Can I Retire At 62 With 300k

Can I Retire at 62 with 300k? In short, it’s possible, but, first, you’ll need to know how much pension and other passive income you’ll be getting. Once you add all your passive income sources, and your pension, you can then work with a financial advisor to come up with an appropriate withdrawal rate for your 300k.

Tax Deductible Ira Contributions If I Have A Solo 401k Question:

My question: As my wife and I are *not* contributing to our solo401k plan, does that mean that we are not active participants and IRA contributions are tax deductible?

Good question. Yes, you are still considered covered by a retirement plan at work even if you are not making solo 401k contributions.

While you can still contribute to a traditional IRA, your traditional IRA contribution deductions will be reduced if your AGI is a certain amount.

For 2017, if you are covered by a retirement plan, your deduction for contributions to a traditional IRA is reduced if your AGI is:

- More than $99,000 but less than $119,000 for a married couple filing a joint return or a qualifying widow,

- More than $62,000 but less than $72,000 for a single individual or head of household, or

- Less than $10,000 for a married individual filing a separate return.

Dont Miss: How To Make 401k Grow Faster

How Much Do I Need To Retire

How much you need to retire depends on how much you plan to spend in retirement. How much will you want to shell out on travel? What about saving for medical expenses? These considerations and more make planning your retirement paycheck difficult for many people, especially when theyre decades from retirement.

Recommended Reading: How To Withdraw From Merrill Lynch 401k

Read Also: How To Check My 401k Plan

Distribution Of Excess Contributions

If you do exceed your contribution limits, to avoid double taxation, contact your plan administrator and ask them to distribute any excess amounts. The plan should distribute the excess contribution to you by April 15 of the following year . For information about taxes on excess contributions, see What Happens When an Employee has Elective Deferrals in Excess of the Limits?

When deciding from which plan to request a distribution of excess contributions keep in mind:

- getting the maximum matching contribution that may be offered

- type of investments

K Contribution Limits For 2021

Jeff Rose, CFP® | January 31, 2022

This year the IRS announced there will be no change to the maximum employee 401 contribution limit for 2021, leaving it at $19,500, the same amount it was set at for the 2020 tax season.

There will also be no change to the maximum allowed for catch-up contributions. Those represent the additional amount of contributions that you can make to a 401 plan if you are age 50 or older.

For 2021, that number will stay at $6,500. That means the total contribution for plan participants age 50 and older is $26,000.

Every year, in October, the 401 contribution limits are reviewed.

Contribution limits increase more during years when the inflation rate is higher, and less when it is lower, as it has been in the past few years. At times, there have even been concerns that the contribution limits might be reduced, based on a negative inflation rate.

Fortunately, however, that scenario has never played out, and the limits have either been increased slightly or left flat.

