What An Early 401 Withdrawal Might Cost You

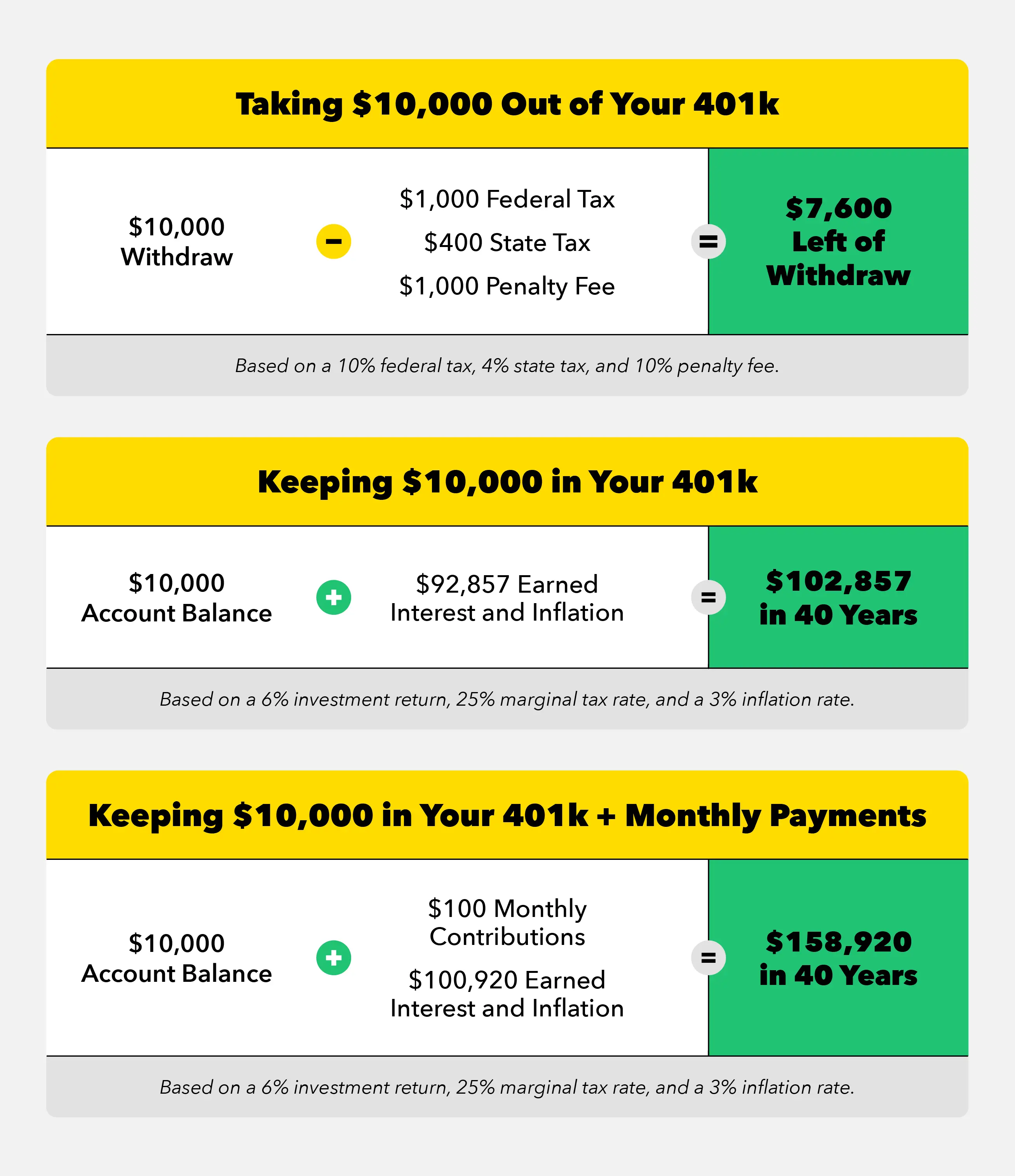

You know how a new car loses a chunk of its value the minute you drive it off the lot? Its similar when you take an early withdrawal from your 401. The amount you planned to get shrinksby a lot:

- Taxes. First, the IRS withholds 20% of your withdrawal amount to cover your tax bill. Why? Because the money you originally contributed to your 401 was pre-tax. So your savings are tax deferred, but not tax free , which means you still have to pay Uncle Sam his due, no matter when you withdraw the money.

