Contributing To A Roth Ira And A 401

Can you have a Roth IRA and a 401k? You fund a Roth IRA with after-tax dollars, meaning you dont get the benefit of deducting the amount you contribute from your current years taxes. The upside of Roth accounts, though, is that qualified withdrawals in retirement are tax free.

But theres a catch: Your ability to contribute to a Roth IRA is based on your income. So how much you earn not necessarily whether you have a 401k at work could be a deciding factor in answering the question, can you have a Roth IRA and 401k at the same time.

The rules for combining a 401k account with an IRA can be complicated. Its best to consult a professional.

Contributing To Your Workplace Retirement Account Up To The Employer Match

REMINDER: YOU NEED TO CHOOSE YOUR INVESTMENTS

Remember that you will need to elect where your contributions are invested. Review your plan documents to see what options are available to invest your savings.

If you have a retirement plan through an employer or 403) find out if they have a “match.” This means they’ll match your contributions up to a certain amount each year. This amount might be a percentage of your contributions, a percentage of your salary, or a certain dollar amount.

Once you find out their policy, do the math to understand how much you’d need to contribute to reach the maximum employer match. That’s like free money! Next, find how long you need to work there to keep the money they give you . But once it vests, it’s yours forever.

Fidelity believes you should contribute at least enough to your employer’s plan to get the match.

FAQ: Should I contribute to a 401 or Roth 401? Both have benefits, but picking one and contributing is what’s most important. You can even split your contributions between the two.

Create A My Social Security Account

To see all of your Social Security benefits online, you’ll first need to create a My Social Security account. Here’s what to do.

1. Go to ssa.gov on your browser and click Learn about my account next to my Social Security account.

2. Next, click Create an Account.

3. You’ll be prompted to sign in with your ID.me account or login.gov account unless you created an account before Sept. 18, 2021. Note that you’ll need to create one of those accounts if you don’t have one.

4. Once you have an account, you’ll need to agree to the terms of service to continue.

5. Next, you’ll need to verify your identity. The Social Security Administration will send a one-time security code to your email that you’ll need to enter within 10 minutes to continue to your account.

You should now have access to all of your Social Security statements and other details online.

Recommended Reading: How Much Do I Need In 401k To Retire

How Much You’ve Already Saved For Retirement

The higher your 401 balance, the less you’ll generally need contribute to your 401 plan as you approach retirement. The lower your balance, the more you’ll need to play catch up by contributing a higher percentage toward your retirement. To help determine how much your 401 could be worth over time, you can use a 401 growth calculator.

Consider Contributing To Your Health Savings Account To The Maximum

Plan to save additionallyand separatelyfor health care costs in retirement. Consider using an HSA if you are enrolled in an HSA-eligible health plan. With an HSA, you can often split your contributions into invested money and cash . You can get 3 tax benefits for contributions: An initial tax deduction for your contributions, tax-free potential earnings, and tax-free withdrawals when you use the money for qualified medical expenses.1

Find out how much you can contribute and if you can, try to reach that limit . Once the money is in your account, don’t forget to choose your investmentsinvesting is how your money has the potential to grow over time. This is particularly important to think about for women, who have higher health care costs in retirement and are more likely to need long-term care.2

FAQ: What if I want to spend the money in my HSA on expenses right now? Consider talking to a financial professional about how to balance what you need right now versus saving for the future.

Recommended Reading: What Is The Safest 401k Investment

Find Out If A 401 Is Right For You And What Amount To Put In

Putting money into a 401 plan account is a smart idea for your financial future. Many experts recommend investing a minimum of 10% to 15% of your gross income into the plan every year. At the very least, you should put enough money in to get the matching contribution from your employer.

But there are times when your money would be better spent elsewhere. What you should do depends on your 401 and your financial situation.

Best Places For Employee Benefits

SmartAssets interactive map highlights the counties across the country that are best for employee benefits. Zoom between states and the national map to see data points for each region, or look specifically at one of four factors driving our analysis: unemployment rate, percentage of residents contributing to retirement accounts, cost of living and percentage of the population with health insurance.

