How To Withdraw From A Fidelity 401k

The Fidelity suite of products offer a wide range of services that help individuals do everything from saving for retirement to investing extra money to trade on the stock market. Fidelity manages employer-sponsored 401 plans and offers its own self-employed and small business 401 plans. Customers with a Fidelity 401 can withdraw money from the account, but they should be aware of the tax implications of early withdrawal.

Dont Miss: What To Do With 401k When You Retire

What Are The Pros And Cons Of Withdrawal Vs A 401 Loan

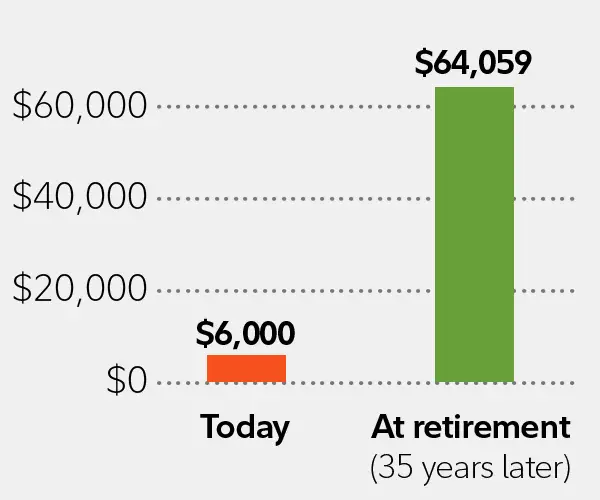

A withdrawal is a permanent hit to your retirement savings. By pulling out money early, youll miss out on the long-term growth that a larger sum of money in your 401 would have yielded.

Though you wont have to pay the money back, you will have to pay the income taxes due, along with a 10% penalty if the money does not meet the IRS rules for a hardship or an exception.

A loan against your 401 has to be paid back. If it is paid back in a timely manner, you at least wont lose much of that long-term growth in your retirement account.

Before You Accept An Offer

So youve found a new opportunity that youre feeling pumped about, and you have an offer in hand. Hopefully, it even comes with a nice boost in pay.

Before you get too dazzled by that salary figure, however, pause to think about how the move would affect your finances in total. A higher pay number might be misleading if youd be moving from an employee role to a contractor role, or if youd be relocating to a more expensive area. And salary may be only one part of each roles total compensation package, which might also include bonus or stock compensation potential, matching retirement contributions, insurance, or even tuition or childcare assistance.

Fidelitys job offer evaluator tool can help you better understand how the new job and your current job compare on total compensation . Consider running the numbers carefully before you make a final decision, or even using the results to give yourself added leverage as youre negotiating.

Also Check: How To Find 401k From An Old Employer

Read Also: Should You Use 401k To Pay Off Debt

Making The Numbers Add Up

Put simply, to cash out all or part of a 401 retirement fund without being subject to penalties, you must reach the age of 59½, pass away, become disabled, or undergo some sort of financial hardship . Whatever the circumstance though, if you choose to withdraw funds early, you should prepare yourself for the possibility of funds becoming subject to income tax, and early distributions being subjected to additional fees or penalties. Be aware as well: Any funds in a 401 plan are protected in the event of bankruptcy, and creditors cannot seize them. Once removed, your money will no longer receive these protections, which may expose you to hidden expenses at a later date.

Read Also: When Can I Set Up A Solo 401k

Consider Contributing To An Ira Up To The Maximum

Another retirement savings option is an individual retirement account . These are not connected to an employer, and you can contribute in addition to your employer’s plan.3

There are several IRA options, with different benefits and requirements. You can contribute to 1, 2, or even all 3, as long as your combined contributions don’t go beyond either your earned income or what the IRS allows.

FAQ: How do I choose an IRA? It depends on what you’re looking for, but there are a few ways to narrow it down. A rollover IRA is where you can move your old workplace plans, but you can also contribute to it yourself once it’s set up. A Roth IRA and traditional IRA are quite different from each other, so you might want to check out this handy comparison chart.

