The Drawbacks Of Taking Out A 401 Loan

On a normal day in a normal market, borrowing from your future self wouldnt be a good idea. Heres why:

- You never get that money back. Even when you repay your loan, the money that wouldve been there the entire time doesnt get a chance to earn and grow. Youre losing out on earnings by taking money out early.

- You might need to pay it off sooner. If you leave your job , youll need to repay your loan by the upcoming tax deadline. So if you took out a 401 loan right now and lost your job next month, youd be on the hook for paying it by the .

- Repayment is with after-tax dollars. That means when you withdraw the money again later down the road, itll be taxed again.

- You could get taxed anyway. If something comes up and you cant pay your loan back, its considered an early distribution and youll face the 10% penalty.

Also Check: Can I Invest In 401k And Ira

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Planning To Leave Your Job Be Careful

If you leave your job, willingly or not, your 401 loan will convert to an accelerated repayment schedule. Depending on your plan, you may need to pay the funds back soon after your severance date.

If your plan doesnt have a repayment plan specific to departing employees, youre bound by IRS rules. Youll still need to repay your loan balance in full by tax day the following year.

Also Check: What Can You Do With Your 401k

How Much Can You Withdraw From 401k Tax Free

The legislation allowed people to take distributions of up to $100,000 from their 401 accounts or IRAs without having to pay the normal 10% penalty in 2020, even if they were younger than age 59 1/2. However, the distribution is considered ordinary income for tax purposes and will increase your tax liability.

Dont Miss: Which Is Better Roth Or Traditional 401k

Does A 401 Loan Or Withdrawal Make More Sense

When you consider the potential tax consequences associated with an early withdrawal, a 401 loan may seem more attractive. Of course, there’s one drawback with both options: you’re diminishing your retirement savings.

With a 401 loan, you’d have the ability to replace that money over time. If you’re cashing out an old 401, however, there’s no way to put that money back. In both cases, you’re missing out on the power of compound interest to grow your retirement wealth over time.

One upside of deciding to borrow from a 401 for a housewhether you take a loan or make a withdrawalis that it may allow you to avoid paying private mortgage insurance if you offer the lender a large enough down payment. Private mortgage insurance protects the lender, and it’s typically required if you’re putting less than 20% down on a conventional mortgage. Private mortgage insurance can be eliminated when you reach 20% equity in the home, but it can add to the cost of homeownership in the early years of your mortgage.

Don’t Miss: How To Save For Retirement Without A 401k

Is A Deemed Distribution Treated Like An Actual Distribution For All Purposes

No, a deemed distribution is treated as an actual distribution for purposes of determining the tax on the distribution, including any early distribution tax. A deemed distribution is not treated as an actual distribution for purposes of determining whether a plan satisfies the restrictions on in-service distributions applicable to certain plans. In addition, a deemed distribution is not eligible to be rolled over into an eligible retirement plan. -1, Q& A-11 and -12)

What Are The Different Types Of 401 Plans

There are five types of 401 plans: traditional, safe harbor, SIMPLE, Solo, and Roth.

Read Also: How Do I Find Out How Much 401k I Have

How Much Can You Withdraw

Generally, you can’t withdraw more than the total amount you’ve contributed to the plan, minus the amount of any previous hardship withdrawals you’ve made. In some cases, though, you may be able to withdraw the earnings on contributions you’ve made. Check with your plan administrator for more information on the rules that apply to withdrawals from your 401 plan.

Ask For Money From The Seller

Whether or not you decide to pull from your 401 for your home purchase, if you truly feel that youre unable to afford the upfront costs of buying a home, it may be a good idea to ask for money from the seller. In this scenario, the seller will pay for a portion of your closing costs upfront and raise the sale price of the home accordingly, which will allow you to pay for your closing cost overtime in the form of a slightly- higher mortgage payment.

While this may sound like a good deal, its important to note that its usually not recommended to go this route unless its absolutely necessary. Often, asking for a seller concession makes your offer appear weaker in the eyes of the seller and may make you less competitive in a hot market.

Read Also: Can I Move Money From 401k To Ira

When To Do It

Ironically, the best time to borrow against your 401 to pay closing costs or cover a down payment is when you can well afford to, suggests David Hultstrom, a financial adviser in Woodstock, Georgia. Otherwise, you are stretching yourself to the point where you couldnt weather an emergency.

If you lose your job and couldnt repay the 401 loan, you would have to take that amount as a distribution. That would cost you income tax and a 10 percent penalty on the amount and it would also leave your retirement plan permanently lighter, as you wouldnt be able to replace that money when you got onto more solid ground.

