When Should You Make A 401 Early Withdrawal

Considering the 10% penalty, financial planners often advise taking an early withdrawal from your 401 as a last resort. Since penalty-free withdrawals are available for a number of financial hardships and situations, plan participants who take an early withdrawal with a penalty are often in serious financial straits.

Ive seen people take withdrawals for a number of reasons, Stiger says. Everything from a childs tuition to a spouses burial expenses the hope is that distributions are used for larger, more unexpected expenses like medical emergencies, keeping a home out of foreclosure or eviction, and in a down period, putting food on the table.

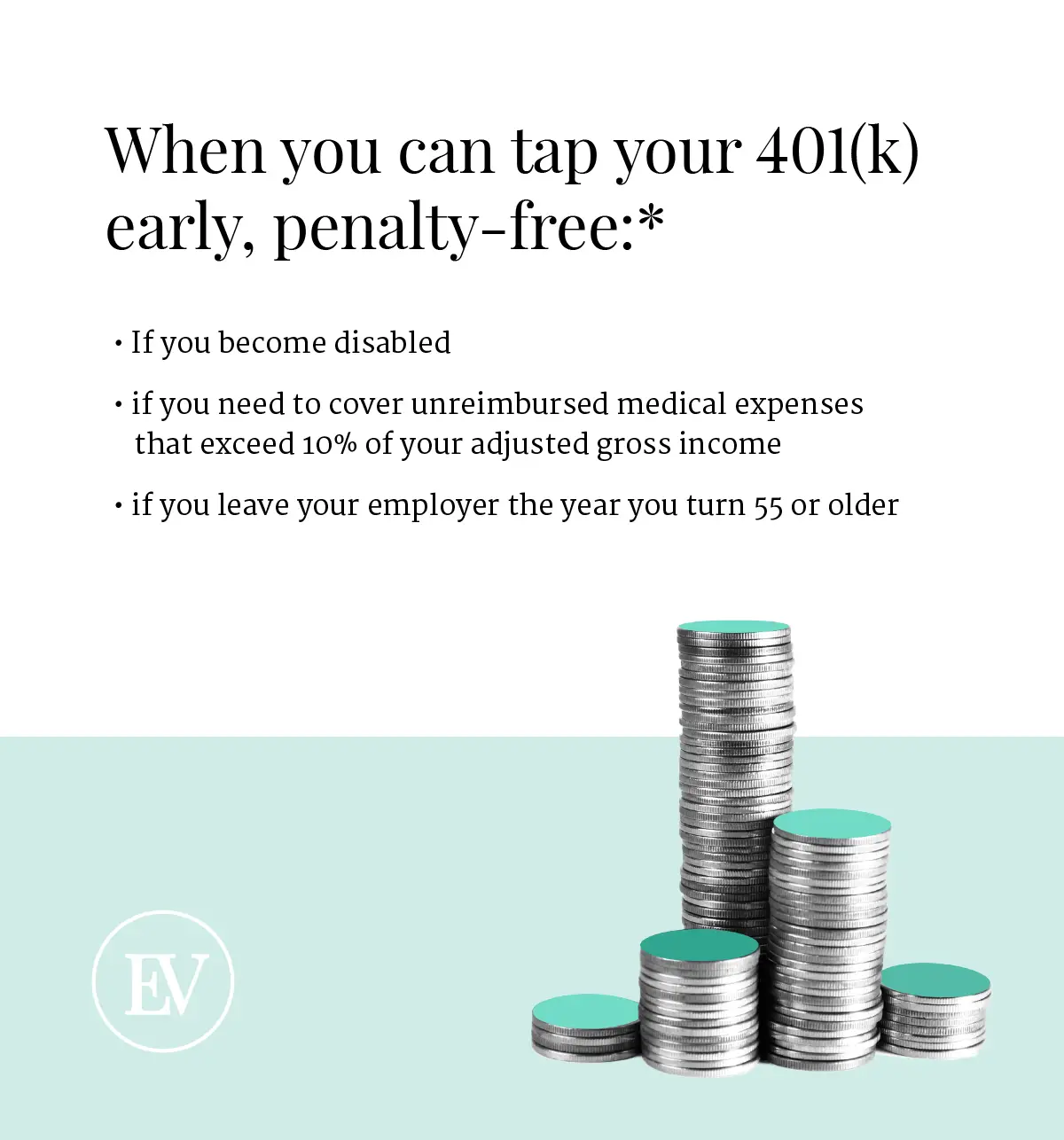

Taking an early withdrawal can make sense if you are able to take advantage of a penalty-free exception, use the Rule of 55 or the SEPP exemption. But might make sense to exhaust other options firstcheck out these 10 ways to get cash now. And keep in mind, contributions to a Roth IRA can always be withdrawn without penalty if youre truly in a bind.