Also Check: How Do I Find An Old 401k

Roll Your Assets Into A New Employer Plan

If youre changing jobs, you can roll your old 401 account assets into your new employers plan . This option maintains the accounts tax-advantaged status. Find out if your new plan accepts rollovers and if there is a waiting period to move the money. If you have Roth assets in your old 401, make sure your new plan can accommodate them. Also, review the differences in investment options and fees between your old and new employers 401 plans.

Dont Miss: How To Start A 401k Self Employed

Can You Pay Off A 401 Loan Early

Yes, loans from a 401 plan can be repaid early with no prepayment penalty. Many plans offer the option of repaying loans through regular payroll deductions, which can be increased to pay off the loan sooner than the five-year requirement. Remember that those payments are made with after-tax dollars, unlike contributions, which are made before taxes.

You May Like: What Do 401k Invest In

Expecting Relatively Large Long

Spreading traditional IRA withdrawals out over the course of retirement lifetime may make sense for many people. However, if an investor anticipates having a relatively large amount of long-term capital gains from their investmentsenough to reach the 15% long-term capital gain bracket thresholdthere may be a more beneficial strategy: First, use up taxable accounts, then take the remaining withdrawals proportionally.

The purpose of this strategy is to take advantage of zero or low long-term capital gains rates, if available based on ordinary income tax brackets. Tax rates on long-term capital gains are 0%, 15% or 20% depending on taxable income and filing status. Assuming no income besides capital gains, and filing single, the total capital gains would need to exceed $40,400 after deductions, before taxes would be owed.

Tax rates: Singles

| 20% |

One strategy for retirees to help reduce taxes is to take capital gains when they are in the lower tax brackets. For example, single filers with taxable income less than $40,400 are in the 2 lower tax brackets. That equates to a 0% tax on capital gains. If taxable income is between $40,401 and $445,850, long-term capital gains rate is 15%. Remember, the amount of ordinary income impacts long-term capital gain tax rates.

The big difference: Jamie pays zero on her long-term capital gains because her income is below that key threshold of $40,400, but David pays 15% on his $5,000 because of his higher earnings.

| $995 | $5,414 |

Should I Convert My 401 Into A Gold Ira

If you no longer have earned income as an early retiree and can no longer contribute to my company 401, converting your 401 to a Gold IRA may be a good idea. For those of you who are transitioning to a new job, rolling over your 401k to a Gold IRA is also a good idea.

Even though a 401 may provide about 40 or so mutual fund choices provided across various sectors, countries, and asset classes, it may not be enough for what you want to do with your overall retirement plan. With a Gold IRA, youve got plenty more investment options.

If you are ready to rollover your 401 or even a Fidelity 401 to a Gold IRA, view our List of Top 10 Gold IRA Companies and see why it you should choose to work with the most trusted IRA Custodian in the industry, Regal Assets.

Do you have any questions on what is the best way to rollover your Fidelity 401 to a Gold IRA? Ask below!

Don’t Miss: How Do I Start My 401k Plan

Make Sure That Youre Eligible

The general rule of thumb is that you established your 401 as a full-time employee from a previous employer, or you are more than 59.5 years old. Other eligibility requirements can vary, depending on the type of retirement plan you have, such as a Roth IRA, 403, 457 and Thrift Savings Plan .

Please note, the rules dictating eligibility to move a 401 to an IRA arent always crystal clear and can vary from person to person. If you are confused or unsure of your own eligibility, please contact BitIRA today for a complimentary consultation.

We have a team of IRA Specialists, who are well-versed in the rules of 401-to-Bitcoin IRA rollovers. If you make a bitcoin investment for your SDIRA, they can assist you with the entire transfer process to make it quick and easy. However, please note that there is no obligation for you to take any action after your consultation.