Read Also: Can I Use My 401k To Purchase A Home

You May Like: How To Find My 401k Balance

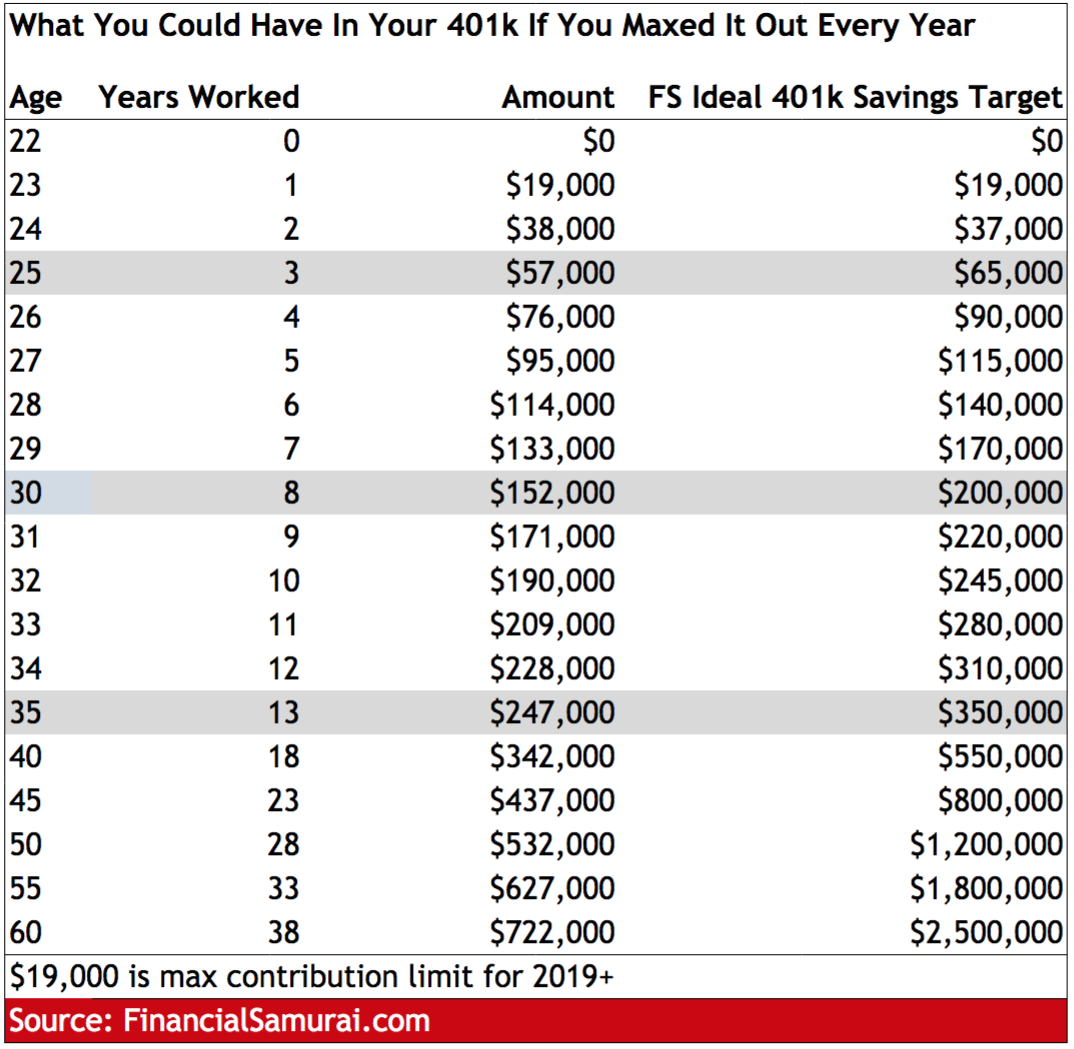

Save Early Often And Aggressively

Yes, saving is hard. Its hard when you are young and not making a large salary, and its hard when youre older and big life expenses get in the way. However, the biggest threat to your retirement is inaction. Even if its uncomfortable to max out your 401k, do it if you can. If you get a salary raise, immediately put 50% of it towards savings if youre able. The earlier and more aggressively you can save, the better off you will be, and you may even surprise yourself with how much you are able to put away. Compounding can do wonders when there is a positive annual return as you can see from the high end of the potential savings chart, so the earlier you can save more, the farther your money will go.

Two Annual Limits Apply To Contributions:

Don’t Miss: When Can You Start To Withdraw From 401k

Average 401k Balance At Age 45

When you hit your 50s, you become eligible to make larger contributions towards retirement accounts. These are called catch-up contributions. Make sure that you take advantage of them! Catch-up contributions are $6,500 in 2022. So if you contribute the annual limit of $20,500 plus your catch-up contribution of $6,500, thats a total of $27,000 tax-advantaged dollars you could be saving towards your retirement.

Compensation Limit For Contributions

Remember that annual contributions to all of your accounts maintained by one employer – this includes elective deferrals, employee contributions, employer matching and discretionary contributions and allocations of forfeitures, to your accounts, but not including catch-up contributions – may not exceed the lesser of 100% of your compensation or $61,000 for 2022 . This limit increases to $67,500 for 2022 $64,500 for 2021 $63,500 for 2020 if you include catch-up contributions. In addition, the amount of your compensation that can be taken into account when determining employer and employee contributions is limited to $305,000 for 2022 $290,000 in 2021 .

