How Does The 401k Plan Work

401k plan is a feature of the eligible profit-sharing scheme, letting workers give away a part of their pay to personal accounts. Moreover, the Internal Revenue Service sets contribution limits to the plan for both employee and merged employee/employer, which differ yearly.

To clarify, employees aged 21 years or more qualify for the plan. Additionally, they must acquire one year of work experience or get covered by a collective bargaining contract not offering plan participation .

The employee elective deferral limit is $20,500 in 2022, based on cost-of-living arrangements. Other than the chosen Roth extension, optional salary deferrals are excluded from the employees net income.

So, here are four vital actions to possess the best 401k plan and relish tax benefits,

Apart from qualified distributions of assigned Roth accounts, distributions are included in taxable retirement payments.

Plan Allows You To Take Loans From 401 Accounts

401 participants have the option of taking 401 loans, but 401 plan loans must be paid back within a set time period.401 plan loan terms vary from plan to plan, and plan participants may borrow money from their accounts to use for almost any purpose. Plan participants can also pay loans back with 401 money.

What Is 401k Plan

401k plan is a retirement savings plan enabling qualified employers and employees to contribute a part of the latters salary for investment in schemes like bonds and stocks. It allows the workers to safeguard a portion of their remuneration for a financially sound life after retirement. Hence, The 401k plan providers fulfill employee expectations and assist the small businesses in maintaining the best talent.

Please note that the Internal Revenue Service decides the amount to be contributed. For employees aged below 50, the highest contribution is $14,000 . Moreover, workers aged 50 and above may make an extra catch-up contribution worth $3000.

Don’t Miss: How Do I Cash Out My Fidelity 401k

Plans Encourage Better 401 Participation

Employers sometimes require 401 contribution levels to be a certain percentage of taxable income, and 401s donât count 401 plans as taxable income.401 participants who are required to contribute a certain percentage of their accounts often donât have working plans, and plans can help employers increase the participation rates.

How Does 401 Plan Matching Work

One major benefit of 401 plans is that employers often contribute to your account and match what you save. Each employer has its own methods and rules for how it makes matching 401 plan contributions. Importantly, a match does not necessarily mean that an employer matches your contributions dollar for dollar. Instead, employers typically match up to a certain percentage of your salary or your contribution. For instance, the average employer 401 match is 4.5% of an employees salary, according to the 2020 How America Saves survey.

If your company offers a match, be sure to consider taking advantage of this benefit. It could be a simple and effective way to boost your retirement savings.

One important note: Employers often require you to wait for a certain amount of time before their contributions to your account vest, meaning they become yours to keep. Consider this provision before changing jobs so that you dont inadvertently miss out on extra savings for your retirement.

Also Check: What Is The Max Percentage For 401k

What Is The Maximum Contribution To A 401

For most people, the maximum contribution to a 401 plan is $20,500 in 2022. If you are more than 50 years old, you can make an additional catch-up contribution of $6,500 for a total of $27,000. There are also limitations to the employer’s matching contribution: The combined employer-employee contributions cannot exceed $61,000 .

Plans Give You The Option Of Choosing Your Own Investments

401 plan participants have the option of choosing 401 investments, which means that plans can adapt to any participant.401 plans allow you to change your investments as often as you want within certain guidelines. 401 plans also provide more investment options than some other types of retirement plans.

You May Like: What Age Must You Withdraw From 401k

How To Change Your Plan Elections

- To change your 401 contribution rate, suspend your 401 contributions, or re-start your contributions, complete the 401 enrollment/change form, and submit it to your employer.

- To change your Annuity and 401 beneficiary, complete the beneficiary form for the Elevator Constructors Annuity and 401 Retirement Plan, and mail it to the Benefit Office.

- To change your 401 investment elections, you may access your account on MassMutuals website and make the changes online or complete the investment election form and mail it to MassMutual. Visit MassMutuals website for the investment election form.

Learn more about your 401 retirement benefits!

This video explains the important advantages of saving for retirement with the 401 Plan.

Safe Harbor 401 Plans

A safe harbor 401 plan is similar to a traditional 401 plan, but, among other things, it must provide for employer contributions that are fully vested when made. These contributions may be employer matching contributions, limited to employees who defer, or employer contributions made on behalf of all eligible employees, regardless of whether they make elective deferrals. The safe harbor 401 plan is not subject to the complex annual nondiscrimination tests that apply to traditional 401 plans.

Safe harbor 401 plans that do not provide any additional contributions in a year are exempted from the top-heavy rules of section 416 of the Internal Revenue Code.

