Choosing The Right 401 Costs For Your Business

Examining 401 costs to employers and employees is not a simple task because of the variety of plans available and the fact that vendors make money in ways that may not be obvious. Don’t wait for plan providers to tell you what you need to know you must ask the questions based on the fee information they provide. Then be ready to discern which plan is right for the business’ and for your employees. Keep in mind that you’re looking for a cost-effective plan’ but also for one that adds value. Use your research to determine if your organization is ready to offer a 401′ and which provider can best meet your needs. Whether you’re a small business owner or the HR director for a company with hundreds of employees’ you deserve a cost-effective 401 plan that discloses the fees and costs required to make this benefit a reality for your organization.

There are also some financial breaks small businesses can receive for starting a 401 plan. For example’ qualified employers may receive a $500 tax credit for the plan’s first three years. Some expenses may also qualify as deductible business expenses. Employer contributions that fall below the threshold of 25% of an employee’s salary are also exempt from federal’ state’ and payroll taxes.

Liz Sheffield has more than a decade of experience working in HR. Her areas of expertise are in training and development’ leadership development’ ethics’ and compliance.

Assets Under Management Fees

Most 401 providers charge asset-based fees on total account balances for the management of the portfolio, investment advice, investment fees, and custodian compensation.

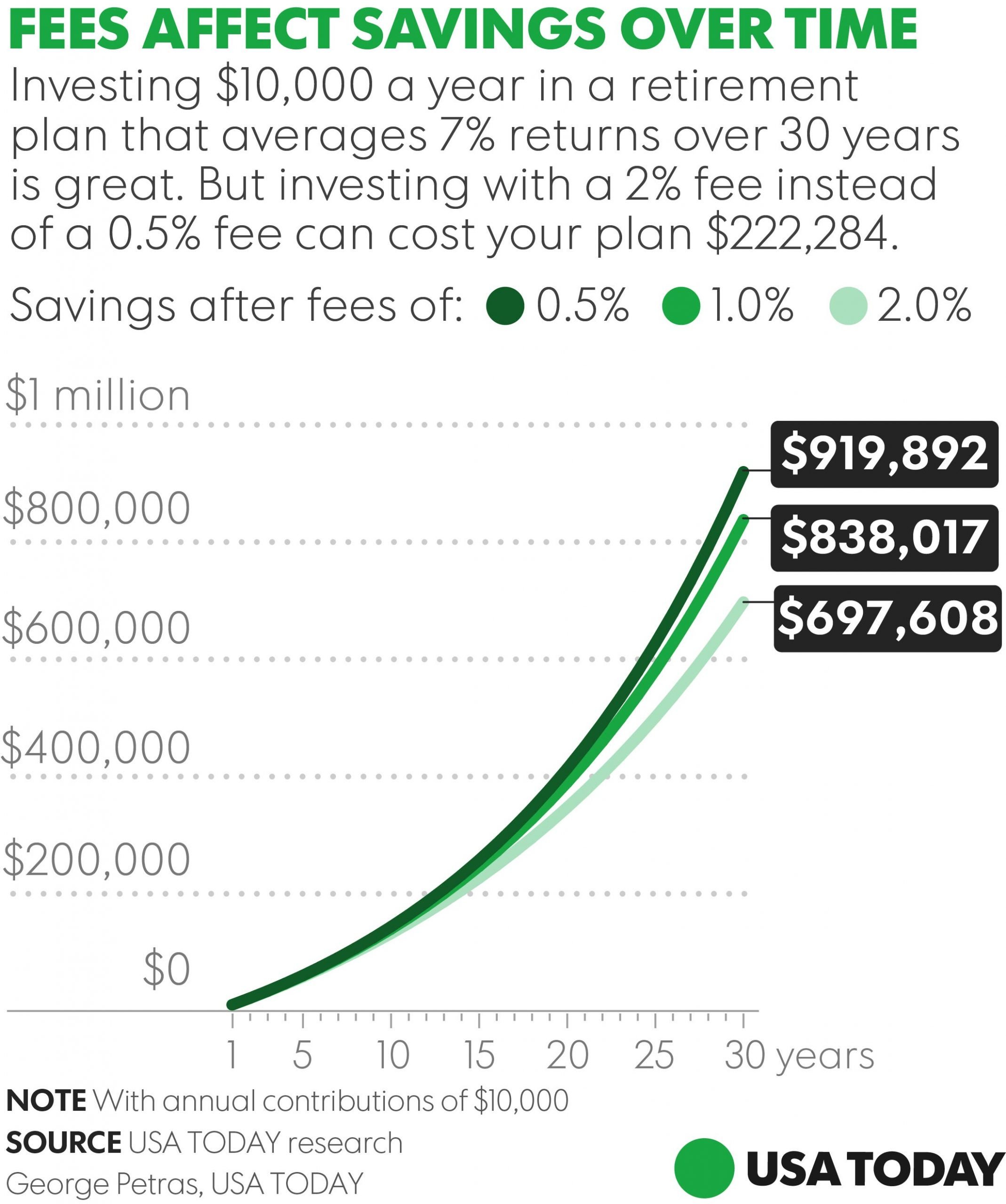

The problem with AUM fees is that the more your portfolio grows, the more money you pay to the provider, and the less your employees get to keep for their retirement.

Lets say you have a 1.5% AUM fee. Thats $1.50 you pay to the provider per every $100 in your 401 account.If you have invested more than $500,000, youd be paying $5,000 to $7,500 .You may also be charged a fee by your provider if your plan fails to reach certain asset levels.

Consider Outsourcing The Administration

Bringing in an in-house expert can be very costly, and doing so without experienced personnel could lead to mistakes or inefficiencies. By outsourcing, you improve efficiency and reduce liability.

Professional employer organizations are third-party companies that handle human resources, payroll, benefits and 401 plans for small businesses. Thousands of small businesses nationwide partner with PEOs to access competitive benefits and 401 plans.

