How Do Solo 401 Withdrawals Work

If you wait until you’re 59½ or older, there are no penalties for withdrawing money from your solo 401. If you opened a Roth solo 401, your withdrawals during retirement are tax-free. If you opened a traditional solo 401, your current tax bracket would determine the amount you pay in taxes.

Remember that if you have a solo 401 you’ll eventually have to begin taking required minimum distributions . You must take your first RMD by April 1 during the year after you turn 72. However, you can avoid RMDs by with a Roth solo 401 by rolling the funds into a Roth IRA.

What To Expect When Working With A Broker

Not all brokerage firms are created equal. You can find some that take a hands on approach to managing your finances and others that will step back and allow you to do-it-yourself if that is your preference. You should expect that all brokers will charge a fee or commission. Some brokers might provide additional tools or resources, such as a mobile app or financial educational trading, that could make them a preferable option.

We compared some of the top providers to help you narrow down your list of potential options. There are lots of excellent brokerage firms out there with various pros and cons,

How To Open A Solo

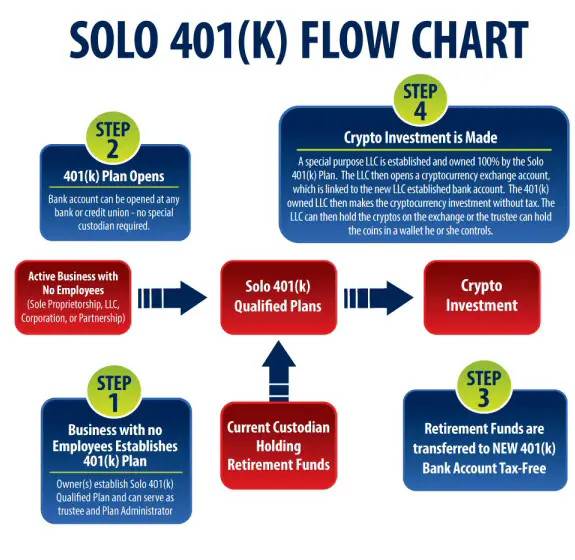

In order to open a Solo-401k, you have to own your own business. Moreover, a Solo-401k can only be opened by business owners that have no employees that are eligible to contribute to the plan. When opening one up, you will set up your plan eligibility requirements in the Solo 401 plan documents used to establish your plan with whichever investment brokerage that you decide to open it with.

The only exception to the eligibility requirements needed for an employee to contribute to a Solo-401k account would be the business owners spouse. A business owners spouse is eligible to contribute up to $19,500 for 2021 if the spouse works for and earns an income from the owners business.

Read Also: Can I Convert My 401k To A Roth

You Can Fund A Traditional Ira

A traditional IRA, or individual retirement account, allows you to contribute pre-tax dollars . You pay taxes when you withdraw the money once you retire, meaning that its tax-deferred.

If you earn taxable income and are under age 70 ½, you can contribute. Easy-peasy. Plus, since you have no 401k or retirement plan at work, you can put money in and deduct the entire amount from your taxes.

You May Like: What To Do With 401k When You Retire

Traditional Vs Roth 401

Traditional 401 plans allow you to contribute to your retirement fund and avoid paying taxes for the year. In such retirement saving plans, your total amount will become tax-deductible when you reach retirement age and withdraw funds from your account. On the other hand, a Roth 401 allows you to contribute your post-tax income. While comparable contributions for the latter might be lower, it is important to note that the funds deposited in a Roth 401 are not subject to any income taxes at the time of retirement. If you feel that your tax rates might be higher when you retire, you can reduce your tax burden by opting for a Roth 401 instead of a traditional plan.

Also Check: How Do You Borrow Money From 401k

When Do You Have To Take Distributions

Where you were required to take Required Minimum Distributions at age 70 ½ until 2019, the recent passage of the Setting Every Community Up for Retirement Enhancement Act bumped that figure up to age 72.

In short, this means youre required to begin taking distributions once you reach that age. This is unlike the Roth IRA, which doesnt require distributions at any age.

Note that you can take distributions without a penalty any time after you reach the age 59 ½.

What Are The Most Common Mistakes People Make With Self

Overcontributing, in Allecs opinion, is the largest mistake. When you discover youve put too much money into your plan, call your provider right away. They can help you withdraw the overcontributed amount so you wont have to pay taxes on it.

Another common error is breaking one of the prohibited transaction rules. For example, your plan buys a house in Florida and rents it out as an investment. If you want to take a family trip to Disney World, you cant stay in that house. Once youve invested in alternative assets and break the rules, you will be subjected to taxes and penalties. Always make sure your provider goes over the rules with you when you open your individual 401.

The last mistake many people make is not getting their solo 401 set up by the end of the year.

Recommended Reading: Do I Need Life Insurance If I Have A 401k

Difference Between 401k Plan And Pension Plan

- Pension plans are being funded by the employers, and they ensure regular income to members. Also, the investments in the fund are handled by the investment managers.