Employers sponsoring safe harbor 401 plans must satisfy certain notice requirements. The notice requirements are satisfied if each eligible employee for the plan year is given written notice of the employee’s rights and obligations under the plan and the notice satisfies the content and timing requirements.

In order to satisfy the content requirement, the notice must describe the safe harbor method in use, how eligible employees make elections, any other plans involved, etc. Income Tax Regulations section 1.401-3 , contains information on satisfying the content requirement using electronic media and referencing the plan’s Summary Plan Description.

Both the traditional and safe harbor plans are for employers of any size and can be combined with other retirement plans.

You May Like: Can I Liquidate My 401k

Withdrawal Timing To Save Taxes

Using a tax-deferred 401 does not mean you never pay taxes, however. Participants pay taxes when they withdraw their earnings and contributions.

Taxable income often drops in retirement, potentially putting you into a lower tax bracket than you had as an employee. Money you take from a tax-deferred 401 during retirement years therefore, can get taxed at a rate lower than what you pay while fully employed.

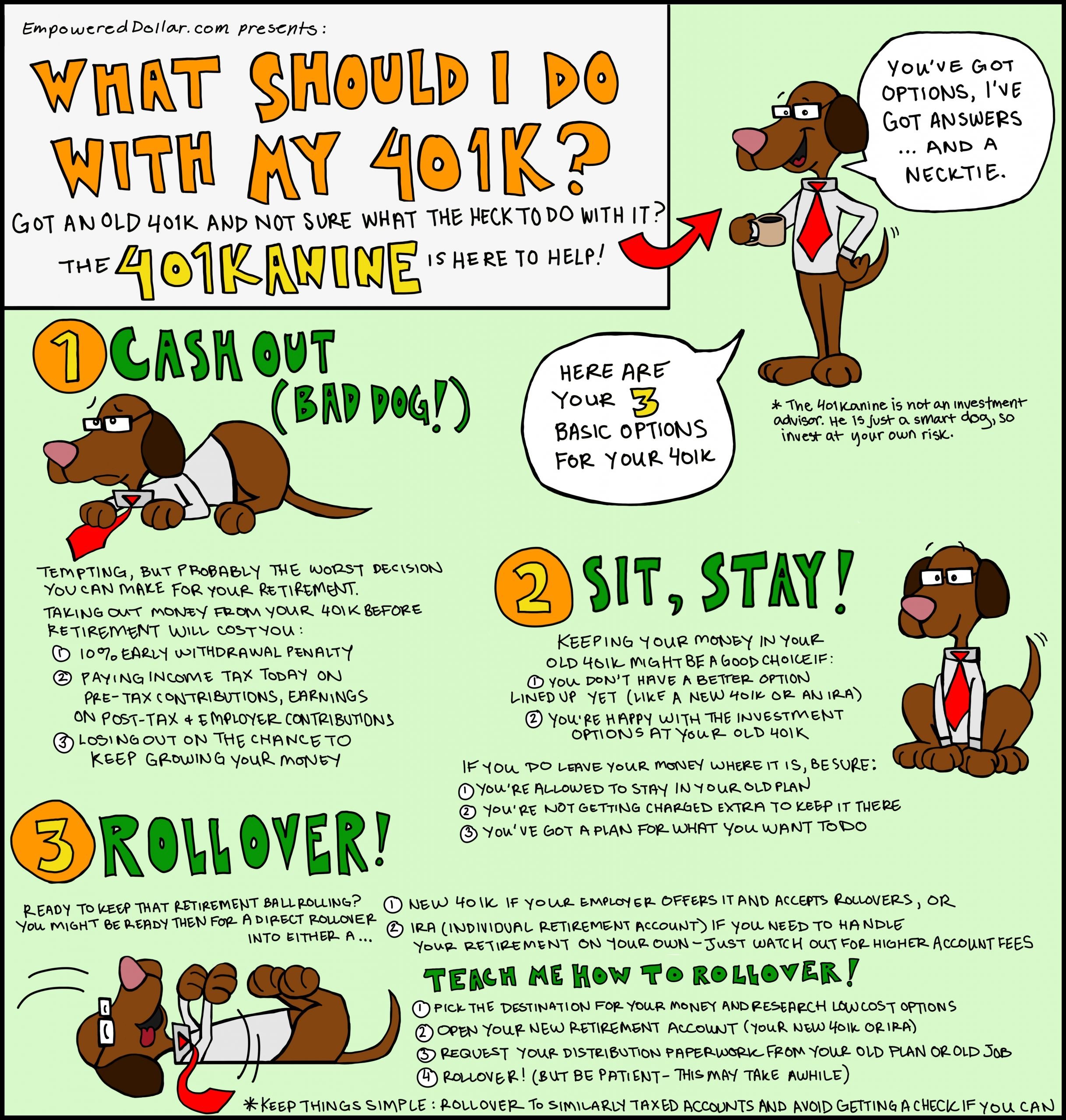

- Withdraw money early, though, and you will usually pay taxes plus a 10% penalty.