Choosing a PEO can be complicated, but several types make sense for small businesses. The best PEOs have industry accreditation, minimal requirements for coverage, and great features, including short-term contracts.

Recommended Reading: How Long Do You Have To Rollover A 401k

Employer Benefits Of Offering A 401 To Employees

One reason companies offer 401 plans is to attract and retain top talent at every level of the organization. A 2022 survey commissioned by Human Interest and conducted by market research company OnePoll, found that retirement plans are the most-wanted benefit after health insurance. Human Interest internal data from March 2022 also found that offering a 401 plan may lead to lower turnover rates for small to medium-sized businesses.

A 401 is attractive to employees as it provides an easy, cost-effective way to save for retirement while deferring income tax on contributions until the future . But employees arent the only ones who receive tax benefits from a 401 plan. Employers can deduct match or profit sharing contributions made to employees 401 accounts .

Whats more, the government incentives qualified small businesses to start 401 plans. Eligible employers can take advantage of a startup costs tax credit of up to $5,500, per year for the first three years of the plan, to cover the the ordinary and necessary costs of starting a new 401 plan and by adding an feature.

See how much a 401 would cost with SECURE Act tax credits applied.

Use A Fee Disclosure Form To Collect Information

Given the complexity of fee structures and schedules’ begin by requesting that potential plan providers fill out a 401 Plan Fee Disclosure Form. This sample form provided by the DOL is a helpful tool and includes a list of possible administrative expenses’ start-up expenses’ termination fees’ and the definition of pricing terms. Bottom line: yes’ 401 plans cost money however’ requesting a fee schedule that details every cost will help ensure that you’re informed about the costs required.

You May Like: How To Set Up 401k In Quickbooks

Fees For 401 Services: What Plan Sponsors Need To Know

Political candidates who dont know the cost of a gallon of gas or a movie ticket usually wind up paying that price with voters and losing on election day. Likewise, many plan sponsors are finding themselves on the losing side of lawsuits because they allowed their defined contribution plan to pay unreasonable service fees.

