How Long Does It Take To Cash Out A 401 After Leaving A Job

Depending on who administers your 401 account , it can take between three and 10 business days to receive a check after cashing out your 401. If you need money in a pinch, it may be time to make some quick cash or look into other financial crisis options before taking money out of a retirement account.

How To Roll Over A 401 Into A New Retirement Account

Kenadi Silcox15 min read

So youve your old employer-sponsored 401 balance into a new account. Now comes the tricky part: deciding where your savings should go and figuring out how to actually get it from one account provider to another without doing damage to your wallet.

Heres everything you need to know about rolling over a 401, from beginning to end:

How To Take Money Out Of Your 401

There are many different ways to take money out of a 401, including:

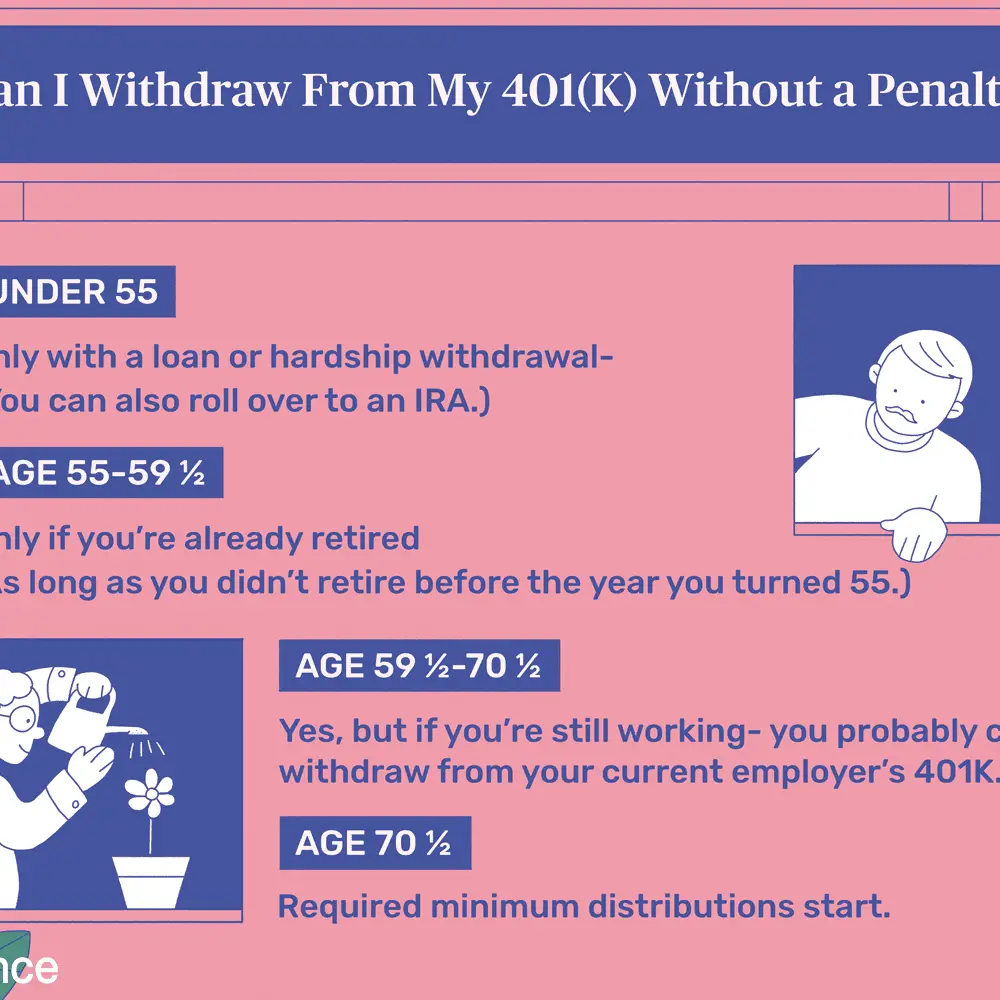

- Withdrawing money when you retire: These are withdrawals made after age 59 1/2.