Also Check: How To Fill Out 401k Rollover Form

Contribution Limits In 2021 And 2022

For 2022, the 401 limit for employee salary deferrals is $20,500, which is above the 401 2021 limit of $19,500. Employer matches dont count toward this limit and can be quite generous.

However, the total contribution limit, which includes employer contributions , has increased to $61,000 in 2022, up from $58,000 in 2021.

On top of these amounts, workers aged 50 and older can add up to $6,500 more annually as a catch-up contribution.

The 401 contribution limits also apply to other so-called defined contribution plans, including:

- 403 plans, available to education and non-profit workers.

- Most 457 plans used by state and local government employees.

- The federal governments Thrift Savings Plan.

| 401 plan limits | ||

|---|---|---|

| Maximum salary deferral for workers | $19,500 | |

| Catch-up contributions for workers 50 and older | $6,500 | |

| Total contribution limit, plus catch-up contribution | $64,500 | |

| Compensation limit for figuring contributions | $290,000 | |

| Compensation threshold for key employee nondiscrimination testing | $185,000 | |

| Threshold for highly compensated employee nondiscrimination testing | $130,000 | +$5,000 |

But How Much Is Enough

Our rule of thumb: Aim to save at least 15% of your pre-tax income1 each year, which includes any employer match. Thats assuming you save for retirement from age 25 to age 67. Together with other steps, that should help ensure you have enough income to maintain your current lifestyle in retirement.

How did we come up with 15%? First, we had to understand how much people generally spend in retirement. After analyzing enormous amounts of national spending data, we concluded that most people will need somewhere between 55% and 80% of their preretirement income to maintain their lifestyle in retirement.1

Not all of that money will need to come from your savings, however. Some will likely come from Social Security. So, we did the math and found that most people will need to generate about 45% of their retirement income from savings. And saving 15% each year, from age 25 to age 67, should get you there. If you are lucky enough to have a pension, your target savings rate may be lower.

Heres a hypothetical example. Consider Joanna, age 25, who earns $54,000 a year. We assume her income grows 1.5% a year to about $100,000 by the time she is 67 and ready to retire. To maintain her preretirement lifestyle throughout retirement, we estimate that about $45,000 each year , or 45% of her $100,000 preretirement income, needs to come from her savings.

You May Like: What Is The Best 401k Investment Option

So How Much Should You Invest In Your 401k

Okay. So, while investing is highly personal and financial goals should be personalized, you are here so we can teach you to be rich. We have some advice to get you started.

How much you should actually be investing each month depends on a system we call the Ladder of Personal Finance. Check out this video, or read about the Ladder below:

1. Your employers 401k match. Each month you should be contributing as much as you need to in order to get the most out of your companys 401k match. That means if your company offers a 5% match, you should be contributing AT LEAST 5% of your monthly income to your 401k each month.

Weve already discussed the importance of this dont throw away free money and the returns from that free money.

2. Whether youre in debt. Once youve committed yourself to contributing at least the employer match for your 401k, you need to make sure you dont have any debt. Remember, if you have employee matching, you are effectively earning a 100% return on every penny you invest in your 401k that is significantly more than the interest you would save by paying down your debt.

If you dont, great! If you do, thats okay. You can check out my system on eliminating debt fast to help you.

Maximize Employer 401 Match Calculator

Contribution percentages that are too low or too high may not take full advantage of employer matches. If the percentage is too high, contributions may reach the IRS limit before the end of the year. As a result, employers will not match for the rest of the year. This calculation can show the contribution percentage window in order to take full advantage of the employer’s matching contributions.

Recommended Reading: How To Select 401k Investments

Can I Deposit My 401k Into My Bank Account

Can you transfer your 401k to your bank? Once you have attained 59 ½, you can transfer funds from a 401 to your bank account without paying the 10% penalty. However, you must still pay the withdrawn amounts ordinary income .

If you have already retired, you can elect to receive monthly or periodic transfers to your bank account to help pay your living costs. An annuity can automate this process and guarantee to continue to deposit a monthly income into the bank account after the 401 has depleted its account.