Also Check: How Often Can I Change My 401k Investments Fidelity

Should You Borrow From 401

Borrowing from your 401 account can be beneficial in some ways. For example, you can take a 401 loan to pay for home improvements such as roof repair, painting, or fixture and fittings replacement, which could raise the value of your property. This can help you add a few thousand dollars to the property valuation if you decide to sell it.

You can also take a 401 loan to pay another high-interest debt to reduce the amount of interest you owe the lender. In this case, the 401 loan would help you avoid additional interest and penalty costs.

On the flip side, a 401 loan might be a bad idea if you are using the funds to buy gifts, pay entertainment expenses, or other unnecessary expenses. It would be better to keep the retirement money in a retirement account, and pay these expenses out-of-pocket or using other sources of cash.

Recommended Reading: How To Roll 401k Into Another 401k

Can A Loan Be Taken From An Ira

Loans are not permitted from IRAs or from IRA-based plans such as SEPs, SARSEPs and SIMPLE IRA plans. Loans are only possible from qualified plans that satisfy the requirements of 401, from annuity plans that satisfy the requirements of 403 or 403, and from governmental plans. Reg. Section 1.72-1, Q& A-2)

When You Should Take All Your Money Out Of A 401

If you are a skilled investor or have access to financial advice, a lump sum payment can help you:

- Better control your lifestyle to travel or live a more comfortable, upscale life.

- Have the opportunity to make your own investments to leave a legacy.

- Pay off your existing debts and mortgage or pay for a new home in cash.

- Feel more confident, no matter what the market does, knowing the set value of your savings.

In some cases, your employers 401 plan may require you to take the lump sum of cash for instance, if you have less than $5,000 invested in the plan. However, there are options for what you can do with that money, and there is no rule preventing you from reinvesting.

