What If You Can’t Meet Your Employer Match

If you aren’t yet in a position to contribute enough to meet your employer’s match, and thus not enough to reach the desired 15% savings rate, aim to boost your retirement contributions by 1% to 2% each year. If you opt in to do so, some companies will automatically raise your contribution rate annually, so it’s worth making sure you are signed up for what is called an “auto-escalation” feature.

Ivory Johnson, a CFP and founder of Delancey Wealth Management, recommends increasing your contribution rate as you get pay raises until you max out the limit. There is a limit to how much you can contribute annually to your 401. In 2021, the standard annual contribution limit is $19,500 for 401 plans. And those over age 50 can use catch-up contributions to add an extra $6,500 in their 401 account. Employer contributions don’t count towards those specific limits.

Lynch reminds retirement savers to be strategic with the magic number they would like to contribute to their 401 before automatically trying to max it out, however.

“Situations can arise where you may need to prioritize your cash savings in your emergency fund or save for a different reason, such as for a down payment on property or a vehicle,” she adds. “$19,500 isn’t a small chunk of change.”

Keep in mind that although you don’t pay income taxes on the money you set aside in a 401, you’ll have to pay taxes later on when you eventually withdraw the funds in your nonworking years.

There Are Contribution Limits For 401s

Since the 401 is a powerful savings tool, the IRS sets an annual limit on how much money you can set aside in a 401. That amount is adjusted every year for inflation. For 2022, the 401 contribution limit is $20,500.

If youre 50 or older by year-end 2022, you can contribute an extra $6,500, for a total of $27,000. Check out the Financial Industry Regulatory Authoritys 401 Save the Max Calculator to see how much you need to save each pay period to max out your annual contribution to your 401. If you cannot afford to contribute the maximum, try to contribute at least enough to take full advantage of an employer match .

Indexed Universal Life Insurance

Indexed universal life insurance is a type of permanent life insurance that can also be used for retirement savings. With indexed universal life insurance, you contribute to the policy over time. The money in the policy then grows based on the performance of an index, such as the S& P 500. In addition, you can take tax-free withdrawals from the policy starting at age 59½, and the death benefit is paid to your beneficiaries tax-free.

Many types of retirement savings plans are available, so be sure to do your research to find the best one for you. A 401 plan is an excellent option for many people, but other options are available if a 401 doesnt fit your needs. Be sure to talk to a financial advisor to get more information about your retirement savings options.

Recommended Reading: How Does A Company 401k Match Work

Benefits Of 401 Plan: Why Is 401 Good

One of the best retirement plans on the market is the 401 plan. The benefits of the 401 plan are so important to a level where many people apply to jobs solely based on 401 and other supporting benefits. After phasing out pension plans, many companies also rely on 401 plans as a means to attract new and retain talented employees.

401 is attractive due to its tax benefits, higher contribution limits, and its flexibility for building retirement savings. This article will cover the top 6 benefits of the 401 plan and what makes it attractive to many people.

The following are the benefits of 401 you probably did not know about.

Reasons To Contribute To A 401

Please fill out all required fields

Email addresses provided will be used only to let the recipient know who sent the web content. The information will not be used for any other purpose by Securian Financial.

Thank you for sharing

Your message has been sent.

If youre employed with a company that offers a 401 plan and you are not participating, reconsider! Consistently contributing to a 401 throughout your working years can help create a secure retirement.

Its not as difficult as you think: Lets say youre starting now at age 25 and your annual salary is $50,000. If you contribute ten percent of your earnings consistently, receive a three percent raise each year and earn an eight percent rate of return on your investment, you could have more than $2 million in your 401 by the time you retire at 65!1

Depending on your employers tax status, your plan may be called 403 or 457. Both are similar to a 401 in how they benefit you.

There are other financial tools available you can use to prepare for retirement, but 401s offer many advantages that other savings and investment vehicles dont. Here are three of them.

