Research Retirement Options For Your Business

It’s important to do your due diligence in researching firms that provide recordkeeping and third-party administration services for 401 plans. As you assemble your list, include a range of established, reputable mutual fund companies, brokerage firms, and insurance companies. Focus on providers that can serve you and your employees long-term with extensive resources and excellent customer service.

You may also want to hear from owners of businesses that are similar to yours, as they may be able to offer insights from their own experiences selecting 401 plan service providers.

Q What Are The Maintenance Costs For Maintaining A 401

Once you select a 401k for your small business and get it up and running, youll need to pay fees associated with ongoing operations, services, investments, and expenditures for matching contributions.

Starting a 401 promotes employee morale, which leads to improved retention and a better ability to attract new talent. It also helps contribute to your and your employees financial well-being. The knowledgeable professionals at Ubiquity are here to assist with customizing a low-cost, easy-to-manage retirement plan for your small business.

Does Automatic Enrollment Increase The Number Of 401 Plan Participants

The Law of Inertia: A body in motion will stay in motion and a body at rest will stay at rest unless an external force acts upon it. While originating in the world of physics, the Law of Inertia is amazingly applicable to the world of retirement planning. As plan sponsors and financial advisors know, getting people who are not already saving to start saving requires a force nearly equal to the gravitational field of a planet. And getting people to save more than they are already saving is an accomplishment of galactic proportions.

Recommended Reading: Should You Withdraw From 401k To Pay Off Debt

How Can A Small Business Owner Open A 401

A small business owner can open a 401 plan by working with a financial institution like Penelope. Once the plan is set up, employees can start contributing to their 401 account by having withdrawals taken from their paychecks. Employers may also contribute to the plan on behalf of their employees if they’d like. 401 plans have some important tax advantages, and they can be a great way to attract and retain good employees.

How Long Does It Take For A Small Business To Set Up A 401

Establishing a 401 can be a fairly straightforward process. However, without due diligence, that approach would be reckless and make your business vulnerable to expensive fees and risks associated with making hasty decisions regarding something as important as selecting a trustee. Depending on how much preliminary research you do, allow yourself ample time to create a plan document, establish a trust, notify employees, and launch your new benefit.

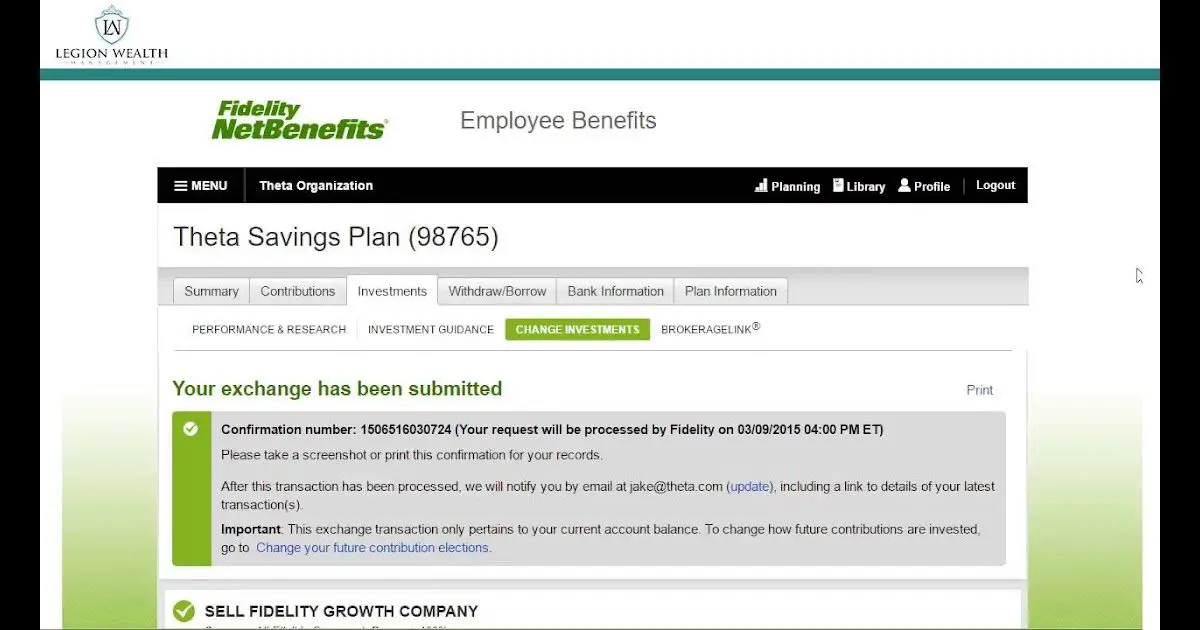

Don’t Miss: How To Rollover 401k To Roth Ira Fidelity

What Are The Maintenance Costs For Setting Up A 401

Once you establish a 401, your business will have ongoing costs in the form of administrative fees and any matching contributions. Fees generally fall into three categories: day-to-day operations, investment fees, and individual service fees.

