Calculate Interest On Lost Earnings

If Lost Earnings are paid to the plan after the Recovery Date, the Plan Official must also pay interest on the Lost Earnings from the Recovery Date to the Final Payment Date. How to perform this calculation is shown by the following table. The Interest column is the previous time period’s Amt. Due times the Factor. Amt. Due is the previous row’s Amt. Due plus Interest. The first row is based on the $65.69 Lost Earnings.

| From |

|---|

Note: The last IRS Factor comes from the IRS Factor Tables for leap years.

The plan is also owed $11.64. This is the amount of interest on $65.69 accrued between April 13, 2001, the Recovery Date, when the Principal Amount $10,000 was paid to the plan, and January 30, 2004, the Final Payment Date.

Therefore, the Plan Official must pay $77.33 to the plan on January 30, 2004, as Lost Earnings plus interest on Lost Earnings for the pay period ending March 2, 2001, in addition to the Principal Amount that was paid on April 13, 2001.

This same calculation must be done for each pay period with untimely employee contributions or participant loan repayments.

Note: If the amount of Lost Earnings and interest, if any, to be paid to the plan is greater than $100,000, the calculation must be redone for each pay period, using the IRC 6621 underpayment rates.

How Much Should I Contribute To My 401

Maxing the IRS annual contribution limit may not be the best idea. Employees annual contribution should contribute, up to the employer match, if employers provide matching contributions. For example, if employer contributions are matching contributions up to 4%, contribute the employer maximum. This is because, when an employer offers a matching contribution, they essentially say that they will match whatever amount the employee contributes, up to a certain percentage of their annual salary. Its free money.

This greatly benefits employees, as it effectively doubles their contribution. However, employees should be aware that they will not receive the employers matching contribution unless they contribute an equal amount themselves.

Therefore, an employees best interest is to contribute at least the amount that their employer will match. Doing so will ensure that they receive the full benefit of the employers contribution.

IRS Annual Contribution Limit:

Plan Compensation For A Self

To calculate your plan compensation, you reduce your net earnings from self-employment by:

- the deductible portion of your SE tax from your Form 1040 return, Schedule 1, on the line for deductible part of self-employment tax, and

- the amount of your own retirement plan contribution from your Form 1040 return, Schedule 1, on the line for self-employed SEP, SIMPLE, and qualified plans.

You use your plan compensation to calculate the amount of your own contribution/deduction. Note that your plan compensation and the amount of your own plan contribution/deduction depend on each other to compute one, you need the other . One way to do this is to use a reduced plan contribution rate. You can use the Table and Worksheets for the Self-Employed to find the reduced plan contribution rate to calculate the plan contribution and deduction for yourself.

Read Also: How To Transfer 401k From Fidelity To Vanguard

You May Like: Why Is It Called 401k Plan

What Determines The Interest Rate

Typically, according to most sources, a 401 loan will carry an interest rate based on the Prime Rate plus 1 or 2 percentage points. The prime rate is published every day by the Wall Street Journal, based on surveys of 30 banks’ lending rates.

Its low rates are comparable only to a HELOC, which, if you don’t have any home equity to tap into, you can’t get. And unlike with HELOC, you’re actually paying yourself the interest — not your bank.

Your 401 Rate Of Return Doesn’t Depend Only On The Stock Market Your Investment Choices Have A Huge Impact On What You Earn

A 401 plan can be invaluable in saving for retirement. But achieving your retirement goals isn’t just a matter of how much you save in your 401. Your returns, or how much your investments earn each year, play a major role, too. Periodically reviewing your annual returns is a must for your 401 plan, as well as your entire investment portfolio.

With your 401 returns, results will vary based on a number of factors. Some of these, like how the stock market performs, are out of your hands. But the decisions you make about how you invest have a big impact as well.

Don’t Miss: Who Can Open A 401k

How Much You Can Earn In Interest If You Have $1 Million

There are a few different ways to invest your money to earn interest and live off of that income. The most popular investments are bonds, certificates of deposit and annuities. The interest that youll earn will depend on the amount of money you have in your account when you go to live off of that interest. Here is what each of those investments would pay in interest in 5 years if you had $1 million:

- High-Yield Savings: Assuming an average APY of 1%, $51,010.

- Certificates of Deposit: Assuming an average interest rate of between 0.03% and 0.39%, $19,653.