If You Are 59 1/2 Or Older

Once you are six months away from your 60th birthday, you can begin making withdrawals from your Fidelity 401k without having to worry about any additional tax penalties. Your 401k is now money thats there for you to start preparing for the next stage of your life as you put the finishing touches on your career and prepare to start drawing Social Security benefits.

However, that doesnt mean you dont have to worry at all about taxes. Money withdrawn from your 401k is taxable income, so you should be careful to consider just how much you need to withdraw in any given tax year to ensure youre not hitting a higher tax bracket and seeing more of your hard-earned money lost to taxes. If you have a Roth IRA or Roth 401k, though, you can make tax-free withdrawals from those, so you can balance withdrawals to minimize the tax impact.

Your Fidelity 401k comes with the option to schedule regular withdrawals so that you can do the paperwork for your withdrawal once and then set up a recurring payment. With structured, regular withdrawals, you can set up a budget that will limit your withdrawals to what you need, and youll be able to have checks showing up on a set schedule.

Learn: The Best 401k Companies

How To Calculate Your Rmd

So, how can you figure out how much you need to take out based on the above table? Heres how to do the calculation:

Make sure you do this for all of the traditional IRAs you have in your name. Once you add up all of the required minimum distributions for each of your accounts, you can take that total amount out of any of your IRAs. You dont have to take the minimum distribution from each account as long as the total money you withdraw adds up.

This only applies to traditional IRAs, not Roth IRAs. Note that the above RMD table also doesnt apply to you if you have a spouse who is the sole beneficiary of your IRA and who is more than 10 years younger than you.

Read Also: When Can I Roll A 401k Into An Ira

Also Check: How Long Will My 401k Last In Retirement

How Do You Take A Withdrawal Or Loan From Your Fidelity 401

If you’ve explored all the alternatives and decided that taking money from your retirement savings is the best option, you’ll need to submit a request for a 401 loan or withdrawal. If your retirement plan is with Fidelity, log in to NetBenefits®Log In Required to review your balances, available loan amounts, and withdrawal options. We can help guide you through the process online.

Options For Borrowing From A 401 While Still Working

If youre still in the workforce and need to access your 401 funds for one reason or another, you may still have options. These pre-retirement withdrawal options include in-service distributions, hardship withdrawals, and plan loans.

In-service distributions allow you to withdraw your vested money before retirement and are sometimes referred to as an early retirement option in the plan. This is generally allowed at age 59 ½ because distributions of your 401 deferrals before that age are subject to a 10 percent penalty tax.

Hardship distributions are allowed for special reasons such as medical care, purchase of your home, tuition, funeral expenses, payments to prevent eviction, and damage to your principal residence. The distribution is limited to the amount you need, and your employer will need to see some proof of the hardship. Hardship distributions are subject to income tax and the 10 percent penalty tax for distribution before 59 ½.

Plan loans occur when you borrow money from your 401 balance, but the amount you can withdraw is limited to the half of your vested balance and cannot be more than $50,000. The loan will have to be paid back to the plan with interest, and the loan period cannot exceed five years in most cases. That being said, loans taken out for principal residence can be longer than five years.

You May Like: Should I Move 401k To Roth Ira

Can I Leave My Money In My 401 Plan After I Terminate Employment

It depends upon your account balance and the terms of your 401 plan. The IRS allows 401 plans to automatically cash-out small account balances defined as less than $5,000 without the owners consent upon their termination of employment. Under these rules, account balances between $1,000 and $5,000 must be rolled over into a personal IRA for the benefit of the employee. Amounts below $1,000 can be paid out by check.