- Making an early withdrawal: These are withdrawals made prior to age 59 1/2. You may be subject to a 10% penalty unless your situation qualifies as an exception.

- Making a hardship withdrawal: These are early withdrawals made because of immediate financial need. You may be still be penalized for them.

- Taking out a 401 loan: You can borrow against your 401 and will not incur penalties as long as you repay the loan on schedule.

- Rolling over a 401: If you leave your job, you can move your 401 into another 401 or IRA without penalty as long as the funds are moved over within 60 days of your distribution.

Recommended Reading: How Much Do I Need To Withdraw From My 401k

Don’t Miss: How Do I Find Out Who My 401k Is With

Advantages Of Rolling Over Your 401

1. You can consolidate your 401 accounts

Especially if you change jobs often, you might find yourself with many 401 accounts scattered around. The more accounts you have, the harder it may be to actively make decisions. By having your retirement funds all in one place, you may be able to manage them more carefully.

2. Youll have more investment choices in an IRA

With your 401, you are restricted to the investment and account options that are offered in that plan. An IRA can give you a more diverse option of items to invest in. In an IRA you may be able to invest in individual stocks, bonds or other vehicles that may not be available in your 401.

You cant add to the 401 at your previous employer. But if you roll this money over into a traditional IRA, you can add to that traditional IRA over time, up to the annual maximum. Youll have to follow the IRA contribution guidelines.

3. Youll have the choice to bring the account anywhere youd like

With an IRA, you can take your money with you to any advisor, if you already have a financial advisor or financial planner that you work with, for example. Or maybe you already have a brokerage where some of your money is being managed, and you want all your funds there.

Net Unrealized Appreciation And Company Stock In A 401

If you have company stock in a 401, it could save you significant money on taxes to transfer those shares into a taxable brokerage account to take advantage of net unrealized appreciation, or NUA. NUA is the difference between what you paid for company stock in a 401 and its value now.

For example, if you paid $20,000 for company stock and its now worth $100,000, the NUA is $80,000.

The benefit of the NUA approach is that it helps you avoid paying ordinary income tax on these distributions of your own companys stock from your retirement account. That can be up to 37 percent, which is now the highest tax bracket, says Landsberg.

Instead, youll enjoy capital gains tax treatment, which even at the highest tax bracket is only 20 percent. High earners, however, will be subject to a bonus 3.8 percent net investment income tax. And an NUA may be subject to a 10 percent early withdrawal tax if you move funds prior to age 59 1/2.

Landsberg says NUA makes the most sense when the difference in tax rates is higher.

Net unrealized appreciation is a very powerful tool, if used correctly, Landsberg says. So you can get creative and potentially have a pretty nice windfall if you use the NUA rules correctly.

Read Also: Does A 401k Have To Be Through An Employer

Why It Works To Move Your Retirement Plan To A Self

There are numerous reasons people choose to transfer and/or rollover their retirement account to a self-directed IRA. The main reason is to protect their savings from a volatile stock market or unpredictable changes in the economy. By diversifying their investments, they have a greater opportunity to stay on track with their retirement goals.

Self-directed IRAs are also known to perform much better than stocks and bonds. A recent examination of self-directed investments held at IRAR suggests that investments held for 3 years had an ROI of over 23%. This is why most investors are self-directing their retirement.

Why Move Your Old 401

Your previous employer could require you to move your 401 out of their plan. They may not want to manage the cost and administrative work of letting you maintain your account after you leave. In this case, you would have to move your savings somewhere else.

Even if you can keep money in the old 401, there are advantages to consolidating your savings into your new retirement account.

Life happens and people do forget about money in old retirement plans. In fact, the National Registry of Unclaimed Retirement Benefits is a free resource that can help you locate lost or forgotten benefits. By rolling over to your current 401, you don’t risk losing track of an old account.

MORE What Happens to Your 401 When You Leave a Job?