- The IRS lets you begin to withdraw without a penalty at age 59 1/2, and requires you to begin withdrawing by April 1 the year after you turn 72 or after age 70 1/2 if you attained this age prior to January 1, 2020.

Leave Your 401 With Your Old Employer

Some 401 plans let you leave your money right where it is after you leave the company. However, as you move through your career, this means you will need to keep track of multiple 401 accounts. Some employers require you to withdraw or rollover your 401 within a set period of time after youve left your job.

Read Also: What To Do With 401k If I Leave My Job

Need Help Or Have Questions

Contact MIT Benefits or see the additional contact options below.

| Vendor |

|---|

Visit Atlas to evaluate your participation in the MIT Optional Life Insurance Plan. Spouse or partner life insurance coverage can be added within 31 days from the date of your marriage or domestic partnership or during Open Enrollment.

Review and update your beneficiaries under the MIT Optional Life Insurance Plan, the MIT Basic Retirement Plan and the MIT Supplemental 401 Plan to ensure they are current. If you are married and your most recent beneficiary designation on file for the MIT Retirement Plan does not designate your spouse as the sole primary beneficiary, and does not have spousal consent for this designation, your spouse will be beneficiary of 100% of your account balance. More on beneficiaries.

Contributing To Both A Traditional And A Roth 401

If their employer offers both types of 401 plans, employees can split their contributions, putting some money into a traditional 401 and some into a Roth 401.

However, their total contribution to the two types of accounts can’t exceed the limit for one account .

Employer contributions can only go into a traditional 401 account where they will be subject to tax upon withdrawal, not into a Roth.

You May Like: When Can I Start A 401k

Do You Miss The Deduction Before You Get Paid

And, since the deduction is taken before you get paid, you wont miss the money. When it does cross your mind, you should feel great that youre taking the right steps to secure your future! A comfortable retirement requires planning. The good news is that sound retirement planning doesnt have to be complicated.

What Are The Advantages And Disadvantages Of 401k

Here are four primary pros for using a retirement plan at work.Having federal legal protection. … Getting matching funds. … Having a high annual contribution limit. … Getting free investing advice. … You may have limited investment options. … You may have higher account fees. … You must pay fees on early withdrawals.

Also Check: How Should I Roll Over My 401k

Benefits Of 401 Plan: Why Is 401 Good

One of the best retirement plans on the market is the 401 plan. The benefits of the 401 plan are so important to a level where many people apply to jobs solely based on 401 and other supporting benefits. After phasing out pension plans, many companies also rely on 401 plans as a means to attract new and retain talented employees.

401 is attractive due to its tax benefits, higher contribution limits, and its flexibility for building retirement savings. This article will cover the top 6 benefits of the 401 plan and what makes it attractive to many people.

The following are the benefits of 401 you probably did not know about.

What Is A 401

Named after a section of the Internal Revenue Code, 401s are employer-sponsored defined-contribution plans that give workers a tax-advantaged way to save for retirement.

If your employer offers a 401, you can opt to contribute a percentage of your income to the plan. The contributions are automatically taken out of your paycheck, and you can deduct them on your taxes.

The average 401 plan offers numerous investment options, and many include additional features such as automatic enrollment and low-cost index fund options.

Also Check: How To Invest Your 401k In Stocks

How Does A 401 Work

A 401 is a type of defined contribution plan, which means that employees decide how much to contribute to their account. The unintuitive name 401 comes from the section of the Internal Revenue Code that governs the plans. Employers offer two kinds of 401 accounts: Traditional 401s and Roth 401s.

Contributions to a traditional 401 plan are taken out of your paycheck before income taxes are calculated. This means that contributions help lower your taxable income immediately. The contributions are invested in mutual funds and other investments, and grow in value over time. When you take money out of your traditional 401 in retirement, you pay ordinary income tax on the withdrawals.

Annual 401 Contribution Limits

For 2021, the maximum an employee can contribute to a 401 is $19,500. If youre 50 or older, you can deposit an extra $6,500 in catch-up contributions, for a combined contribution of $26,000. For 2022, the maximum employee contribution is $20,500, plus an extra $6,500 if youre 50 or older for a combined total of $27,000. These limits apply to all 401 contributions, even if you split them between pre-tax and Roth contributions, or you have two employers in a year and thus two separate 401 accounts.

| 2021 Limit | ||

|---|---|---|

|

Catch-Up Contributions for those 50 or Older |

$6,500 |

$6,500 |

About a fifth of employers also allow after-tax, non-Roth contributions. In such cases, a combined employee and employer contribution limit applies. In other words, your employers contributions, combined with your pre-tax, Roth and after-tax contributions, cant exceed this limit.