To find the cash-out limit applicable to your 401 plan, check your plans Summary Plan Description . If your account exceeds this limit, you can postpone withdrawals until the date you must start taking Required Minimum Distributions.

Consequences Of A 401 Early Withdrawal

- IRS Penalty. If you took an early withdrawal of $10,000 from your 401 account, the IRS could assess a 10% penalty on the withdrawal if its not covered by any of the exceptions outlined below.

- Withdrawals are taxed. Even if it were covered by an exception, all early withdrawals from your 401 are taxed as ordinary income. The IRS typically withholds 20% of an early withdrawal to cover taxes. So if you withdrew $10,000, you might only receive $7,000 after the 20% IRS tax withholding and a 10% penalty.

- Less money for retirement. Perhaps the biggest consequence of an early 401 withdrawal is missing out on long-term returns in the market. The stock markets average returns have been around 9.6% a year since the end of the Great Depression. If you withdrew $10,000 from your 401 and were about 30 years away from retirement, you could be giving up more than $117,000 in total returns.

You May Like: How To Move A 401k To A Roth Ira

Need A Loan Get One In 3 Simple Steps

If you are considering applying for a personal loan, just follow these 3 simple steps.

Apply

Apply online for the loan amount you need. Submit the required documentation and provide your best possible application. Stronger applications get better loan offers.

Accept

If your application meets the eligibility criteria, the lender will contact you with regard to your application. Provide any additional information if required. Soon youll have your loan offer. Some lenders send a promissory note with your loan offer. Sign and return that note if you wish to accept the loan offer.

Repay

The loan then gets disbursed into your U.S. bank account within a reasonable number of days . Now you need to set up your repayment method. You can choose an autopay method online to help you pay on time every month.

About Stilt

Stilt provides loans to international students and working professionals in the U.S. at rates lower than any other lender. Stilt is committed to helping immigrants build a better financial future.

We take a holistic underwriting approach to determine your interest rates and make sure you get the lowest rate possible.

Learn what others are saying about us on , Yelp, and or visit us at . If you have any questions, send us an email at

Can An Account Owner Just Take A Rmd From One Account Instead Of Separately From Each Account

An IRA owner must calculate the RMD separately for each IRA that he or she owns, but can withdraw the total amount from one or more of the IRAs. Similarly, a 403 contract owner must calculate the RMD separately for each 403 contract that he or she owns, but can take the total amount from one or more of the 403 contracts.

However, RMDs required from other types of retirement plans, such as 401 and 457 plans have to be taken separately from each of those plan accounts.

Read Also: Can You Open 401k Your Own

Also Check: Can I Contribute To A Roth Ira And A 401k

Roth 401s: The Basics

A Roth 401 includes a combination of the features of a traditional 401 and a Roth IRA. Though not all companies with employer-sponsored retirement plans offer a Roth 401, they are increasingly popular.

Unlike a traditional 401, contributions are made with after-tax dollars and are not deductible. However, you dont pay taxes on withdrawals when you retire. For 2022, you can contribute up to $20,500 per year , or $27,000 if you are age 50 or older .

