Getting Your Solo 401 Started

Once you have established the type of plan you want, you will need to create a trust that will hold the funds until you need them or you reach retirement age. You can select an investment firm, online brokerage, or insurance company to administer the plan for you.

You also need to establish a record-keeping system, so that your investments are accounted for properly.

How It Works: Solo 401 Contributions

Its important to re-stress that the Solo 401 allows for contributions from both the employee and the employer, acknowledging that both people are the same person, the self-employed business owner .

At the employee level, the participant is permitted to contribute up to 100% of their earned income or net income into the plan. However, there is a statutory cap on the employee contribution each year.

In 2022, that cap sits at $20,500. If the participant is over the age of 50 when they open their account, they are permitted to contribute up to an additional $6,500 as a catch-up contribution.

A spouse who works for you and earns compensation also has the same employee contribution limit.

At the employer level, the annual profit-sharing contribution is set at up to 25% of the employees earned income or $40,500.

Between the employee and employer amounts combined, the maximum contribution any participant can make is set at $61,000 in 2022, plus any portion of the $6,500 amount related to the over 50 catch-up provisions.

All contributions are usually made from pre-tax earnings , making the contributions tax-deferred.

In other words, the participant will not have to pay taxes on the income they contribute until those monies are taken as distributions.

Note: Contributions can be made at any time during the tax year. That includes going into the next year up until the point the individual files their tax return.

Read Also: How Do I Get A Loan From My 401k

Make Contributions To Your Solo 401

Once the account is opened, it can be funded. Most providers accept checks, wire transfers, or automated clearing house payments to fund the solo 401. You can fund the account monthly or in a lump-sum payment.

The IRS allows you to contribute up to $20,500 from your salary if youre younger than 50 years old. If youre 50 or older, you can contribute up to $27,000). The second part comes from employer profit-sharing contributions of up to 25% of your net self-employment income.

The IRS limit on compensation used to determine your contribution is $305,000 in 2022. Consult your tax advisor to develop an optimal strategy thats IRS-compliant. Penalties for excessive contributions are applied in the year the contribution is made and when the money is distributed, so its essential to get your contribution correct.

Once your account reaches $250,000 in assets, youll have new requirements, including filing IRS Form 5500. If you ever hire employees who become eligible for your plan, youll need to make adjustments to accommodate these new participants.

Also Check: How To Collect Your 401k

Contribute To An Ira And Solo 401k Plan

QUESTION 1: Can I make both solo 401k and Traditional IRA contributions for the same year?

ANSWER: Yes you can contribute to both your solo 401k plan and your IRA in the same year. However, the IRA contributions may not be fully tax deductible since you are also contributing to a solo 401k plan. It comes down to your modified AGI which means you may be able to deduct some of your IRA contribution. for the AGI chart.

Other Financial Benefits Of A Solo 401

The solo 401 can be an excellent choice for those with a side gig as well, especially if theyre already able to live comfortably on their main salary. With the solo 401 you can go above the usual limits of a 401.

While you may contribute to multiple 401 accounts, your total employee contribution to all types of 401s may not exceed the annual maximum contribution, that is, $20,500 in 2022.

But the solo 401 can be valuable even if you already have a 401 plan and even if youve maxed out that other plan for a given year. Thats because you can still make an employer contribution, allowing you to exceed the smaller employee-only contribution amount. So the solo 401 allows you to save more with the employer contribution, reducing your business taxes.

Another benefit of the solo 401 is that it doesnt prevent you from taking advantage of other retirement plans such as the IRA. You can still contribute up to the annual maximum there. If youre an individual looking to set up a traditional IRA or Roth IRA, then youll want to look at the benefits of those plans.