Plaintiffs class action lawsuits against excessive fees dominated Employee Retirement Income Security Act litigation in 2017, according to Seyfarth Shaws annual Workplace Class Action Litigation Report. Of the $2.72 billion spent by employers on the top 10 aggregate workplace class action settlements, nearly $928 million came from the 10 largest ERISA settlements. That is up from $807 million in 2016.

Seyfarth Shaw expects more of these lawsuits to come in 2018. That is bad news for many employers because defending and settling lawsuits can significantly affect an organizations bottom line. For example, in a case settled in May, plaintiffs alleged that Philips North America LLC paid too much for its investment management and administrative services. While the company said in court documents that it did nothing wrong, a U.S. District Court preliminarily approved a $17 million payment to participants in its 401 plan.

Knowing your Fees

According to NEPC, the median plan record keeping fee for 2017 was $59 per participant, compared to $64 in 2015. The median investment fee ratio was 0.41 percent, compared to 0.46 in 2015.

How Fees Affect Participants

Fees Paid By The Employee

Employees enrolled in the employerâs 401 plan can be charged any of the three types of 401 fees. However, the main types of fees that employees pay include investment fees and administrative fees. Also, where the employer does not cover fiduciary and consulting fees charged by 401 specialized advisors, these costs will be passed on to the employee.

Employees will also be subject to the 12b-1 fee, which derives its name from the Investment Company Act of 1940. This fee is charged by mutual funds, and it pays for the cost of marketing and distributing mutual funds, and to compensate salespeople for bringing in new clients into the retirement plan. As more investors join the retirement plan, there will be more money to invest into the mutual fund, and this will reduce the operating costs per investor. The 12b-1 fee ranges from 0.25% to 0.75%.

Don’t Miss: Should I Transfer 401k To Roth Ira

Keep An Eye On Your 401 Fees And The Fine Print

Once you understand what types of fees you are paying, either as the business owner of the 401 plan or as a saver in the plan, it is also essential to keep an eye on plan costs over time to ensure you continue to receive the best value. This is especially true for investment fees because they usually make up the largest portion of expenses in a 401 plan.

Employers, with the assistance of their service providers, must provide information about 401 fees to employees who save in the 401 plan. Employees can also find an explanation of fees charged to their accounts in their quarterly account statements, which is an IRS requirement.

What Is The Result Of The Analysis

At the conclusion of the process, Multnomah Group will provide an executive summary of the project that was completed, and specific recommendations for your consideration. The documentation is an important step in the governance process. We provide this summary so that you may document your diligence in meeting your fiduciary obligations.

There is no cost for this service.

Recommended Reading: How To Claim 401k From Previous Employer

Transaction Or Individual Service Fees

Transaction fees may be charged in tandem with asset-based fees or flat-fee structures. Triggers for transaction fees may include changing a fund line up, withdrawing a loan, taking a distribution, or using premium investment advisory services. Frequent or high-cost transaction fees can be a major drain on your savings.

Choose A Plan For Your Employees

Once you’ve chosen a retirement services provider, it’s time to decide on a plan that fits both your business and your employees’ needs. Options available to employers regardless of size, including businesses with only one employee, include:

1. A traditional 401 plan, which is the most flexible option. Employers can make contributions for all participants, match employees’ deferrals, do both, or neither.

2. The safe harbor 401 plan, which has several variations and requires the company to make a mandatory contribution to the plan participants. The contributions benefit the company, the business owner, and highly compensated employees by giving them greater ability to maximize salary deferrals.

3. An automatic enrollment 401 plan, which allows you to automatically enroll employees and place deductions from their salaries in certain default investments, unless employees elect otherwise. This arrangement encourages workers to participate in the company 401 plan and increase their retirement savings, which also benefits business owners. Automatic enrollment plans may also contain a safe harbor provision.