Read Also: How Many Years Of Tax Returns Should I Keep

Can You Contribute To A Roth And Traditional Ira At The Same Time

You may be able to contribute to both Roth and the traditional IRA, up to the limit set by the IRS, which is a total of $ 6,000 between all IRA accounts in 2021 and 2022. These two types of IRA also have the eligibility requirements you need to meet .

Can I contribute to a Roth IRA and a traditional IRA in the same year?

You can contribute to a traditional IRA and a Roth IRA in the same year. If you are eligible for both types, make sure your combined contribution amount does not exceed the annual limit. You can also contribute to a traditional IRA and 401 in the same year. Contribution limits apply for each account type.

Read Also: Can A Sole Proprietor Have A 401k

You May Like: How To Withdraw Money From Nationwide 401k

If You Start At Age 2:

With a 4% rate of return: $1,264.86 per month

- Annual salary needed if you save 10% of your income: $151,783

- Annual salary needed if you save 15% of your income: $101,194

With a 6% rate of return: $753.20 per month

- Annual salary needed if you save 10% of your income: $90,385

- Annual salary needed if you save 15% of your income: $60,259

With an 8% rate of return: $429.68 per month

- Annual salary needed if you save 10% of your income: $51,561

- Annual salary needed if you save 15% of your income: $34,376

Contribution Limits For 2021 And 2022

When most people think of 401 contribution limits, they are thinking of the elective deferral limit, which is $19,500 in 2021 and $20,500 for 2022. This is the maximum amount you are allowed to voluntarily defer to your 401 for the year. Adults 50 and older are also allowed $6,500 in catch-up contributions, which are additional elective deferrals, in 2021 and 2022. This brings the maximum amount they can contribute to their 401s to $26,000 in 2021 or $27,000 in 2022.

The IRS also imposes a limit on all 401 contributions made during the year. In 2021, it rises to $58,000 and $64,500, respectively. In 2022, it rises to $61,000 and $67,500, respectively. This includes all your personal contributions and any money your employer contributes to your 401 on your behalf.

Highly paid employees have some additional limitations to keep in mind. Companies can elect to stop a participant’s salary deferrals once that person has earned $290,000 in 2021 or $305,000 in 2022, and companies use only that first amount to calculate employer matching contributions.

For example, say your company matches up to 6% of your salary and you earn $300,000 in 2021. Six percent of $300,000 is $18,000 however, your company can only match you up to 6% of $290,000, the maximum employee compensation limit for 2021. So rather than up to $18,000, you’d get up to $17,400 as an employer match.

Here’s a useful reference chart to help you remember these important limits and thresholds:

| Type of Contribution |

|---|

Don’t Miss: How To Move 401k To Ira Without Penalty

How Do I Withdraw Money From My Retirement Account

Many worry about how they will generate income during retirement, especially if they do not have a pension. One way to ensure a steady income stream during retirement is to purchase an annuity with a guaranteed lifetime withdrawal benefit.

You can transfer or roll your retirement account into the annuity when you retire. The annuity will then provide you with an income stream for the rest of your life.

This can be a very effective way to use your retirement account, as it ensures that you will have a consistent income throughout your retirement years.

Social Security: How Much Will 2023 Cola Be Based On Latest Cpi Numbers

With 2023 fast approaching, Social Security beneficiaries will soon get a definite answer on how much their monthly payments will go up next year based on the current quarters inflation rate. For now, the estimated Social Security cost of living adjustment for 2023 is 8.7%, according to The Senior Citizens League, a non-partisan seniors advocacy group.

More: This Credit Score Mistake Could Be Costing Millions of Americans

Its estimate was updated on Sept. 13, 2022, following the release of the Labor Departments Consumer Price Index for All Urban Consumers report. According to that report, overall inflation in August rose 8.3% from the previous year, as monthly increases in the prices of food, shelter and medical care offset a steep drop in energy and gas prices. The August increase came on top of an 8.5% gain in July.