There are also potentially fees or penalties associated with being non-compliant with regular 401 benchmarking, which you’ll want to avoid at all costs. A few examples of 401 penalties include:

- Non-compliance with ERISA for failing to meet certain filing and notification requirements

- Failing to file Form 5500 with the IRS each year

- Not providing 402 notices to plan participants who are seeking distributions from their retirement plan accounts

One way to avoid fines and penalties is working alongside a knowledgeable retirement services provider that can help ensure compliance when it comes to retirement plan forms, deadlines, and notifications.

The Basics Of A Small Business 401

First, lets discuss what a 401 plan is and why a small business might want to set one up. A 401 effectively is a retirement plan where employees can hold back a portion of their salary each paycheck and then that money is invested on a pre-tax basis in an investment plan. Many companies also offer to match the contributions employees make as an incentive for employees to use the 401.

One of the biggest reasons to add a 401 offering is to attract and retain talent. Retirement security is such an important concept for all employees, Ben Thomason, executive vice president of revenue at Vestwell, told CO last year. To me, that is the why of offering 401s to attract the right talent so your business can grow the right way. The right people make all the difference.

One other reason for companies to add one is that it can provide tax benefits for both employers and employees. The Setting Every Community Up for Retirement Enhancement Act of 2019, which was signed into law in the U.S. in December 2019, offers small businesses a tax credit up to $5,000 for three years for setting up a new retirement plan like a 401. On the employee side, 401 contributions are pre-tax, so their taxable income decreases and they pay less tax overall while saving for the future.

Companies have a fiduciary responsibility to make sure the selected 401 program is run appropriately. This means you should not offer a 401 without doing the proper planning and research.

Don’t Miss: Is There A 401k For Self Employed

Focus On Running Your Business Not Your 401 Plan

-

Recruit & retain top talent. A Human Interest study found that a retirement plan is the most-wanted benefit, after health insurance.3

-

Easy to start, easy to use. Admin dashboards provide insight into plan participation, reporting, and more.

-

Reduce manual work. In-house recordkeeping and complianceplus depending on your plan.

Maintaining 401k Plans For A Business

Most 401k plans are subject to the requirements of the IRC and the Employee Retirement Income Security Act , which provide minimum standards that protect individuals in retirement plans. Administering and maintaining plans that comply with these regulations ranges in difficulty from the moderate to the complex.

Also Check: What Can You Roll Your 401k Into

Starting A 401 Without A Job

If you dont currently have a job, you may have some challenges. 401 plans are employer-sponsored plans, meaning only an employer can establish one. If you dont have your own organization and you dont have a job, you may want to evaluate contributing to an IRA instead. However, those accounts may require earned income during the year to contribute, so its not as simple as you might hope. That said, a spousal IRA may allow certain couples to contribute to a retirement account with no job.

Important: This page touches on complicated topics related to tax and employment law. The information on this page might not be accurate, up-to-date, or relevant to your situation. Do not make important decisions based on what you read here. Instead, speak with an expert who has a detailed knowledge of your situation and any applicable regulations.

Next Up: Curious About Meeting?

Finalizing Your 401 Selection

Next, with the help of a financial advisor, choose the plan that makes the most sense for your company and your employees. If you have a relatively small company with only a few employees, your plan selection will likely be quite different if you have 90 employees.

The final step will be to inform your employees and to update your benefits package to reflect the change, so you can clearly tell potential employees about the 401 plan, as well. You will likely want to mention the benefit on all of your job listings in the future, too.

CO aims to bring you inspiration from leading respected experts. However, before making any business decision, you should consult a professional who can advise you based on your individual situation.

Want to read more?

To stay on top of all the news impacting your small business, go here for all of our latest small business news and updates.

COis committed to helping you start, run and grow your small business. Learn more about the benefits of small business membership in the U.S. Chamber of Commerce, here.

Recommended Reading: When Can I Roll A 401k Into An Ira

Maintaining Your Businesss 401 Plan

Figuring out how to start a 401 for a small business is just the beginning. Keep in mind that there are some recurring employer responsibilities after starting a 401 for a small business.

Depending on the type of 401 you selected, youll need to conduct nondiscrimination testing, make employer contributions, report plan information, and keep up with fees.

Determine A 401k Provider

Determining a 401k provider may not be as difficult as it sounds. You may be thinking of reaching out to various financial institutions for their advice but consider first what youre looking for in a provider and ask these questions:

- Whats Your Investment Lineup Like? How many funds do you offer? How diversified is the portfolio and how well has it done previously? Best to ask these tough questions now, and see how the answers stack up to their competitors.