Read Also: Should I Move My 401k When I Change Jobs

Dont Forget About The Tax Benefits

There are 3 big tax benefits that can help offset the cost of a 401:

1. Retirement Plans Startup Cost Tax Credit

Qualified employers could receive a $500 tax credit for the first 3 years of the plan. This can cover anything from setup and administration costs to participant education fees.

2. Administration Costs Tax Deduction

Some administrative costs can be deducted as a business expense.

3. Employer Contribution Tax Deduction

Whether they are profit sharing, non-elective contributions, or matching contributions, if your employer contributions fall below 25% of the employees annual compensation, they are exempt from federal, state, and payroll taxes.

Factoring in these tax breaks can make a 401 a lot more feasible for your business.

How Much Does A 401 Cost

401 Fees and Why the Cost Is Worth It

In recent years, a lot of media attention has been focused on 401 cost and the fees business owners and their employees are paying for 401 investments and recordkeeping services and for good reason.

Differences in fees as small as 0.1% per year can lower your account balance by thousands of dollars by the time you retire.

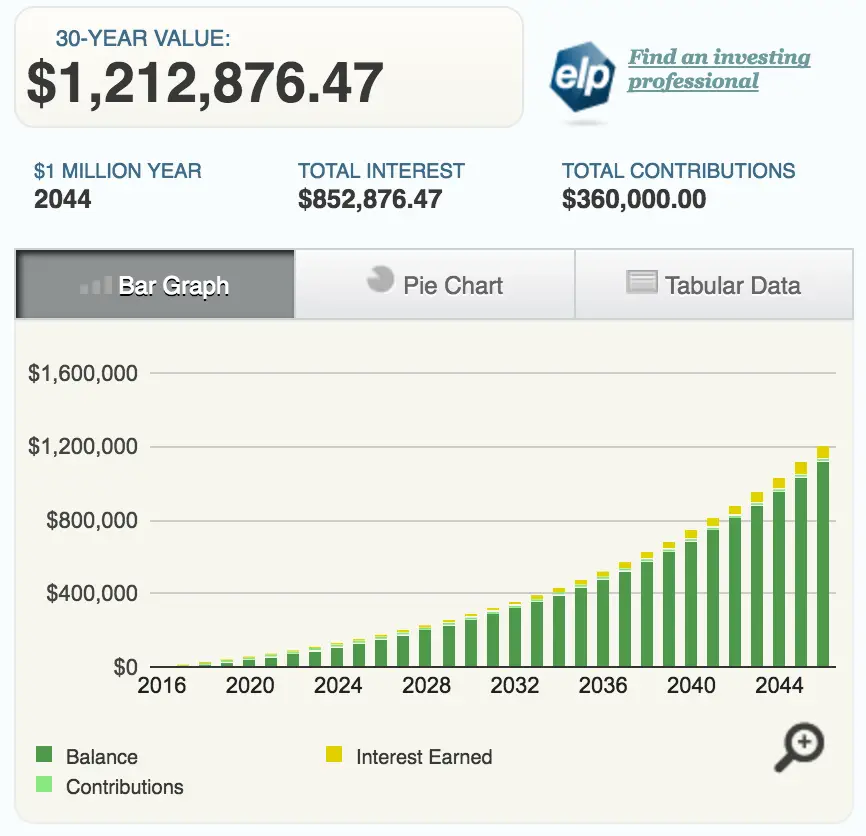

Fee example: Assume an employee with 35 years until retirement has a current 401 account balance of $25,000 and earns an average investment return of 7% per year until retirement. Without any additional contributions, here is how 401 fees could affect the account balance at retirement.

Total 401 Fees

Department of Labor, A Look at 401 Plan Fees

Also Check: Does 401k Get Split In Divorce

How To Set Up A 401k For A Small Business

Setting up a 401 for your small business includes some crucial steps, some of which can be outsourced. It’s important to remember that the employer maintains a fiduciary duty to ensure that the plan is providing a benefit to participants. The U.S. Department of Labor provides in-depth details of the process:

1. Create a 401 plan document

Create a plan document that complies with IRS Code and outlines the details of your retirement plan. Set up procedures to ensure the document is followed.