- On the other hand, these are funded by the employees. The amounts in the fund depend on deposits made the income arising from the investment therein. Also, the investments are managed by the employees themselves.

What Is An Individual 401 Plan

Individual, or solo 401K plans cover a business owner with no employees. If you are self-employed, whether part-time or full-time, you are eligible to open an account for yourself. While you cannot cover any other full-time employees under this plan, you can also cover your business partner or your spouse. As both the business owner and the employee, you can contribute to the account.

As the account holder, you have the freedom to split contributions between different accounts, borrow against your savings, and take advantage of tax breaks from your 401 . If you are interested in opening a solo401 , there are few options for making investments.

You May Like: Should I Rollover Old 401k To Ira

What Are The Irs Rules About How Much And When The Business Owner Must Make Contributions To A Solo 401k

The intent of the business owner must be to make significant contributions to the Solo 401k plan, however there are no established thresholds regarding how much money is required to be contributed annually. Also there are no IRS rules about how soon contributions must be made after establishing a Solo 401k plan.

Recommended Reading: Can I Invest In Gold Through My 401k

What Are The Benefits Of Using A Solo

A solo-401k is a type of retirement account that you can open all on your own without having to rely on an employer-sponsored plan. Similar to the , the self-employed version of an IRA, all you need to do in order to open one is open and own your own business, whatever that might be.

If youre interested in opening your own business youll need a business EIN in order to do so. You can click on the link here to see this websites article on how to do so. Business EIN Whats The First Thing You Need When Starting A Business?

Youll need a business EIN in order to open your own Solo-401k. One of the potential benefits of them is the flexibility to choose how you want to deal with your tax obligation. This means that you can actually make contributions to one as either the employer or the employee. In a traditional solo-401k plan, all contributions you make as the employer will be tax-deductible to your business with any earnings growing tax-deferred until withdrawn.

But for contributions, you make as an employee you have more flexibility. Typically, your employee contributions reduce your personal taxable income for the year and can grow tax-deferred, with distributions in retirement taxed as ordinary income. You can also make some or all of your employee contributions in a Roth solo-401k plan. These Roth employee contributions do not reduce your current taxable income, but your distributions in retirement are 100% tax-free.

You May Like: When Can I Use My 401k

Who Is Eligible For An Solo 401k

In order to be eligible to establish a Solo 401k, the business owner must have the presence of self employed activity which generally would include ownership and operation of the business. It is generally believed that the IRS will consider a business owner eligible for a Solo 401k if the business being conducted is legitimate and it is run with the intention of generating profits.

What Is The Best Retirement Plan For A Self

Allec says that, for most businesses, the solo 401 is the best option. Many small businesses can contribute more to a solo 401 than, say, a SEP at the same income level. With an IRA, you can contribute only $6,000 or $7,000 in 2022. With a SEP IRA, you cant contribute as both employer and employee, only as an employer.

There are several other types of retirement plans besides self-employed 401s. These include the following:

Summary: The solo 401 is the best retirement plan for a self-employed person, but traditional IRAs, Roth IRAs, SEP IRAs and SIMPLE IRAs remain options.

Read Also: Can The Irs Garnish Your 401k

How Do You Set Up A Self

It is easy to set up a self-employed 401 plan with many 401 administrators. You can also open a solo 401 online. To set one up, you will need an Employer Identification Number , which you can get from the IRS. You also need to complete a plan adoption agreement and an account application. Self-employed 401s are easy to administer and attract low maintenance fees because they involve only one or two people.

Before choosing a plan administrator, it is important to compare their fees before you sign up. You may also want to choose an administrator that allows you to invest your retirement savings into a broad range of assets including mutual funds, ETFs, CDs, stocks, and bonds. Other features to look for include 24-hour multi-channel support, investment advisory, low fees, and positive customer reviews. Once youve completed the paperwork, and the plan becomes active, the only thing you have to do is to set contribution levels and choose investments.

Self-employed 401 plans have no annual minimum contribution requirements. In good years, you can make the maximum contributions and reduce your savings when the cash flow is low. But once you have up to $250,000 in the account, you must file IRS Form 5500-EZ to report the financial status of your solo retirement plan to the tax authorities.

What Alternatives Are There To A Solo 401

If you’re on the fence about opening a solo 401, here are some other options you can consider:

- A Simplified Employee Pension IRA is a good option for anyone who’s self-employed. This plan comes with much higher contribution limits than a traditional IRA.

- Keogh plan: Keogh plans are retirement plans for self-employed individuals and come with high contribution limits. However, there are more administrative tasks than you’ll find with other plans.

- Traditional IRA: With a traditional IRA, you can let your money grow on a tax-deferred basis. You won’t pay taxes on the savings until you begin withdrawing the funds at retirement.

- Roth IRA: With a Roth IRA, your money will grow tax-free, and you won’t have to pay any taxes at retirement. And you’ll have the flexibility to use your contributions for certain qualified expenses.

You May Like: Can You Do Your Own 401k

How Does A Solo 401 Work

As a business owner, in terms of 401 contributions, youre the employer as well as the employee.

