Using A 401 Loan To Buy A House

A 401 loan to buy a house is permitted by the IRS, provided it is permitted by the plan.

Such a loan allows an employee to withdraw the lesser of:

- 50% of their 401 accountâs vested balance or a minimum of $10,000, whichever is greater

So, if an employee has $120,000 vested in a 401 plan, they would only be able to take a loan of up to $50,000 from the account. However, if their vested account balance was just $15,000, they could take out a loan of up to $10,000.

A 401 plan loan often needs to be repaid, allowing the employee to stay on track toward their retirement savings goals. While most 401 loans must be repaid over five years, loans taken to purchase a primary residence can be repaid over a longer period of time.

When a 401 loan is repaid, it avoids classification as a distribution. This means that a loan isnât subject to early withdrawal penalties or income taxes on the funds. However, if the loan is not repaid according to the plan rules, it may be considered a distribution and would then be subject to both taxes and any applicable penalties.

Loans from 401 plans are to be repaid with interest. This means that the loan will cost the employee extra money out of pocket, but that interest is also added to their own retirement plan .

Loans You Behind Financially While Pmi Does Not

In the example in a previous section, we showed how removing just $10,000 from a retirement account could result in a $50,000 lower balance at retirement.

Now imagine you remove $20,000 or even $30,000 to reach the 20% down payment mark to avoid PMI. The future losses are going to be way more impactful than the $200 per month outlay now. Dont sacrifice your retirement savings because youre averse to PMI. Look at the long-term, broader view.

