Roll It Over To An Ira

This option makes sense if you want to roll over your 401 and you want to avoid a taxable event. If you have an existing IRA, you may be able to consolidate all of your IRAs in one place. And an IRA gives you many investment options, including low-cost mutual funds and ETFs.

There are plenty of mutual fund companies and brokerages that offer no-load mutual funds and commission-free ETFs, says Greg McBride, CFA, Bankrate chief financial analyst.

You also want to just make sure that youre satisfying any account minimums so that you dont get dinged for an account maintenance fee for having a low balance, McBride says. Index funds will have the lowest expense ratios. So theres a way that you can really cut out a lot of the unnecessary fees.

Check with your IRA institution first to ensure that it will accept the kind of rollover that you would like to make.

The letter of the law says it is OK . But in practice, your 401 plan may not allow it,says Michael Landsberg, CPA/PFS, member of the American Institute of CPAs Personal Financial Planning Executive Committee.

Also Check: How To Find Out If You Have An Old 401k

Finding Old Retirement Accounts

You may want to start by contacting your former employers and the plan administrators, the companies that ran the retirement plan. Sometimes, youll find that your retirement account is still there and chugging along as is, hopefully growing in value over time. If you want, you may be able to leave it there, although update the company with your current contact information so it can let you know about any important changes.

However, its not always that easy. If your account had less than $5,000 in it when you left, the plan administrator can transfer the funds to an individual retirement account that was set up in your name. If it had less than $1,000, the company may have tried to send you a check for the amount to the address it had on file. You may also have trouble tracking down the account if the company went bankrupt or switched plan administrators, leaving it up to you to figure out who is holding onto the money now.

One thing is certainother companies dont get to keep your money. If a company cant figure out how to contact you, it has to turn unclaimed funds over to state agencies. You can start searching for your unclaimed funds in these databases:

Once you find your account or money, youll still need to decide what to do with it.

Heres how the Treasury Offset Program works:

What If Your Employer Goes Out Of Business

Under federal law, your employer must keep your 401 funds separate from their business assets.

This means that even if your employer abruptly shuts their doors overnight, your money is protected. It cannot be used to pay off your companys loans, cover employee payroll, or for any other purpose.

If your company shut down abruptly, it is possible that a portion of money will be at risk. If your money has been withheld, but has not yet been sent to the 401 plan to be invested, the company could in theory, access those funds.

Recommended Reading: How Much Is Max 401k Contribution

What To Do When You Find Your Old 401 Plan

If find your lost 401, congratulations! However, its not time to celebrate by blowing it all on a fancy vacation or a shopping spree. You invested that money to build a retirement nest egg and thats exactly where those funds should stay.

To invest your old 401, you can do whats known as a rollover to avoid early withdrawal penalties. You can roll over the funds into an individual retirement account or into another retirement plan, such as your current employers 401.

In both cases, you can avoid withholding taxes if you roll over the funds directly via the plan administrator. If a distribution is made directly to you, you have 60 days to deposit it into your new retirement account in order to avoid taxes and penalties.

How To Check 401k Balance

Knowing how to check how much is your 401 can help calculate your net worth. Additionally, checking your 401 balance ensures your investments are performing, helping you reach your retirement goals.

Monitoring your finances should be cemented in your overall personal finance strategy. Whether it be your budget, credit profile, or retirement accounts, knowing where you stand is essential in determining your financial health. Some, like your bank accounts and credit, are relatively easy to monitor. However, figuring out how to check 401 balances can be more difficult.

Like your car, your 401 needs regular maintenance. Without it, it may not perform as well or will no longer fit your overall investment strategy anymore.

You can find your 401 balance by logging into your 401 plans online portal and check how your 401 is performing. If you donât have access to your account online, contact your HR department and make sure your quarterly statements are being sent to the correct address.

Checking your 401 too frequently can cause overwhelm and panic when the market isn’t performing well. Dips and peaks are typical for any long-term retirement investment. Checking your 401 balances at least once a year will help you gauge how it fits in your retirement strategy.

Letâs look into how to check how much is in your 401, what to look for, and how often you should be checking.

Recommended Reading: Can I Pull From My 401k

Does Adp Show 401k

There are many people who believe that ADP shows 401k plans.

There is no one answer to this question as it is dependent on the company that is doing the testing and the individuals specific needs. However, some people may believe that ADP shows 401k plans because it is a reliable source of information.

How Can I Find My Old 401 Account

Ask previous employers whether theyre maintaining any accounts in your name. If the company no longer exists, contact the plan administrator. If you dont know the name of the plan administrator, search the Department of Labor website for the companys Form 5500 , which will list their contact information. You might also check the states unclaimed property database via the National Association of Unclaimed Property Administrators .

Darin Bostic, a Schwab financial planner, points out that the best way to keep track of your funds is not to lose them in the first place. Consolidating similar accounts, such as old and new brokerage or IRAs, can help you keep track of your savings, says Darin.