Here are the three steps to take to convert your 401 savings into bitcoin:

You May Like: How Do I Cash Out My 401k After Being Fired

Traditional Rollover Sep And Simple Iras

If you are considering a withdrawal from one of these types of IRAs before age 59½, it will be considered an early distribution by the IRS.

In many cases, youll have to pay federal and state taxes. There may also be a 10% penalty unless you are using the money for exceptions such as a first-time home purchase, birth or adoption expense , qualified education expense, death or disability, health insurance , and some medical expenses. A 25% penalty may apply if you take a distribution within the first 2 years of opening a SIMPLE IRA.

If any of these situations apply to you, then you may need to fill out specific IRS forms. Always consult your tax advisor about your specific situation.

You May Like: Can I Get A 401k Plan On My Own

Your Retirement Money Is Safe From Creditors

Did you know that money saved in a retirement account is safe from creditors? If you are sued by debt collectors or declare bankruptcy, your 401k and IRAs cannot be liquidated by creditors to satisfy bills you owe. If youre having problems managing your debt, its better to seek alternatives other than an early withdrawal, which will also come with a high penalty.

Transfer The Money To Your New Employers 401

If your new employers plan allows it, you may transfer your old 401 savings into your new 401 plan.

In Lesters view, rolling your old account into your new employers 401 plan should be your default unless theres a good reason not to.

But youll only want to do that if the new plan offers solid, low-cost investments or at the very least, low-cost target date funds.

The benefit of consolidating your retirement savings into one employer-sponsored plan is that it will be easier for you to track and manage the money.

Recommended Reading: What To Do With 401k After Quitting

Three Consequences Of A 401 Early Withdrawal Or Cashing Out A 401

Taxes will be withheld. The IRS generally requires automatic withholding of 20% of a 401 early withdrawal for taxes. So if you withdraw $10,000 from your 401 at age 40, you may get only about $8,000. Keep in mind that you might get some of this back in the form of a tax refund at tax time if your withholding exceeds your actual tax liability.

The IRS will penalize you. If you withdraw money from your 401 before youre 59½, the IRS usually assesses a 10% penalty when you file your tax return. That could mean giving the government $1,000 or 10% of that $10,000 withdrawal in addition to paying ordinary income tax on that money. Between the taxes and penalty, your immediate take-home total could be as low as $7,000 from your original $10,000.

You may lock in your losses. That may be especially true if the market is down when you make the early withdrawal. If you’re pulling funds out, it can severely impact your ability to participate in a rebound, and then your entire retirement plan is offset, says Adam Harding, a certified financial planner in Scottsdale, Arizona. That may mean less money for your future.

What Are The Penalty

The IRS permits withdrawals without a penalty for certain specific uses, including to cover college tuition and to pay the down payment on a first home. It terms these exceptions, but they also are exemptions from the penalty it imposes on most early withdrawals.

It also allows hardship withdrawals to cover an immediate and pressing need.

There is currently one more permissible hardship withdrawal, and that is for costs directly related to the COVID-19 pandemic.

Youll still owe regular income taxes on the money withdrawn but you wont get slapped with the 10% early withdrawal penalty.

Don’t Miss: How Can I View My 401k

How Long Does It Take To Get Money Out Of My 401k

May 3, 2011 It usually takes a week or two to get money out of your 401, although it can take much longer. The countdown begins when you request payment and ends when you actually receive the money in the form of a check or wire transfer.

Principal 401k phone number What is your 401k plan based on your retirement count?Your 401 is qualified retirement plan Although your donation has been reported in field 12 code D in format W2. You dont need to report them again in TurboTax. If youre going to bring up another issue, youll only answer yes to this question, such as BT IRA or Roth IRA. June 4, 2019 at 11:51 a

Recommended Reading: How To Know If You Have A 401k

How To Cash Out Your 401k And What To Consider

4-minute readMay 18, 2021

One of the surest ways to create a comfortable retirement for yourself is to begin saving early on in your career. A 401 plan a type of financial contribution plan which allows you to put a percentage of your salary into an account whose investment gains remain tax-free until funds are withdrawn presents one of the most popular vehicles for doing so. Even better, employers will often match the amount of money set aside up to a certain amount, effectively guaranteeing you free income.