1. 401 contributions are before tax money

The amount you choose to contribute to your 401 is deducted from your paycheck before taxes are taken out. As a result, youre paying taxes on a smaller portion of your salary and your overall tax rate may be lower.

2. When you finally pay taxes on your 401, it may be at a lower rate

Read Also: When Can I Start Using My 401k

When Should You Max Out Your 401

Maxing out your 401 can be a smart move in some circumstances. If you have a high income, you may want to max out every tax-advantaged account available. You may also need to double down on retirement savings if you’re behind your goal.

But your personal situation should guide how much you put in your 401. Saving for retirement isn’t your only financial goal. If you have shorter-term goals, think carefully before maxing out your 401.

Setting Up Automatic Contributions Makes Saving Easy

Once you’ve opened your IRA, set up a monthly automatic deposit from your checking account to your IRA. A $6,000 yearly contribution comes out to $500 a month. If that’s more than you can manage, contribute as much as you can and try to add to it with any bonuses, raises, or gifts. You actually have until the tax filing date of the following year to make your full IRA contribution.

Read Also: Is A 401k A Traditional Ira

Best Retirement Plans For Small Businesses & The Self

Self-employment is increasingly popular in the United States. According to the Pew Research Center, in 2019 16 million Americans were self-employed, and 29.4 million people worked for self-employed individuals, accounting for 30% of the nations workforce.

Being a small business owner or a solo entrepreneur means youre on your own when it comes to saving for retirement. But that doesnt mean you cant get at least some of the benefits available to people with employer-sponsored retirement plans.

Whether you employ several workers or are a solo freelancer, here are the best retirement plans for you.

| Who Is It Best For? | Eligibility |

|---|---|

|

Self-employed business owners with no employees . |

Higher contribution limits than IRAs. Contributions are tax-deductible as a business expense. |

Opportunity Costs Can Be Hefty

Any time you pull your money out of the market, youre missing out on potential gains and the magic of compounding returns.

If you took out a one-year, $15,000 loan from your 401 on Jan. 1, 2021, with a 4.25% interest rate, you would pay back $15,347. If youd left the money invested in an S& P 500 index fund instead, then you would have $19,034 in your account. Taking out a loan means that you would missed out on a more than $3,800 return.

Also Check: How To Set Up A 401k Plan

Limits For High Earners

For most people, the contribution limits on 401s are high enough to allow for adequate levels of income deferral. In 2021, highly paid employees can only use the first $290,000 of income when computing the maximum possible contributions.

Employers also can provide non-qualified plans such as deferred compensation or executive bonus plans for these employees.

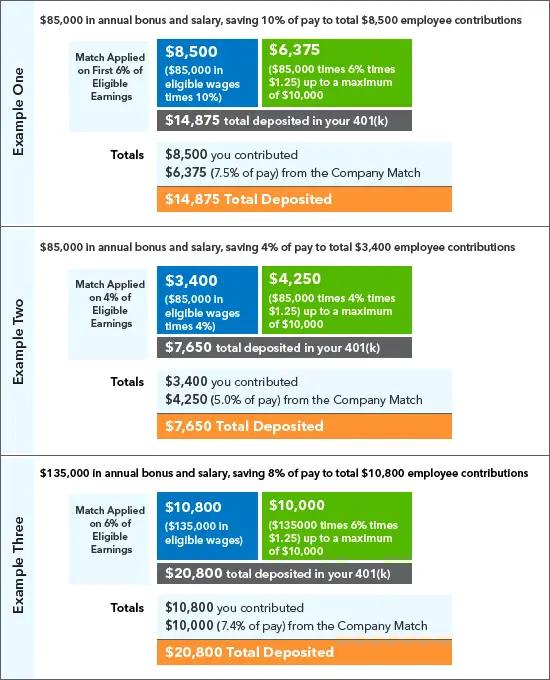

Annual Limits For An Employers 401 Match

The 2021 annual limit on employee elective deferralsthe maximum you can contribute to your 401 from your own salaryis $19,500. The 2022 elective deferral limit is $20,500. The 2021 annual limit for an employers 401 match plus elective deferrals is 100% of your annual compensation or $58,000, whichever is less. In 2022, this total rises to $61,000 or 100% of your compensation, whichever is less.