Whats more, consolidation helps ensure your assets are working in harmony toward your long-term goals. Its difficult to follow a comprehensive investment strategy when your money is spread out all over the place.

Recommended Reading: How To Transfer Rollover Ira To 401k

Converting Your Retirement Plan Is Simple

We can work with your current provider to make switching to Paychex simple including handling filing documents, setting up payroll processing, transferring assets, re-enrolling employees into the new plan, and much more. We’ll also work with you to establish your plan’s investment lineup, customize the parameters of the plan, and build new documents.

How Much Do You Need To Retire Comfortably

How much you need to retire comfortably isnt black-and-white because the cost of living looks different for each individual. Consider what it takes to live comfortably and maintain your lifestyle. Many experts suggest that youll need roughly 80 percent of your salary after retirement to avoid making sacrifices.

You May Like: How To Opt Out Of 401k Fidelity

Also Check: Does Max Contribution To 401k Include Employer Match

How Do I Find Out If I Have Retirement Money

You can track down your pension at pbgc.gov/search-all. Its also possible that your employer turned over your 401 balance to your states unclaimed property fund. Your states treasury department should offer an online service that lets you search for your money.

How do I find out if I have any unclaimed money?

How to find

How do I find out if I have a retirement account?

The simplest and most direct way to check up on an old 401 plan is to contact the human resources department or the 401 administrator at the company where you used to work. Be prepared to state your dates of employment and Social Security number so that plan records can be checked.

How do I pull money out of my 401k?

Wait Until Youre 59½ By age 59½ , you will be eligible to begin withdrawing money from your 401 without having to pay a penalty tax. Youll simply need to contact your plan administrator or log into your account online and request a withdrawal.

What proof do I need for a 401k hardship withdrawal?

Documentation of the hardship application or request including your review and/or approval of the request. Financial information or documentation that substantiates the employees immediate and heavy financial need. This may include insurance bills, escrow paperwork, funeral expenses, bank statements, etc.

Read Also: What Investment Is Better Than 401k

How Long Does It Take To Get A 401 Sent To You

The amount of time it takes your 401 custodian to send your funds to you depends on a number of factors including, the manner in which the funds are disbursed and the timing of your request to receive the money. 401 withdrawals are subject to taxation, and depending on your age, you may also have to pay an early withdrawal penalty.

Tips

-

When you decide to cash in your 401 account, a portion will be automatically withheld to ensure that all taxes are accounted for. The remainder of the funds will likely arrive within two weeks.

Also Check: Should I Roll My 401k Into An Ira

How Do I Find My Unclaimed 401k Benefits

There are a few simple steps you can take in order to find out if you are owed any 401k benefits. First, you should check with your employer to see if they have any records of who has contributed to your account. If so, you can check to see how much money you have left in your account, and if any money has been taken from your account, you can file a claim with the IRS.If you have any questions or concerns about your 401k account, or if you feel like you may have been overpaid or misspelled contributions, you can reach out to our team of experts at accountancy firm, Grant Thornton LLP.

Check Every Corner Of Your 401

Once you gain access to your account online or review your statement, check how your money is invested.

Most 401 administrators automatically invest your money into a target-date fund. Target date funds are portfolios of various mutual funds and investments tailored to your estimated retirement date. Using your age, the percentage mix of these investments changes to match your risk tolerance as you near retirement.

If you don’t want to hold your money in a target-date fund, you have the option to change investments.

However, if your plan hasn’t automatically allocated your money, it may be waiting to be invested. In this case, your money will be sitting in your account, not growing in a glorified savings account.

Itâs a rare occurrence, but checking your 401 balance will help catch any funds not adequately invested.

Recommended Reading: Can You Convert Your 401k To A Roth Ira

Are 401k Plan Documents Public

The Employee Benefits Security Administration makes available through its Public Disclosure Room certain employee benefit plan documents and other materials required by the Employee Retirement Income Security Act of 1974 .

Where can I find my 401k statement?

Your 401k retirement plan statement is now available online! To view or print your statement, just log into www.principal.com/retirement/statements to view account information.

Contact The 401 Plan Administrator

If your employer is no longer around, try getting in touch with the plan administrator, which may be listed on an old statement.

If youre unable to find an old statement, you still may be able to find the administrator by searching for the retirement plans tax return, known as Form 5500.

You can find a 5500s by the searching the name of your former employer at www.efast.dol.gov.

If you locate a Form 5500 for an old plan, it should have the contact information on it.

You May Like: How Can I Invest My 401k

Borrowing Money From My 401k

It may seem like an easy way to get out of debt to borrow from your retirement accounts for DIY debt consolidation, but you can only borrow $50,000 or half the vested balance in your account, if its less than $50,000. You wont face a tax penalty for doing so, like you would with an out-right withdrawal, but youll still have to pay the money back.