2. Set up a trust to hold the plan assets

A plan’s assets must be held in trust to assure its assets are used solely to benefit the participants and their beneficiaries. At least one trustee must handle the plan’s activities regarding contributions, plan investments, and distributions. Given that these decisions affect the plan’s financial integrity, selecting a trustee is a critically important decision. Another fiduciary, such as the employer who sponsors the qualified retirement plan, will generally assign the trustee.

3. Maintain records of 401 employee contributions and values

Maintain accurate records that track employee contributions and current plan values. Many small businesses choose to work with a 401 recordkeeper to help them manage plan setup and ongoing record management.

4. Provide information to plan participants

What Fees Are Included In Your 401

Many American workers believe that 401 funds charge fewer fees than individual investments, but that isnt always the case. 401 fees fall into three basic categories. The U.S. Department of Labor defines them as investment fees, plan administration fees and individual service fees. The table below compares them:

Recommended Reading: Why Is Ira Better Than 401k

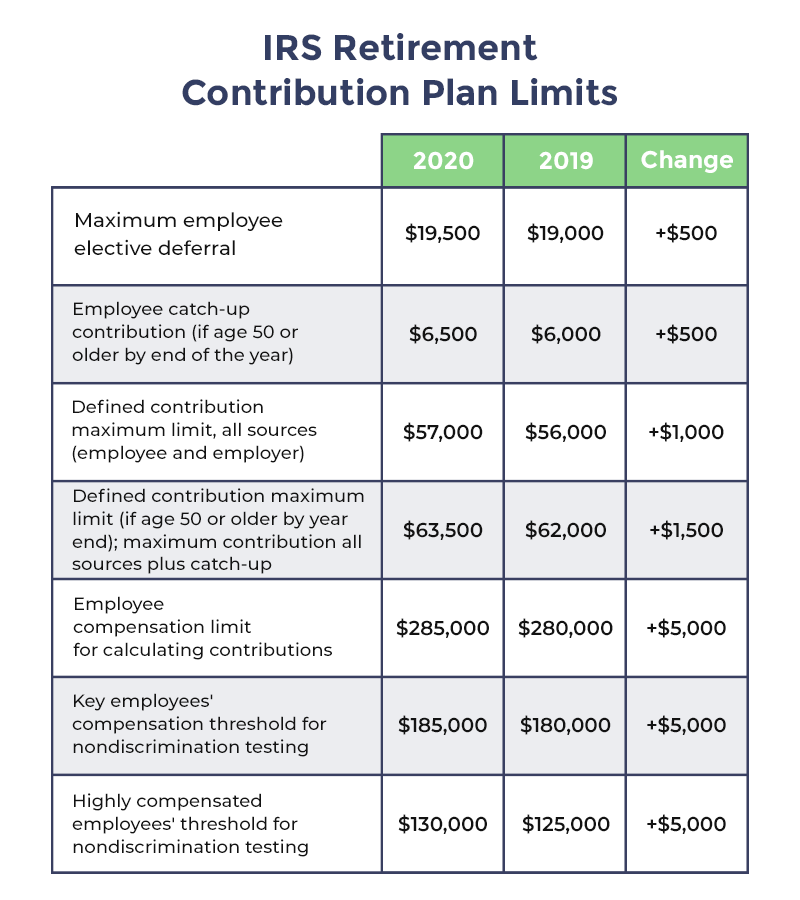

What Are The New Rules For Required Minimum Distributions Or Rmds In 2023

Currently, Americans must start receiving required minimum distributions from their 401 and IRA accounts starting at age 72 . The Secure 2.0 Act of 2022 raises the age for RMDs to 73, starting on Jan. 1, 2023, and then further to 75, starting on Jan. 1, 2033.