Also Check: How To Find A Deceased Person’s 401k

Make The Best Decision Based On Your Needs

When it comes to deciding what to do with an old 401, there may be factors that could be unique to your situation. That means the best choice will be different for everyone. One thing to remember is that the rules among retirement plans vary, so its essential to find out the rules your former employer has and the rules at your new employer.

Do also compare the fees and expenses associated with the accounts youre considering. If you find it confusing or overwhelming, contact us and we can help answer questions you may have about the rollover process.

Roll Over Your 401 To An Ira

This option makes sense if you want to roll over your 401 and you want to avoid a taxable event. If you have an existing IRA, you may be able to consolidate all of your IRAs in one place. And an IRA gives you many investment options, including low-cost mutual funds and ETFs.

There are plenty of mutual fund companies and brokerages that offer no-load mutual funds and commission-free ETFs, says Greg McBride, CFA, Bankrate chief financial analyst.

You also want to just make sure that youre satisfying any account minimums so that you dont get dinged for an account maintenance fee for having a low balance, McBride says. Index funds will have the lowest expense ratios. So theres a way that you can really cut out a lot of the unnecessary fees.

Check with your IRA institution first to ensure that it will accept the kind of rollover that you would like to make.

The letter of the law says it is OK . But in practice, your 401 plan may not allow it, says Michael Landsberg, CPA/PFS, principal at wealth management firm Homrich Berg.

Recommended Reading: Does My Employer 401k Match Count Towards Limit

Option : Do Nothing And Leave The Money In Your Old 401

Now, you could just leave the money in your old 401 if youre really happy with your investments and the fees are low.

But thats rarely the case. Most of the time, leaving your money in an old 401 means youll have to deal with higher fees that cut into your investment growth and settle for the limited investment options from your old plan. Most people come out way ahead by doing a direct transfer rollover to an IRA .

Pros And Cons: 401 Vs Ira

401 Pros |

|

|---|---|

|

|

|

|

You May Like: Who Has The Best Solo 401k

How 401 Rollovers Work

If you decide to roll over an old account, contact the 401 administrator at your new company for a new account address, such as ABC 401 Plan FBO Your Name, provide this to your old employer, and the money will be transferred directly from your old plan to the new or sent by check to you , which you will give to your new companys 401 administrator. This is called a direct rollover. Its simple and transfers the entire balance without taxes or penalty.

Another, even simpler option is to perform a direct trustee-to-trustee transfer. The majority of the process is completed electronically between plan administrators, taking much of the burden off of your shoulders.

A somewhat riskier method is the indirect or 60-day rollover in which you request from your old employer that a check be sent to you made out to your name. This manual method has the drawback of a mandatory tax withholdingthe company assumes you are cashing out the account and is required to withhold 20% of the funds for federal taxes. This means that a $100,000 401 nest egg becomes a check for just $80,000 even if your clear intent is to move the money into another plan.

Cashing Out Your 401k

As explained above, you can cash out all or part of your 401k if you want. However, we generally dont recommend cashing out your 401k if you are younger than 59½ due to the current taxation and 10% penalty that will be assessed.

However, if a portion of your 401k is invested in company stock, then cashing out a portion could make sense. The reason? Company stock has different tax treatment if its taken out as a lump sum distribution from a 401k. Typically, whether you withdraw money from a 401k as a lump sum distribution or as income during retirement, you pay tax on all of your withdrawals at ordinary income rates. Gains that came from appreciation and income, therefore, have the same tax treatment.

Company stock, on the other hand, can be distributed from a 401k as a lump sum and the ordinary income tax rate will be applied only to the cost basis of the stock. Any growth in your company stock is considered net unrealized appreciation, or NUA. Youll only pay tax on your NUA once you sell the stock, and if you sell it a year after taking the lump sum distribution, youll be taxed at long-term capital gains rates.

There are some other requirements that must be met as part of the NUA rules. First, within one year, you must distribute the entirety of the vested balance held in the plan, including all assets from all of the accounts sponsored by the same employer.

