Retirement Funds Dont Have To Be Off

Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018. Thomas experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning.

For those who invest in their 401 plan, the traditional thinking is to wait until retirement before taking distributions or withdrawals from the account. If you take funds out too early, or before the age of 59½, the Internal Revenue Service could charge you with a 10% early withdrawal penalty plus income taxes.

However, life events can happen, which might put you in a position where you need to tap into your retirement funds earlier than expected. The good news is that there are a few ways to withdraw from your 401 early without incurring a penalty from the IRS.

Restrictions On Investment Returns

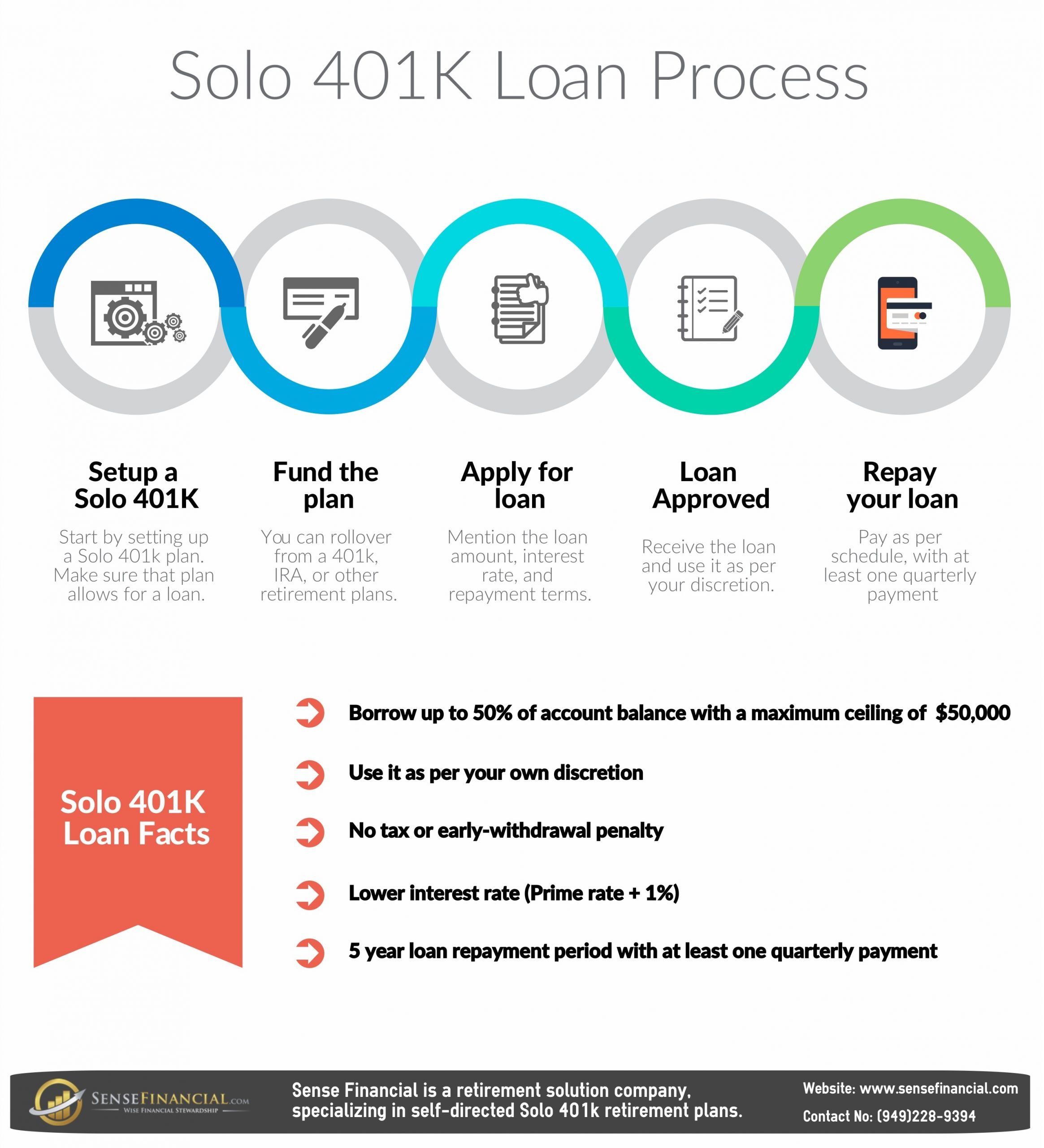

When you enrolled in your 401, you should have received a Summary Plan Description which tells you what you can and can’t do with your plan contributions and balances. In some cases, you will not be earning investment returns while you are repaying the 401 loan.