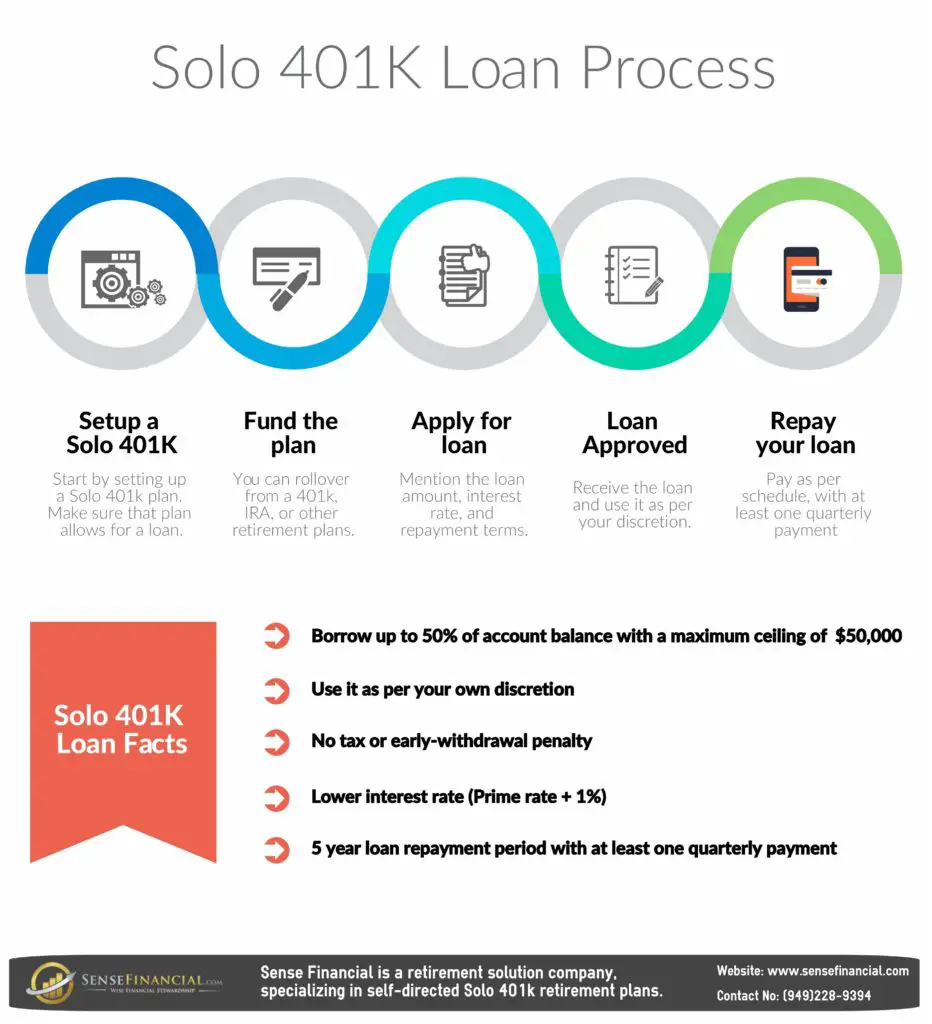

Like the typical 401 plan, the solo 401 also allows you to take out a loan against your account. loan.)

While I generally encourage clients to avoid that strategy, it can come in handy at times, Conroy says.

Don’t Miss: What To Do With 401k After Layoff

What Are The Benefits Of A Solo 401

Unlike other options, a Solo 401 account holder can choose between a traditional option and a Roth option. The traditional option allows you to deduct the amount you pay in from your income for that year, giving you an immediate tax break. With the Roth option, the income taxes on that money is paid immediately and you owe no taxes when you withdraw the funds.

The Solo 401 has far higher annual contribution limits than a plain-vanilla IRA, although that is also true for the SEP IRA and the Keogh plan.

The Solo 401 allows you to take loans from your account before you retire. This is not an option with many other retirement plans.

Finally, the Solo 401 is relatively straightforward in terms of paperwork, as it is designed for one-person shops, not corporations.

Looking For A Financial Advisor

Get In Touch With A Pre-screened Financial Advisor In 3 Minutes

That may be just as well because many financial advisors feel its a good idea to hedge your bets for any tax scenario by investing in a mix of pre-tax and after-tax retirement accounts. room for strategy in the future, says Shon Anderson, a certified financial planner in Dayton, Ohio. Ultimately, the choice of whether to invest your money in a traditional solo 401 versus a Roth solo 401 is a matter of age, income, location and preference.

Recommended Reading: How To Start A 401k For My Company

In South Florida Microschools Are Reshaping K

Talk with your tax-planning financial planner and CPA to determine how much you and your small business can contribute to a Solo 401 in 2022. Your employer contribution limit will depend on your net income, your age in 2022, and your business structure. As an employee, you can contribute 100% of your income up to the $20,5000 limit. The additional catch-up contribution is only available to those who are 50 or older at some point in 2022.

The Modern Small Business Owner Is Lean And Efficient

While employment offered stability for factory workers and factory owners in the Industrial Era, employment has many disadvantages in the modern Information Era.