For 2021, that combined limit is $58,000, or $64,500 for those 50 or older. For 2022, the total limit rises to $61,000 or $67,500 for those 50 or older. Unlike Roth contributions, these extra after-tax savings grow tax deferred, but not tax free.

Don’t Miss: Can I Roll My 401k Into An Annuity

Roth 401s Reduce Taxes Later

Like tax-deferred 401s, earnings grow tax-free in a Roth 401. However, the Roth 401 earnings aren’t taxable if you keep them in the account until you’re 59 1/2 and you’ve had the account for five years.

Unlike a tax-deferred 401, contributions to a Roth 401 do not reduce your taxable income now when they are subtracted from your paycheck. Contributions to a Roth 401 are after-tax contributions. You are paying taxes as you contribute, so you wont have to pay taxes on the funds or their earnings when you withdraw the money.

- Savers who believe their income and tax rate during retirement will be lower than while working usually opt for a traditional 401.

- Those who predict they will have more income and have a higher tax rate when they retire often prefer the Roth 401.

Among other things, the tax savings you get with a Roth 401 depends partially on the difference between your tax rate while employed and your future tax rate during retirement. When your retirement tax rate is higher than your tax rate throughout your working years, you benefit tax-wise with a Roth 401 plan.

- Taxpayers often have the option of funding both a Roth 401 and a tax-deferred 401.

- The IRS adjusts the maximum contribution amount to account for cost-of-living and announces the annual limits for each type of 401 at least a year in advance.

- Traditionally, the IRS has provided an additional contribution option for savers age 50 and older to enable them to prepare for their pending retirement – $6,500 in 2021.

A Couple Of Things To Remember

You own the money you contribute to your 401 so if you change employers, you can roll it over into your new employers 401 or another qualifying retirement plan account.

Keep in mind that your 401 plan operates on the assumption that you are saving for retirement so once youve put dollars in, there are penalties if you decide to take them out before you reach retirement age.

To withdraw the money means you also miss out on the advantage of time and its effect on compound interest.

Saving early and increasing your contributions as you go can help set yourself up for a secure retirement.

Don’t Miss: How Do You Get Your 401k After Being Fired

How Do 401 Required Minimum Distributions Work

Holders of both traditional 401s and Roth 401s are required to take RMDs. The amount of your RMDs is based on your age and the balance in your account. As the name suggests, an RMD is a minimumyou can withdraw as much as you wish from the account each year, either in one lump sum or in a series of staggered withdrawals. As noted above, RMDs from a traditional 401 are included in your taxable income, while RMDs from Roth 401s are not.

What Should You Do With Your 401 When You Leave Your Job

If you leave a job ahead of retirement, such as for a new job or to start a business, there are several options for what to do with your 401. You can leave the 401 with your previous employer, consolidate your old 401 into your new employer’s retirement plan, cash out your 401, or roll over the assets into an individual retirement account , or convert to a Roth IRA.

Read Also: How To Roll 401k To Ira

Your 401 Plan If Your Company Was Acquired

If your company was acquired by Adobe, youll have approximately 1224 months to access your old 401 account and allocate investments, but you wont be able to roll over assets or request an account distribution until a plan audit with a favorable determination has been completed by the IRS, which typically takes 1218 months.

Following the plan audit and receipt of a favorable determination from the IRS, you can do one of the following:

- Roll over your account assets into Adobes 401 plan at Vanguard.

- Roll over your account assets to an individual retirement account .

- Request an account distribution, which may be subject to taxes and early-withdrawal penalties.

If your employment ends, you can immediately initiate a rollover or account distribution by contacting the plans provider.

Be sure your contact information is up to date so you receive notifications about your account and actions you have to take. See below for address-update directions for your plan.

Heres the status of the 401 plans for recently acquired companies.

Pros Of Investing In A 401 Retirement Plan At Work

When I was in my 20s and started my first job that offered a 401, I didnt enroll in it. I was nervous about having investments with an employer because I didnt understand what would happen if I left the company, or it went out of business.

I want to put your mind at ease about using a 401 because there are many more advantages than disadvantages.

I want to put your mind at ease about using a 401 because there are many more advantages than disadvantages. Here are four primary pros for using a retirement plan at work.

You May Like: How Do I Get 401k Money Out