What Is A 401 Rollover

A 401 rollover is when you take funds out of your 401 account and move them into another tax-advantaged retirement account. You can roll a 401 over into an individual retirement account or into another 401, most commonly when you get a new job with a new retirement plan. Either way, you should understand the best 401 rollover options for your particular situation.

Access To A Roth Option

An increasing number of employers are offering a Roth 401 option in addition to the traditional 401 option. With a Roth 401, the money you contribute is after-taxit doesnt minimize your taxable income. But when you take distributions in retirement, you wont have to pay taxes on the withdrawal amount. As long as the account has been open for five years and youre over 59 ½, you can receive tax-free distributions.

A Roth 401 option can be appealing if you feel your income in retirement will be higher than your current income. If your new employer offers this benefit and you think it will be advantageous to your financial situation, then rolling over your 401 to a Roth 401 plan may make sense.

Option : Leave Your Money Where It Is

Usually, if your 401 has more than $5,000 in it, most employers will allow you to leave your money where it is. If youve been happy with your investment options and the plan has low fees, this might be a tempting offer. Before you decide, compare your old plan with any retirement plans offered at your new job or with an IRA of your own.

Your new employer-sponsored plan might have more limitations on it than your previous plan or other available options. Maybe there are fewer investment choices/options. Maybe it doesnt have an employer match or higher management fees. So youll want to look closely.

Also consider how often you tend to stay at jobs. If you change jobs every few years, you could end up with a trail of 401 plans at all the different places youve worked. Consolidating might be easier in the long run.

Recommended Reading: How To Set Up A Solo 401k Account

Tax Implications Of Cashing Out A 401 After Leaving A Job

The following are some tax rules regarding your old 401:

-

When you leave your 401 account with your old employer, you wont need to pay taxes until you choose to withdraw the funds.

-

Even when you roll over your old 401 account to your new employer, you need not pay any taxes.

-

At the time of your 401 distributions, you will be liable to pay income tax at the prevailing rates applicable for such distribution.

-

If you havent reached the age of 59 ½ years at the time of distribution, you may be liable to pay a premature withdrawal penalty of 10%, subject to certain exceptions.

-

Distributions from a designated Roth account are tax-free after you reach the age of 59 ½ years, provided your account is at least five years old.

Although legally, you have every right to liquidate your old 401 account and cash out the entire funds, doing so would reduce your savings for the retired life. Additionally, the distributions will add up to your annual taxable income.

Article By

The Human Interest Team

We believe that everyone deserves access to a secure financial future, which is why we make it easy to provide a 401 to your employees. Human Interest offers a low-cost 401 with automated administration, built-in investment education, and integration with leading payroll providers.

Changing Jobs Reinvest Your Retirement Funds

Pamela Rodriguez is a Certified Financial Planner®, Series 7 and 66 license holder, with 10 years of experience in Financial Planning and Retirement Planning. She is the founder and CEO of Fulfilled Finances LLC, the Social Security Presenter for AARP, and the Treasurer for the Financial Planning Association of NorCal.

When workers change jobs, their retirement savings in employer-sponsored plans tend to get withdrawn and spent. Its an understandable phenomenon, albeit an unfortunate one.

Well show you how to avoid the trap of cashing in your retirement savings and how to transfer your funds when you change jobs.

You May Like: How To Pull Out Of 401k

Convert Into A Roth Ira

The pros: Withdrawals are entirely tax-free in retirement, provided you’re over age 59½ and have held the account for five years or more. Roth IRAs are also exempt from RMDs.

The cons: Because Roth IRAs are funded with after-tax dollars, you’ll have to pay taxes on your existing 401 funds at the time of the conversion. A Roth IRA must be open for five years in order to withdraw earnings tax-free, and you’ll be subject to a 10% penalty if you withdraw any money before you’re 59½ without an exemption.

The Database Isnt Slated Until 2025 What Can People Do Now

Other than hunting down contact information for your former company or the current plan administrator, theres not much people can do to find their retirement accounts.

However, later this year Vanguard and Fidelity plan to launch a so-called auto-portability program that allows them to find owners of lost plans of less than $5,000 that they oversee and automatically transfer the funds to their owners.

Vanguard and Fidelity joined Alight Solutions and Retirement Clearinghouse to create Portability Services Network, which will continue to add more plan administrators to the network so more people can be found and automatically reunited with their forgotten funds. Alight has already launched its program, but it remains small. When Fidelity and Vanguard join, though, the three companies together will hold records for about 40% of retirement accounts in America, Long said.

