Roth 401 To Roth Ira Conversions

If your 401 plan was a Roth account, then it can only be rolled over to a Roth IRA. The rollover process is straightforward. The transferred funds have the same tax basis, composed of after-tax dollars. This is not, to use IRS parlance, a taxable event.

However, you should check how to handle any employer matching contributions, because those will be in a companion regular 401 account and taxes may be due on them. You can establish a new Roth IRA for your 401 funds or roll them over into an existing Roth.

Exceptions To Additional Taxes

You dont have to pay additional taxes if you are age 59½ or older when you withdraw the money from your SIMPLE IRA. You also dont have to pay additional taxes if, for example:

- Your withdrawal is not more than:

- Your unreimbursed medical expenses that exceed 10% of your adjusted gross income ,

- Your cost for your medical insurance while unemployed,

- Your qualified higher education expenses, or

- The amount to buy, build or rebuild a first home

Where Should You Transfer Your 401

You have several options on what to do with your 401 savings after retirement or when you change jobs. For example, you can:

The right choice depends on your needs, and thats a choice everybody needs to make after evaluating all of the options.

Want help finding the right place for your retirement savings? Thats exactly what I do. As a fee-only fiduciary advisor, I can provide advice whether you prefer to pay a flat fee or youd like me to handle investment management for you, and I dont earn any commissions. To help with that decision, learn more about me or take a look at the Pricing page to see if it makes sense to talk. Theres no obligation to chat.

Important:The different rules that apply to 401 and IRA accounts are confusing. Discuss any transfers with a professional advisor before you make any decisions. This article is not tax advice, and you need to verify details with a CPA and your employers plan administrator. Likewise, only an attorney authorized to work in your state can provide guidance on legal matters. Approach Financial, Inc. does not provide tax or legal services. This information might not be applicable to your situation, it may be out of date, and it may contain errors and omissions.

Next Up: Curious About Meeting?

Also Check: Where Do I Get My 401k Money

How To Roll Over Your 401 To An Ira

There are many reasons why you may have decided to make a 401-to-IRA rollover. You may have left your job for a position at a new company, you may have been laid off or you may have decided to take your career in a new direction. Regardless, if youve been contributing diligently to your employer-sponsored retirement plan for a number of years, you could have a decent stash of cash in your account. If you want help managing your retirement accounts after your rollover, consider working with a financial advisor.

Ira Rollover Vs Transfer

Although both rollovers and transfers allow you to move your retirement savings from one financial institution to another, the process for each is different, and each have different rules.

A 401 rollover occurs when you move retirement funds from an employer-sponsored plan to an IRA this is why its also called a Rollover IRA. This option is typically chosen when an employee leaves a job and is no longer contributing to the employer-sponsored retirement plan.

A Transfer is when you move your IRA to another IRA at a different institution. In the case of a transfer, funds or assets are sent between institutions, from the previous custodian or trust company to the new one. This is not only the quickest, but also the best method of moving your IRA to a self-directed IRA.

Don’t Miss: How To Create A 401k Account

Transfers From Simple Iras

You may be able to transfer money in a tax-free rollover from your SIMPLE IRA to another IRA or to an employer-sponsored retirement plan , 403, or governmental 457 plan). However, during the 2-year period beginning when you first participated in your employer’s SIMPLE IRA plan, you can only transfer money to another SIMPLE IRA. Otherwise, you are considered to have withdrawn the amount transferred and you will have to:

- include the amount in your gross income, and

- pay an additional 25% tax on this amount, unless you are at least age 59½ at the time of the transfer or you qualify for another exception to the additional tax.

After the 2-year period, you can make tax-free rollovers from SIMPLE IRAs to other types of non-Roth IRAs, or to an employer-sponsored retirement plan. You can also roll over money into a Roth IRA after the 2-year period, but must include any untaxed money rolled over in your income.

Why Should You Do A 401 To Ira Rollover

The most common reason for a 401 to IRA rollover is to consolidate one or more old 401 accounts into a single account. This frequently happens when someone switches jobs. By moving a 401 to a rollover IRA, you can keep a closer eye on your money and make it harder to forget that youve got an old 401.

The bottom line: A 401 to IRA rollover can simplify your retirement planning.

Keep in mind that you can carry out a 401 to IRA rollover at any age, regardless of whether youve recently changed jobs or whether youre still employed.

Also Check: When You Change Jobs What Happens To Your 401k

Us Gold Bureau Gold Ira Review

When creating a precious metals IRA to diversify your investment portfolio, finding a trustworthy gold IRA company can be challenging. Investors like you require a safe, secure institution with integrity that you can rely on to protect your hard-earned money and investments. At Learn About Gold, we aim to help you make informed buying decisions

How Is The Ira Tax Credit Changing

The new law will repeal and replace the IRA tax credit, also known as the “Saver’s Credit.” Instead of a nonrefundable tax credit, those who qualify for the Saver’s Credit will receive a federal matching contribution to a retirement account. This change in tax law will start with the 2027 tax year.

