Consider Contributing To An Ira Up To The Maximum

Another retirement savings option is an individual retirement account . These are not connected to an employer, and you can contribute in addition to your employers plan.3

There are several IRA options, with different benefits and requirements. You can contribute to 1, 2, or even all 3, as long as your combined contributions dont go beyond either your earned income or what the IRS allows.

FAQ: How do I choose an IRA? It depends on what youre looking for, but there are a few ways to narrow it down. A rollover IRA is where you can move your old workplace plans, but you can also contribute to it yourself once its set up. A Roth IRA and traditional IRA are quite different from each other, so you might want to check out this handy comparison chart.

Also Check: How Do I Find An Old 401k

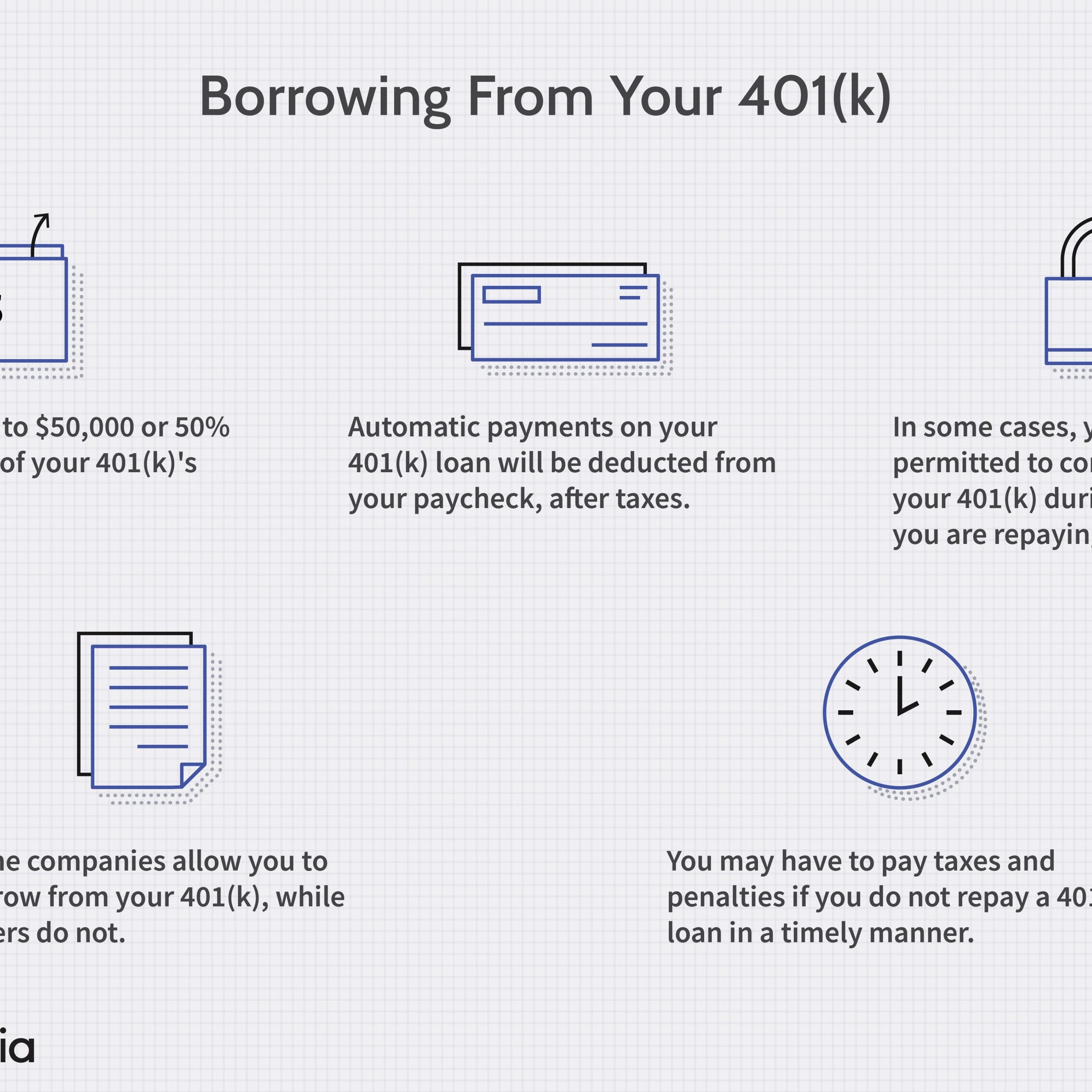

How Long Do You Have To Repay A 401 Loan

You generally have up to five years to repay your 401 loan, and you must make at least quarterly repayments. You may be able to get longer loans under special circumstances, like when you use a 401 loan for your primary residence. Your employer may set different terms for any of the above, so make sure to check with your plan administrator before you withdraw money from your 401.

Regardless of the requirements of your plan and company, you may choose to make more frequent repayments or to borrow money for a shorter amount of time. Paying off a 401 early minimizes the opportunity cost of having money not compound in your retirement accounts. It also helps protect you from the consequences of not repaying a 401 loan if you suddenly lose your job.

Remember: Your company determines when you must repay your 401 loan by if youâre no longer employed. While your company may allow repayment up until you file taxes for the current year, you must repay your loan by then. Otherwise, you may owe taxes or an early withdrawal penalty on the amount you borrowed.

How Can Paying Off Student Loan Debt Soon Help Save For Retirement

One of the more revolutionary changes included in the Secure 2.0 Act of 2022 is the option for employer plans to credit student loan payments with matching donations to 401 plans, 403 plans or Simple IRAs. Government employers will also be able to contribute matching amounts to 457 plans.

This means that people with significant student loan debt can still save for retirement just by making their student loan payments, without making any direct contributions to a retirement account. The new regulation will take effect in 2025.

You May Like: How Long Will My 401k Last When I Retire

Can You Borrow From Your 401