- Penalty. Unless youre covered by one of the situations described below, the IRS will also tack on a 10% penalty. So a $20,000 withdrawal would become $14,000 in hand .

- Lost earnings. The third cost is less visible, but no less substantial. If you dip into your nest egg now, theres less in your account to grow in the years to come. So youre not only depleting your retirement savings, but youre also losing the potential earnings on that money.

But if you must, you must. So if you can find a way to sidestep the 10% zinger, thats at least some consolation.

Roll Over Your Assets To An Ira

For more retirement investment options and to maintain the tax-advantaged status of the account, roll your old 401 into an individual retirement account . You will have greater flexibility over access to your savings .3 Before-tax assets can be rolled over to a Traditional IRA, while Roth assets can be rolled directly to a Roth IRA. Review the differences in investment options and fees between an IRA and your old and new employers 401 plans.

Taking Money Out Of Your 401

Once you know how much you need from your 401, youll want to understand how you can take money out. Some plans offer installments or flexible withdrawals that allow you to take money when you need it. Others require you to take it all out at once.

The simple budget presented earlier assumes nice, even spending. But your withdrawal needs are likely to vary each year. In this case, youll need a plan that offers flexible withdrawals. Tell your 401 service provider how youll need to withdraw your money, and find out if they can accommodate you. Be sure to ask them about:

Expense and income planningDo they offer services to help you estimate and plan for withdrawals?

Withdrawal optionsCan you take money when you need it, and are there any limits? Are installments available?

Investment adviceWill someone be available to help you decide the best way to invest?

FeesDo withdrawals carry a charge? And what other fees apply to retirees?

Answers to these questions will help ensure that your 401 can meet your needs both today and over time as your retirement lifestyle evolves.

Dont Miss: How To Find A 401k From A Previous Job

Read Also: Can I Open My Own 401k Account

What To Ask Yourself Before Making A Withdrawal From Your Retirement Account

Retirement may feel like an intangible future event, but hopefully, it will be your reality some day. Before you take any money out, ask yourself an important question:

Do you actually need the money now?

Rather than putting money away, you are actually paying it forward.

If you are relatively early on in your career, you may be single and financially flexible. But your future self may be neither of those things. Pay it forward. Do not allow lifestyle inflation to put your future self in a bind.

Try to think of your retirement savings accounts like a pension. People working towards a pension tend to forget about it until they retire. There is no way they can access it before retirement. While that money is locked up until later in life, it becomes a hugely powerful resource in retirement.

Consider contributing to a Roth IRA, if you qualify for one.

Because contributions to Roth accounts are after tax, you are typically able to withdraw from one with fewer consequences. Some people find the ease of access comforting.

Keep a few factors in mind:

- There are income limits on contributing to a Roth IRA.

- You will still be taxed if you withdraw the funds early or before the account has aged five years.

Leave Your Assets Where They Are

If the plan allows, you can leave the assets in your former employers 401 plan, where they can continue to benefit from any tax-advantaged growth. Find out if you must maintain a minimum balance, and understand the plans fees, investment options, and other provisions, especially if you may need to access these funds at a later time.

Also Check: What Should My 401k Contribution Be

How 401 Hardship Withdrawals Work

The IRS allows anyone to take penalty-free withdrawals if they have an immediate and heavy financial need. You can use the money to cover your needs or those of someone else.

You may qualify for a hardship distribution if the funds go to:

- Pay for certain medical expenses

- Buy a primary residence

- Pay for burial and funeral expenses

- Make necessary home repairs after a disaster

The amount youre able to withdraw will be limited to the amount necessary to cover the expense.

You Will Probably Take An Immediate Tax Hit

You didnt pay taxes on this money before it went into your 401, so the IRS will be looking for its due when you withdraw it. But dont think they are going to wait until April 15th. Your plan administrator is typically required to automatically withhold 20% of your withdrawal and send it directly to the IRS to cover your federal income tax bill. And you may still owe additional federal taxes plus state and/or local taxes, come April. Clients should check with their tax advisor about potential downsides such as these.

Read Also: When Is A 401k Audit Required

How To Withdraw 401k Money

As with any decision involving taxes, consult with your tax professional on considerations and impacts to your specific situation. An Edward Jones financial advisor can partner with them to provide additional financial information that can help in the decision-making process. When considering withdrawing money from your 401 plan, you can withdraw in a lump sum, roll it over or purchase an annuity. Your financial advisor or 401 plan administrator can help you with this.