Social Security payments:Why you may have to claim Social Security early, even if you dont want to

Read Also: Can I Convert My 401k Into A Roth Ira

Traditional Or Roth Ira

Your retirement savings can be rolled over into an IRAeither a traditional IRA or a Roth IRAthat can offer you some advantages for your money.

| Traditional IRA vs. Roth IRA | |

|---|---|

| Traditional IRA | Roth IRA |

|

|

When Youre Between Jobs:

-

Stick to your budget. When you dont have a paycheck coming in, the last thing you want to do is run up debt . Do your best to stick to the budget youve laid out for yourself while between jobs, even if it means cutting back on fun. In the long run, youll be glad you did.

-

If youre planning to roll your 401 over into an IRA, get the process started. Contact your new plan administrator to set up an IRA account and begin the rollover. Remember that if your old plan administrator cuts you a check with the proceeds from your 401 plan, you only have 60 days to deposit it into your rollover IRA to avoid substantial taxes and early withdrawal penalties. If you decide a rollover is right for you, were here to help. Call a Rollover Consultant at .

Dont Miss: How Many Loans Can I Take From My 401k

Also Check: How To Pull Money From Fidelity 401k

Roll It Into A Traditional Individual Retirement Account

The pros: Because IRAs aren’t sponsored by employersyou own them directlyyou won’t have to worry about making changes to your account should you change jobs again in the future. IRA providers may also offer a wider array of investment options and services than either your old or new employer-sponsored plan.

The cons: Once you roll your funds into an IRA, they may no longer be eligible for a future rollover into a 401 plan, and RMDs apply at age 72, regardless of whether you’re employed. Also, you’ll need to specify how the funds in your traditional IRA are to be invested. Until you do so, the money will remain in cash or a cash equivalent, such as a money market account, rather than invested.

Decide What To Do With Health Savings Account Funds

If youre enrolling in a high deductible health plan at your new employer, you can often transfer a balance in your HSA. If you dont plan to enroll in a HDHP, you can generally leave remaining funds and use as needed for future eligible healthcare expenses.

Tip: If you use HSA funds for unapproved health care expenses, youll face tax implications.

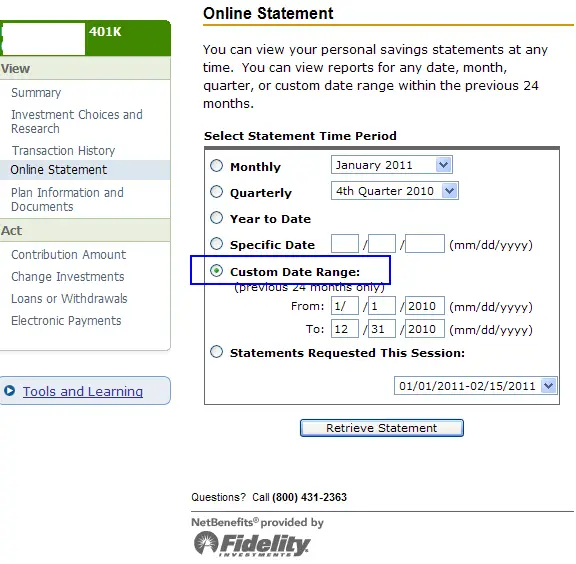

Don’t Miss: How To Access An Old 401k Account

Rolling Into An Ira Stay On Top Of The Move

If you decide to roll over your 401 into an IRA, your IRA sponsor or advisor will help guide you through the process to ensure the money gets to the proper destination in a timely manner.

Be sure your new broker or advisor has experience with rollovers, especially if you have company stock in your 401. Why? Because company stock is liquidated when its rolled into an IRA, and later, when distributed, may be taxed as ordinary income resulting in a higher tax liability.

As recommended above, stay vigilant until your money is safely in its new home and that you have proof typically verified online through the IRA providers website.

Rolling Over To A New 401

The first step in transferring an old 401 to a new employer’s qualified retirement plan is to speak with the new plan sponsor, custodian, or human resources manager who assists employees with enrolling in the 401 plan. Because not every employer-sponsored plan accepts transfers from an outside 401, it is imperative for a new employee to ask if the option is available from the new employer. If the plan does not accept 401 transfers, the employee needs to select one of the three other options for the 401 account balance.

If the new employer plan accepts 401 transfers from other companies, there is often a substantial amount of paperwork that must be completed by the employee. The paperwork is provided by the new plan sponsor or human resources contact and requires the name, date of birth, address, Social Security number, and other employee identifying information.

In addition, the 401 transfer form must provide details of the old employer plan, including total amount to be transferred, investment selections held in the account, date contributions started and stopped, and contribution type, such as pre-tax or Roth. A new plan sponsor may also require an employee to establish new investment instructions for the account being transferred on the form. Once the transfer form is complete, it can be returned to the plan sponsor for processing.