You May Like: How To Set Up 401k On Adp

Personal Capital Average 401k Balance By Age

| AGE | |

|---|---|

| $458,563 | $132,101 |

*Note: Averages are rounded up to the nearest dollar. Numbers are based on aggregated and anonymous data from the Personal Capital Dashboard. Accounts included are the following: 401k, former employer, Roth 401k. Excludes test and invalid accounts. Excludes any account value greater than $100,000,000 or less than -$100,000,000. Excludes spouse accounts. Snapshotted balance as of 9/7/2022.

Do Not Dip Into Your Funds Early

Peter Ferriello, CFP, Senior Wealth Advisor, and VP at Mollot & Hardy, Inc. Wealth Advisors

At a minimum, people should contribute an amount equal to their employer match. Many workers miss out on free money that their employer is willing to contribute to their account. This is a critical mistake that has a lasting impact on ones future. In order to calculate how much you should actually contribute beyond the match, it’s recommended you sit with a financial planning professional, preferably a CFP, who can help you calculate the amount that is necessary, but also realistic.

It’s also important to stress that taking loans and withdrawals from one’s 401k can have detrimental consequences on the future value of the account.

You May Like: How Can I Check My 401k Online

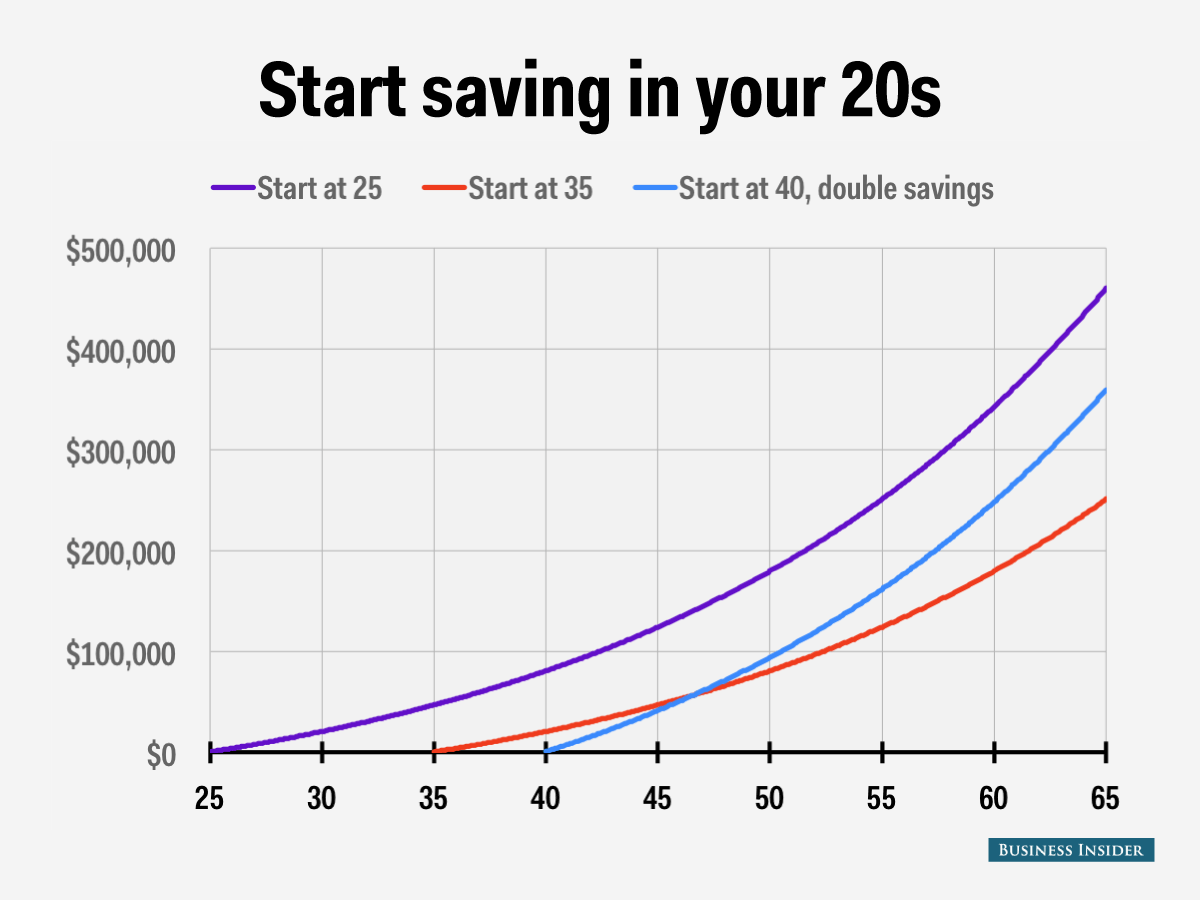

The Power Of Compound Returns

The earlier you start saving for retirement, the less youll need to save each month. You can thank compounding, which is basically the returns you make on returns. Once youre making money on your earnings, your returns compound at an accelerated rate.

