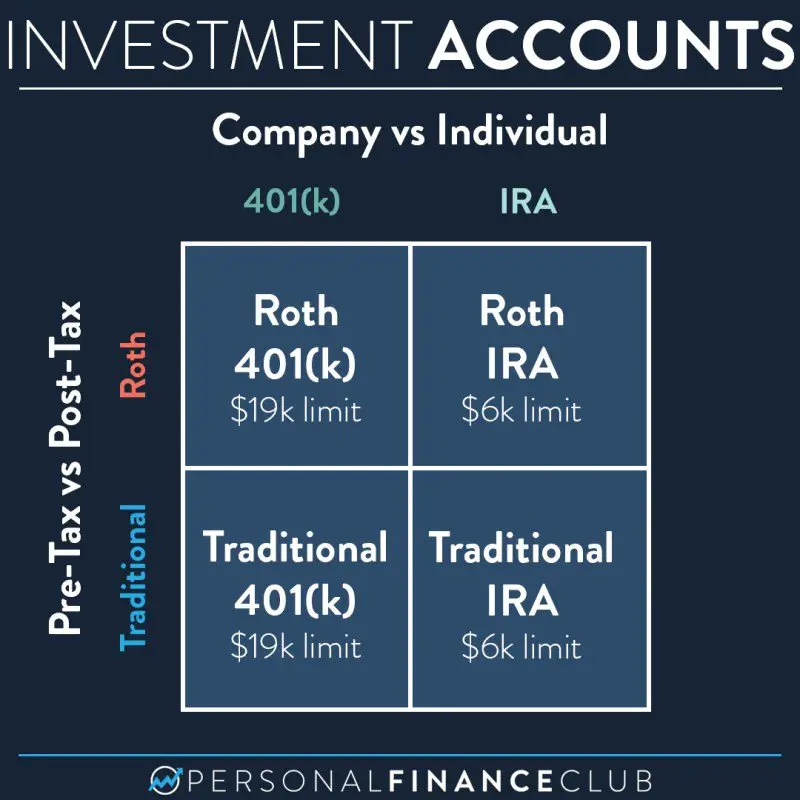

Contribution Limits

The IRS sets contribution limits for the amount that an individual can invest in a 401 or IRA each year. And these annual contribution limits are often adjusted to account for factors like inflation.

For example, the 401 contribution limit was increased from $19,500 in 2021 to $20,500 in 2022. And that limit applies only to employeesâemployer contributions donât count toward the limit.

Those aged 50 and older may be able to make an additional contributionâwhatâs known as a âcatch-up contribution.â The current catch-up contribution limit is $6,500.

For IRAs, on the other hand, the maximum allowed contribution is $6,000 for the 2022 tax year. And those aged 50 and older may be able to make a catch-up contribution of $1,000.

Keep in mind that there are also income limits to IRA contributions that are based on your modified adjusted gross income. For a full breakdown, see the IRSâs IRA contribution limits.

Distributions

Don’t Miss: How To Transfer 401k To Ira Fidelity

Profit From A Roth Ira And A Savings Account

Roth IRAs and savings accounts are both effective but distinct financial products. Consider both because a Roth IRA is an excellent option for retirement savings, and a federally insured savings account is ideal for short-term goals and emergencies.

Even if youre in college, in your 20s or 30s, or otherwise have no income, you can still contribute to a Roth IRA. Even if youre young and retirement seems a long way off, opening a Roth IRA can help you capitalize on the power of compound interest and accumulate a sizable nest egg. Meanwhile, your savings account can ensure that a surprise or emergency does not jeopardize your current financial stability.

Traditional Ira Contributions May Not Be Fully Tax Deductible

While the IRS rules allow for contributions to both Solo 401k plans and IRAs, if you are also participating in a solo 401k plan, you can still make the traditional IRA contributions but they may not be tax deductible. See the chart listed on the following IRS link for these limits:

You May Like: Can You Rollover A 401k Into A Roth Ira

Ira Vs : Whats The Difference

Morsa Images / Getty Images

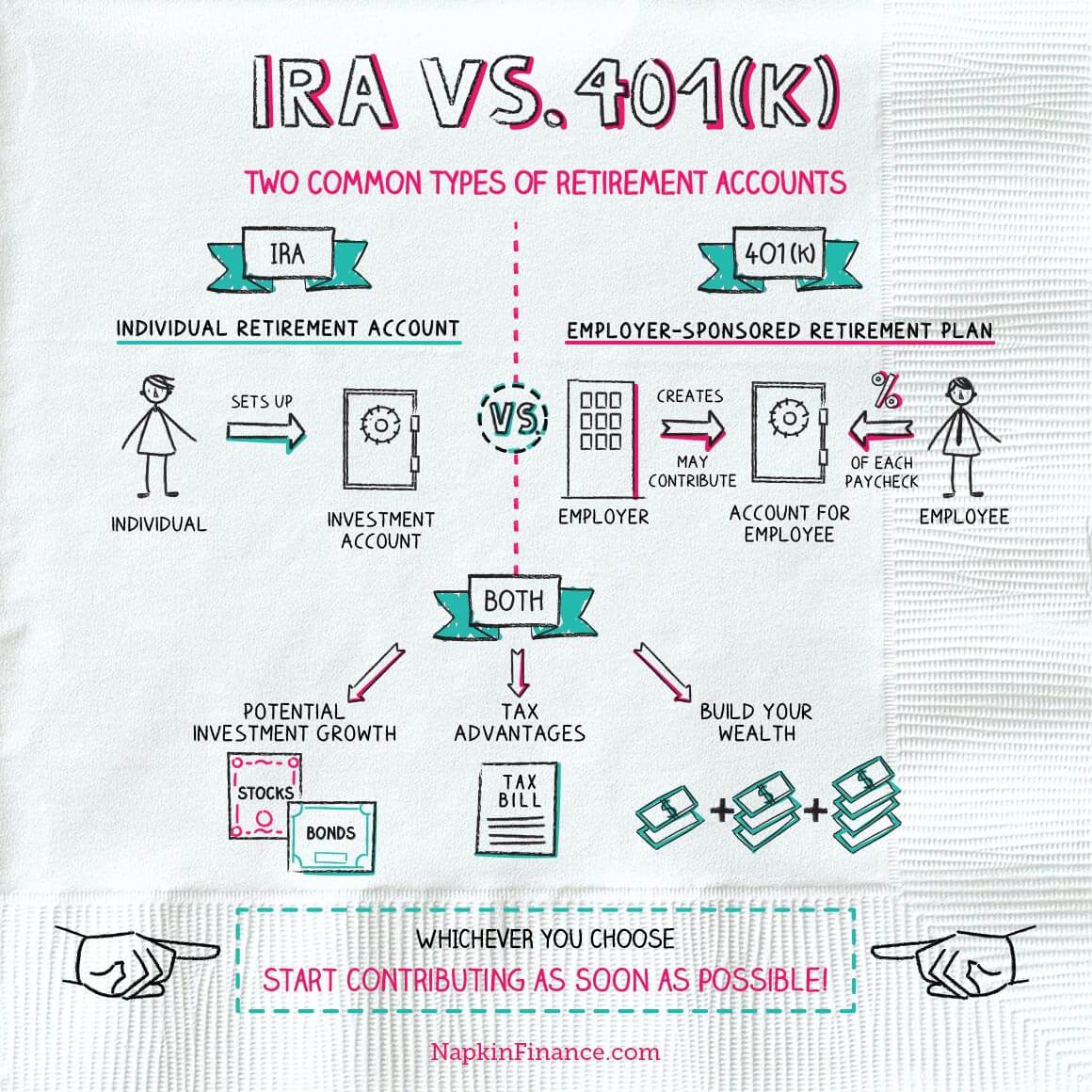

An IRA and a 401 are two common types of retirement accounts that offer tax advantages when you invest. The key difference between the two is that an IRA is a type of retirement account that you open, fund, and invest on your own, while a 401 is a retirement account you open through your employer.

If you want to know more about the differences between an IRA and a 401, youre in the right place. Learn more about how each type of retirement account works, who can contribute, and which one makes sense for you.

Transparency Is Our Policy Learn How It Impacts Everything We Do

Transparency is how we protect the integrity of our work and keep empowering investors to achieve their goals and dreams. And we have unwavering standards for how we keep that integrity intact, from our research and data to our policies on content and your personal data.

Wed like to share more about how we work and what drives our day-to-day business.

Read Also: Can I Transfer 401k To Ira

What Are Roth 401 Contribution Limits

For 2022, the 401 contribution limit is $20,500. This contribution limit applies to all of your 401 contributions, whether theyre in a Roth or traditional 401. That means if youre contributing to both, the combined total of your contributions cant exceed that amount. And in case you were wondering, your employers contributions do not count toward the limit.

If youre 50 or older, you can also pitch in an extra $6,500 as a catch-up contributionwhich increases your contribution limit to $27,000.

What Are The Similarities Between A Roth 401 And A Traditional 401

Now that we know the differences between a Roth 401 and a traditional 401, lets talk about how theyre similar.

The Roth 401 includes some of the best features of a 401, but thats where their similarities end.

Don’t Miss: Does Fidelity Offer A Solo 401k

How Does A 401 Roth Conversion Work

A MissionSquare a 401 Roth conversion generally refers to converting some or all of your 401 savings to a Roth 401 within your existing plan. You might decide to do this after saving a considerable amount in your 401 and wanting to have some of that savings available as tax-free withdrawals later.

If your employer doesnt offer a Roth 401, you could convert some or all of the funds in your 401 into a Roth IRA, but only if you have left your employer, or the employer allows you to take in-service distributions. You would pay taxes on the amount youd like to convert. Conversions to a Roth IRA typically involve more steps. Check with your plan sponsor first.