Plan offerings: Before you count on a loan, verify that you actually can borrow from your 401 under your plans rules. Not every plan allows loans its just an option that some employers offer and theres no requirement that says 401 plans need to have loans. Some companies prefer not to. Employers might want to discourage employees from raiding their retirement savings, or they may have other reasons. For example, they dont feel like processing loan requests and repayments. How do you find out if you can borrow from your 401 plan? Ask your employer, or read through your plans Summary Plan Description . If loans are not allowed, there might be other ways to get money out.

Former employees: 401 loans are generally only allowed while youre still employed. If you no longer work for the company, youd have to take a distribution from the plan instead. Former employees dont have any way to repay the loan: You cant make payments through payroll deduction because youre not on the payroll any more.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Also Check: Why You Should Rollover Your 401k

Retirement Account Changes: How New Rules Will Impact Your Ira And 401

The congressional spending bill for 2023 includes more than 90 changes to retirement account rules.

After much debate and many delays, the US Congress agreed on a $1.7 trillion spending bill for 2023 to avoid a partial government shutdown. Along with keeping the federal government operational, the law, signed by President Joe Biden on Dec. 29, 2022, also makes significant changes to the rules for retirement accounts like 401 plans, IRAs and Roth IRAs.

These new changes to retirement regulations follow in line with the amendments of the Secure Act of 2019 and are collectively called the Secure 2.0 Act of 2022.

The biggest changes for most Americans with retirement accounts are the extension of the age for required minimum distributions and increased “catch-up” limits for people over 60. But there are more than 90 different retirement changes overall in the giant spending package.

With Biden’s signing, some retirement account changes will take effect immediately, while others will start beginning 2024. Here’s what you need to know.

How Much Can You Borrow From Your 401

In general, you can borrow the greater of $10,000 or 50% of your vested account balance up to $50,000. You are limited to the balance in your current companyâs 401, not the collective balance of all of your retirement accounts. You may, however, be able to roll over funds into your current 401 to increase the amount you can borrow. You are limited to borrowing from the assets in your current employerâs 401 plan.

Also Check: How To Invest In A 401k For Dummies

Whats The Average Interest Rate On A 401 Loan

Loan terms and rates are determined by your plan administrator your employer, in other words. The interest rates on most 401 loans is prime rate plus 1% or 2%. The prime rate as of September 2022 is 5.5%.

Since youre borrowing your own money, the interest isnt paid to a lender. Instead, the interest is paid back into your 401 account.