Disadvantages of employment to the worker now include:

- Employment is becoming harder and harder to find

- Over 70% of college graduates today will not work in their field of study

- Employees get less tax deductions

- Employees usually have their retirement money locked up in the stock market, leaving their financial future at high risk

- Employees in the Information Era are less likely to have career stability because their employers are less lean and efficient than modern small businesses

Disadvantages of employment to the business owner now include:

- Its harder to attract great staff because with employment more money goes to taxes and less goes to the staffs take-home paycheck

- Its nearly impossible to provide powerful retirement and investment tools to employees

- Its more difficult to compete with lean and efficient companies and respond to changes in the marketplace with employees

Recommended Reading: How To Grow My 401k Faster

How Does A Solo 401 Lower Your Tax Bill

Your contributions to a Solo 401 are made pre-tax. You won’t owe income taxes on the funds you contribute to your retirement plan.

The goal would be to make contributions today when you are in a higher tax bracket. Later, take distributions and pay taxes when you may be in a lower tax bracket. Funds will need to stay in the Solo 401 retirement account until you reach the age of 59 ½, or your withdrawals will be taxable and incur an additional 10% early withdrawal penalty.

How To Set Up A Solo 401 In 5 Steps

Matt has more than 10 years of financial experience and more than 20 years of journalism experience. He shares his expertise in Fit Small Business financing and banking content.

A solo 401, also known as a one-participant 401 plan, is a retirement plan allowing self-employed individuals to contribute up to $61,000 per year before taxes, including $20,500 of employee contributions. The business owner contributes as both the employer and employee in this type of retirement plan.

Setting up a solo 401 requires five steps, ranging from understanding how a solo 401 works to funding the account. First, you need to make sure youre eligible for a solo 401, which requires an employer identification number . Then, choose a solo 401 provider, which will give you a plan adoption agreement and an application. Once those are completed, you can open your account. The last step is to set up your contribution amounts and choose your investment options.

If youre looking for an excellent digital-only 401 provider, is a great choice. ShareBuilder offers low-cost retirement plans, making it easy and affordable for businesses of all sizes to open an account. The company also offers other types of 401 plans in the event your company expands in the future. Visit ShareBuilder 401ks website for more information.

Recommended Reading: Can You Withdraw Your 401k If You Quit Your Job

How To Lower Your Small Business Taxes With A Solo 401

Saving Solo: Keep reading to find out how you can reduce your small business taxes with a 401 Retirement Plans for the Self-Employed. Often called a Solo 401 or Individual 401 this tax saving retirement plan can help you slash your tax bill this year and into the future. Not to mention stay on track for your retirement goals. California business owners in the highest income tax brackets could save several hundred thousand dollars in taxes over the next decade when maxing out a solo 401.

What solopreneurs, freelancers, and small business owners need to know and need to do to fund their retirements utilizing a solo 401 Plan. You wont get a current tax deduction but a Roth Solo 401 can help lower your taxes in retirement.

Update: Contributions limits have increased for 2022 to a total of $61,000. Plus an additional $6500 catch-up contribution if you 50 or older. The TCJA Tax Plan makes these plans even more valuable for many small business owners. Defined Benefit Contribution Limits have also increased for 2022. Talk to your Fabulous Financial Planner and CPA about the 20% pass-through tax break.

If nothing else these retirement plans can help you minimize your current tax bill. Do you really want to write a check to the IRS?

Should I Choose A Traditional Or Roth Solo 401

For many investors, deciding between a traditional or Roth solo 401 comes down to whether you believe youre in a lower tax bracket today than you will be in retirement. If you think you are paying lower taxes now, you might choose a Roth solo 401. If you anticipate being in a lower tax bracket in retirement, a traditional solo 401 may be a better bet.

Theres another wrinkle with a Roth solo 401 account: You can only contribute up to $19,500 in 2021 , plus catch-up contributions of $6,500 if youre 50 or older. If youre able to save more than this amount, you will need to contribute the extra into a traditional solo 401 account. You can make both employer and employee contributions to a solo 401, but your employer contributions cannot be saved in a Roth account.

Don’t Miss: What Age Can You Start A 401k

Drawbacks To The Solo 401

The solo 401 has the same drawbacks of typical 401 plans, plus a couple others that are specific to itself. Like other 401 plans, the solo 401 will hit you with taxes and penalties if you withdraw the money before retirement age, currently set at 59½. Yes, you can take out a loan or may be able to access a hardship withdrawal, if needed, but those are last resorts.