Suppose you want to retire at age 60 with $2 million and that you get average returns of 10%. Thats slightly less than what the S& P 500 index has delivered before inflation over the past 60 years with dividends reinvested.

Heres what youd need to invest, between your own contributions and your employers match, if you have a $50,000 annual salary.

- If you started investing at 20: Youd need to invest $316.25 per month, or 7.6% of your salary.

- If you started investing at 30: Youd need to invest $884.76 per month, or 21.2% of your salary.

- If you started investing at 40: Youd need to invest $2,633.76 per month, or 63.2% of your salary.

The examples above show not only how much more youll have to contribute to your 401 each month if you start saving later, but also how much more youll have to save overall. In the first example, youd invest just under $152,000 total by starting at 20. But if you didnt get started until 40, youd wind up investing more than $632,000 to reach your goal.

Keep in mind that 10% is an average, not the 401 rate of return you should expect every year. Your returns will vary, based on how your investments perform, along with the risk tolerance you indicate when you choose your investments.

The 2021 Rrsp Contribution & Deduction Limit

Theres a limit to how much you can contribute to your RRSP and it changes each year. For the 2021 tax year, you can contribute up to 18% of the earned income you reported for last years taxes , or $27,830 whichever is less.

Fortunately, youre able to beef up your 2021 contributions even after the calendar turns. The deadline to contribute to your RRSP for the 2021 tax year is March 1, 2022.

Remember, even if you miss the deadline, unused RRSP room carries forward and adds up. If you havent maxed out your account in previous years, you should have a considerable amount of space available to you.

You May Like: Where To Put My 401k Rollover

Considerations Around Contributing To A 401

Perhaps the most important question to ask yourself with regard to retirement planning is, “What percentage should I contribute to my 401?” You may have heard that you should typically contribute at least 10% of your salary to your 401, but everyone’s financial situation is different. For additional guidance, you can also review some general tips for contributing to a 401 plan.

Keep these considerations in mind when deciding how much to contribute to your 401:

Average 401 Retirement Balances

Based on Fidelitys 2020 study, here are the average retirement balances for the IRA, 401, and 403. Expect the balances to be 5-10% higher for 2022 after a huge 2021 and a poor 2022.

- The average IRA balance was $111,500, a 13% increase from last quarter. It is slightly higher than the average balance of $110,400 in 2019.

- The average 401 balance increased to $104,400 in Q22020, a 14% increase from Q1 but down 2% from a year ago. For 4Q2020, the average 401 balance rose to roughly $120,000.

- Average 403 account balance increased to $91,100. This is an increase of 17% from last quarter and up 3% from a year ago.

Based on Fidelitys latest 2022 report, the average 401 balance is $121,700 as of 1Q 2022. Heres a more filtered breakdown of the average 401 balance by age range in 2022.

- Age 20-29: $14,600

- Age 50-59: $206,100

You May Like: Do I Have An Old 401k

What Is A Match And How Can I Meet It

Depending on your employers 401 benefit, you may have access to whats known as an employer match. Its more or less what it sounds like – the employer will match your own contributions up to a certain amount.

This can take a few different forms, so its important to pay attention to what is required in order to earn the full amount of the match in your plan. Common examples of an employer match are:

Single-tier formula: The employer matches the same amount for each dollar that you contribute, up to a certain percentage of your income.

Example A: Your employer matches 50% of the first 6% of your contributions. In this case, you need to contribute at least 6% per-pay-period to earn your full match. Here, the employer is matching $.50 for each $1, up to 6% of your income.

Example B: Your employer matches 100% of the first 3% of your contributions. Therefore, you need to contribute at least 3% per-pay-period to earn your full match. Here, the employer is matching $1 for each $1 up to 3% of your income.

In both cases, the employers match is 3% of the employees income, but in the first example you would need to defer at least 6% to get the full 3% match.