Dont Miss: How To Pull Money From A 401k

Consider Converting Your 401 To An Ira

Individual retirement accounts have slightly different withdrawal rules from 401s. So, you might be able to avoid that 10% 401 early withdrawal penalty by converting your 401 to an IRA first. s and IRAs, of course.) For example:

-

Theres no mandatory withholding on IRA withdrawals. That means you might be able to choose to have no income tax withheld and thus get a bigger check now. You still have to pay the tax when you file your return, though. So if youre in a desperate situation, rolling the money into an IRA and then taking the full amount out of the IRA might be a way to get 100% of the distribution. This strategy may be valuable for people in low tax brackets or who know theyre getting refunds.

You May Like: How To Hide 401k In Divorce

You Put Your Retirement Savings At Risk

There are many reasons folks end up taking out a 401 loan, from covering the cost of an emergency to wiping out credit card debt. According to the Ramsey Solutions 2021 Q1 State of Personal Finance study, more than half of those who borrowed money from a 401 in the past year said they did so to cover basic necessities.

But heres the deal: Your 401 is for retirement, not for emergencies, getting rid of debt or going on vacation. When you turn to your 401 for help now, youre putting your retirement future at risk.

Borrowing as little as $10,000 from your 401 when youre 25 years old, for example, could set your retirement back several years and cost you hundreds of thousands of dollars in your nest egg down the linemaybe more.

In fact, a whopping 7 out of 10 people who borrowed money from their account in the past year because of COVID-19 said they regretted that decision.4On top of that, more than half of Americans now feel they are behind on their retirement goals.5

What Tax Form Do You Use To Show You Repaid Your 401 Loan

You dont need to report a 401 loan or your repayments. The IRS generally doesnt know about your 401 loan unless you default and your plan issues a 1099-R.

Keep detailed records of your loan and repayments, such as confirmation letters and account statements, in case of any problems.

Thanks for reading.

If you found this post useful, please help others find it by sharing on social or linking from your blog.

Also Check: Is 401k Divided In Divorce

How To Withdraw From A Fidelity 401k

The Fidelity suite of products offer a wide range of services that help individuals do everything from saving for retirement to investing extra money to trade on the stock market. Fidelity manages employer-sponsored 401 plans and offers its own self-employed and small business 401 plans. Customers with a Fidelity 401 can withdraw money from the account, but they should be aware of the tax implications of early withdrawal.

Dont Miss: What To Do With 401k When You Retire

Retirement Savings Can Benefit

As you make loan repayments to your 401 account, they usually are allocated back into your portfolio’s investments. You will repay the account a bit more than you borrowed from it, and the difference is called “interest.” The loan produces no impact on your retirement if any lost investment earnings match the “interest” paid ini.e., earnings opportunities are offset dollar-for-dollar by interest payments.

If the interest paid exceeds any lost investment earnings, taking a 401 loan can actually increase your retirement savings progress. Keep in mind, however, that this will proportionally reduce your personal savings.

Don’t Miss: How Do You Get Your 401k After Being Fired

What Are The Pros And Cons Of Withdrawal Vs A 401 Loan

A withdrawal is a permanent hit to your retirement savings. By pulling out money early, youll miss out on the long-term growth that a larger sum of money in your 401 would have yielded.

Though you wont have to pay the money back, you will have to pay the income taxes due, along with a 10% penalty if the money does not meet the IRS rules for a hardship or an exception.

A loan against your 401 has to be paid back. If it is paid back in a timely manner, you at least wont lose much of that long-term growth in your retirement account.

The True Cost Of A 401 Loan

Any money you borrow from your retirement fund misses both market gains and the magic of compound interest.

Just imagine taking out a five-year 401 loan during this current bull market at 30 or 35 years old it could severely impact your future nest egg, says Malik Lee, a certified financial planner at Henssler Financial in Kennesaw, Georgia.

According to Vanguards 401 loan calculator, borrowing $10,000 from a 401 plan over five years means forgoing a $1,989 investment return and ending the five years with a balance thats $666 lower.

But the cost to your retirement account doesnt end there. If you have 30 years until retirement, that missing $666 could have grown to $5,407, according to NerdWallets compound interest calculator .