The Social Security COLA is based on the Consumer Price Index for Urban Wage Earners and Clerical Workers , a slightly different measurement than the CPI-U. The COLA is calculated by using the average rate of inflation in the third quarter of the year. When those figures come out, the data for July, August and September will be added together and divided by three to get the average. The 2022 number will then be compared with the third quarter average of 2021 to determine the percentage of change for 2023.

Live Richer Podcast: Unexpected Ways Losing a Spouse Can Affect Your Finances and Retirement

More From GOBankingRates

Also Check: Can I Open A Roth Ira And A 401k

Is It Better To Withdraw Monthly Or Annually From 401k

Withdrawing from your 401 monthly is better than annually because you earn interest on the money in the account, not the money in your pocket.

An annuity with a guaranteed lifetime withdrawal benefit can automate this process and continue to pay you a monthly income for the rest of your life, even after the 401 has run out of money.

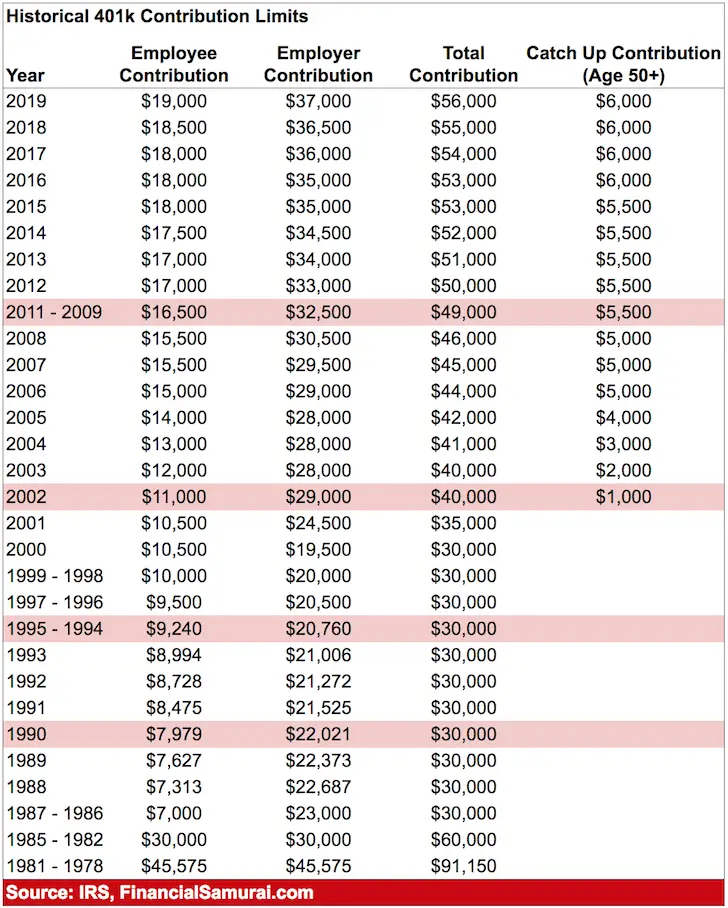

Everything You Need To Know About 401k Contribution Limits For :

The chart below shows the base 401 maximum contribution, the catch-up contribution for employees ages 50 and older, and the maximum allocation from all tax-sheltered retirement plans, from 2009 to 2020.

As you can see, the rate of increase over the past eleven years has typically moved at a snails pace. There has been only a $3,000 increase in the maximum contribution since 2009, and an even smaller increase in the catch-up contribution over the same space of time.

And as you can also see, contribution limits have stagnated in the past, such as 2009 through 2011, when they remain at $16,500 for three years in a row. Even more obvious is the lack of increase in the catch-up contribution for a full six years, when the amount remained at $5,500 from 2009 through 2014.

From 2009 through 2021, the maximum increased from $49,000 to $58,000. Thats an increase of $9,000 over 10 years, which works out to be over 2% per year.

| Year | |

|---|---|

| $5,500 | $49,000 |

For each year, the maximum allocation is increased by the amount of the allowable catch-up contribution . For example, for 2021, the maximum allocation is $63,500. That is the maximum allocation of $57,000, plus the $6,500 catch-up contribution.

Also Check: How To Collect My 401k Money

Also Check: Can You Get A Loan Against Your 401k