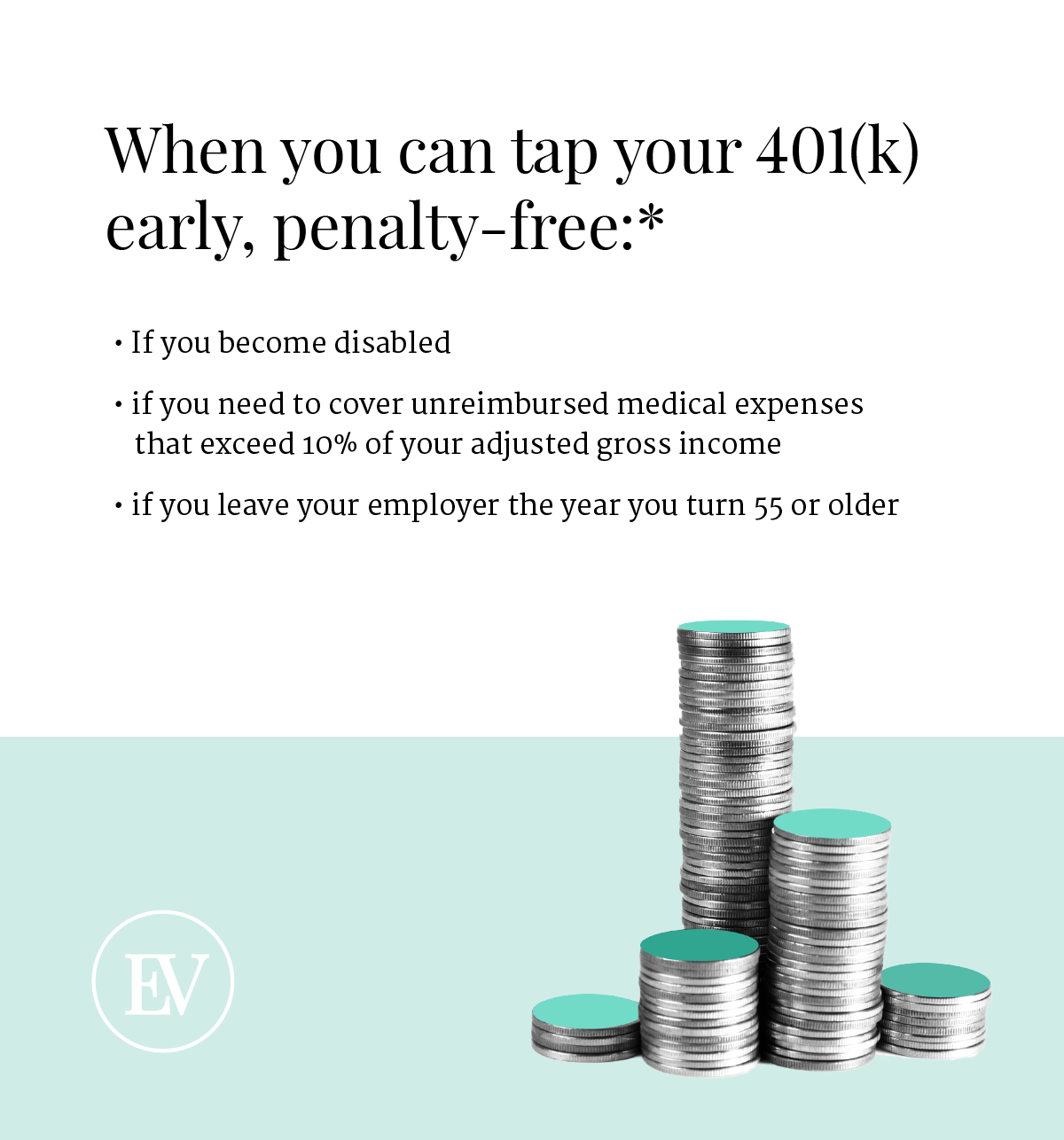

Do I Qualify For An Early Distribution

Early distributions from 401s are set up on a strong-needs basis to provide immediate relief from financial hardship. Suffering a permanent disability permits 401 holders who havent turned 59 and a half yet to access their savings.

Preventing an underwater mortgage on a primary residence may count as an immediate, strong need for an early distribution. However, buying a second home is not considered an economic hardship to potentially qualify for an early distribution. For 401 holders under 59 and a half who are still enrolled in a 401 plan sponsored by their company, it’s impossible to take out your money to buy a second home, much less without penalties.

If you are experiencing a hardship, you may be eligible to borrow money as a loan from your 401. Typically, the repayment includes interest and specified length of repayment terms.

Lets say you do leave your company and decide to leverage your 401 to buy a second home. You should expect to absorb the early withdrawal penalty with the distribution received.

Unless you qualify for a different exception, the early withdrawal penalty is taxed at a rate of 10%. If you were to take out $100,000 from your 401 to purchase a second home, the penalty would be $10,000.

Read Also: Can I Roll My 401k Into Another 401k

What Do I Need To Know About Roth 401 Withdrawal Rules

When it comes to retirement savings, there are different routes you could go. You may have your traditional 401. You could also have an individual retirement account or a Roth IRA. But what if you have a Roth 401? How does one work and what are the Roth 401 withdrawal rules? Lets answer these questions and more here. You can also work with a financial advisor to not only get your questions answered but to help you manage your retirement plan and investments.

What Is a Roth 401 and How Does It Work?

A Roth 401 is an employer-sponsored retirement savings program that uses post-tax money. That means that the government has already taxed the money you put in the account. Because its already been taxed, you dont pay taxes on withdrawals when you retire, like with a Roth IRA. However, you cant deduct contributions from your taxes like you can with a traditional 401.

What Are the Basic Roth 401 Withdrawal Rules?

There are four basic Roth 401 withdrawal rules that you m just follow to avoid penalties or unnecessary taxes. These withdrawal rules are:

1. Qualified Withdrawals Are Tax-Free

If you wait until youre 59 ½, you can take withdrawals on your Roth 401 without paying taxes. That includes contributions as well as earnings. Compare this to a traditional 401, where you avoid the taxes upfront but pay on both contributions and earnings when you withdraw. You can see why, if your employer offers it, a Roth 401 might be a good option.

3. The Five-Year Rule

Should I Take The Hit On My 401 Now To Set Myself Up To Be In A Better Financial Position Later

Have you maxed out your 401 company match contributions and after doing the math realized it still isnt getting you where you want to go on the financial and retirement planning road ahead? For some 401 holders, sucking it up and paying the 10% penalty still has the competitive advantage over leaving their funds to accumulate as they lie in the volatile stock market.

A 10% penalty might seem substantial, but for some individuals, the opportunity cost of a missed investment opportunity is too severe to overlook.

Bear in mind that the rate at which your 401 earns is tied to the market that fluctuates based on a 10-year cycle. From age 55 to 64, marking the lower end of the retirement age spectrum, the average 401 balance sits at $232,379, while the median sits at $84,714. For many of us, the math adds up to a patterned outcome when it comes to preparing for retirement not enough.

Don’t Miss: Should I Rollover My 401k Into An Ira

Can I Use A 401 To Buy A House

If you have a 401, then you already know its a type of retirement savings account sponsored by your employer. Over time, you contribute a predetermined amount from each paycheck, and your employer may even match some of your contributions to help fund the account.

Your 401 account can be a powerful tool when it comes to financial goal-setting and retirement planning. Not only do the funds in this account earn money over time, this type of savings account comes with some key tax advantagesnamely, contributions you make into a 401 come from your gross income as an employee.

