Fidelity National Financial Group

- 401 match: Up to 7% of contributions per pay period

- Total participants: 30,000

- Net plan assets: $1.84 billion

Part of the Fidelity National Financial Groups business involves advising some of the largest retirement plans in the country. So its no surprise that it offers a generous plan to its own employees. Fidelity matches employee contributions dollar for dollar up to 7% per pay period.

In addition, the firm built its investment menu with more than 200 proprietary mutual funds and options from other firms. BrightScope ranked the firm among the top 15% when it comes to total plan costs and praised the firm for having among the lowest fees in its study.

Start Making 401 Contributions Immediately

Some employers have a waiting period after you start a job before they begin matching your 401 contributions. However, Vanguard notes that 68% of plans let you start making contributions immediately as a new employee. Dont wait for the matching contribution to kick in start contributing when you begin your new job.

If youre intimidated by the investment options, take advantage of the plans target-date funds. The vast majority of employers have their default investments set up as a target-date fund, which is tied to your age and retirement year, said Taylor. You can put your money in there, and its a sort of do-it-for-me option where its allocated across equities appropriate for your age.

United Technologies 401k Match

United Technologies has an automatic employee enrollment feature in its 401 plan that starts at a contribution rate of 6%. This rate increases by 1% every year until it reaches 10%.

United Technologies matches 60% of an employeeâs first 6% of their eligible pay contributed to the 401, which is equivalent to 3.5% for employees who contribute at least 6% or more into the plan.

Apart from matching contributions, United Technologies also makes automatic contributions to the 401 plan based on the employeeâs age. Employees below 30 receive 3% in automatic contributions while those above 50 receive 5.5%.

Employees are 100% vested in the matching contributions after three years of employment.

Recommended Reading: How To Pull 401k Out

Offering A 401 Matching Program As Part Of Your Employee Retirement Plan Can Be A Helpful Incentive For Attracting Top Employees To Your Business

- 401 employer matching is the process through which an employer matches an employees contributions to their 401 retirement account.

- 401 employer matches can improve employee morale and retention, attract better hires, and provide tax benefits to your company.

- When offering 401 matching, you should set employer match contribution limits, review the IRS contribution limits and include vesting provisions.

- This article is for business owners and employers interested in 401 matching.

Retirement plans are among the benefits employers most commonly offer their employees. Some employers take their retirement offerings a step further by offering 401 employer matching, which incentivizes employees to participate in the companys 401 plan by adding money into their retirement savings based on how much they contribute each pay period.

If youre thinking about opening retirement accounts for your team, want to improve your existing 401 options, or are in need of a new 401 plan for a startup, you should consider setting up a 401 employer match. Before doing so, though, you need a clear understanding of what 401 employer matching is, what the benefits are and how you should operate your matching program.

Editors note: Looking for the right employee retirement plan for your business? Fill out the below questionnaire to have our vendor partners contact you about your needs.

What Is The Maximum Amount You Can Contribute To 401 Plans

When determining how much money you should contribute to an employees retirement account, you should also consider the annual contribution limits that the IRS sets for both you and your employee. For 2022, the limit on elective salary deferrals retirement plan contributions an employee voluntarily makes is $20,500 for a traditional 401 plan. For a SIMPLE 401 plan, this limit is lowered to $14,000. Employees age 50 and older can contribute an additional $6,500 in elective salary deferrals to a traditional 401 plan or $3,000 to a SIMPLE 401 plan.

The total contribution limit a person can make to an employer-sponsored retirement account during a year is the sum of elective salary deferrals, employer contributions and allocations of forfeitures. For 2022, the total contribution limit is $61,000 for an employee with an annual income below $61,000, the limit is whatever their income is. Notably, if an employee has a retirement account with your company and a separate 401 they contribute to through side income they generate as an independent contractor, that separate account is unaffected by the limits on the employer-sponsored account.

Don’t Miss: What’s The Difference In An Ira And A 401k

Crank Up The Investments Available

- Contribute more Put a higher percentage of your income into your existing retirement plan. Since it lowers your taxable income, it may be cheaper than you think.