What Exactly Qualifies As A Hardship Withdrawal

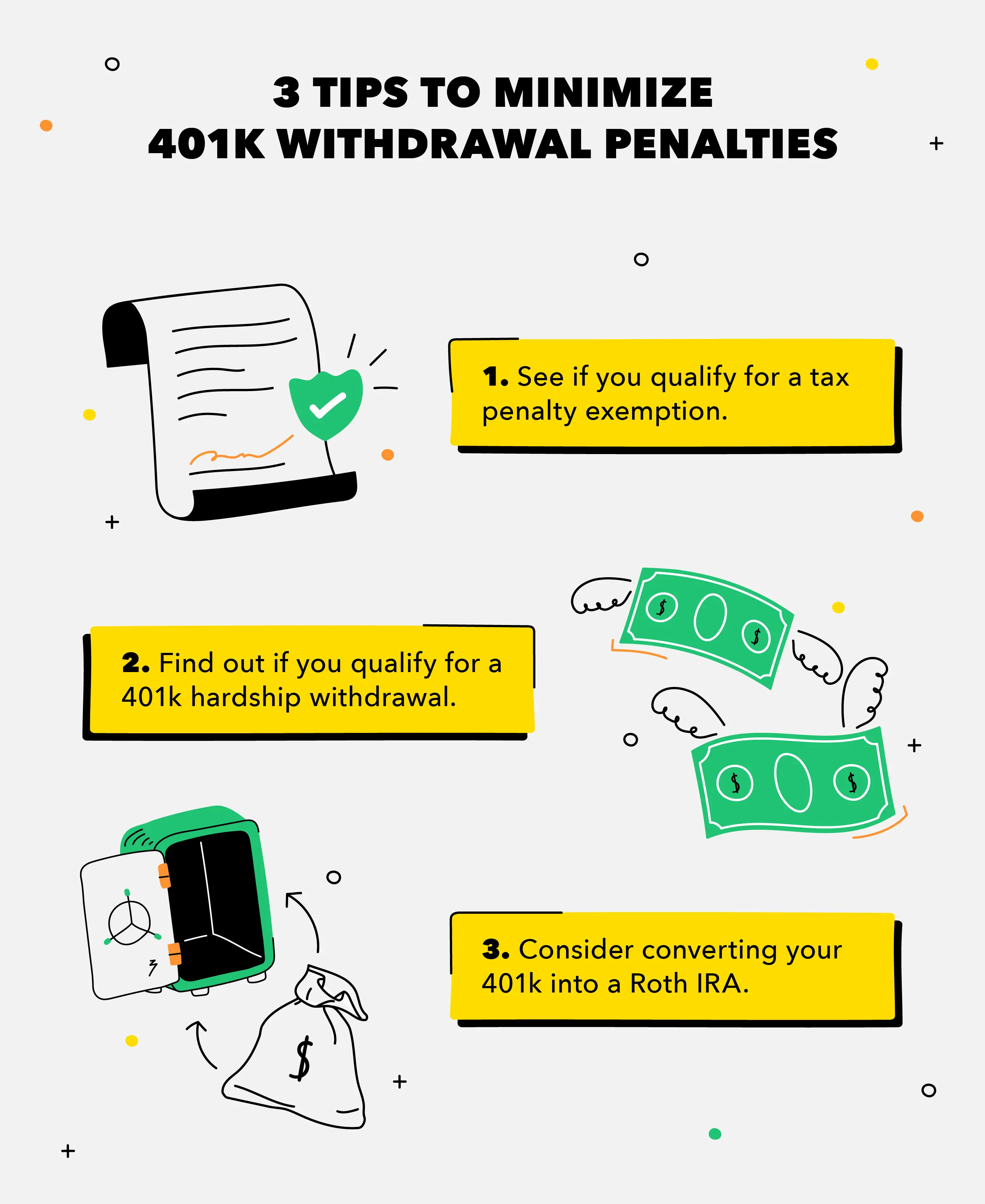

Financial withdrawals are permitted when a certain event is in a dire need of financial aid. For example, emergency medical procedures fall into this category. The amount that you borrow must be used entirely to cover said hardship. In these circumstances, you wont have to pay any early withdrawal penalties, but youll still have to deal with the taxes.

Recommended Reading: What Happens To My 401k From My Old Job

Recommended Reading: When Can I Take 401k

Rollover To A Traditional Ira

If you are simply withdrawing funds from a 401 and transferring them to another retirement account, you can opt for a direct rollover. A direct rollover moves retirement money directly from one retirement account to another, and it does not have a tax implication. You can also choose an indirect rollover, where the plan sponsor sends you a check with your 401 balance. You must then deposit the funds to a 401 or IRA within 60 days, failure to which the amount will be considered a distribution for tax purposes.

Can I Transfer My 401k To My Checking Account

Once you have attained 59 ½, you can transfer funds from a 401 to your bank account without paying the 10% penalty. However, you must still pay income on the withdrawn amount. If you have already retired, you can elect to receive monthly or periodic transfers to your bank account to help pay your living costs.

Recommended Reading: Can You Move Money From 401k To Ira

Are You Still Working

You can access funds from an old 401 plan after you reach age 59½ even if you haven’t yet retired. The best idea for old 401 accounts is to roll them over when you leave a job. You won’t be hit with penalties if you withdraw from your old accounts if you’re at least age 59½. But you should check with your human resource department about the rules for withdrawing from your current 401 if you’re still in the workplace.