In other words, your money can grow tax-free. And because taxes havent been taken out of this money yet, the entire sum of your contributions can be written off to reduce your total taxable income at the end of the year. You dont have to pay taxes on the money you put into a 401 or the earnings that accrue in that account until you withdraw it later in life.

For many people, a 401 account contains the largest percentage of their total savings portfolio. If thats the case for you, it might be tempting to put that money toward a worthwhile purchaselike buying a new home.

While it is technically possible to make an early withdrawal and put money from your 401 toward your home purchase, there are also some serious downsides to this tactic.

If Im Considering A 401 Loan What Information Should I Get From My Plan Provider

If youre considering taking a loan from your 401, ask your plan administrator for the following information:

- Whether or not loans are/are not permitted

- The minimum dollar amount required to obtain a loan

- The maximum number of loans permitted by the plan

- The maximum dollar amount permitted

- The term of repayment

- Any interest rate information

- Any required security for the loan

- How repayment may be made

- Any spousal consent requirements

Read Also: How To Convert 401k To Self Directed Ira

Is A 457 Plan Worth It

There are certainly tax benefits associated with participating in a 457. This includes being able to contribute pre-tax money to decrease your overall tax burden. The gains also grow tax-free. Your only taxation occurs when you take it out.

Is a 457 plan better than an IRA?

If tax rates are substantially higher when you retire, you will significantly benefit from your Roth IRA because your withdrawals will be tax-free. If tax rates are lower when you retire, your 457 will be the more tax-efficient account. Either way, one will help to balance the other.

Seller Financing By Solo 401k Question:

I am selling a property out of my solo 401K and was wondering if the 401K could carry a note on the property? Are there any special requirements?

ANSWER:

Yes the solo 401k can carry the note on the property being sold out of the solo 401k as long as the buyer of the property is not a disqualified party .

You May Like: What Should You Invest Your 401k In

Wait And Save For Your House

While you might want to buy a house now, in some cases it may be better to wait and save up enough for a down payment so that you dont have to borrow extra money.

Review your budget and see if there are areas where you can cut your spending. You may also want to consider earning some additional income on the side to help shorten the time it takes you to save.

What Is A 401 And How Does It Work

Before diving into whether you should use your 401 to buy a house, its important to first have a firm grasp on how, exactly, a 401 retirement account works.

Your 401 account is an earmarked savings account created specifically to help you prepare for retirement. As defined by the Internal Revenue Code of the IRS, 401 holders can claim a tax deduction and will see their contributions to the account accrue tax-free interest over time. The trade-off is that access to the account is strictly limited.

Withdrawals from a 401 should not be made before the account holder turns 59½, or before they turn 55 and have left or lost their job. Early withdrawals incur a 10% early withdrawal penalty on the amount of money being taken out of the account. This amount also immediately becomes subject to income tax, since its no longer in the protected retirement savings account.

While these regulations may seem harsh, they are in place to incentivize account holders to set aside enough money to support a comfortable retirement. That being said, its not illegal to withdraw money from your 401 early, and those funds can certainly be put toward a down payment on a house.

Take the first step toward the right mortgage.

Apply online for expert recommendations with real interest rates and payments.

Also Check: How Can I Invest My 401k Money

How Much Can You Take Out Of Your 401 For A House

If youre taking a distribution, theres not necessarily a limit on how much you can withdraw. However, for a hardship withdrawal, you can only withdraw enough to meet the immediate financial need. In the case of a 401 loan, you can withdraw up to $50,000 or 50% of your account balance, whichever is lower.

Are There Other Options

Certainly! We encourage you to talk to a New American Funding Loan Officer to learn about other Conventional loans and government-sponsored programs that could help you get into your new home.

Additionally, we offer a mortgage calculator that can help you begin thinking about your budget.

If youre in the market for a new home or simply want to discuss your financing options a first-time homebuyer, wed love to hear from you today!

You May Like: How Much Does A 401k Cost An Employer

Do 401k Loans Affect Debt

Borrowing From Your 401k Doesn’t Count Against Your DTI Even though the 401k loan is a new monthly obligation, lenders don’t count that obligation against you when analyzing your debt-to-income ratio. … The lender will, however, deduct the available balance of your 401k loan by the amount of money you borrowed.

Our Advice 401 Loans Are Your Last Resort

You dont need to take money from your retirement to fund your first home purchase. Low- and no-downpayment mortgage options are safer, less expensive, and lower risk.

Before cashing out your 401, check your other options.