A transfer from one 401 to another is a tax-free transaction, and no early withdrawal penalties are assessed.

You May Like: How Much Can You And Your Employer Contribute To 401k

You May Be Paying Hidden Fees

There are all sorts of fees that go into effect when you open a 401, including recordkeeping fees, maintenance fees, and fund fees. Expressed in a percentage, these fees inform the expense ratio of a plan.

Employers may cover those fees until you leave the company. Once youre gone, that cost might shift to you without you even realizing it.

Fees matter: When you pay a fee on your 401, youre not just losing the cost of the fee youre also losing all the compound interest that would grow along with it over time. The sooner you roll your plan over, the more you could potentially save.

Leave Your 401 In Your Former Employers Plan

Many Americans leave their 401s behind when they change jobs, at least temporarily. The key advantage of this is that their 401 savings remain invested in a tax-deferred account, and theres no effort involved.

Ultimately, though, many people dont like the idea of having their money tied to their old employer for too long. It can be easier to lose track of what fees are being charged and what their money is invested in if its in an old 401 account that they rarely check. Theres also a risk that your old employer initiates whats known as a forced rollover to an IRA provider of their choice. This typically happens for small accounts under a certain size . Your old employer might also choose to switch 401 providers, which means your money gets moved to a new institution with different fees and investment options without your input. But if you like your old 401 provider and investment options, leaving it behind is an option, too.

Read Also: How Much Should You Contribute To Your 401k

Roll Over 401 Into An Ira

For those who would prefer not to rely on their new companys 401 plan’s investment offerings, rolling over a 401 to an IRA is another option. Again, rollovers can be direct, direct trustee-to-trustee transfers, or indirect, with the distribution paid to the account owner. But either way, once you start the process, it has to happen within 60 days.

The best option might be rolling the money over into the new companys 401 plan. The 401 plan is simpler because the plan is already set up for you. It’s also less expensive, because costs are spread over many plan participants.

Cashing Out A 401 Is Popular But Not So Smart

Intellectually, consumers know that cashing out retirement accounts isnt a smart move. But plenty of people do it anyway. As discussed, you may be forced out of your former plan based on your account balance, but that doesnt mean you should cash the check and use it for non-retirement-related purposes. In the long run, your financial future will be better served by rolling the money over into an IRA or, if applicable, your new employers 401 plan.

A 2020 survey by Alight, a leading provider of human capital and business solutions, found that 4 out of 10 people cashed out their balances after termination between 2008 and 2017. About 80 percent of those who had an account balance of less than $1,000 cashed out, while 62 percent who had balances between $1,000 and $5,000 did the same.

Based on historical rates of return, a $3,000 cash-out at age 24 leads to $23,000 less in your projected account balance at age 67 a total of 5 percent. Even a small amount of money invested into a retirement vehicle today can make a big difference in the long run.

Don’t Miss: Can I Move My 401k To Gold

What Will Happen To Your 401k After Leaving A Job

If you leave a job, you have several options with regard to your 401K. It will depend on how much you have in the 401K when you leave as well as what your plans policies are as stated in the summary plan description. If you know your 401K balance before you leave and have a plan beforehand will save you a lot of stress and time.

Should I Cash Out My 401 When I Change Jobs

If you’re changing jobs and need money, it can be tempting to cash out your 401 upon leaving. But before you do, it’s best to understand the possible drawbacks. For example, the money you withdraw is taxable and at risk for a mandatory 20% federal withholding tax.

Plus, the money will be taxed as ordinary income and can no longer grow. You might also face an early withdrawal penalty of 10% if you’re under the age of 59½. But maybe the scariest outcome of cashing out your 401 is that you could be short of cash when you really need itat retirement.

Recommended Reading: Can I Create My Own 401k

Statistics Tell The Story

According to research done by the IRS, Americans are losing a collective $5.7 billion each year to early withdrawal penalties and fees.

A leading reason for taking out the money? Changing or leaving a job. In fact, nearly half of all workers in the U.S. take the money out of their retirement plans and spend it when they change jobs, according to a U.S. Federal Reserve Board Survey of Consumer Finances.

In short, many people completely deplete their retirement savings when they change jobs. Hard data on job changes is elusive, but many surveys suggest that the average worker will change careers several times during the course of a lifetime. Indeed, the Bureau of Labor Statistics reports that that the average American worker will hold around 12 jobs between ages 18 and 52.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Also Check: How Much Can You Borrow From 401k For House