- Try other tax-deferred options Consider opening an individual retirement account if youve reached the maximum contribution level in your employer-sponsored plan.

- Consider getting taxed up front Money placed in a Roth IRA is taxed now, but qualified Roth earnings are never taxed. This can save you more money in the long run.

Move Your 401 To A New Employer

You can usually move your 401 balance to your new employer’s plan. As with an IRA rollover, this maintains the account’s tax-deferred status and avoids immediate taxes.

It could be a wise move if you aren’t comfortable with making the investment decisions involved in managing a rollover IRA and would rather leave some of that work to the new plan’s administrator.

Recommended Reading: How To Move 401k To Vanguard

How Much Can You Contribute To A 401

The most you can contribute to a 401 is $20,500 in 2022 . Employer contributions are on top of that limit. These limits are set by the IRS and subject to adjustment each year.

That limit dictates how much you can contribute, but it doesnt tell you how much you should contribute. To figure that out, consider the following.

You May Like: How To Know If You Have A 401k

What Is 401k Matching

For most employees, a defined contribution plan is one of the primary benefits offered by their employer, with a 401k being the standard employer-sponsored retirement plan used by for-profit businesses. Employer matching of your 401k contributions means that your employer contributes a certain amount to your retirement savings plan based on the amount of your annual contribution.

Similarly, some employers use 403b or 457b plans. While there are some minor differences between these plans, they are generally treated in a similar manner, and they usually have the same maximum contribution limits.

The type of plan is based on the type of entity:

- 403b plans are used by tax-exempt groups, such as schools or hospitals.

- 457b plans are for government workers, although there are some non-governmental organizations that also qualify to use these plans.

Whether youre on your first job or are thinking about retirement, here are a few considerations to keep in mind when offered an employer match to your 401k contributions.

Don’t Miss: Can A Small Business Set Up A 401k

Matching Makes Financial Sense

401 matching makes financial sense for employers and employees alike. Employee matching is the best way for employees to maximize their retirement savings, while employers get the benefits that come with investing in their team members futures namely, tax savings and reduced employee turnover. Learn more about employee retirement plans and their features in our buyers guide.

Kimberlee Leonard contributed to the writing and reporting in this article.

How To Take Full Advantage Of A 401 Match And Build Retirement Savings:

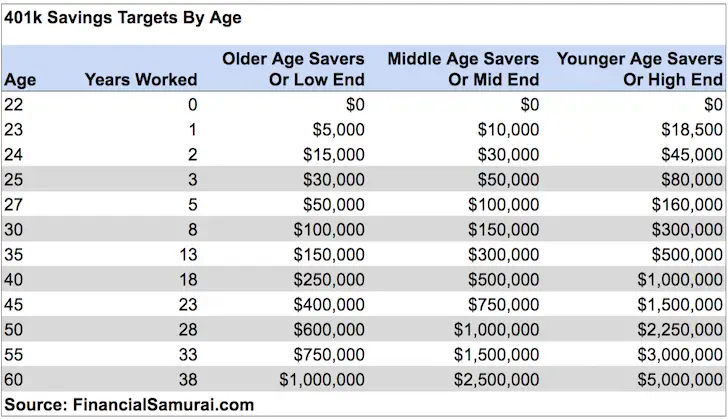

Your minimum goal as a 401 plan participant should be to make sure you dont leave any employer dollars on the table. Find out what the maximum employer match on your plan is, and make sure you contribute enough to qualify for that match.

Beyond that, though, there would most likely still be tax advantages and retirement saving benefits to be had by contributing more than you need to qualify for the full employer match. According to Vanguard, 47% of employees do this, making contributions that go beyond what is necessary to qualify for the full employer match available.

In most cases, you can contribute up to $19,500 to a 401 plan for 2020 . Chances are this is well above what you need to contribute to maximize your employer match, but your goal should be to come as close to this limit as possible. Doing so will enhance your tax savings and build your retirement nest egg more quickly and your employer match should help as well.