Similarly, you may also be restricted from making new 401 contributions until the loan is fully repaid.

Be sure to speak with your Human Resources department or your financial investment planner for clarification on anything that may seem confusing.

How Do I Qualify For Robs

In order to be eligible for a ROBS transaction, a borrower will need to:

Have at least $50,000 in an approved, tax-deferred retirement account, typically a 401, 401, or IRA .

Be an active employee of their company , not simply a passive investor.

The company itself must also be actively involved in a specific business, and cannot simply invest passively in another business or financial instrument.

Typically, ROBS transactions can be completed in as little as 3 weeks, making them a great way to get down payment funds for businesses that need them fast. Plus, using tax-deferred retirement funds for business down payments helps borrowers maintain the amount of cash they have on hand for emergencies, working capital, and other expenses that may come up in the process of running a business.

This website is owned by a private company that offers business advice, information and other services related to multifamily, commercial real estate, and business financing. We are a technology company that uses software and experience to bring lenders and borrowers together.

All users should perform their own due diligence and research. Nothing on this website is an offer or a solicitation for a loan. This website does not endorse or charge you for any service or product. None of the information on this site constitutes legal advice. We are not affiliated with the Small Business Administration . If you need to visit the SBA directly please click here: sba.gov

Also Check: How Can I Find Out Where My 401k Is

Repayment If You Leave Your Job

If you think youll want to leave your job in the next few years, review what your plan says about 401 loan repayment if you leave. Some 401 plans require you to repay the entire loan balance if you leave your job.

If you dont repay the loan in full, the unpaid amount will be treated as a withdrawal from your retirement account. Youll be required to pay income tax on the distribution and if youre under 59 ½ or dont meet another exemption, you may be charged a 10% penalty.

When Using Your Retirement Savings Might Be Worth It

You should consider all other options before using a 401 account to finance your home purchase. The interest and penalty fees will substantially add to the cost of your home, and borrowing against your retirement savings can have severe financial consequences later in life.

However, if you need to buy a home and have no other option to secure funds for a down payment, borrowing against your 401 can provide the necessary cash. What is a 401 account if not a financial resource to be used to the fullest? If you need access to that money to buy a home, that alone may be reason enough to use your savings now rather than at retirement.

Don’t Miss: How Much To Put In Your 401k

Be Careful Using 401 For A Down Payment

The biggest challenge most buyers face when purchasing a home? Coming up with that big down payment. Even if your mortgage lender only requires a down payment of 5 percent, that still comes out to $10,000 for a modestly priced home of $200,000. Many buyers simply don’t have that much cash lying around.

If you have a 401 plan at work, though, you might have a convenient source for down payment funds. You are allowed to borrow money from this retirement account for a down payment. You just have to pay back your loan — with interest — on time to avoid any penalties or taxes.

But does doing this make financial sense? That depends upon how badly you want the home, how close you are to retirement and how certain you are that you can pay back the loan on time.

Heather McRae, senior loan officer with Chicago Financial Services in Chicago, said that a 401 loan has helped several of her clients gather the funds they need for down payments. She considers it a smart financial move for borrowers who know they can handle the payback schedule.

“If you don’t have the money for a down payment and you don’t have family members who are kind enough to gift you the down payment, you’re kind of out of luck,” McRae said. “The 401 loan is often the best option for these buyers. If you haven’t saved the money for a down payment and you’ve fallen in love with a property, the 401 can make the purchase work.”

Final Word On Using A 401 To Buy A Home

It seldom makes good financial sense to take money out of your 401. The penalties for withdrawals are designed to make it costly to do so, and youll miss out on years of interest-free growth on the money you withdraw. If you are buying a house, tapping your 401 shouldnt be one of your first options.

That said, it can be the right move in a limited set of circumstances. If you really cant wait to buy a house, dont have an IRA, and dont qualify for low-cost mortgage programs, you could consider taking a 401 loan. Just make sure you are able to pay it back fairly quickly, so you continue to make the most out of your 401 plan.