The new rules also reduce the penalty for failing to take RMDs. The previously steep 50% excise penalty will be reduced to 25%, and lowered further to 10% if the error is corrected “in a timely manner.” The penalty reductions take effect immediately, now that Biden has signed the law.

Claim Your Tax Credits

To help pay for 401 costs, and as another incentive to save for retirement, the IRS provides tax credits for employers and employees who start and save in a 401 plan.

Employers Certain employers can claim a tax credit for up to 100% of the costs of setting up and administering a plan and educating employees about the plan. Up to a maximum of $500 per year may be claimed for three years. To be eligible for the credit, the business must meet the following requirements:

- No more than 100 employees who received $5,000 or more in pay last year

- At least one employee who owns less than 5% of the company and who earned less than $150,000 last year

- No retirement plan for your employees in the last three years

Everything you need to know about 401 fees and cost.

If your business does not qualify for the tax credit, you may be able to deduct the startup costs as a business expense.

Also Check: Can You Invest With Your 401k

What Is A Matching Employer Contribution Are Employers Required To Match Contributions

Unlike a pension, most employers arent required to make contributions to employees 401 retirement accounts. This flexibility can make overall costs more manageable for some employers. However many employers choose to match their employees 401 deferral contributions up to a certain percentage as an added benefit for their employees. In fact, as of January 2022, 75% of all Human Interest plans offer an employer match*.

So, whats an average employer match? This is a tough question. Each business has their own motivations for providing different match types. However, at Human Interest, as of January 2022, 42% of total plans that provide a match offer a dollar per dollar contribution on the first 4% of deferred compensation to their employees*.

Common employer matching contribution formulasEmployers have options when selecting a match contribution formula. Four of the most common formulas are:

Employer matches employee contributions dollar for dollar up to a set dollar amount per employee

Employer matches employee contributions at a set percentage of each employee-contributed dollar up to a set dollar amount per employee

Employer matches employee contributions dollar for dollar up to a percentage of the employees salary

Employer matches employee contributions at a set percentage of each employee-contributed dollar up to a percentage of the employees salary

Small Business 401 Plan Fees

Small businesses are overlooked in the 401 industry and charged higher fees because they have fewer employee participants and smaller account balances. At Ubiquity Retirement + Savings, helping small businesses with affordable retirement plans is all we do. Ubiquity was the first in the industry to offer small businesses a flat fee retirement plan. We also offer a diverse group of investments for you to choose from. Our goal is to help small business start and maintain 401 plans in a way that saves time and money, so employers and employees can grow their retirement savings.

Recommended Reading: Can I Access My 401k If I Quit My Job

How Employers Can Save Money With A 401 Plan

As a healthcare practice employer, youre probably familiar with the benefits of a 401 plan for your employees. Of course, its also important to consider the potential 401 benefits for employers and your overall employer costs.

Many employers are advantageously positioned for the following benefits of a 401:

- Tax savings for both plan startup costs as well as contributions

- Retirement funds and tax savings for leadership and key personnel

- A variety of investment options

In short, a 401 gives both employees and employers the opportunity to invest in retirement with substantial tax benefits. Though there are expenses involved, these are often offset by potential cost savings. Whether youre analyzing your existing 401 plan or comparing potential new plans, its important to weigh all the benefits, so you make an informed decision.

Breaking Down 401 Plan Fees

Notably, 401 plan fees typically fall into four categories:

- Individual service

To illustrate the point, heres a sample account quarterly summary, not from a 401provider but rather from a third-party firm that administers plans and keeps records. The figures, which represent dollar amounts, are on a total contribution of $3,207.70 for the quarter.

| Expenses | |

| TOTAL | $44.91 |

This means the contributor is paying $44.91 in fees on a principal of $3,207.70. Curiously, thats 1.4% to the penny, which makes it seem as though the expenses are retrofitted to the ratio.

Is it reasonable that only 98.6% of your contributions find their way into the designated investments? Thats not a rhetorical question.

Also Check: How To Calculate Employer 401k Match

Also Check: What Is Qualified Domestic Relations Order 401k