As an employee, you can contribute up to a total of $19,500 of your income to your 401 accounts in 2021. If youre at least 50 years old in 2021, you can add another $6,500 in catch-up contributions.

You can also make company contributions to yourself. I’ll go into more detail about how that works in the section on solo 401 contribution limits.

Other than yourself, the only people who can make or receive contributions within your solo 401 plan are:

- Your spouse. He or she must earn income from your business in order to qualify. By rule, your spouse must receive “employer” contributions as well.

- Your business partners. If you have a business with multiple owners and zero employees, all the owners can open a shared solo 401 plan.

Let Penelope Help You Set Up Your Solo 401

A Solo 401 plan can be a great way for small business owners to save for retirement. The plan is easy to set up and offers many benefits, including tax savings and the ability to contribute more money each year than you could with other retirement plans. If youre interested in learning more about Solo 401 plans or need help setting up your own, let Penelope help. We can walk you through the process and answer any questions you have about using this type of retirement plan.

Also Check: How Can I Get A Loan From My 401k

Contribution Limit As An Employer

Wearing the employer hat, you can contribute up to 25% of your compensation.

The total contribution limit for a solo 401 as both employer and employee is $61,000 for 2022, and $66,000 in 2023, or 25% of your adjusted gross income, whichever is lower.

People ages 50 and above can add an extra $6,500 a year as a “catch-up contribution” in 2022 and $7,500 in 2023. In other words, in 2022 you can contribute a total of $61,000 along with a $6,500 catch-up contribution if applicable for a maximum of $67,500 for the year.

You can have a solo 401 even if you’re moonlighting. If you have a 401 plan at both jobs, the total employee contribution limits must be within the maximum for the year, but the employer contribution is not limited. If you’re one of these lucky folks with two retirement savings plans, talk to a tax adviser to make sure you follow the IRS rules.

Solo 401 Versus Other Retirement Plans

If you dont think a solo 401 is a good fit for you, here are some other options you may want to consider:

- Simplified Employee Pension IRA: A is another popular option among self-employed individuals with no employees. You may contribute up to the lesser of $61,000 in 2022 or 25% of your net income. Contributions are tax-deferred, and there is no Roth option. You can use one of these accounts if you have employees, too, although youll have to make mandatory contributions to your employees accounts. This could limit how much you can afford to contribute to your own retirement.

- Traditional or Roth IRA:Traditional IRAs and Roth IRAs are open to all workers, even those who arent self-employed. You can open them with most brokers, and youre free to choose from many common investments. You may contribute up to $6,000 in 2022, or $7,000 if youre 50 or older.

- Self-directed IRA:Self-directed IRAs are traditional, Roth, or SEP IRAs that allow you to invest your money in real estate and other assets you cant typically invest in with an IRA.

Each account has its pros and cons, so youll have to decide which is best for you. A SEP IRA might be a better fit if you dont want to deal with the more complex reporting requirements of a solo 401. But solo 401s let you choose between tax-deferred and Roth accounts and take out loans, while SEP IRAs dont allow these things.

You May Like: Can You File Bankruptcy With A 401k

Who Is Eligible For A Solo 401

Solo 401 plans are intended for the self-employed. If you have employees and are looking for a retirement plan, then you have other options such as the or SIMPLE IRA, both of which allow you to provide tax-advantaged benefits to your employees. A lesser-known program called a SIMPLE 401 also allows businesses to set up retirement plans.

While solo 401 plans are intended for one-person businesses, there is an exception. The spouse of the business owner can also participate in the plan. With a spouse in the plan, your small business can really stash away cash for retirement. A qualifying couple could save as much as $114,000 annually in the plan, and even more if they were eligible for catch-up contributions.

Understanding The Solo 401 Plan Contribution Rules

Adam Bergman is the President of IRA Financial Group & IRA Financial Trust Company – a leading provider of self-directed retirement plans

getty

The Solo 401 plan offers small-business owners the ability to maximize their plan contributions more efficiently than almost any other retirement plan, including an individual retirement account , SEP IRA and SIMPLE IRA. And one of the best ways to maximize the benefits of your Solo 401 plan is to have a solid understanding of how the contribution rules work. These rules are the heart of the plan.

What Is A Solo 401 Plan?

A Solo 401 plan, which is also sometimes called an Individual 401, One Participant 401 or Self-Employed 401, is a retirement plan that covers just one individual. Anyone with self-employment income, including an owner-only business, can establish one.

One of the main reasons this type of account has grown in popularity is its high annual maximum contribution options. Gaining the ability to maximize your plan contributions is so important because of the concept of tax deferral, which holds that your money will grow faster when it is not subject to tax. Accordingly, the more money you can sock away, the greater the opportunity you will have to generate more retirement wealth. Further, a Solo 401 gives you more investment options than a regular workplace plan.

There are three types of contributions that can be made to a Solo 401 plan: employee deferrals, employer contributions and after-tax contributions.

Don’t Miss: How Much Should I Invest In My 401k