Dont Miss: How To Enroll In 401k

Also Check: When You Leave A Company What Happens To Your 401k

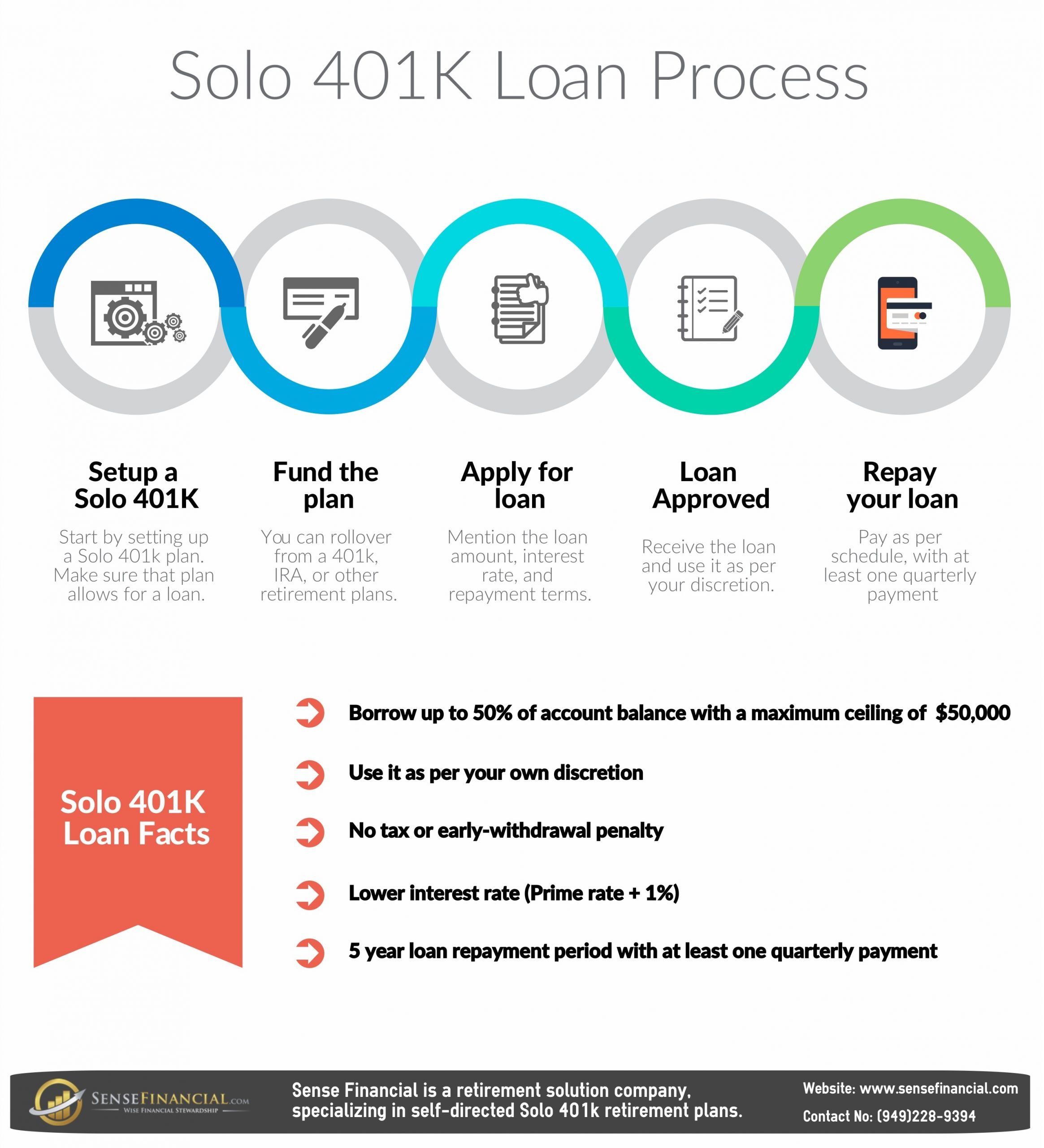

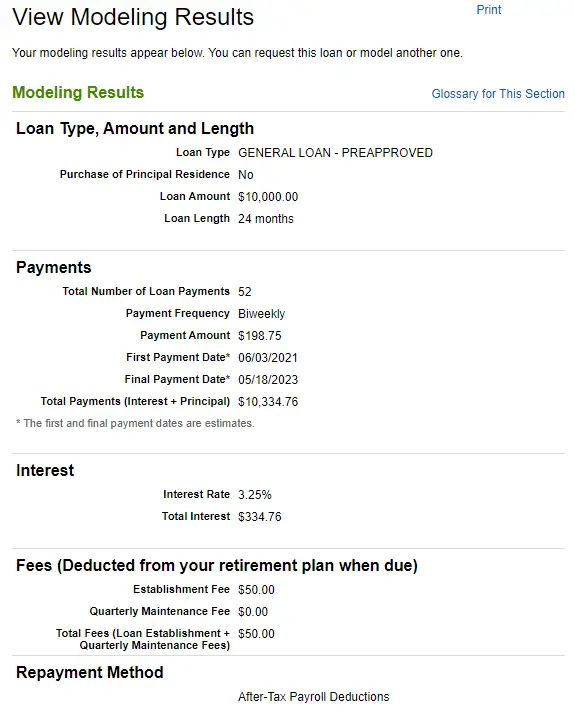

What Are The 401 Loan Limits

Your 401 is subject to legal loan limits set by law. The maximum amount you can borrow is traditionally the lesser of $50,000 or 50% of your vested account balance, whichever is less. Your vested account balance is the amount that belongs to you. If your company matches some of your contributions, you may have to stay with your employer for a set amount of time before the employer contributions belong to you. Your 401 plan may also require a minimum loan amount.

Reasons Taking A Loan From Your 401 Is A Bad Idea

If youre deep in debt and not sure how to get out, borrowing from your 401 might seem tempting. Its a pot of money thats not tied to any application process, scrutinizing lenders or credit score requirements. Easy fix, right?

Unfortunately, the reality isnt so simple. Consider these six effects of borrowing from a 401 to help you make the best decision.

Recommended Reading: What Is A Roth Ira Vs 401k

Q: Does It Make Sense To Borrow From My 401 If I Need Cash

When cash is tight, your 401 can seem like a perfectly reasonable way to make life a little easier. The money is there and its yoursso why not tap it to pay off debt or get out of some other financial jam? Or you might be tempted to use it to pay for that dream vacation you deserve to take.

Stop right there. The cash in your 401 may be calling youbut so is your financial future. The real question here: Will taking the money today jeopardize your financial security tomorrow?

Im not saying a 401 loan is always a bad idea. Sometimes, it may be your best option for handling a current cash need or an emergency. Interest rates are generally low and paperwork is minimal. But a 401 loan is just thata loan. And it needs to be paid back with interest. Yes, youre paying the interest to yourself, but you still have to come up with the money. Whats worse is that you pay yourself back with after-tax dollars that will be taxed again when you eventually withdraw the moneythats double taxation!

Can You Borrow Money From Your 401

If you’ve got a decent amount invested in your 401 and need a short-term loan, you may be considering borrowing from the popular retirement vehicle.