Finally, remember that your 401 plan is not your only option for retirement savings.

If you reach the IRS maximum for 401 contributions, there are still other ways from health savings accounts to after-tax savings that you can build a bigger nest egg.

Glossary:

Also Check: How To Find Fidelity 401k Fees

Suggested Next Steps For You

If you are not able to max out your 401k contributions, then the best strategy may be to contribute the minimum amount required to take advantage of your employers matching contributions.

Here are some steps you can take now, and for free, to help you manage and evaluate your 401k.

The content contained in this blog post is intended for general informational purposes only and is not meant to constitute legal, tax, accounting or investment advice. You should consult a qualified legal or tax professional regarding your specific situation. Keep in mind that investing involves risk. The value of your investment will fluctuate over time and you may gain or lose money.

Average 401 Match: Everything You Need To Know

Average 401 match guidelines are fairly inconsistently applied across employers. Any employee who has worked at more than one company can likely discuss the differences in 401 matching guidelines experienced at each of their employers. An employee can certainly use their knowledge of a traditional 401 match program to help in their analysis of the employers total compensation offer. Generally, if an employer is known for offering an unfavorable 401 match, that employer is likely to offer other unfavorable benefits, as well. If an employee has an understanding of the typical range for 401 match offerings, that employee is in a better position to compare whether their prospective or current employer is offering a competitive 401 match. Lastly, employees should also consider the terms and length of a vesting schedule as it pertains to matching contributions.

The Bureau of Labor statistics indicate that the average employer 401 matching contribution is approximately 3.5 percent of the employees annual compensation the median matching contribution is approximately 3 percent. A breakdown of the statistics is as follows:

- 10 percent of employers provide a 401 matching contribution of greater or equal to 6 percent of annual compensation.

- 41 percent of employers provide a 401 matching contribution that falls in the range of 0 6 percent.

- 49 percent of employers do not provide employees with any 401 match.

Recommended Reading: How To Claim 401k Money

What Can You Do If Your Employer Doesnt Offer A 401 Match

Some employers encourage employee participation in their retirement plans by offering to match a portion of the funds. For example, many companies will add 50 cents of every dollar up to 6% of an employees 401 contributions.

But what if your employers retirement plan offers a 401 without a match? Is there any way you can still beef up your retirement a little more? Here are some ideas:

How Matching Works

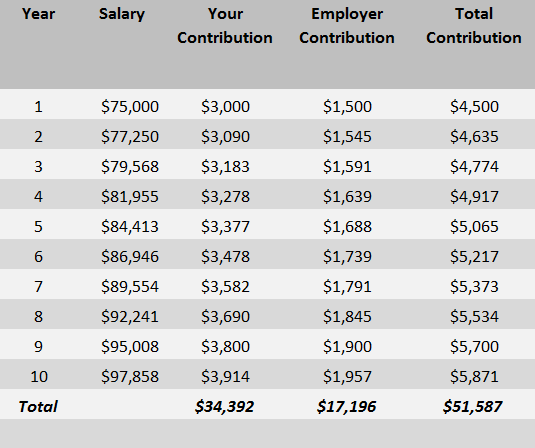

Assume your employer offers a 100% match on all your contributions each year, up to a maximum of 3% of your annual income. If you earn $60,000, the maximum amount your employer would contribute each year is $1,800. To maximize this benefit, you must also contribute $1,800. If you contribute more than 3% of your salary, the additional contributions are unmatched.

A partial matching scheme with an upper limit is more common. Assume that your employer matches 50% of your contributions, equal to up to 6% of your annual salary. If you earn $60,000, your contributions equal to 6% of your salary are eligible for matching. However, your employer only matches 50%, meaning the total matching benefit is still capped at $1,800. Under this formula, you must contribute twice as much to your retirement to reap the full benefit of employer matching.

If your employer matches a certain dollar amount, as in the first example, you must contribute that amount to maximize benefits, regardless of what percentage of your annual income it may represent.