Congress also amended the IRS laws for retirement account rollovers from 529 plans, which are tax-advantaged savings accounts for higher education. Currently, any money withdrawn from a 529 plan that’s not used for education is subject to a 10% federal penalty.

Beneficiaries of 529 college savings accounts will be allowed to roll over up to $35,000 total in their lifetime from a 529 plan into a Roth IRA. The Roth IRA will still be subject to annual contribution limits, and the 529 account must have been open for at least 15 years.

You May Like: How To Buy A House With 401k

How To Roll Over Your 401 To A Roth Ira

Rolling over your 401 plan to a Roth IRA is a taxable event. Youll have to pay income tax on your contributions, your employer-match contributions and all earnings. Depending on the size of your account, this could push you into a much higher tax bracket, so you shouldnt proceed before youve done the math. You may also want to consult a financial advisor to make sure this move is the right one for you.

How To Complete An Ira To 401 Rollover

The first step is checking whether your employers 401 plan accepts IRA rollovers. Not all plans will allow you to roll over IRA assets. If they do, youll want to request a direct transfer to avoid any income tax or the 10% early withdrawal penalty.

If a direct transfer isnt an option, your IRA provider will send you a check for 80% of your accounts value and withhold the remaining 20% for taxes. You must deposit 100% of the value of your IRA into your 401 within 60 days or the transaction will become an early distribution, triggering the 10% penalty and income taxes. The 20% that your IRA provider withheld will serve as a tax credit when you file your tax return.

Don’t Miss: Can I Buy Stock With My 401k

How To Request A Rollover

An employers 401 plan will be rolled over with little difficulty. IRAs are opened with a financial institution, such as a bank, brokerage, or online investing platform. It would be best to inform your 401 plan administrator where you have opened the account.

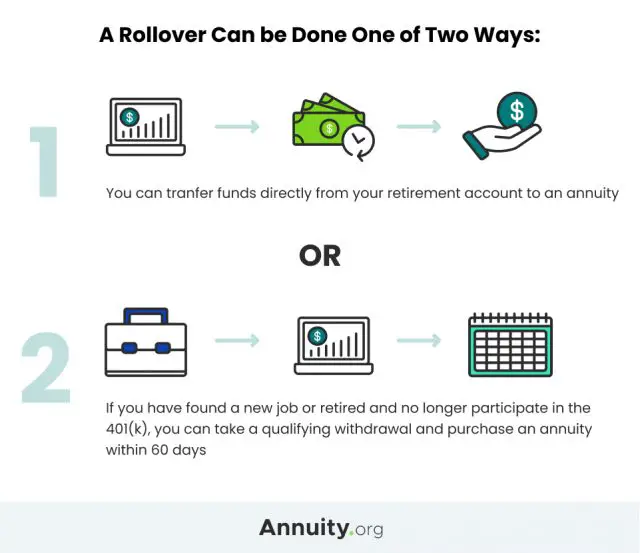

Direct rollovers and indirect rollovers are the two types of rollovers.

Move Money Into The Tsp

Whether youre a civilian employee, a member of the uniformed services, or a separated participant, you can roll over money from other eligible plans to your existing TSP account. The money will be invested according to your investment election on file. Rollovers do not count against the Internal Revenue Code limits on contributions.

Don’t Miss: How Do 401k Investments Work

Already Have An Ira With Principal

Log in to view account information online or add to your account.

Learn more about rollover IRAs:

This document is intended to be educational in nature and is not intended to be taken as a recommendation.

Investment and insurance products are:

- Not insured by the Federal Deposit Insurance Corporation or any federal government agency.

- Not a deposit, obligation of, or guaranteed by any Bank or Banking affiliate.

- May lose value, including possible loss of the principal amount invested.

The subject matter in this communication is educational only and provided with the understanding that Principal® is not rendering legal, accounting, or tax advice. You should consult with appropriate counsel or other advisors on all matters pertaining to legal, tax, or accounting obligations and requirements.

Financial professionals are sales representatives for the member of Principal Financial Group®. They do not represent, offer, or compare products and services of other financial services organizations.

Insurance and plan administrative services provided through Principal Life Insurance Co. Securities offered through Principal Securities, Inc., 800-547-7754,member SIPC. Principal Life and Principal Securities are members of Principal Financial Group® , Des Moines, IA 50392.

Principal, Principal and symbol design, and Principal Financial Group are trademarks and service marks of Principal Financial Services, Inc., a member of the Principal Financial Group®, Des Moines, IA 50392.

Pick An Ira Provider For Your 401 Rollover

When moving your money, you need to figure out which brokerage will provide you with the services, investment offerings and fees you need. If youre a hands-on investor who wants to buy assets beyond stocks, bonds, ETFs or mutual funds, you need to look for a custodian that will allow you to open a self-directed IRA. On the other hand, if youre more hands-off, it might make sense to choose a robo-advisor or a brokerage that offers target date funds.