Dont Miss: How To Calculate How Much To Contribute To 401k

Special Rules Resulting From The Coronavirus Pandemic

It should be noted that the CARES Act of 2020 gave employers the option to amend their 401 plans only if they so choose to allow investors who are impacted by the coronavirus to gain access to of their retirement savings without being subject to early withdrawal penalties and with an expanded window for paying the income tax they owe on the amounts they withdraw per The Security and Exchange Commissions Office of Investor Education and Advocacy .

An employer could amend their plan by allowing coronavirus-related distributions but not increasing the 401 loan limit, according to Porretta.

The SECs OIEA guidance on the CARES Act allowed qualified individuals impacted by the coronavirus pandemic to pay back funds withdrawn over a three-year period , and without having the amount recognized as income for tax purposes.

For income taxes already filed for 2020, an amended return can be filed. The 10 percent early withdrawal penalty was also waived for withdrawals made between Jan. 1 and Dec. 31, 2020. It also waived the mandatory 20 percent withholding that typically applied.

The Act also allowed plan participants with outstanding loans taken before the Act was passed but with repayment due dates between March 27 and Dec. 31, 2020 to delay loan repayments for up to one year. .

You May Like: Can I Buy Bitcoin With My 401k

What Is The Standard Irs Penalty For Withdrawing 401 Funds Early

For early withdrawals that do not meet a qualified exemption, there is a 10% penalty. You will also have to pay income tax on those dollars. Both calculations are based on the amount withdrawn. So if you are in the 20% tax bracket and take out $10,000 you will owe $1,000 in penalties and another $2,000 in income tax .

What Are The Penalties For Withdrawing From My 401 Before Age 59

Unless you fall into one of the special exemption categories, you will pay a penalty of 10% of the amount of funds you withdraw. This can get quite pricey and really cut into your retirement savings. If you must make a withdrawal before reaching retirement age, then make sure you check the list of exemptions to the penalty. If you can qualify under one of the exemptions, then you will not be forced to pay this extra penalty.

You May Like: Can You Use Your 401k To Buy Stocks

How Much Tax Do I Pay On An Early 401 Withdrawal

The money will be taxed as regular income. That’s between 10% and 37% depending on your total taxable income.

In most cases, that money will be due for the tax year in which you take the distribution.

The exception is for withdrawals taken for expenses related to the coronavirus pandemic. In response to the coronavirus pandemic, account owners have been given three years to pay the taxes they owe on distributions taken for economic hardships related to COVID-19.

Early Withdrawals From Your 401

If you take a withdrawal from your 401 before you reach age 59½, this is considered an early withdrawal.

Early withdrawals are subject to income tax and a penalty of up to 50% of the amount withdrawn. The IRS does make some exceptions, however.

You can also take early withdrawals without paying the penalty if you are withdrawing money after certain life events: death, divorce, or disability. You may have to pay taxes on these withdrawals, but not the 50% penalty.

Also Check: How Do I Collect My 401k

Can You Make An Early Withdrawal From Your 401 Plan

Yes, you can make an early withdrawal but just because you can, it doesnt mean that you should. Cashing out from your 401 plan early can come with several financial consequences such as loss of interest growth or penalties. This is why its not recommended to cash out the 401 until you are at least 59 years old.

So How Much Do You Need To Retire Early

If you want to retire early, youll have to dedicate yourself to saving aggressively beginning at an early age. Although $1 million could potentially fund an early retirement at age 62, retiring with less money or at an even earlier age will be a stretch.

The amount you will need is heavily predicated on the type of lifestyle you want to lead, but you can use these numbers as a rough guidepost as to what you should be targeting. In a nutshell, youll likely need at least $1 million to retire early, and the earlier you want to stop working or the grander the lifestyle you want to lead the more you will have to bump that number higher.

Talk with your financial advisor as early in life as you can if you want to pursue a life of early retirement so you can develop a plan to reach your goals.

More From GOBankingRates

Recommended Reading: Who Can Open A 401k

Read Also: How Do I Use My 401k To Start A Business

Heard It From A Friend

Fear of missing out, or FOMO, can be a powerful thing, and if you keep hearing your friends talk about their monthly Social Security payouts, you may want in, too.