- Annuities: Assuming an average interest rate of 3%, $75,380.

You can learn more about how much interest your account could accumulate if you have a $2 million nest egg.

Why Should I Use One

Matching dollars, for one thing. Over 90% of employers that offer a 401 plan also kick in a company match, which means as you contribute, your employer will, too. Commonly, that match will be worth 50% to 100% of your contributions, up to a limit that typically falls between 3% and 6% of your annual salary. If your employer offers up this free money, a good rule of thumb is to do everything you can to contribute enough to take advantage of it.

The other huge benefit of the 401 is that it allows you to put a lot of money away for retirement in a tax-advantaged way. The annual 401k contribution limit is $20,500 for tax year 2022, with an extra $6,500 allowed as a catch-up contribution every year for participants age 50 or older.

You May Like: How To Rollover A 401k Without Penalty

Which Option Is Better For You

If your 401 or 403 retirement plan accepts both traditional and Roth contributions, you have two ways to save for your retirement. Both offer federal income tax advantages.

Traditional accounts provide a tax break now. Traditional contributions are not taxed at the time of investment. Instead, taxes are paid on withdrawals, including any earnings. Getting a tax break at the time of investment will leave more money in your pocket now money that you can invest, save or spend.

Roth accounts provide a tax advantage later. Roth contributions are made with money thats already been taxed, so you wont have to pay taxes on qualified withdrawals, including earnings.

Enter your personal information to compare the results of traditional before-tax savings and Roth after-tax savings. You can click each for help.

Investors should carefully consider investment objectives, risks, charges and expenses. This and other important information is contained in the fund prospectuses and summary prospectuses, which can be obtained from a financial professional and should be read carefully before investing.

Future tax rates may change. The analyzer applies tax rates to all taxable income. When estimating your future tax rate, you should consider whether the amount of taxable distributions might push you into a higher tax bracket.

- STAY CONNECTED:

Also Check: How Do I Find My 401k Account Number

Does Roth 401k Have Income Limits

Unlike traditional IRAs or Roth IRAs, there is no income cap above 401k to discourage your contribution. This makes it a very attractive option when you consider the benefits between IRA and 401k.

Roth ira 5 year ruleWhen does the five-year rule apply to Roth IRAs?The Legacy of the IRA. The 5-year rule applies to one of the many options available to beneficiaries when it comes to receiving distributions from an inherited IRA.Traditional ARI. Under the 5-year rule, the beneficiary of a traditional IRA is not subject to the usual 10% penalty on distribution, even if it occurs before the cut-off date.The mouth of

Dont Miss: How To Invest My 401k In Stocks

You May Like: Should You Roll Over 401k To Roth Ira

How To Calculate Using A 401 Contribution Calculator

One needs to follow the below steps to calculate the maturity amount for the 401 Contribution account.

Step #1 Determine the initial balance of the account, if any. Also, a fixed periodical amount will be invested in the 401 Contribution, which would be a maximum of $19,000 per year.

Step #2 Figure out the rate of interest that would be earned on the 401 Contribution.

Step #3 Now, determine the duration left from the current age until retirement.

Step #4 Divide the interest rate by the number of periods the interest or the 401 Contribution income is paid. For example, if the rate paid is 9% and compounds annually, the interest rate would be 9%/1, which is 9.00%.

Step #5 Determine whether the contributions are made at the start or the end of the period.

Step #6 Determine whether an employer is contributing to match the individuals contribution. That figure plus the value in step 1 will be the total contribution in the 401 Contribution account.

Step #7 Use the formula discussed above to calculate the maturity amount of the 401 Contribution, which is made at regular intervals.

Step #8 The resultant figure will be the maturity amount, including the 401 Contribution income plus the amount contributed.

Step #9 There would be tax liability at the time of retirement for the entire amount since the contributions are pre-tax, and deductions are taken for the contributed amount.

General Pros And Cons Of A 401

Pros

Cons

- Few investment optionsGenerally speaking, 401s have few investment options because they normally originate from employers, they are limited to what is offered through employers’ 401 plans, as compared to a typical, taxable brokerage account.

- High feesCompared to other forms of retirement savings, 401 plans charge higher fees, sometimes as a percentage of funds. This is mainly due to administration costs. Plan participants have little or no control over this, except to choose low-cost index funds or exchange-traded funds to compensate.