Multi-tier formula: The employers match may have different tiers, where the first tier is matched at one ratio and subsequent tiers may be matched at different ratios.

How Much Should I Have In My 401 At 30

Saving for a financially secure retirement is a long-term project with a sometimes indistinct final objective, especially when people are just starting in their careers. Retirement is far in the future at that point and key concerns such as career earnings, investment returns and post-retirement living expenses seem remote. One rule of thumb is that by age 30 people should have approximately a years salary in a 401 or other retirement account. Other benchmarks suggest more or less may be appropriate. If youd like some help planning for retirement you can find a financial advisor who serves your area with our free online matching tool.

401 Basics

One of the most common retirement savings vehicles is a 401 plan. These plans offer tax advantages and flexibility in investment choices. Employees contribute to these plans through payroll deductions. And many employers will match savers contributions. Combined with tax-deferred investment gains, these features allow 401 owners to build sizable balances over time.

Whether a given balance will be adequate depends on a number of factors, including age at retirement, annual income, local cost of living, healthcare needs and projected expenses in retirement. To find out more on how a 401 can perform over time, you can use the SmartAsset 401 calculator.

What 30-Year-Olds Actually Save

Retirement Savings Benchmarks

Additional Retirement Saving Insights

Bottom Line

Tips on Saving for Retirement

You May Like: How To Contribute To 401k Without Employer

What Percentage Should I Contribute To My 401

The rule of thumb that many financial advisors and experts use is to contribute 10% to 15% of your annual income to your 401. You could also aim to contribute as much as needed to at least maximize your employer contributions through any matching program youre offered.

If you aim to retire early, your contribution rate should be as high as you can afford. For example, those who seek the FIRE strategy significantly cut their living costs to direct more money to their retirement fund.

What Is The Average And Median 401 Balance By Age

401 balances can average roughly $6,000 at the age of 24 to more than $255,000 at the age of 65. Both average and median 401 balances can vary greatly depending on a few factors. This can include how long you have been saving for retirement or whether your company provides 401 matching, which is when your employer contributes to your retirement savings based on the amount of your contribution.

While savings are personal, the idea of a nest egg will likely make you contemplate what your financial future holds. Retirement might seem like a long way down the road, but time flies faster than we realize. And the earlier you start saving for retirement, the better off youll be later in life.

Knowing the 401 average by age can help you figure out where you stand and how you can be better prepared for the future. Heres what you can learn from Vanguards research on How America Saves in 2021:

| Age |

|---|

Dont Miss: Best Free Retirement Planning Tools

Read Also: How To Transfer 401k After Leaving Job

It Depends On Your Effective Tax Rate

Garrett Konrad, Partner at IFC Financial Advisors

My biggest piece of advice regarding contributing to your 401 is to contribute up to the max amount. You can’t beat the return on a 50-100 percent match and there’s no reason to leave free money on the table. Contribute anything you can up to that maximum your company will match.

Once you hit the max , evaluate what your effective tax rate is. If you are paying 20 percent or less effective tax, save in a Roth 401 if available or a Roth IRA and pay the tax now instead of kicking the tax liability can down the road.

How Much Should I Save For Retirement

We get that question a lot.

A good rule of thumb is to try to save 1015% of your income toward retirement, says Stanley Poorman, a financial professional with Principal®, but that also depends on when you get started. That may be fine if youre 25 if youre starting at 50, you may need to save more to retire comfortably. Theres no one-size-fits-all answer.

Another factor is whether you have a matching contribution from your employer, and if so, what percentage the company contributes. Poorman suggests deferring enough of your pay to get that match.

Get a snapshot of how much you may need to save with our Retirement Wellness Planner.