- What Are the Total Fees? Perhaps the funds the institution you are considering look attractive. But how much will the investing, record keeping and administration expenses cost you and your employees? Are there any surprise service fees or occasional costs that if you dont ask about now youll only find out about later? Great returns could be offset by heavy fees. Ask exactly what this is going to cost from month to month.

- How Easy Is the Administration of the Plan? How easy will this plan be to administer to your employees? Will it require a lot of day to day management or will it practically run itself? Will your employees be able to access their plans online? What digital tools will the institution offer that will help you and your employees get the information they need, or navigate the site?

Recommended Reading: How Can I Borrow Money From My 401k

% Of Small Businesses Add Profit Sharing

Bar none, profit sharing contributions are the most flexible type of employer contribution a small business can make to their 401 plan. These contributions are not only discretionary, but they can be made to any eligible plan participant even if the participant does not make salary deferrals themselves. They can also be allocated using dramatically different formulas allowing employers to meet a broad range of 401 plan goals with them.

Start Your Own Retirement Plan

When youre an employee, you can only use a 401 plan if your employer establishes a plan and youre eligible to contribute. All too often, thats not the case. But you still have options.

5 Ways to Save on Your Own

Ask for a 401: Your employer might be willing to set up a 401 they just havent done it yet. Start the conversation by asking why there isnt one, why you want one, and that there are potential tax benefits for employers. Explain that valuable employees like yourself would be even more valuable with excellent benefits. Offer to do some of the legwork required to get the plan up and running. In some cases, especially with small organizations, your employer simply doesnt have time to set up a plan. Cost is another factor companies and small nonprofits might be hesitant to pay plan costs . If cost is the primary concern, discuss less-expensive options like SIMPLE plans. Only time will tell if itll actually happen, but it never hurts to ask.

IRAs: If you dont have a 401, you may still be able to save in an individual retirement account , and you might even receive tax benefits similar to a 401. Unfortunately, the IRS sets maximum annual limits much lower for IRAs. Still, something is better than nothing. Evaluate traditional IRAs for potential pre-tax saving, and Roth IRAs for possible tax-free withdrawals . Another drawback of IRAs ) is that you may need to qualify to make contributions or receive a deduction. Speak with a tax expert before you do anything.

You May Like: How Do I Find Out How Much 401k I Have

How Much Does It Cost To Set Up A 401 For A Small Business

Costs to set up a 401 plan will vary depending on the size of your business and the types of benefits you select. Initial setup fees can generally run anywhere from $500 to $3,000, depending on the chosen retirement service provider. Other costs to consider are fees associated with rolling assets over from another plan and initial consulting costs for investment advice.

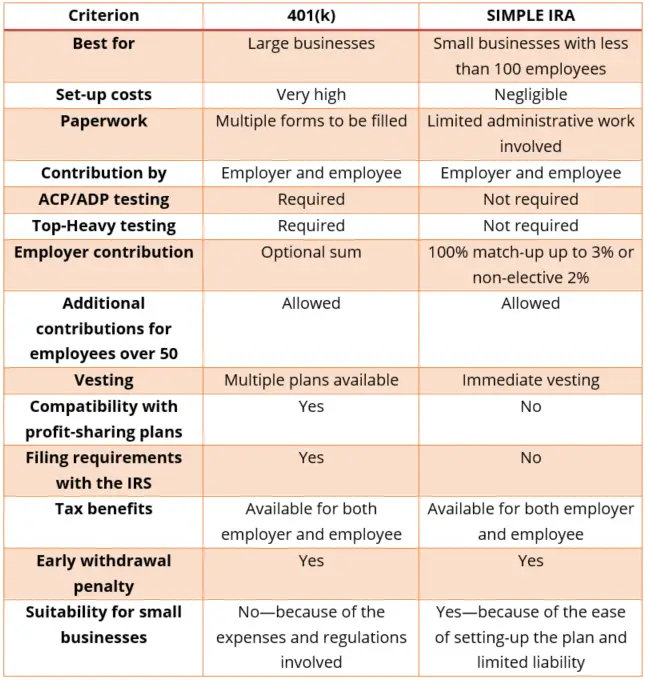

Choosing A Retirement Plan: Simple 401 Plan

A subset of the 401 plan is the SIMPLE 401 plan. Just like the SIMPLE IRA plan, this is a plan just for you: the small business owner with 100 or fewer employees. However, just as with the SIMPLE IRA plan, there is a two-year grace period if you exceed 100 employees, to allow for growing businesses.

Under a SIMPLE 401 plan, an employee can elect to defer some compensation. But unlike a regular 401 plan, you the employer must make either:

No other contributions can be made. The employees are totally vested in any and all contributions.

If you establish a SIMPLE 401 plan, you:

- Must have 100 or fewer employees.