- Illiquid 401 funds can only be withdrawn without penalty in rare cases before 59 ½. This includes all contributions and any earnings over time.

- Vesting periodsEmployers may utilize vesting periods, meaning that employer contributions don’t fully belong to employees until after a set point in time. For instance, if an employee were to part ways with their employer and a 401 plan that they were 50% vested in, they can only take half of the value of the assets contributed by their employer.

- Waiting periodsSome employers don’t allow participation in their 401s until after a waiting period is over, usually to reduce employee turnover. 6 month waiting periods are fairly common, while a one-year waiting period is the longest waiting period permitted by law.

Don’t Miss: How Do I Find Out What My 401k Balance Is

Why Living Off Interest Alone Isnt A Practical Plan

Of course, for most people, a $6 million nest egg isnt within the realm of possibility. Even accumulating $1 million is out of the reach of the majority of Americans. According to a survey conducted by the TransAmerica Center for Retirement Studies in 2021, Baby Boomers , have a median $202,000 in retirement accounts.

Feasibility aside, living off the interest of your savings is a bad plan for two big reasons. First, inflation will likely depress the purchasing power of your income. So the $60,000 you think youll need in 30 years will actually be worth $28,600 in todays dollars, assuming a 2.5% rate of inflation. To have $60,000 in todays dollars in 30 years, you would need to aim for an annual income of $125,900. That would reset your savings goal to $2.1 million, assuming an optimistic 6% interest rate.

Second, the calculation assumes a steady interest rate over the span of approximately 25 years. In reality, interest rates fluctuate. Between January 1991 and January 2016, a five-year certificate of deposit that was rolled over every time it matured could have earned 7.67%, 5.28%, 5.58%, 3.92%, 1.57% and 0.86% . When the interest rate is higher than you expected, youll have extra cash. But for the years the interest rate is lower, youll probably dip into savings. And if you touch the nest egg, you will lower the amount you earn every year thereafter.

What Kind Of Investments Are In A 401

401 accounts often offer a small, curated selection of mutual funds. Thats a good thing and a bad thing: On the plus side, you may have access to lower-cost versions of those specific funds, especially at very large companies that qualify for reduced pricing.

The negative is that even with discounted costs, that small selection narrows your investment options, and some of the funds offered may still have higher expense ratios than what youd pay if you could shop among a longer list of options. That can make it harder to build a low-cost, diversified portfolio.

Some plans also charge administrative fees on top of fund expenses, which can add up. If your 401 is expensive, contribute enough to earn your company match, and then direct any additional retirement savings contributions for the year into an IRA.

Read Also: Why Is It Called 401k

How Much Will Safe Harbor Contributions Cost

It may seem counterintuitive, but the 3% non-elective contributions can be cheaper than the 4% match at a certain point. The overall participation and savings rate will influence the total cost of the plan.

To calculate how much a safe harbor matching contribution will cost, run this formula:

# employees x % employees participating x $ average salary x % safe harbor contribution = $$

Lets consider a few different scenarios for an employer with 50 employees whose average salary is $40,000.

- Basic 4% Match, 60% participation rate: The employer contribution will cost $48,000 a year.

- 3% Nonelective contribution for all employees: The employer pays $60,000 a year.

- Basic 4% Match, 100% participation rate: With everybody saving, your 4% match costs $80,000.

Choosing which safe harbor contributions to make is a personal decision based on the unique factors of your business. Contact Ubiquity, a low-cost, flat-fee 401 administrator, to explore your options.

Read Also: Can I Pull Out My 401k

How Much Can I Contribute Into A Solo 401k Sep Ira Defined Benefit Plan Or Simple Ira

Using the retirement calculator you can calculate the maximum annual retirement contribution limit based on your income. Enter your name, age and income and then click Calculate.

The result will show a comparison of how much could be contributed into a Solo 401k, SEP IRA, Defined Benefit Plan or SIMPLE IRA based on your income and age.

Note: If you are taxed as a sole proprietorship use your NET income when using the calculator. If you are incorporated, then only use your W-2 wages when using the calculator. For example, S corporation K-1 distributions are not included when making the contribution limit calculation.