Convert To A Roth Ira

Money in a 401 plan isnt taxed when you contribute to it, but the money is taxed when you start taking out funds. When you have a Roth IRA, you pay taxes on the money you contribute, but you withdraw tax-free in retirement as long as you meet the qualifications.

Whereas a 401 is set up through an employer, youll have to open your own Roth IRA account through a bank or investment firm.

You May Like: Can You Set Up A 401k On Your Own

What Do I Do With My 401 If I Leave My Job

If you’re older than 55 and are no longer employed, you can start withdrawals from your 401 without penalties. If you’re under age 55, you may be able to keep the 401 with your previous employer or move it to a new employer’s plan when you start working again. Talk to the plan administrator about your options. No matter what, don’t abandon your 401 when you change employers.

Next Steps To Consider

This information is intended to be educational and is not tailored to the investment needs of any specific investor.

Fidelity does not provide legal or tax advice. The information herein is general in nature and should not be considered legal or tax advice. Consult an attorney or tax professional regarding your specific situation.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

Read Also: How Long Does It Take To Get 401k After Quitting

When Must I Receive My Required Minimum Distribution From My Ira

You must take your first required minimum distribution for the year in which you turn age 72 . However, the first payment can be delayed until April 1 of 2020 if you turn 70½ in 2019. If you reach 70½ in 2020, you have to take your first RMD by April 1 of the year after you reach the age of 72. For all subsequent years, including the year in which you were paid the first RMD by April 1, you must take the RMD by December 31 of the year.

A different deadline may apply to RMDs from pre-1987 contributions to a 403 plan .

How Can I Avoid Paying Taxes On My 401k Withdrawal

Heres how to minimize 401 and IRA withdrawal taxes in retirement:

Read Also: Can I Pull My 401k To Buy A House

Taxes If You Withdraw Money In Retirement

When you withdraw money from a 401 in retirement, you will owe taxes in the year when you take the distribution. The withdrawals will be taxed as your other sources of income at your tax bracket rate. At the minimum, you will pay federal income taxes on the distribution. If you are a resident of a state that imposes state income taxes on retirement distributions, you will pay extra taxes. However, certain states don’t tax 401 distributions, and you wonât pay additional taxes.

For Roth 401 withdrawals, you wonât pay income taxes when you withdraw money in retirement, since you had already paid income taxes at the onset. You must have reached 59 ½ and have held the account for five years or more to qualify for tax-free withdrawals from your Roth 401.

If you are already 72, you must start taking the required minimum distributions from a traditional 401 and Roth 401. If you do not take the mandatory distributions, you will incur a 10% penalty on the distribution not taken.

The Benefits And Drawbacks Of Buying A House With A 401

Pulling money from your 401 to buy a house seems like a natural fit. A 401 helps save for retirement, and owning a home provides additional stability and security, especially when living on a fixed income. If youre wondering if you should use your 401 to buy a house, first consider these benefits and drawbacks.

Read Also: How To Withdraw 401k After Leaving Job

Read Also: Should I Transfer 401k To New Employer

Better Options For Emergency Cash Than An Early 401 Withdrawal

It can be scary when suddenly you need emergency cash for medical expenses, or when you lose your job and just need to make ends meet.

The money squeeze can be quick and traumatic, especially in a more volatile economy.

Thats why information about an early 401 withdrawal is among the most frequently searched items on principal.com. Understandably so, in a world keen on saddling us with debt.

But the sad reality is that if you do it, you could be missing out on crucial long-term growth, says Stanley Poorman, a financial professional with Principal® who helps clients on household money matters.

The most severe impact of a 401 loan or withdrawal isnt the immediate penalties but how it interrupts the power of compound interest to grow your retirement savings.

In short, he says, You may be harming your ability to reach and get through retirement. More on that in a minute. First, lets cover your alternatives.

What Are The Pros And Cons Of Withdrawal Vs A 401k Loan

| Pros and Cons of 401k Withdrawal vs. 401k Loan | ||

|---|---|---|

| 401k Withdrawal | ||

|

|

|

| Cons |

|

|

Also Check: How To Check 401k From Previous Job