In addition, it can take more paperwork to open a solo 401, but its not especially onerous. You usually wont be able to open the account completely online in 15 minutes, as you would a typical brokerage account. Plus, youll need to get a tax ID from the IRS, which you can do online quickly. On top of this, youll have to manage the plan, choose investments and ensure that you dont exceed annual contribution limits.

Another wrinkle: Once you exceed $250,000 in assets in the plan at the end of the year, youll need to start filing a special form with the IRS each year.

These drawbacks arent especially burdensome, but you should be aware of them.

Mega Back Door Roth Solo 401k Contribution Limit Question:

Yes and see the following.

- The overall limit in 415C applies on a per employer basis Provided that the employers are unrelated.

- This limit is applied without consideration of contributions made to a plan sponsored by an unrelated employer

- The elective deferral limit in 402G applies only to elective deferrals and does not impact after-tax contributions

- Here is an Example:

- For 2021, an individual contributes $19,500 of the elective deferrals to a 401 plan sponsored by his W-2 employer & additional matching and profit-sharing contributions are made up to the limit of $58,000

- Individual has an S-corp side business with no employees that generates self-employment income greater than $58,000 for 2021.

- The individual can contribute after-tax contributions up to $58,000 for 2021 to the solo 401 sponsored by side business and subsequently convert the voluntary after-tax funds to a Roth IRA or to the Roth Solo 401k.

You May Like: When Can I Use My 401k

Who Is Eligible For Individual 401 Plans

A common misconception about the solo 401 is that it can be used only by sole proprietors. In fact, the solo 401 plan may be used by any small businesses, including corporations, limited liability companies , and partnerships. The only limitation is that the only eligible plan participants are the business owners and their spouses, provided they are employed by the business.

A person who works for one company and participates in its 401 can also establish a solo 401 for a small business they run on the side, funding it with earnings from that venture. However, the aggregate annual contributions to both plans cannot collectively exceed the IRS-established maximums.

Solo 401k Calculator For S Corp

- Pay yourself a reasonable wage on a W2. S-Corp owners are required to pay a reasonable wage that is subject to employment tax. Make sure you and your accountant agree on the wage first.

- Make your employee deferral of $19,000 via payroll deductions. Remember that the deferral is elective and is the lower of compensation or the $19,000.

- Consider how much profit sharing you want to contribute. Remember that profit sharing is elective as well. You can take your gross compensation at 25%. But your combined contributions cant exceed $56,000 for 2019 and $57,000 for 2020.

- Many accounts are opened at the large players like Vanguard, Fidelity, and Schwab. But you may be able to self-direct the funds and be your own custodian.

- Fund your account before the deadline. Dont forget to contribute the profit sharing contributions up to the date you file your taxes including extensions.

You May Like: Is Solar Power Cost Effective

Don’t Miss: Where Do I Check My 401k Balance

Solo 401 Early Withdrawal Rules

Early withdrawal rules for solo 401s depend on which type of account you have. With a few exceptions, you must pay a 10% penalty tax on withdrawals from a traditional solo 401 account made before you turn 59 ½, plus income taxes on the amount withdrawn.

With a Roth solo 401, early withdrawals of contributions are free of the 10% tax penalty and income tax payments, but you pay the penalty and income tax on earnings. You cannot withdraw contributions exclusively, meaning you will have to pay taxes and a penalty on at least part of your early withdrawal.

How To Set Up A Solo 401

There are specific steps that must be taken to properly open a solo 401 plan, according to the Internal Revenue Service .

First, you have to adopt a plan in writing, making a written declaration of the type of plan you intend to fund. The choices are the same as are given to an employee opening a 401 plan: you can choose a traditional 401 or a Roth 401. Each has distinct tax benefits.

A solo 401 must be set up by Dec. 31 in the tax year for which you are making contributions.

You can open a solo 401 at most online brokers and traditional brokers or directly through a financial services company. You’ll want to do some research ahead of time to identify the best solo 401 company for you.

You’ll need an employer identification number to get started with the enrollment process. If you don’t have one already, you can apply online directly to the IRS.The rest of the documentation will be provided by the broker or financial services company you choose for the account.

Also Check: Can I Take A Loan Out Of My 401k