Also Check: What Percentage Of 401k Should I Contribute

We Researched Dozens Of Gold Ira Companies So You Dont Have Toanswer These Six Questions To Find Your Match

- How much have you saved for retirement?*

- Have you invested in gold or precious metals before?*

- What is your main goal for owning gold?*

- To increase in value

-

Legal: By clicking the button See My Match, I direct Learn About Gold to share my information and give my express written consent for Learn About Gold and/or the BRAND I am matched with to call, text or email me with marketing offers or other messages regarding the products and services about which I have inquired at the phone number I have provided using an automated dialing system or otherwise. I understand that my consent is not a condition of purchase. I agree to the Terms of Use and have read the Privacy Policy and California Privacy Notice.

Do I Have To Pay Taxes When Rolling Over A 401

Whether you owe taxes on a rollover depends on whether youre changing account types . Generally, if you move a traditional 401 account to a Roth IRA, you could create a tax liability. Here are a few scenarios:

- If youre rolling over money from a traditional 401 to another traditional 401 or traditional IRA, you wont create a tax liability.

- If youre rolling over a Roth 401 to another Roth 401 or Roth IRA, you wont create a tax liability.

- However, if youre rolling a traditional 401 into a Roth IRA, you could create a tax liability.

Its also important to know that if you have a Roth 401 that has any employer matching funds in it, those matching funds are categorized as a traditional 401 contribution. So if you transfer a Roth 401 with matching funds into an IRA, youll need to create two IRA accounts a traditional IRA and a Roth IRA to avoid any tax issues during the rollover.

Of course, youll still need to abide by the 60-day rule on rollovers. That is, you have 60 days from the date you receive a retirement plan distribution to roll it over into another plan, according to the IRS. Taxes generally arent withheld from the transfer amount, and this may be processed with a check made payable to your new qualified plan or IRA account.

Don’t Miss: Can I Use My 401k To Purchase A Home

What Are The New Rules For Early Withdrawals From Retirement Accounts

The Secure 2.0 Act of 2022 includes several rule changes that will benefit Americans who need to withdraw money early from their retirement accounts. Normally, withdrawals from retirement accounts made before the owner of the account reaches 59 and a half years old are subject to a 10% penalty tax.

First, Congress added a basic exception for emergencies. Account holders who are younger than 59 and a half can withdraw up to $1,000 per year for emergencies and have three years to repay the distribution if they want. No further emergency withdrawals can be made within that three-year period unless repayment occurs.

The new law also specifies that employees will be allowed to self-certify their emergencies — that is, no documentation is required beyond personal testimony. The law will also eliminate the penalty completely for people who are terminally ill.

Americans impacted by natural disasters will also get some relief with the changes. The new rules will allow up to $22,000 to be distributed from employer plans or IRAs in the case of a federally declared disaster. The withdrawals won’t be penalized and will be treated as gross income over three years. The rule will apply to all Americans affected by natural disasters after Jan. 26, 2021.

Tax Consequences Of A 401

As mentioned above, you generally wont have to pay any taxes on your 401-to-IRA rollover. The only time youll have to deal with taxes is if you have a traditional IRA and want to roll over to a Roth IRA.

One other tax consideration: You can choose to do a direct or indirect rollover. For a direct rollover, your old plan sends the money directly into your new IRA. In an indirect rollover, your old plan sends you a check with the cash and withholds 20% of your funds. These withheld funds are a taxable distribution unless you make up the difference out of pocket. Youll likely have to pay a 10% fine for the early withdrawal. This rule only applies if the check is sent directly to you, though. It doesnt matter if your old plan sends you a check to forward to your new IRA.

Don’t Miss: How To Transfer Voya 401k To Fidelity

Are There Any Downsides To 401

You might lose some protection against creditors. Additionally, you forfeit the ability to access 401 money penalty-free if you separate from your employer at 55 or older. You can, however, still access money for certain eligible purchases and life events, regardless of whether its in a 401 or IRA.

What Spouses Should Know

If you are the spouse of someone who plans to roll over their 401 balance to an IRA, be aware that you’d lose the right to be the sole heir of that money. With the workplace plan, the beneficiary must be you, the spouse, unless you sign a waiver.

Once the money lands in the rollover IRA, the account owner can name any beneficiary they want without their spouse’s consent.

Here’s another potential misstep: Making a withdrawal from your 401 to give to your ex-spouse as dictated in a divorce agreement. That won’t work the money will be considered a distribution to you, subject to taxation, as well as potentially a penalty if you’re under age 59½.

In a divorce, retirement assets that are awarded to the ex-spouse can only be distributed penalty-free via a qualified domestic relations order, or QDRO. That document is separate from the divorce decree and must be approved by a judge.

Also Check: Should I Convert My 401k To An Ira

A Rollover Or Transfer Ira May Be Right For You If You Want

Streamlined account management

Access your accountswhenever you need to, however you want. Whatever your preferences, you can securely manage and monitor your accountsalmost anytime, anywhere.

A centralized view of your investments

Whether youre saving for future education, saving for a major life event, or simply want to build your wealth over time, you can invest all your goals in one place.

Ongoing tax-deferred growth potential

Choose an option that allows you to continue to benefit from your savings tax-advantaged status and increase the growth potential of your wealth.

Additional select client benefits

As your assets with us increase, so will your benefits. All our clients enjoy a competitive list of benefits aligned to your investment tier.