You May Like: What To Do With Your 401k When You Retire

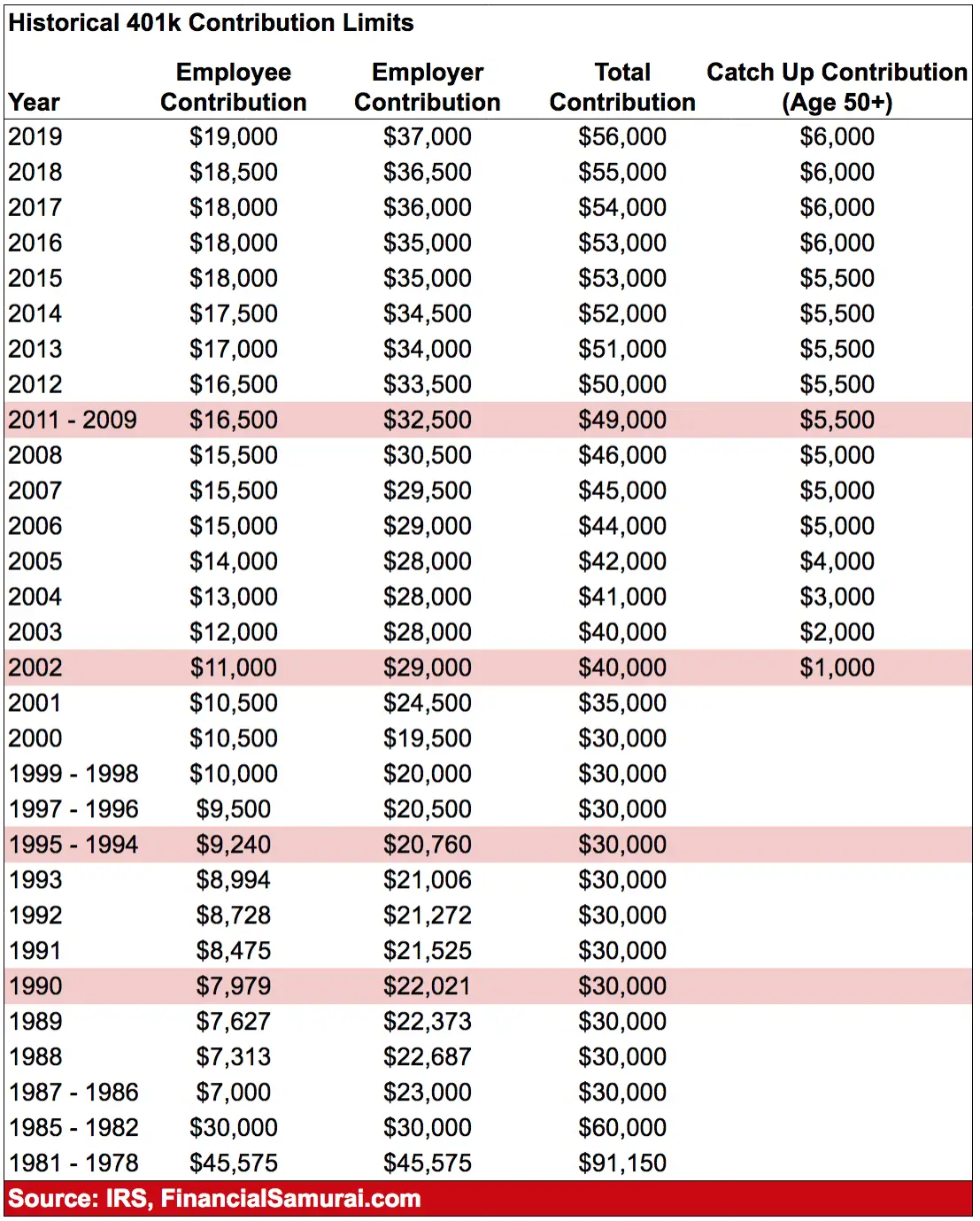

How 401 Contribution Limits Work

There are two types of contribution limits for a 401 plan:

- The annual salary deferral contribution limit: This is how much an employee could contribute using their pre-tax dollars. The maximum contribution is $20,500 in 2022 and is raised periodically. The limit increases if youre 50 or older, allowing you an extra $6,500 catch-up contribution in 2022. This brings the total contribution limit to $27,000.

- The overall limit: This is the upper cap for employee and employer contributions. This limit is $61,000 for 2022, with a limit of $67,500 for employees over 50.

If You Start At Age :

With a 4% rate of return: $1,090.78 per month

- Annual salary needed if you save 10% of your income: $130,893

- Annual salary needed if you save 15% of your income: $87,262

With a 6% rate of return: $698.41 per month

- Annual salary needed if you save 10% of your income: $83,809

- Annual salary needed if you save 15% of your income: $55,872

With an 8% rate of return: $433.06 per month

- Annual salary needed if you save 10% of your income: $51,967

- Annual salary needed if you save 15% of your income: $34,644

Also Check: Can I Rollover My 401k To A Roth Ira