Moreover, many people reduce their 401 contributions while making payments on a loan from the plan. In fact, some plans prohibit contributions when a loan is outstanding. This further damages retirement plans.

Recommended Reading: What Is The Best Percentage To Put In 401k

Should You Take A 401 Loan Or 401 Withdrawal

Some plans allow loans from 401 plans as an option to get access to the fund for virtually any purpose. Maybe you want to travel, pay your childs college tuition, put a down-payment on a new house, or cover the cost of a divorce. There are many personal reasons to consider a loan.

Generally, you can take up to 50% of the balance to a maximum of $50,000. The good news is that there is no age restriction, and there are no taxes due when you take out a loan. However, the loan must be repaid over a five-year period, with interest owed back to your account.

There is risk involved in taking out a loan. Some plans allow you to roll over a 401 when changing employers. However, in other cases, you may have to pay your outstanding loan balance in full within 60 days of leaving an employer otherwise, it will be considered a 401 withdrawal, taxed as ordinary income and subject to the 10% withdrawal penalty.

Compared to a loan, an early 401 withdrawal:

- Must have an option that allows for in-service withdrawals, which may be restricted by age or hardship.

- Will be taxed as ordinary income .

- Can be subject to a 10% penalty if youre under 59.5 .

- Will not require repayment loan).

Its Quick And Convenient

A person can easily procure 401K loans. They generally do not require any sort of application or credit check and therefore do not negatively affect your credit score. In addition, many 401Ks allow you to request a loan easily on their website, with funds available to you within a few days.

Some companies have even implemented the use of debit cards, making your loans available instantly. As long as you follow all 401K withdrawal rules, you will avoid a penalty for withdrawing from the 401K early.

Read Also: Can You Roll Your 401k Into A Roth Ira

Should I Convert My 401 Into A Gold Ira

If you no longer have earned income as an early retiree and can no longer contribute to my company 401, converting your 401 to a Gold IRA may be a good idea. For those of you who are transitioning to a new job, rolling over your 401k to a Gold IRA is also a good idea.

Even though a 401 may provide about 40 or so mutual fund choices provided across various sectors, countries, and asset classes, it may not be enough for what you want to do with your overall retirement plan. With a Gold IRA, youve got plenty more investment options.

If you are ready to rollover your 401 or even a Fidelity 401 to a Gold IRA, view our List of Top 10 Gold IRA Companies and see why it you should choose to work with the most trusted IRA Custodian in the industry, Regal Assets.

Do you have any questions on what is the best way to rollover your Fidelity 401 to a Gold IRA? Ask below!

Dont Miss: How Do I Start My 401k Plan

Ways To Help Manage A Margin Line Of Credit

To ensure that youre using margin prudently, it may be possible to manage your margin as a line of credit by employing the following strategies:

- Have a plan. You should never borrow more than you can comfortably repay. Think about a process for taking out the loan and ensuring that it aligns with your financial situation, and consider how youll respond in the event of various market conditions. Among other things, you should know how much your account can decline before being issued a margin call. Find out more on managing margin calls

- Set aside funds. Identify a source of funds to contribute to your margin account in the event that your balance approaches the margin maintenance requirement. This can be anything from cash in another account to investments elsewhere in your portfolio .

- Monitor your account frequently. Consider setting up alerts to notify you when the value of your investments declines by an amount where you need to start thinking about the possibility of a margin call.

- Pay interest regularly. Interest charges are automatically posted to your account monthly. Its important to have a plan for reducing your margin balance to minimize the interest amount youre charged which you can do by selling a security or depositing cash into your account.

You May Like: What To Do With 401k When You Quit Your Job

How Long Does It Take For Your 401 Withdrawal To Get To Your Bank

Moving money from a 401 to a bank account is simple enough, given youre over the penalty-free minimum withdrawal age of 59 ½ years old. However, just how long it takes for the money to actually reach you varies. Depending on how your companys 401 is structured, the reason for your withdrawal and several other factors, it could take up to a week or more to receive your 401 withdrawal.

Tip

It takes up to a week for your 401 withdrawal to process, and you could then get a direct deposit within one or two business days or wait longer for a check to come in the mail.