Considering that surveys suggest many Americans dont have enough money saved for retirement, meeting or exceeding the amount needed to gain your employers full 401 matching contribution should be a key plank in your retirement savings strategy.

Taking into account the power of compounding and a 6% annual rate of return, contributing enough to receive the full employer match could possibly be the difference between retiring at 60 versus 65, said Young.

Use Fidelitys 401 match calculator to find out how matching contributions can impact your retirement savings.

Read Also: How Much Tax On 401k After Retirement

Read Also: What Is The Tax Rate On 401k Withdrawals

Rules For Withdrawing Money

The distribution rules for 401 plans differ from those that apply to individual retirement accounts . In either case, an early withdrawal of assets from either type of plan will mean income taxes are due, and, with few exceptions, a 10% tax penalty will be levied on those younger than 59½.

But while an IRA withdrawal doesn’t require a rationale, a triggering event must be satisfied to receive a payout from a 401 plan. The following are the usual triggering events:

- The employee retires from or leaves the job.

- The employee dies or is disabled.

- The employee reaches age 59½.

- The employee experiences a specific hardship as defined under the plan.

- The plan is terminated.

Are You Prepared For Retirement

Find out with My Interactive Retirement PlannerSM

This material is not a recommendation to buy, sell, hold, or roll over any asset, adopt an investment strategy, retain a specific investment manager or use a particular account type. It does not take into account the specific investment objectives, tax and financial condition or particular needs of any specific person. Investors should discuss their specific situation with their financial professional.

Life and annuity products are issued by Nationwide Life Insurance Company or Nationwide Life and Annuity Insurance Company, Columbus, Ohio. The general distributor for variable products is Nationwide Investment Services Corporation , member FINRA, Columbus, Ohio. The Nationwide Retirement Institute is a division of NISC. Nationwide Funds are distributed by Nationwide Fund Distributors, LLC, Member FINRA, Columbus, OH. Nationwide Life Insurance Company, Nationwide Life and Annuity Company, Nationwide Investment Services Corporation and Nationwide Fund Distributors are separate but affiliated companies.

The Nationwide Group Retirement Series includes unregistered group fixed and variable annuities issued by Nationwide Life Insurance Company. It also includes trust programs and trust services offered by Nationwide Trust Company, FSB.

Also Check: Can I Move My 401k Into A Roth Ira

People Are Also Reading

Many plans now allow participants to begin contributions immediately, with no waiting period. Others have waiting periods of one to six months. Some require people to wait a full year the maximum allowed under federal law and that delay can be expensive for workers.

A great 401 lets you keep the match

Plans offer a number of different matching formulas, with some of the most common being 50% of the first 6% of earnings and 100% of the first 3% to 6% of pay. The more generous the match, the better for participants to a point. Many plans have long vesting periods for employer contributions. You might not have a right to any matching funds until you’ve worked for the company for three years, for example.

After you hit the three-year mark, you would own 100% of any match you’ve earned and 100% of any future matches.

Another common approach is a six-year “graded” vesting schedule. You might have to work two years before you get 20% of the match. You would get another 20% after each year of service until you were 100% invested in past and future matches after year six.

A growing number of plans give employees immediate ownership of matching funds.

A great 401 gives you more ways to save

Most plans today offer a Roth 401 option that allows participants to put away money that won’t be taxed in retirement.

What Is A 401 Plan

A 401 plan is a retirement savings account that allows an employee to divert a portion of their salary into long-term investments. The employer may match the employee’s contribution up to a limit.

A 401 is technically a qualified retirement plan, meaning it is eligible for special tax benefits under Internal Revenue Service guidelines. Qualified plans come in two versions. They may be either defined contributions or defined benefits, such as a pension plan. The 401 plan is a defined contribution plan.