Recommended Reading: How Do You Repay A 401k Loan

Are My Retirement Savings Worth A Down Payment

Conventional wisdom suggests that you dont touch the money accumulated in your 401 until you reach retirement age. The tax advantages of putting money away in a 401 are lost if you pull the money out early. Whats more, the fund in which your money is invested will usually charge you their own early withdrawal fee.

While buying a home could be the biggest investment you will ever make, having a healthy 401 is a key part of your long-term financial plan. Gutting your 401 now could leave you ill-prepared for retirement. Fortunately, there is a way to take advantage of the savings in your 401 without sacrificing your long-term plan.

Are There Other 401 Options

Withdrawal is not the only way to access 401 funds for a down payment.

Your benefits provider may also offer 401 loan options. If available, this option not only helps you avoid the early withdrawal penalty fee, but also paying income tax on your withdrawal.

401 loans let you borrow up to 50% of your vested account balance Taking out this type of loan puts your 401 account on hold for the duration of the loan you wont be able to make additional contributions until the money is paid back.

But how can you calculate whether the 401 loan is a smart financial decision? As with any lending scenario, the price you pay to borrow the money has a big impact on determining whether the loan is worth it. You can typically expect a 1%-2% spike above the prime rate for these types of loans. Another factor to consider has to do with your employment. If youre unable to pay back the loan on time or before leaving/losing your job, you may be subject to the same financial penalties that come with a withdrawal.

Also Check: How To Get Money Out Of 401k Early

Get A Gift From A Loved One

Another alternative to using a 401 to buy a house is to ask for a gift from a loved one. Gift money can be used for a down payment as long as the lender can verify the source of the funds and the person giving the gift submits a statement that says the money is truly a gift and not a loan.

While parents typically give their children gifts, depending on your loan program, the gift may be able to come from another source. For instance, Fannie Mae allows gift funds to come from an immediate family member, fiancé or domestic partner, while the FHAs list includes family members, employers, close friends and charitable organizations, as well as organizations or agencies providing homeownership assistance.

Should You Borrow From Your 401 To Make A Home Down Payment

by Christy Bieber | Updated July 19, 2021 First published on June 17, 2021

Many or all of the products here are from our partners that pay us a commission. Its how we make money. But our editorial integrity ensures our experts opinions arent influenced by compensation. Terms may apply to offers listed on this page.

You may regret making the choice to raid your retirement funds.

When youre trying to buy a home, its best to make a 20% down payment. Doing so allows you to avoid having to buy private mortgage insurance . PMI ensures lenders dont end up with out-of-pocket losses if they have to foreclose. Unfortunately you cover the expenses of PMI, although it provides you with no personal protection.

A 20% down payment is also useful because it:

- Makes it easier to get approved for a home loan

- Allows you to borrow less

- Saves you money on interest over time

- Makes it less likely youll end up owing more than your home is worth

Unfortunately, coming up with 20% down can be difficult for many home buyers. And, in fact, even finding the money for a smaller down payment can be a challenge if youre in an expensive market.

If you decide now is a good time to buy a home but struggle to come up with the cash to make a down payment, you may be tempted to borrow against your 401. After all, if you have a lot of money sitting in this account, it may seem like an attractive source of funds that could solve your down payment issues.

Recommended Reading: How Much Will Be In My 401k When I Retire

If I Dont Use My 401 To Buy A House When Can I Use My 401

Put simply, 401s are meant to be retirement accounts, meaning that the money is ideally supposed to be used when you reach retirement age. The early withdrawal taxes that 401s and IRAs use are supposed to incentivize you to leave the money untouched until you reach retirement age.

However, hardship withdrawals do exist to allow you to borrow money early under extenuating circumstances.

Does A 401 Loan Or Withdrawal Make More Sense

When you consider the potential tax consequences associated with an early withdrawal, a 401 loan may seem more attractive. Of course, there’s one drawback with both options: you’re diminishing your retirement savings.

With a 401 loan, you’d have the ability to replace that money over time. If you’re cashing out an old 401, however, there’s no way to put that money back. In both cases, you’re missing out on the power of compound interest to grow your retirement wealth over time.