Theres a lot of misinformation amongst family and friends about Social Security, and rarely does the advice involve delaying, says Jody DAgostini, a certified financial planner and retirement specialist at the Falcon Financial Group in Morristown, New Jersey.

Instead, people hear from friends and relations about how great it is to receive a monthly payment and how they dont have to worry about Social Security not being there when they are ready to collect, she says. Often lost in these conversations is the fact that the longer you wait, the more you get.

The counterargument: Whats right for your friends might not be right for you. When deciding when to collect your own benefit, consider your own health, finances and family situation, not those of others, however well-meaning.

Better to speak to an expert, like a trusted financial adviser or retirement planner. You can also find answers to common claiming questions in AARPs Social Security Resource Center.

Withdrawing Money Early From Your 401

The method and process of withdrawing money from your 401 will depend on your employer, and which type of withdrawal you choose. As noted above, the decision to remove funds early from a retirement plan should not be made lightly, as it can come with financial penalties attached. However, should you wish to proceed, the process is as follows.

Step 1: Check with your human resources department to see if the option to withdraw funds early is available. Not every employer allows you to cash in a 401 before retirement. If they do, be sure to check the fine print contained in plan documents to determine what type of withdrawals are available, and which you are eligible for.

Step 2: Contact your 401 plan provider and request that they send you the information and paperwork needed to cash out your plan, which should be promptly completed. Select providers may be able to facilitate these requests online or via phone as well.

Step 3: Obtain any necessary signatures from plan administrators or HR representatives at your former employer affirming that you have filed the necessary paperwork, executed the option to cash in your 401 early, and are authorized to proceed with doing so. Note that depending on the size of the company, this may take some time, and you may need to follow up directly with corporate representatives or plan administrators at regular intervals.

You May Like: What Is The Maximum Employer 401k Contribution For 2020

How Do You Qualify For The Exemption

- You, your spouse, or dependent was diagnosed with COVID-19 by a CDC-approved test, OR

- You experienced adverse financial consequences as a result of certain COVID-19-related conditions, such as a delayed start date for a job, rescinded job offer, quarantine, lay off, furlough, reduction in pay or hours or self-employment income, the closing or reduction of your business, an inability to work due to lack of childcare, or other factors identified by the Department of Treasury.

is one that meets this criteria and is made from an eligible retirement plan to a qualified individual from January 1, 2020, to December 30, 2020.

What Are The Penalty

The IRS permits withdrawals without a penalty for certain specific uses, including to cover college tuition and to pay the down payment on a first home. It terms these “exceptions,” but they also are exemptions from the penalty it imposes on most early withdrawals.

It also allows hardship withdrawals to cover an immediate and pressing need.

There is currently one more permissible hardship withdrawal, and that is for costs directly related to the COVID-19 pandemic.

You’ll still owe regular income taxes on the money withdrawn but you won’t get slapped with the 10% early withdrawal penalty.

You May Like: Can I Transfer 401k To Ira

What Can You Withdraw From 401k Without Penalty

Retirement accounts after age 59 12 are permitted to withdraw penalty free, but those after 72 12 are restricted to withdrawals. (The required minimum distributions, or RMDs, are also called distributions, or distributions, that are due due. 401k plans as well as other qualified plans are some exceptions to these rules.

Also Check: How To Roll Your 401k From Previous Employer

Withdraw Early From A : The Covid

The 2020 CARES Act permitted employers to amend their 401 plans in Section 2022. If employers authorize this option, those affected by the coronavirus can withdraw up to $100,000 from their retirement account, including a 401, penalty-free.

Theyll also have three years to pay the taxes due. After that, the IRS will let you recoup the taxes you paid on the withdrawal by filing an amended federal tax return.

Also Check: How To Increase 401k Contribution Fidelity

Cashing Out A : What A 401 Early Withdrawal Really Costs

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

It’s fairly easy to put money into a 401, but getting your money out can be a different story. That is, unless youre at least 59½ years old thats when the door swings wide open for a 401 withdrawal.

But 2022’s high inflation, rising interest rates and rocky stock market might have some investors itching to cash out early. However, if you do decide to make an early 401 withdrawal before that magical age, you could pay a steep price if you dont proceed with caution.

» Dive deeper:What to do when the stock market is crashing

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our reporters and editors focus on the points consumers care about most how to save for retirement, understanding the types of accounts, how to choose investments and more so you can feel confident when planning for your future.

Read Also: What Is An Individual 401k