There are many things to consider before you take out a loan from your 401, including potential penalties, taxes and the possibility of a smaller retirement nest egg.

Before you many any major financial decisions, it may be wise to consult with a financial adviser who can explain the impact.

Don’t Miss: How To Take A Loan Out Of Your 401k

What Happens If You Leave Your Job

When you take out a loan from a 401, you may have no intention of leaving your current employer. But if you receive a better job offer, or are laid off or otherwise leave, you could be required to pay the loan back in full or face some serious tax consequences.

Employees who leave their jobs with an outstanding 401 loan have until the tax-return-filing due date for that tax year, including any extensions, to repay the outstanding balance of the loan, or to roll it over into another eligible retirement account. If you cant repay it, the amount of money you still owe will be considered a deemed distribution and could be taxed as it would be if you were to default on the loan.

That means if you left your job in January 2021, you would have until April 18, 2022 when your 2021 federal tax return is due to roll over or repay the loan amount. Prior to the Tax Cuts and Jobs Act of 2017, the deadline was 60 days.

If you cant repay the loan, your employer will treat the remaining unpaid balance as a distribution and issue Form 1099-R to the IRS. That amount is typically considered taxable income and may be subject to a 10% penalty on the amount of the distribution for early withdrawal if youre younger than 59½ or dont otherwise qualify for an exemption.

Factor In Whenand Howyou Have To Pay It Back

Youre borrowing your own money, but you do have to pay it back on time. If you dont, the loan is considered a taxable distribution and youll pay ordinary income taxes on it. If youre under 59½, youll also be hit with a 10 percent penalty. Put that in real dollars: If youre 55, in the 25 percent tax bracket, and you default on a $20,000 loan, it could potentially cost you $5,000 in taxes and $2,000 in penalties. Thats a pretty hefty price to pay for the use of your own money!

Before borrowing, figure out if you can comfortably pay back the loan. The maximum term of a 401 loan is five years unless youre borrowing to buy a home, in which case it can be longer. Some employers allow you to repay faster, with no prepayment penalty. In any case, the repayment schedule is usually determined by your plan. Often, paymentswith interestare automatically deducted from your paychecks. At the very least, you must make payments quarterly. So ask yourself: If youre short on cash now, where will you find the cash to repay the loan?

Read Also: Can You Start A 401k Without An Employer

How Does A 401 Loan Work

If your employer provides a 401 retirement savings plan, it may choose to allow participants to borrow against their accounts though not every plan will let you do so. Borrowing from your own 401 doesnt require a credit check, so it shouldnt affect your credit.

As long as you have a vested account balance in your 401, and if your plan permits loans, you can likely be allowed to borrow against it. Just like with any other loan, youll need to repay a loan from your 401 with interest within a set time frame. A key difference with this type of loan, though, is that youre borrowing money from yourself so youre paying yourself back, with interest.

What Qualifies As A Hardship Withdrawal For 401k

Hardship distributions

A hardship distribution is a withdrawal from a participants elective deferral account made because of an immediate and heavy financial need, and limited to the amount necessary to satisfy that financial need. The money is taxed to the participant and is not paid back to the borrowers account.

Read Also: How Much Money Should I Put In My 401k

Also Check: Can You Open An Individual 401k

Comparing 2022 And 2023 Limits

The chart below provides a breakdown of how the rules and limits for defined-contribution plans , 403, and most 457 plans are changing for 2023 vs. 2022.

| Defined Contribution Plan Limits | |

|---|---|

| $150,000 | +$15,000 |

* The catch-up contribution limit for participants age 50 or older is available to those turning 50 at any time during the year. For instance, if you were born on New Year’s Eve, it applies.

What Happens When You Quit Your Job Before You Finish Paying Off Your 401 Loans

There are times when you will have to move from one employer to another, quit your job, or simply get fired. What will happen if you quit your job before paying off your 401 loans.

The answer to this question will follow the meaning of your retirement account. The purpose of your retirement account is to save money for retirement. So, when you borrow money from your 401 plan, the account becomes lower and its activities get affected. This is why you must return all the money you have borrowed 401 to bring it to its original form. No matter what happens, the money you borrowed from your 401 must be paid off.

If you quit your job before paying off your 401 loans, you must pay off the remaining balance with your former employer. Failure to make successful payments on the remaining balance will cause your 401 loan to default. After you have defaulted, the unpaid balance will become a distribution. As a result, you will end up paying a 10% penalty if you are not 59½ or older. Furthermore, you will pay applicable tax on the outstanding balance. You may also pay charges depending on the terms of the account.

Also Check: What Happens To My 401k If I Switch Jobs