- Cannot have any other retirement plans.

- Need to annually file a Form 5500.

The IRS has issued Model Amendments for SIMPLE 401 plans. These Model Amendments permit a 401 plan to become a SIMPLE 401 plan .

Also Check: How To Withdraw 401k From Old Job

Reasons To Add A Safe Harbor 401 Feature

- You expect your plan to be top heavy. A top heavy 401 plan must generally make a 3% minimum contribution to non-owners. That means adding a safe harbor contribution to a top heavy 401 plan may add little to no cost. A safe harbor match might even lower the cost of your plan if participants defer at low rates.

- You expect your plan to fail ADP/ACP testing. A safe harbor plan allows HCEs to maximize annual contributions without the risk of corrective refunds due to failed testing.

- You want to offer a generous retirement benefit to employees.

What Benefits Do Employers Get From Offering A 401 Plan

401 plans are funds that allow employees to contribute a portion of their wages to save for retirement.

Any business can set up a 401, a salary deferral plan to which employees can contribute part of their salary and have it not count as income on their W-2, said Christian Brim, CEO of financial firm Core Group. And oftentimes, businesses with fewer employees benefit most from them.

Here are some of the advantages for employers:

Read Also: How Much To Invest In 401k Calculator

Get Clear On Why Youre Offering A Small Business 401

The 401 can be a very powerful benefit for you and your employees. In order to ensure that youre getting the most value you can out of your 401, youll need to be clear on your reasons for starting one. Here are 3 of the most compelling reasons why so many business owners nowadays are setting up a 401k for their small businesses:

Dont Miss: Can I Rollover 401k To Another 401 K

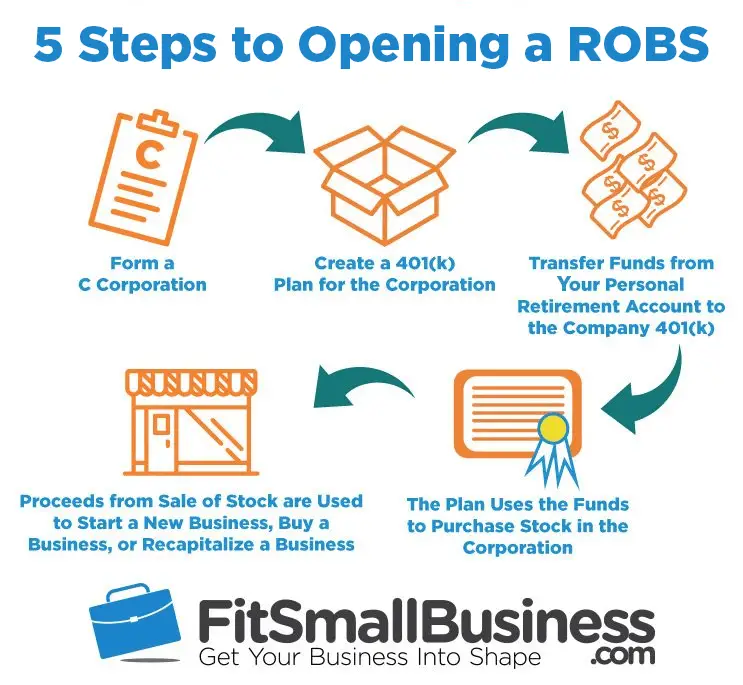

How To Set Up A 401k For A Business

The path to a successful retirement savings program starts with plan design. And while its true that employers can set up 401ks on their own, its generally recommended to seek the help of a professional or a financial institution. Theyll provide expert guidance throughout each of the following steps:

Read Also: How To Opt Out Of 401k Fidelity

What Are The Benefits Of Offering A 401 To Employees

When it comes to 401 plans, there are often common misconceptions around the time, resources, and costs it takes to establish and set up a plan. Business owners may believe that a 401 plan isn’t right for them, are unclear of the benefits, or believe the administrative responsibilities are too cumbersome. In truth, there are some significant advantages in offering a 401 plan to employees:

- A 401 can help make your business more competitive in attracting and retaining top talent.

- Employers can take advantage of an annual tax credit of up to $5,000 for the first three years of the plan.

- Plan expenses are tax-deductible, along with employer contributions such as an employee match or profit-sharing.

- Advances in payroll integration and recordkeepingmake the implementation and maintenance of offering a retirement plan more affordable than ever.

What Else Do Small Business Owners Need To Know About 401 Plans

Small business owners who offer retirement savings plans may be able to take advantage of tax incentives. Matching employee contributions, for instance, is generally tax deductible as a business expense. For the first three years of the plan, employers may also be eligible for tax credits up to 50% of the start-up and administration costs or $5,000 , as well as a $500 automatic enrollment credit per year.

Recommended Reading: How Much Of My Paycheck Should Go To 401k