Also Check: How To Make Your 401k Grow Faster

What Is A Dollar

With a dollar-for-dollar 401 match, an employers contribution equals 100% of an employees contribution, and the employers total contribution is capped as a percentage of the employees salary.

We commonly see employers offer a 3%, dollar-for-dollar match, said Taylor. They match 100% of your contributions up to 3% of your salary.

Imagine you earn $60,000 a year and contribute $1,800 annually to your 401or 3% of your income. If your employer offers a dollar-for-dollar match up to 3% of your salary, they would add an amount equal to 100% of your 401 contributions, raising your total annual contributions to $3,600.

Taking Withdrawals From A 401

Once money goes into a 401, it is difficult to withdraw it without paying taxes on the withdrawal amounts.

“Make sure that you still save enough on the outside for emergencies and expenses you may have before retirement,” says Dan Stewart, CFA®, president of Revere Asset Management Inc., in Dallas.”Do not put all of your savings into your 401 where you cannot easily access it, if necessary.”

The earnings in a 401 account are tax-deferred in the case of traditional 401s and tax-free in the case of Roths. When the traditional 401 owner makes withdrawals, that money will be taxed as ordinary income. Roth account owners have already paid income tax on the money they contributed to the plan and will owe no tax on their withdrawals as long as they satisfy certain requirements.

Both traditional and Roth 401 owners must be at least age 59½or meet other criteria spelled out by the IRS, such as being totally and permanently disabledwhen they start to make withdrawals.

Otherwise, they usually will face an additional 10% early distribution penalty tax on top of any other tax they owe.

Some employers allow employees to take out a loan against their contributions to a 401 plan. The employee is essentially borrowing from themselves. If you take out a 401 loan, please consider that if you leave the job before the loan is repaid, you’ll have to repay it in a lump sum or face the 10% penalty for an early withdrawal.

Recommended Reading: How To Find 401k Funds

Matching Contributions: How Much And When

The specific terms of 401 plans vary widely. Other than the necessity to adhere to certain required contribution limits and withdrawal regulations dictated by the Employee Retirement Income Security Act , the sponsoring employer determines the specific terms of each 401 plan.

Your employer may elect to use a very generous matching formula or choose not to match employee contributions at all. Some 401 plans offer far more generous matches than others. Whatever the match is, it amounts to free money added to your retirement savings, so it is best not to leave it on the table.

Refer to the terms of your plan to verify if and when your employer makes matching contributions. Not all employer contributions to employee 401 plans are the result of matching. Employers may elect to make regular deferrals to employee plans regardless of employee contributions, though this is not particularly common.

How We Found The Listings Below

As of 2019, these plans listed below were found based on numerous factors, such as company match frameworks, total assets under management and additional benefits such as access to a bonus pension plan or especially low fees. The information behind the list came from sources such as BrightScope, a financial information and technology company that analyzes 401 plans, and Employee Benefit News .

Recommended Reading: How Much To 401k Per Year

How Much Should You Match 401 Contributions

Employers 401 match amounts vary widely. However, all contribution limits and withdrawal regulations must comply with the standards of the Employee Retirement Income Security Act. Otherwise, you can set your 401 contribution rates however you please.

There are two especially common methods for determining how much money you should contribute to your employees retirement accounts:

- As a percentage of an employees wages: Some employers will match all employee contributions up to a contribution limit equal to a percentage of an employees wages. For example, if you set a contribution limit of 4% of an employees income and the employee makes $50,000 per year, you will contribute at most $2,000 over the course of the plan year. Note that if your employee contributes less than $2,000 to their retirement account, you have to match only that amount, not the full $2,000.

- As a percentage of an employees contributions: Other employers will match a percentage of contributions instead. For example, if you choose to match 40% of your employees contributions with the same 4% contribution limit as in the prior scenario, then for an employee with a $50,000 annual salary, your employer contribution limit isnt $2,000 over the course of the plan year. Instead, its $800 .

Did you know?:Self-employed 401 plans may not offer employer matching, but they still allow independent contractors and sole proprietors to save for their retirement.