Dont Miss: How Much Should I Put In My 401k Calculator

You May Like: How Much Can I Invest In 401k And Roth Ira

Create The Savings Calculator

You can use the compound interest calculator that you made previously to create this one since many of the fields will be similar. Right-click on the Compound Interest tab at the bottom of the sheet to make a copy and set up your fields as shown in the image below. Note that the formulas have been entered in the cells to the right of their respective fields. The Principal label has been changed to Deposit. The total interest earned is now the difference between the final account balance and the deposit times period time number of years invested. This calculator assumes you will deposit regularly each month and make no early withdrawals. Next, well store the formulas.

Living Off Of Interest Alone In Retirement

When doing the math for retirement, interest-only retirement is an ideal strategy where you invest your savings in assets that pay you interest and you live off that money after retiring without touching the principal balance.

This means that you will have to figure out where your retirement income will come from and how much of your golden age lifestyle it could maintain. But since you do not spend the principal, you could pass this nest egg on to your heirs when you die.

Interest-only retirement is a good starting point for calculating your retirement goals and needs. Well show you how to do the math for yourself. But you probably dont want to plan on living off just the interest. Well explain why and suggest other ways of living off your savings.

Also Check: Can You Lose Your 401k If You Get Fired

Other Sources Of Retirement Income

Home Equity and Real Estate

For some people in certain scenarios, preexisting mortgages and ownership of real estate can be liquidated for disposable income during retirement through a reverse mortgage. A reverse mortgage is just as it is aptly named â a reversing of a mortgage where at the end , ownership of the house is transferred to whoever bought the reverse mortgage. In other words, retirees are paid to live in their homes until a fixed point in the future, where ownership of the home is finally transferred.

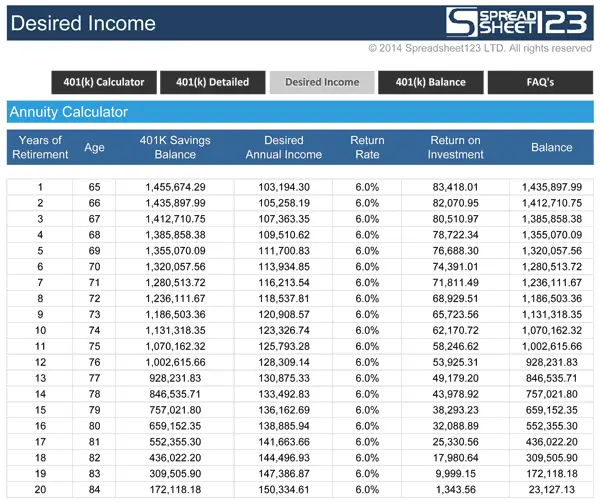

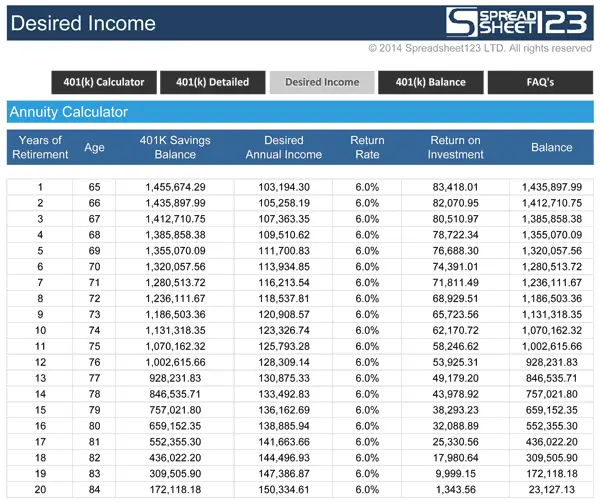

Annuities

A common way to receive income in retirement is through the use of an annuity, which is a fixed sum of periodic cash flows typically distributed for the rest of an annuitant’s life. There are two types of annuities: immediate and deferred. Immediate annuities are upfront premiums paid which release payments from the principal starting as early as the next month. Deferred annuities are annuities with two phases. The first phase is the accumulation or deferral phase, during which a person contributes money to the account . The second phase is the distribution, or annuitization phase, during which a person will receive periodic payments until death. For more information, it may be worth checking out our Annuity Calculator or Annuity Payout Calculator to determine whether annuities could be a viable option for your retirement.

Passive Income

Inheritance