Don’t Miss: How To Take Money Out Your 401k

Keep Tabs On The Old 401

If you decide to leave an account with a former employer, keep up with both the account and the company. People change jobs a lot more than they used to, says Peggy Cabaniss, retired co-founder of HC Financial Advisors in Lafayette, California. So, its easy to have this string of accounts out there in never-never land.

Cabaniss recalls one client who left an account behind after a job change. Fifteen years later, the company had gone bankrupt. While the account was protected and the money still intact, getting the required company officials and fund custodians to sign off on moving it was a protracted paperwork nightmare, she says.

When people leave this stuff behind, the biggest problem is that its not consolidated or watched, says Cabaniss.

If you do leave an account with a former employer, keep reading your statements, keep up with the paperwork related to your account, keep an eye on the companys performance and be sure to keep your address current with the 401 plan sponsor.

Keeping on top of how the plan is performing is important, as you may later decide to do something different with your hard-earned money.

What Happens If You Cash Out Your 401

If you withdraw 401 money before age 59 ½, you could face a 10% penalty from the IRS on top of paying applicable income taxes. There are some exceptions, such as if you leave your job at age 55 or later or if you make a hardship or other eligible withdrawal, but its a good idea to consult a tax professional before cashing out your 401.

No matter when you cash out your 401, though, you may owe income tax on what you withdraw if its a traditional account or investment earnings in a Roth account that you didnt start contributing to at least five years before.

Read Also: Can They Take Your 401k If You File Chapter 7

What If You Have An Existing 401 At Your Previous Employer

If you have a 401 at a previous employer, youll want to consider whether a rollover makes sense for you. You may want to consult with a tax professional to make sure that you are making a decision that is best for your unique circumstances.

As youre thinking about what to do with your old 401, here are some options to consider:

Where Should You Transfer Your 401

You have several options on what to do with your 401 savings after retirement or when you change jobs. For example, you can:

The right choice depends on your needs, and thats a choice everybody needs to make after evaluating all of the options.

Want help finding the right place for your retirement savings? Thats exactly what I do. As a fee-only fiduciary advisor, I can provide advice whether you prefer to pay a flat fee or youd like me to handle investment management for you, and I dont earn any commissions. To help with that decision, learn more about me or take a look at the Pricing page to see if it makes sense to talk. Theres no obligation to chat.

Important:The different rules that apply to 401 and IRA accounts are confusing. Discuss any transfers with a professional advisor before you make any decisions. This article is not tax advice, and you need to verify details with a CPA and your employers plan administrator. Likewise, only an attorney authorized to work in your state can provide guidance on legal matters. Approach Financial, Inc. does not provide tax or legal services. This information might not be applicable to your situation, it may be out of date, and it may contain errors and omissions.

Next Up: Curious About Meeting?

Read Also: Can You Get A 401k On Your Own

Option : Roll Over The Money Into Your New Employers Plan

Rolling your money over to your new 401 plan has some benefits. It simplifies your investments by putting them in one place. And you also have higher contribution limits with a 401 than you would with an IRAwhich means you can save more!

But there are lots of rules and restrictions for rolling money over into your new employers plan, so its usually not your best bet. Plus, your new 401 plan probably only has a handful of investing options to choose from too. And if youre feeling iffy about those options, why put all your retirement savings there? Which brings us to . . .

You Have Three Basic Choices For An Old 401

Broadly speaking, you have several options for your old 401. You may be able toleave it where it is, roll it into your new workplace plan or an individual retirement account, or cash it out although experts generally caution against the third move.

Cashing out “is the least desirable option,” said Eric Amzalag, a certified financial planner and owner of Peak Financial Planning in Canoga Park, California.

More from Personal Finance:Overconfidence in investing can be costly

For starters, he said, you’d face paying taxes on the distribution unless it’s post-tax money you put in a Roth 401. With some exceptions, you’ll typically also pay a 10% tax penalty if you’re younger than age 59½, which is when withdrawals from 401s and other retirement accounts can begin.

“If the account size is large, it could push the individual into a high tax bracket, causing the funds to be taxed at a higher and disadvantageous rate,” Amzalag said.

Don’t Miss: How To Start A 401k At Work