One upside of deciding to borrow from a 401 for a housewhether you take a loan or make a withdrawalis that it may allow you to avoid paying private mortgage insurance if you offer the lender a large enough down payment. Private mortgage insurance protects the lender, and it’s typically required if you’re putting less than 20% down on a conventional mortgage. Private mortgage insurance can be eliminated when you reach 20% equity in the home, but it can add to the cost of homeownership in the early years of your mortgage.

Don’t Miss: How Much Can I Contribute To My Solo 401k

How Do I Avoid Taxes On My 401k Withdrawal

Here’s how to minimize 401 and IRA withdrawal taxes in retirement:

Borrowing Against Your 401

So can you use your 401 to buy a house, and more importantly, should you? Yes, the money is technically yours so you can use it for anything you want or need it for, including as a 401 first-time home buyer.

While you can withdraw your money from the 401 plan in some cases, such as financial hardship, it can be more financially advantageous to borrow instead. But you do need to be aware of some of the potential downsides. Here are some questions to ask.

You May Like: Can A Sole Proprietor Have A Solo 401k

Using Your 401k For A Down Payment

Theres no specific penalty exemption for home purchases when you pull money out of a 401k, so any money you take out will be classified as a hardship exemption. Youll be assessed a penalty of 10% on the amount withdrawn and youll have to pay income tax on it as well.

If possible, roll over the amount you want to withdraw to an IRA, so you can avoid paying the penalty. However, you cant roll over a 401k thats with an employer for whom you are still working. If you have an old 401k from a former employer, roll that. Since a rollover can take time to process, fill out the necessary paperwork as soon as possible.

Requesting A Loan From Your 401

If you do not meet the criteria for a hardship distribution, you may still be able to borrow from your 401 before retirement, if your employer allows it. The specific terms of these loans vary among plans. However, the IRS provides some basic guidelines for loans that wont trigger the additional 10% tax on early distributions.

Whether you can take a hardship withdrawal or a loan from your 401 is not actually up to the IRS, but to your employerthe plan sponsorand the plan administrator the plan provisions theyve established must allow these actions and set terms for them.

For example, a loan from your traditional or Roth 401 cannot exceed the lesser of 50% of your vested account balance or $50,000. Although you may take multiple loans at different times, the $50,000 limit applies to the combined total of all outstanding loan balances.

You May Like: Can I Borrow Money From My Fidelity 401k

Don’t Miss: Does A Solo 401k Need An Ein

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our reporters and editors focus on the points consumers care about most how to save for retirement, understanding the types of accounts, how to choose investments and more so you can feel confident when planning for your future.

Read Also: What Is A 401k For Dummies

Withdrawing From A 401

The first and least advantageous way is to simply withdraw the money outright. This comes under the rules for hardship withdrawals, which were recently made a little easier, allowing account holders to withdraw not just their own contributions, but those from their employers. Home-buying expenses for a “principal residence” is one of the permitted reasons for taking a hardship withdrawal from a 401.

-

You owe income tax on the withdrawal.

-

The withdrawal could move you to a higher tax bracket.

-

If you are younger than 59½, you also owe a 10% penalty on the money you withdraw.

-

You can never repay your account and lose years of tax-free earnings on the money you withdraw.

If you withdraw money, however, you owe the full income tax on these funds, as if it were any other type of regular income that year. This can be particularly unappealing if you are close to a higher tax bracket, as the withdrawal is simply added on top of the regular income. There is a 10% penalty tax, also known as an early withdrawal penalty, on top of that if you are under 59½ years of age.

401 plans do not have a first-time homebuyer exception for early withdrawals, but IRAs do.

You May Like: How Can I Find Out About My 401k

Borrow From 401 To Pay College

Most 401 plans allow participants to borrow from their 401 savings to pay college expenses either for themselves, their spouses, or their children. You can use the money to cover college expenses such as tuition, fees, books and stationery, room and board, etc.

A 401 loan can be an alternative to a student loan, and you will make principal and interest payments to your retirement account rather than to a bank.

Typically, you can borrow a maximum of $50,000 or half of your vested balance to pay college expenses during the four years of college. You can also take out multiple 401 loans as long as the total loan amount does not exceed the allowed limit.

You will have five years to repay the loan in full, as long as you remain an employee of the company. If you midway through the repayment period, the outstanding loan will become due immediately, or by the following yearâs tax deadline.