That means the available balance in the account is determined by the contributions made to the plan and the performance of the investments. The employee must make contributions to it. The employer may choose to match some portion of that contribution or not. The investment earnings in a traditional 401 plan are not taxed until the employee withdraws that money. This typically happens after retirement when the account balance is entirely in the hands of the employee.

More than 100 million Americans are covered by defined-contribution plans, like a 401 or similar, nearly half of U.S. workers in the private sector. And nearly half of those plans are immediately vested participants in employer matching contributions, according to a 2019 report by Vanguard.

Recommended Reading: How Do I Close Out My 401k Account

Ks Dont Produce Income

As defined by financial expert Robert Kiyosaki, author of Rich Dad Poor Dad, an asset is something that puts money in your pocket. That is, an asset creates cash flow.

Have you noticed that your 401 plan never pays you are darn cent until youre 59.5 or older?

Thats unfortunate, because there are a lot of income-producing investments that will provide you with cash flow throughout your lifespan, including but not limited to:

- Even dividend paying stocks, mutual funds, and ETFs held outside your 401 account

What’s The Difference Between A Traditional 401 And A Roth 401

While traditional 401 plans allow you to make pre-tax contributions, the Roth version involves after-tax contributions. The tax benefit, though, occurs when you make withdrawals from your account. When you take required minimum distributions from a Roth 401, that money is tax-free. Withdrawals from traditional accounts, though, are taxed at your normal tax rate. That’s because the contributions are made on a tax-free basis.

Don’t Miss: Does Vanguard Accept 401k Rollovers

You Can Borrow From Your 401

A 401 loan, if your plan offers one, can be an appealing option, with interest rates usually set at the prime rate plus one percent. Plus, that interest goes back to you, since youre borrowing from yourself. Win-win, right?

First, of all, as with any debt, you should think hard about why youre taking it on and how youre going to pay it back. Additionally, there are limits set by the IRS rules that govern 401s: generally, the lesser of $50,000 or 50% of the account balance. Unless theyre for a primary residence, 401 loans must be repaid within five years payments must be made at least quarterly. And heres a big catch: Remember that 401 plans are tied to your employment and your employer. Same goes for the loans. If you leave your job, you generally have to pay back the loan within 30 to 60 days of your last day on the job or youll owe taxes on the balance plus a 10% penalty if youre younger than 55.

Finally, you should also consider opportunity cost: You may be paying yourself 5% interest, but how much more could that money have been making if youd left it invested?

Roll Over Your 401k Into A New 401 Or Ira

If your new employer offers a 401k plan with low costs and a wide variety of investment options, this might be a viable option to consider. What could be an even better option though is to roll over your old plan into a Rollover IRA. 401s can be costlier than IRAs, mostly if they come with an extra layer of fees, and can be lacking in investment options like low-cost ETFs.

You or your advisor can choose among thousands of ETFs, bonds, mutual funds or individual stocks in an IRA. By law, 401 plans can offer as few as three investment options. Mutual funds are not only expensive, but also tend to underperform the market. ETFs, on the other hand, provide a relatively low-cost, tax-efficient way to create a well-diversified portfolio. Low-cost investments help boost your retirement security without having to ramp up savings or portfolio risk.

You May Like: What To Do With 401k When You Switch Jobs

From Pension Plans To 401s

Large employers benefited dramatically from these new laws, because 401 plans are substantially less expensive to fund than pensions.

401ks are also more predictable, because the employer is not responsible for making payments to retirees through death. 401ks dont require the lifespan estimations that are central to pension plans.

In short, the 401ks place the burden of retirement investing and taking distributions during retirement squarely onto employees. For the most part, this is healthy for our nation, because we should all want to take responsibility for our own retirement.

However, it means that most Americans are now relying on a system that hasnt existed for even 40 years! Is this how you want to prepare for your financial future?

Its not the approach that Im taking. Below I explain the reasons I think 401ks are an appalling idea.

Before I do though, lets explore the upside they present.