And unlike a home equity loan where payments can be drawn out over a 10-to-30-year period, most 401k loans need to be paid back on a shorter time table like five years. This can take a huge chunk out of your paycheck, causing you even further financial distress. Borrowing money from your 401k also limits the ability of your invested dollars to grow.

Paying off some of your debt with a 401k loan could help improve your debt-to-income ratio, a calculation lenders make to determine how much debt you can handle. If youre almost able to qualify for a consolidation or home equity loan, but your DTI ratio is too high, a small loan from your retirement account, amortized over 5 years at a low interest rate may make the difference.

How To Get Money Out Of Your 401

Your 401 money is meant for retirement. Itâs not easy to take money out while youâre still working, without incurring a steep financial loss. The account is structured that way on purpose you let the money grow for your future use.

There are certain circumstances under which you can take funds out of your 401 without paying any penalty. Youâll still need to pay income taxes on the money, since it most likely went into your account on a pre-tax basis.

You can start taking withdrawals once you reach 59 1/2 years of age. You can also take penalty-free withdrawals if you either retire, quit, or get fired anytime during or after the year of your 55th birthday. This is known as the IRS Rule of 55.

Recommended Reading: How Should I Set Up My 401k

Recommended Reading: What Happens When You Rollover A 401k

Contact Your Old Employer

When you cant locate an old 401, your prior employer is the first entity you should contact. Reach out to human resources and they should be able to point you in the right direction.

Be prepared to provide the dates you worked for them, your full name and your Social Security number.

Note that if there was more than $5,000 in your 401, your funds are likely to still be in your old workplaces account. If your balance was $1,000 or less, however, its possible that your employer sent a check for the total amount to your last known address.

Plan For Your Retirement Over Your Career

Remember that retirement planning is not a singular event, but rather something you do over the course of your career.

Keep this mindset and continually review your retirement planning progress and account balances. If you havent started to save for retirement, its never too late.

Talk to your HR department about retirement planning options, or open up an IRA, or even basic savings account to get started putting money aside for your future.

Thursday, 21 Oct 2021 11:13 PM

Advertiser Disclosure: Many of the offers appearing on this site are from advertisers from which this website receives compensation for being listed here. This compensation may impact how and where products appear on this site . These offers do not represent all account options available.

Editorial Disclosure: This content is not provided or commissioned by the bank advertiser. Opinions expressed here are authors alone, not those of the bank advertiser, and have not been reviewed, approved or otherwise endorsed by the bank advertiser. This site may be compensated through the bank advertiser Affiliate Program.

User Generated Content Disclosure: These responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiserâs responsibility to ensure all posts and/or questions are answered.

Recommended Reading: What Is The Average Employer Contribution To 401k

Option : Move The Money To An Ira

If you’re not able to transfer the funds to your current 401 or you don’t want to, you can roll over the funds to an IRA instead. The process is the same as doing a rollover to a new 401, and you still have the choice between a direct or indirect rollover.

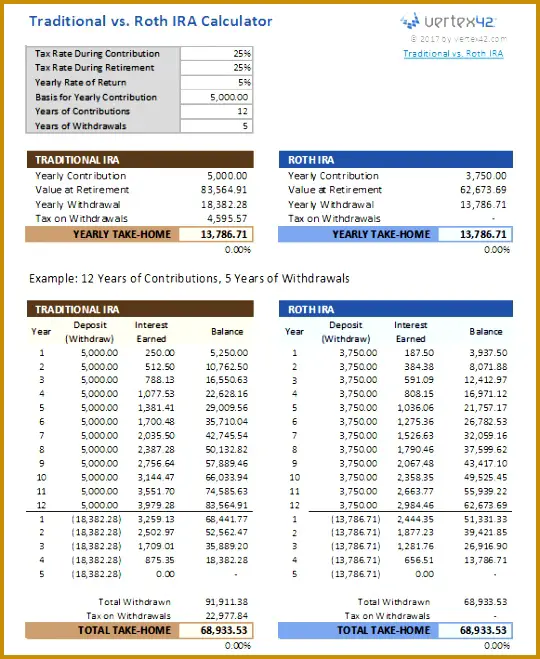

You’ll need to set up a new IRA with any broker if you don’t already have one. Make sure you choose an IRA that’s taxed the same way as your old 401 funds. Most 401s are tax-deferred, which means your contributions reduce your taxable income in the year you make them, but you pay taxes on your withdrawals in retirement. You want a traditional IRA in this case because the government taxes these funds the same way.

If you had a Roth 401, you want a Roth IRA. Both of these accounts give you tax-free withdrawals in retirement if you pay taxes on your contributions the year you make them.

In most cases, losing track of your old 401 doesn’t mean the money is gone for good. But finding it is only half the challenge. You must also decide where to keep those funds going forward so they’ll be most useful to you. Think the decision through carefully, then follow the steps above.