Start by getting pre-approved for a mortgage in just three minutes.

Happy homebuying.

Don’t Miss: How To Rollover A 401k Without Penalty

Can You Use A 401 To Buy A House

The short answer is yes, since it is your money. While there are no restrictions against using the funds in your account for anything you want, withdrawing funds from a 401 before age 59½ will incur a 10% early withdrawal penalty, as well as taxes. So, while it is possible to tap your 401 in lieu of a mortgage loan, it would end up being a very expensive source of funds, not to mention being disruptive to your retirement savings.

Should You Use Your 401 To Buy A House

In general, home buyers should not use their 401 to help buy a home except as a last resort when:

Even then, home buyers should investigate every available option before taking money from their 401 to fund the purchase of a home.

Taking money from your 401 is a high-cost transaction:

- A tax is assessed on early withdrawal

- A penalty fee may be charged on cash withdrawn

- The tax advantages of investing are lost or reset permanently

When retirement account balances shrink, they provide less money for the future, which may extend a persons working life by up to a decade.

Using a 401 to buy a home is rarely a good idea. Instead, buyers should look to low- and no down payment mortgages, and seek additional downpayment assistance for first-time home buyers, if necessary.

The cost of using a 401 to buy a home is too large.

Don’t Miss: Can You Buy Gold With Your 401k

You Can Use Your 401 To Buy A Housebut It Isn’t Recommended

According to Rocket Mortgage, it isn’t illegal to withdraw money from your 401 to buy a house or to pay for any other expense, but its also isn’t advisable in many cases.

One of the biggest arguments against withdrawing 401 funds early is that youll likely be hit with a 10 percent early withdrawal penalty if youre under the age of 59.5 years oldor 55 in the case of jobless individuals. Also, youll have to pay any applicable income tax on the 401 distribution.

There are exemptions to the early withdrawal penalty. Spending the 401 money on home buying experiences for a principal residence could qualify you for these exemptions, according to Rocket Mortgage. However, the company warns that qualifying for those exemptions is difficult, especially because youll likely be disqualified if you have other assets that could go toward your home purchase.

Either way, youll also have to contend with the loss in potential 401 growth. Investopedia said, If you have $20,000 in your account and take out $10,000 for a home, that remaining $10,000 could potentially grow to $54,000 in 25 years with a 7-percent annualized return. But if you leave $20,000 in your 401 instead of using it for a home purchase, that $20,000 could grow to $108,000 in 25 years, earning the same 7-percent return.

What You Need To Know

- Borrowing against your 401 to buy a house is a valid option, but its not necessarily the best one

- The maximum amount you can borrow from your retirement account is 50% of your vested account balance or $50,000, whichever amount is less

- You may opt to withdraw from your 401 without having to pay it back , but in many situations, youll have to pay a 10% early-withdrawal fee and income tax

You May Like: How To Do 401k Rollover

Can I Deduct 401k Mortgage On An Investment Property

The idea that only interest expense that is secured by the rental real estate can be deductible in a rental business is simply incorrect. There are specific tracing rules under Treasury Regulation § 1.163-8T that provide guidance for allocating interest based on how loan proceeds are used. Having said that, there are addition restrictions on the deductibility of 401k loan interest, I believe that kick in when borrowing against elective deferrals. That is the cite I was looking for, but Ill find it myself when Im at a computer.

You May Like: What Will My 401k Be Worth

Does Your Employer Match Your 401

Many employers match 401 contributions, generally with a limit to how much theyll match. If your employer does match, then you could miss out on hundreds of dollars each year if you dont invest up to the match amount, even if the match amount is low.

For example: a common match amount is 6% of your salary. So if your salary is $50,000, then 6% is $3,000. If you contribute the full $3,000, your employer will match some percentage of that often up to 50% which would be a free $1,500 each year.

One option might be to save just up to the matching amount and then divert the rest of that possible 401 savings into a down payment fund, but any employer matching is a benefit you should probably take full advantage of while you can.

Jake Oyler, a Financial Advisor at Colwyn Investments, works with clients to help them figure out their best option and advises, If the company you work for has a 401 match program, you should contribute at least the amount that the company will match. If you dont contribute at least that much, you are leaving free money on the table.

Remember, too, that your 401 contributions are pre-tax, whereas mortgage savings are post-tax, so you can usually increase your balance more rapidly in a 401.

If your employer doesnt match your 401 or youre self-employed, it may make more sense for you to invest in a house, whether you live in it or choose to rent it out.

You May Like: How To Pay Off 401k Loan