However, in the event that access to money is needed, especially in the wake of a large or unexpected expense, its not uncommon to wonder how to cash out your 401 as well. Here, well take a closer look at the process of cashing out a 401 early, how long it takes to get access to money, and the pros and cons of doing so, including how much early withdrawal before retirement may cost you.

Recommended Reading: What To Do With Old Employer 401k

When To Cash Out Your 401k To Pay Off Debt

The decision to withdraw 401k will depend on your financial situation. If debts are stressful on a daily basis, you should consider serious debt payment plans. Withdrawing the 401k plan early can cost money. The decision to withdraw 401k will depend on your financial situation. If debts are stressful on a daily basis, you should consider serious debt payment plans.

A Note About The Cares Act

Signed into law on March 27, 2020, the $2 trillion dollar Coronavirus Aid, Relief and Economic Security Act emergency stimulus bill was drafted to help those affected by the coronavirus pandemic. Under the act, 401 account owners can make a hardship withdrawal of up to $100,000 without paying the 10% penalty. The bill also grants the account holder 3 years to pay the income tax, rather than it being due within that same year.

You May Like: How To Take Money Out Of Your 401k Without Penalty

How To Apply For A Loan

Current faculty and staff who are a participant in the Plan, are eligible to take a loan against their voluntary, pre-tax account balance held at Fidelity . You may apply for a loan by calling Fidelity at 800.343.0860. Your application will specify the amount you wish to borrow and the duration of the loan, in whole months. If you are married, spousal consent is required.

Before requesting a loan, you should be aware of the general provisions of the loan program:

- You can have only one outstanding loan at any time.

- The minimum amount you can request is $1,000.

- You may not borrow more than 50% of your total balance in your Plan accounts reduced by your highest outstanding loan balance during the one-year period ending on the day before your new loan is made.

- The interest rate is the prime rate plus 1% The prime rate is determined using the rate published by Reuters and is updated quarterly.

- The term for repayment of the loan may not exceed 5 years , unless the loan is extended due to a leave of absence for military service.

- A $75.00 non-refundable loan application fee will be withdrawn from your account each time a loan is issued to you. A $25 loan maintenance fee will also apply to each loan.

- Loan repayments must be made monthly on a level repayment schedule through ACH debit from your bank account.

To learn more about or request a loan, log on to Fidelity NetBenefits at www.netbenefits.com/vanderbilt or call the Fidelity Retirement Service Center at 1.800.343.0860.

Disadvantages Of Closing Your 401k

Whether you should cash out your 401k before turning 59 ½ is another story. The biggest disadvantage is the penalty the IRS applies on early withdrawals.

First, you must pay an immediate 10% penalty on the amount withdrawn. Later, you must include the amount withdrawn as income when you file taxes. Even further down the road, there is severe damage on the long-term earning potential of your 401k account.

So, lets say at age 40, you have $50,000 in your 401k and decide you want to cash out $25,000 of it. For starters, the 10% early withdrawal penalty of $2,500 means you only get $22,500.

Later, the $25,000 is added to your taxable income for that year. If you were single and making $75,000, you would be in the 22% tax bracket. Add $25,000 to that and now youre being taxed on $100,000 income, which means youre in the 24% tax bracket. That means youre paying an extra $6,000 in taxes.

So, youre net for early withdrawal is just $16,500. In other words, it cost you $8,500 to withdraw $25,000.

Beyond that, you reduced the earning potential of your 401k account by $25,000. Measured over 25 years, the cost to your bottom line would be around $100,000. That is an even bigger disadvantage.

Read Also: Where To Put My 401k

You May Like: When You Leave A Job Where Does Your 401k Go